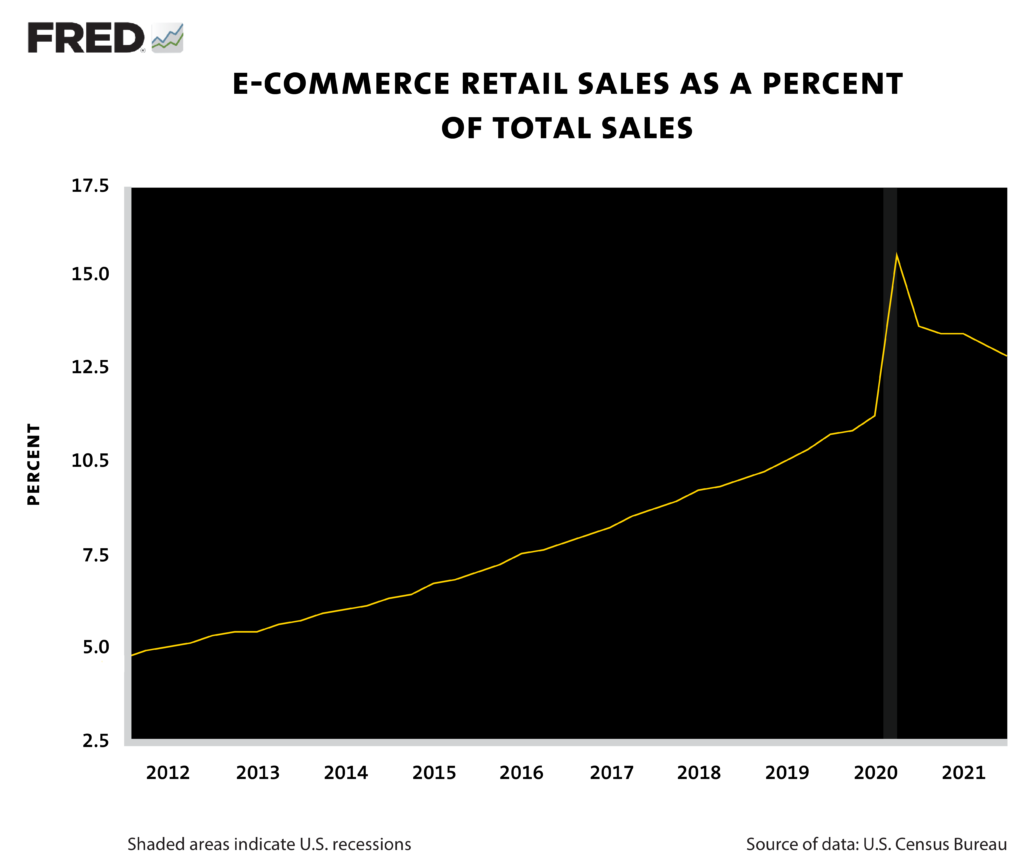

Several tailwinds have emerged for the Air Freight & Logistics (“AF&L”) industry since mid-2020 and are expected to continue into early next year, if not further. Covid’s impact, the primary factor, has been decisively beneficial. The combination of restrictions and stimulus packages set fire to e-commerce shopping and consumer spending. With bottlenecks and congestion occurring at ocean ports worldwide, labor and chip shortages impacting trucking operations due to a lack of drivers and equipment, the supply-demand equation has become materially lopsided. And while consumers await their presents in angst, wondering if they’ll be showing up empty-handed to this year’s family Christmas get-together, AF&L companies are rejoicing in their record-breaking quarterly results; raising year-end outlooks, and relaying positive sentiments for early-to-mid-2022.

Given the recent market volatility, it may be of value to shift some focus towards AF&L names which are still benefiting from a number of tailwinds. The industry outlook is strong with no expectation of change in the favorable market conditions. Pricing power is firm as demonstrated by the recent general rate increases announced by UPS (5.9%) and FedEx (5.9%). Not surprisingly, the fourth quarter encompasses peak season for the AF&L industry and typically yields the best results of the year for most AF&L companies.

Management’s optimism is positive going into what is already a seasonally strong quarter. The general theme across the 15 AF&L companies Canalyst covers, including United Parcel Service, Inc. (NYSE: UPS), XPO Logistics Inc. (NYSE: XPO), and Hub Group, Inc. (NASDAQ: HUBG), was that supply chain normalcy will not be restored until consumer demand falls. Even with Joe Biden’s announcement of the Los Angeles Port becoming a 24-hour, seven-days-a-week operation, many companies believe the current tailwinds will extend until early-mid 2022 and possibly further. Though headwinds are a risk, AF&L management most often cited labor and equipment shortages as a primary factor hampering productivity. Management commentary was focused on congested ports, full storage facilities, loaded containers waiting to be offloaded, and in some cases, having to turn away volume to maintain their service quality.

Among Canalyst AF&L models, Atlas Air Worldwide Holdings, Inc. (NASDAQ: AAWW), a global provider of outsourced aircraft and aviation operating services appears particularly well positioned in the near term. Its primary offerings are ACMI (the provision of an aircraft, crew, maintenance, and insurance), CMI (the provision of crew, line maintenance, and insurance, but not the aircraft), Charter (the provision of cargo and passenger charter services), and Dry Leasing (the provision of cargo and passenger aircraft and engine leasing solutions). In FY2020, ACMI and CMI combined, Charter, and Dry Leasing represented ~38%, ~58%, and ~5% of total revenue, respectively.

In Q3/21, Atlas produced record revenue and adjusted net income, topping ~$1 billion in revenue for the first time and adjusted net income of ~$145 million. During the conference call, management dubbed it as the best quarter in the company’s history and stated an expectation of an even stronger fourth quarter. Management cited higher yield and aircraft utilization, ongoing reduction of available cargo capacity in the market and the continued disruption of global supply chains due to the pandemic as favorable conditions paving the way for the impressive results. Atlas believes the airfreight market is very strong; they expect industry conditions and demand to remain favorable for the foreseeable future. Furthermore, the Company believes the accelerated growth in ecommerce will drive current and longer-term airfreight demand.

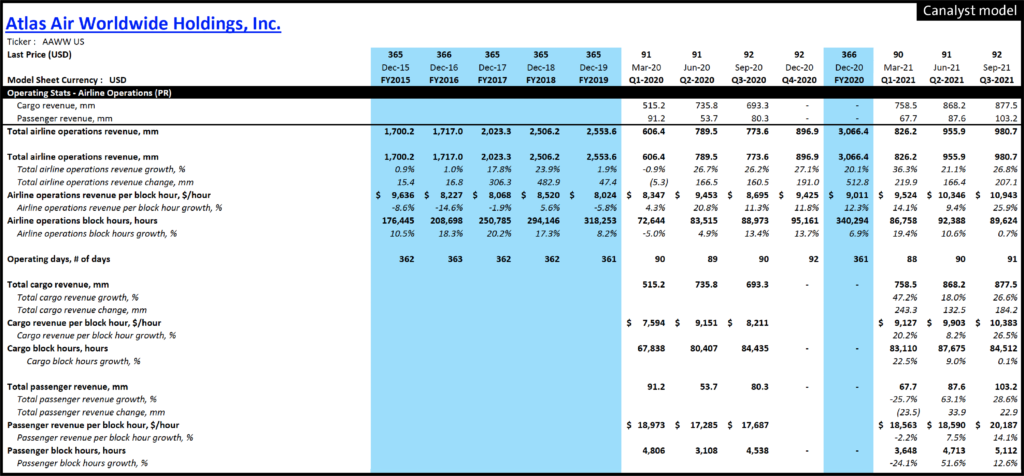

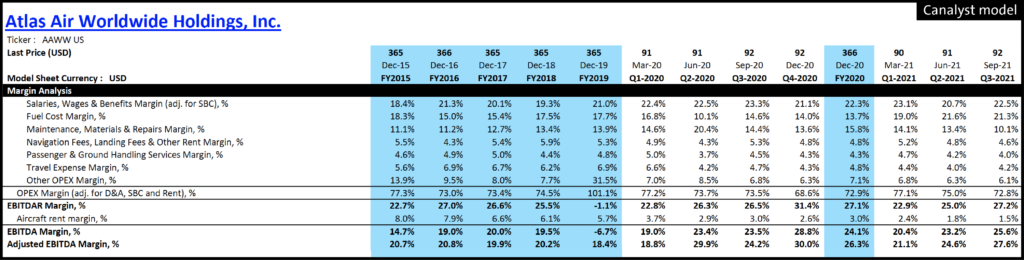

Breakdown of Atlas’ Results

Airline Operations revenue (ACMI & CMI) grew ~27%, representing ~96% of total revenue. Resulting in operations revenue per block hour — the time interval between when an aircraft departs the terminal and it’s arrival at the destination terminal — reaching a record high of $10,943 per block hour, reflecting ~26% pricing growth. Atlas posted 90,363 block hours, of which 84,512 were Cargo and 5,112 were Passenger.

Atlas also produced a record adjusted EBITDA of $280.5 million, posting a near all-time high 27.6% margin. Savings emerged from reducing less profitable smaller gauge CMI services as well as lower maintenance expenses. Otherwise, margins were stable aside from dragging fuel costs spurred by higher prices and a slight improvement in their aircraft rent margin.

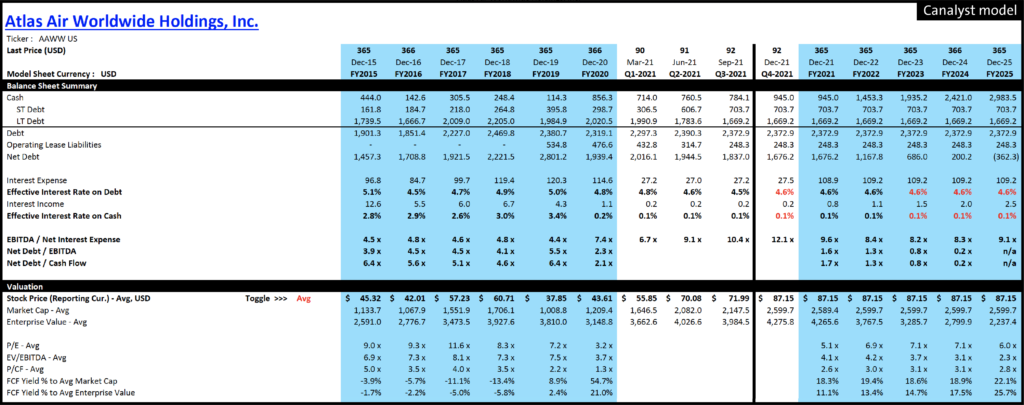

Valuation Metrics: Undervalued?

Our model highlights interesting themes in Atlas’ valuation and risk. The Company has deleveraged from its historical debt high in FY2019. With EBITDA/Net Interest Expense ratios of 7.4x and 10.4x in FY2020 and Q3/21, respectively, there is little concern for the Company’s interest coverage ability. The average trading P/E multiple started falling in FY2017 from 11.6x to a low of 3.2x in FY2020. Simultaneously, free-cash-flow yield to average market cap has ballooned from -11.1% in FY2017 to 54.7% in FY2020.

Even at the closing price of $86.86 from December 10, 2021, our model, which is tuned to consensus estimates, projects Forward P/E multiples and FCF Yields of 5.1x, 6.9x, 7.1x and 18.3%, 19.4%, and 18.6% for FY2021, FY2022 and FY2023. However, consensus estimates appear to be pricing in an earlier end to current tailwinds and could prove light. Based on CFO comments in the Q3/21 conference call regarding next year: “the environment is incredibly strong, and we expect that will continue. The acceleration of express and the adoption of e-commerce, the record low inventory levels, all of these things bode really well for airfreight overall,” it appears there could be more runway left to deliver investors presents under the tree.

Disclaimer: Canalyst does not provide recommendations for public companies. Canalyst only provides high quality financial models.