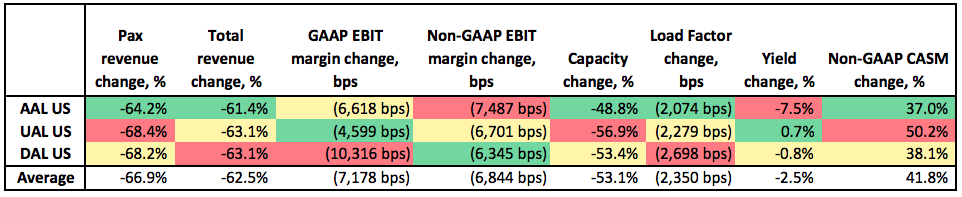

A cheat-sheet to go over YTD results of major U.S. airlines

NOTE: All figures are 9 months ended September 30, 2020 over 9 months ended September 30, 2019.

- American Airlines (NASDAQ: AAL) – The most levered airline out of the “Big 3” in the United States, AAL cut capacity by 49% in response to the travel restrictions brought on by the COVID-19 pandemic. It took a bigger hit on passenger yield (down 7%) and suffered a far more drastic change in Non-GAAP EBIT margin (down 7500 bps) than both Delta and United. The airline has initiated an intensive fleet restructuring program by accelerating the retirement of 150 aircraft bringing the total type of aircraft in its mainline fleet down from eight to four.

- United Airlines (NASDAQ: UAL) – UAL cut capacity (down 57%) more aggressively than others but managed to increase passenger yield by 1%. Passenger revenue declined 68% and Non-GAAP cost per ASM went up 50%, each change worse than any other major airline in the U.S., resulting in a Non-GAAP EBIT margin contraction of 6700 bps. Unlike its competitors, UAL has not announced any major plans to retire mainline aircraft and has chosen to temporarily park them instead.

- Delta Airlines (NYSE: DAL) – DAL reduced capacity by 53% and announced plans to retire over 200 aircraft in the year including the flagship Boeing 777s. While passenger yield went down by only a percent, the steep decline in load factor (down 2700 bps) meant that passenger revenue decreased by 68%. Non-GAAP EBIT margin shrank by 6300 bps. The airline has extended its policy of blocking middle seats until March 30, 2021.

Above: All data sourced from Canalyst models

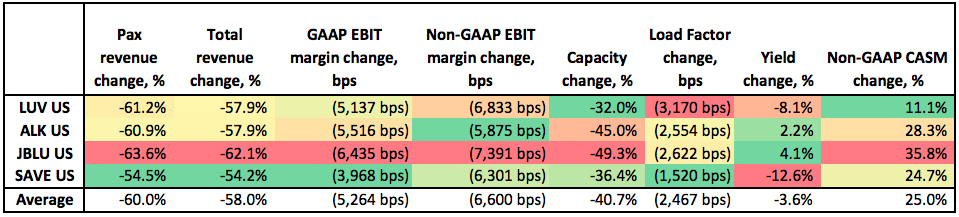

- Southwest Airlines (NYSE: LUV) – The world’s largest low-cost carrier, Southwest Airlines was the most conservative in cutting capacity (down only 32%) during the pandemic. This resulted in a drastic 3200 bps decrease in load factor, the worst of all other major U.S. carriers. Passenger yield was down 8% while passenger revenue was down 61%. Non-GAAP EBIT margin contracted by 6800 bps. The airline has placed approximately 100 aircraft in long-term storage including 34 Boeing 737 MAX aircraft. This is noteworthy as Southwest is Boeing’s largest customer.

- Alaska Air Group (NYSE: ALK) – ALK cut capacity by 45% but managed to increase passenger yield by 2%. Non-GAAP cost per ASM went up by 28%, lower than the industry average of 32%. Combined, these resulted in a Non-GAAP EBIT margin reduction of 5900 bps, better than any other major U.S. airline.

- JetBlue Airways (NASDAQ: JBLU) – JetBlue cut capacity by 49% suffering a 2600 bps contraction in load factor during the process. Passenger yield was up 4%. However, a 36% increase in Non-GAAP cost per ASM, the highest outside of the “Big 3” airlines, resulted in the Non-GAAP EBIT margin declining by 7400 bps. The airline has deferred deliveries of Airbus aircraft that were scheduled over the next few years and reduced capex by approximately $2 billion between 2020 and 2022.

- Spirit Airlines (NYSE: SAVE) – SAVE cut capacity by 36%. It witnessed a 13% drop in yield, the most in the industry. However, load factor only came down by 1500 bps leading to passenger and total revenue declines of 54% each, the lowest declines in the industry. Non-GAAP EBIT margin declined by 6300 bps.

Above: All data sourced from Canalyst models