Over the past half century, booming air traffic demand, a growing number of airlines, and increasing geographic coverage have been secular tailwinds for the air leasing industry. As the saturation of airlines increased, incremental risk rose accordingly. It became increasingly difficult to recruit trained flight crews, take market share and secure profitable routes. Heightened risk, exacerbated by significant initial capital outlay for new aircrafts, made the option to lease rather than buy new aircrafts, particularly attractive. This prompted the emergence of air leasing companies in the early 70’s. The intrinsic flexibility of this financing option (extend, convert, or terminate leases in favor of upgrading to newer models) has increased adoption across the airline industry over the last ~40 years. According to FlightGlobal, operating leases of commercial jet passenger aircraft accounted for less than 2% of total fleet in 1976, then grew to 15% in early 1990s, 25% in 2000, and 40% in 2017.

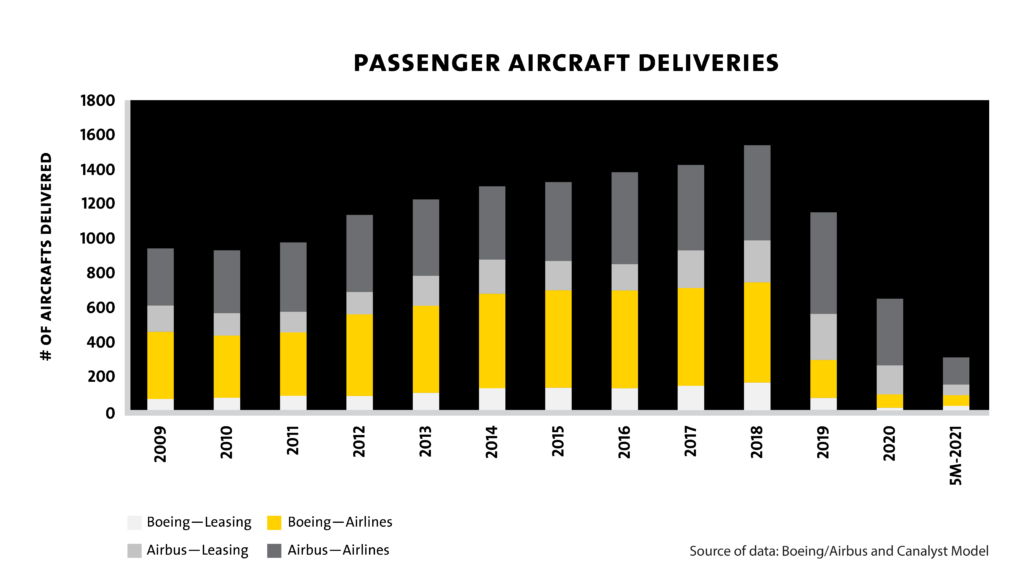

The consistent role leasing companies have played in the expansion/upgrading of airline fleets is evident in the delivery data over the past decade.

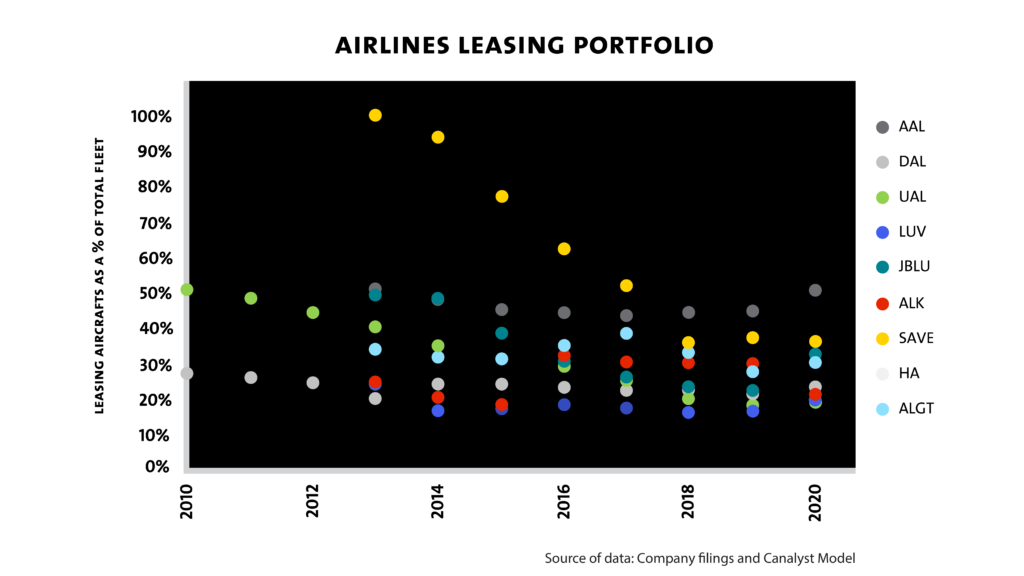

As airlines mature, they may pare back percentage allocation towards aircraft leasing vs ownership. However, over time the percentage tends to stabilize, as such growth leveraged to mature markets is typically contingent on overall growth within the airline industry.

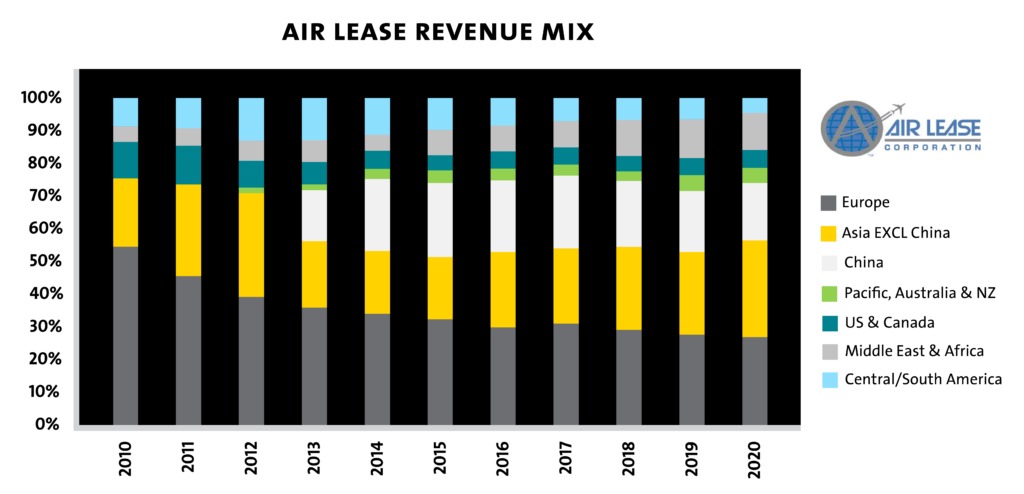

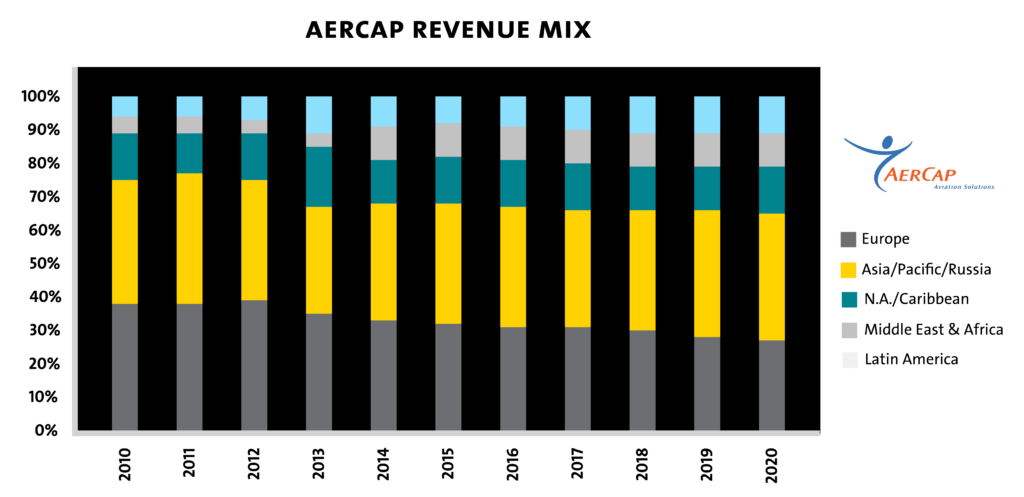

Growth in developing markets is also a material contributor to demand. Developing markets have constituted a significant portion of air leasing customers, a trend that has been accelerating over the past decade. Air Lease has earned ~$40 million on average from each of its Chinese customers compared to ~$10 million from US/Canadian customers and roughly $12.4 million from EU customers (Canalyst Model).

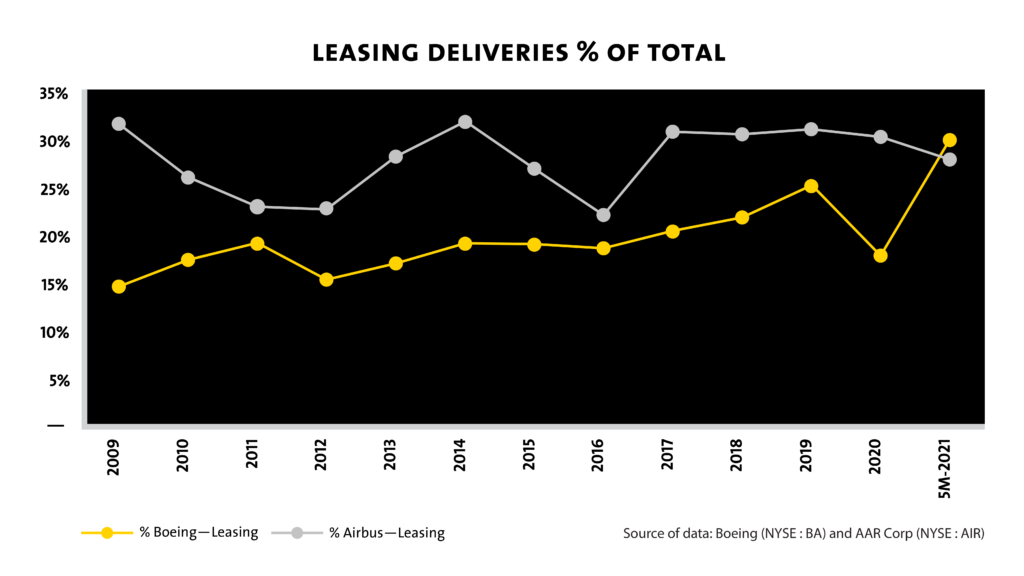

The material decline in aircraft purchases by leasing companies through 2019-2021 was consistent with the overall industry decline, beginning with the 737 MAX issue, continuing with 787 delays, culminating with the global pandemic. Leasing deliveries have since stabilized alongside the post pandemic industry recovery, and continue to contribute ~30% of total deliveries (excluding freight & Military, et al).

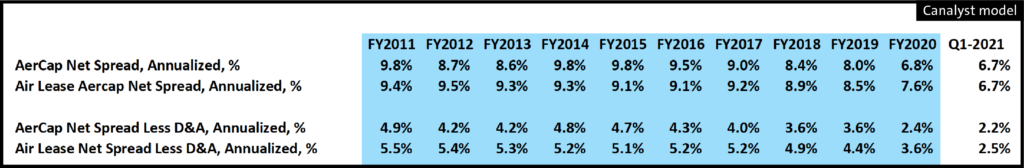

Overall industry exposure is very similar for airlines and air leasing companies. However, the underlying economics create materially different operating risks. Air leasing companies charge airlines rental fees while paying down interest expenses. As such, leasing entities profit from the discrepancy which is known as lease rate factor (net spread as % of net book value of aircraft lease assets). The airlines avoid the initial capital outlay associated with the airline purchase, but remain responsible for the operation and maintenance, forfeit any residual value of aircraft and also pay more than directly financing through banks (see examples below from two leading leasing companies, AerCap and Air Lease).

Airlines are willing to pay the spread to benefit from the flexibility of renting and to avoid aircraft residual value risks. For example, during 2020 AerCap recognized a $1.1 billion asset impairment primarily to A330 and B777 aircrafts as airlines shifted towards new technology widebody models (A350, B787). To mitigate such potential losses and risks associated with obsolescence, Air Lease will only own the aircraft for the first 1/3 of its 25-year useful life. Therefore, it has maintained a younger fleet with an average age of 4 years, compared to 6.5 years of AerCap. Although slightly lagging, AerCap has been replacing their fleet, and consequently its New Technology portfolio has increased from 23% in 2016 to 63% in 2020.

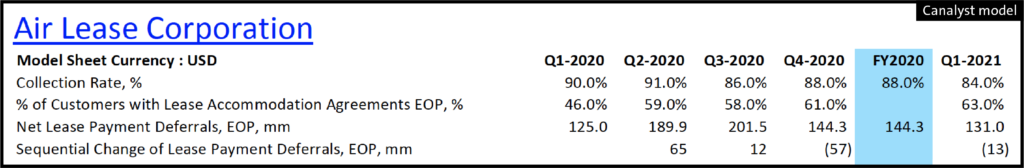

The downstream effect of the pandemic on air leasing companies has been meaningful. Airlines struggled to pay leases during the pandemic while their aircrafts were parked. Lease accommodations have been negotiated to delay payment. Although the collection rate was still below 90%, total net deferrals have been improving since Q3-2020.

However, the industry appears poised for a material rebound. As the distribution of vaccines proliferates and planned reopenings proceed on schedule, IATA forecasts that 2021 global passengers will be 52% of 2019, ramp up to 88% in 2022, ultimately topping 2019 levels in 2023. A robust long-term growth outlook for air traffic should bolster the order books of air leasing companies as they maintain their share of manufacturers’ future deliveries and continue to benefit from renewed growth in developing markets.