As mentioned in our last note, broad-based selling typically has an outsized effect on the newest companies. With only quarters and not years to build a public investor base and track record, interest in recent listings wanes quickly when the market turns.

For SPACs, this is now compounded by a bit of a stigma. “If it was such a great company, why didn’t it do a regular IPO?” is an easy question now, for a market that has solidly turned against growth names.

What SPAC performance looked like in 2021

First, some numbers. Since the start of 2021, Canalyst has built de-SPAC models on 81 companies, after deals were announced. By sector: 28 TMT, 17 Consumer, 11 Healthcare, 7 Financials, 11 Industrials, and 7 in other sectors.

Of these, only 7 are trading above their $10 benchmark prices. The average performance for the basket is -53%. Intra-sector, Consumer, Financials, and Health Care had the worst performance, as many names had significant debt loads heading into a rising rate environment.

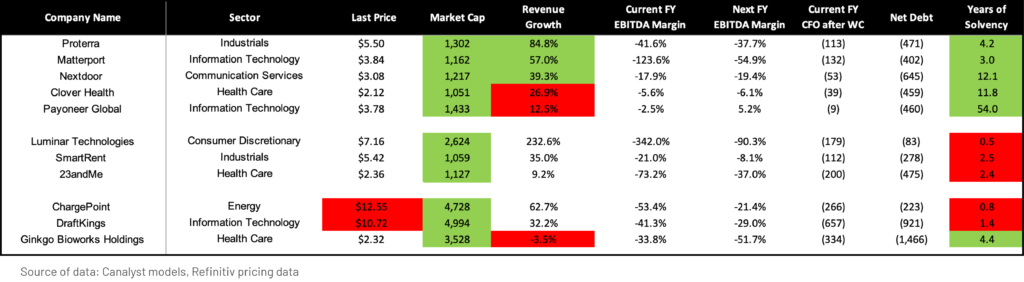

We start our deep dive with a market cap constraint of $1bb. This eliminates 47 companies, leaving us with a universe of 34 to examine. Interestingly, 6 of the 7 SPACs trading >$10 are in this group, suggesting that a subset of more mature companies had performed relatively better.

Next, we think about the type of names that have been punished by this market, and they tend to be money-losing companies, as the cost of capital has risen significantly since last year. In this list, there are 14 names with negative current EBITDA margins. Of these, 11 have net cash.

Unlike our IPO screen, where we discarded these names, for our SPAC deep dive, we lean into these instead! Our logic here is that anyone brave enough to wade into the devastated SPAC market is looking for multi-year growth stories. In fact, these 11 names have a median FY+1 revenue growth rate of 35% vs. 9.7% for the other cohort of 23 names.

In the 11 names, we throw out the two names trading over $10. It’s a shortcut, but we assume this fortunate pair are not being overlooked. We also discard one name with negative revenue growth. Of the remaining 8 names, we sort for revenue growth >30%, and >3 years of cash burn, measured by Net Cash / Current year CFO.

Highlighted SPACs

Three names are surfaced by the image above. Please note as usual, these are not recommendations! However, investing in any broken SPACs is a contrarian play, so looking for high growth & enough runway to make it seems like a good place to start.

Proterra (PTRA) is a designer/manufacturer of zero-emission electric transit vehicles and EV technology solutions for commercial applications. Download the model here.

Matterport (MTTR) is leading the digital transformation of the built world, turning buildings into data to make nearly every space more valuable and accessible. Buildings are transformed into immersive Matterport digital twins to improve every part of the building lifecycle. Download the model here.

Nextdoor (KIND). Neighbors around the world turn to Nextdoor daily to receive trusted information, give and get help, get things done, and build real-world connections with those nearby — neighbors, businesses, and public services. Download the model here.

Canalyst increasingly aims to be a platform where you can explore and uncover new research ideas. In the coming months we’ll be releasing new functionality on both our web portal and inside Excel, so sign up to get our product announcements for more info.