A great product, long runway for teenage/younger growth, and the persisting impact of COVID digitization, have all contributed to the phenomenal run by Align Technology, Inc. (NASDAQ: ALGN) since Q3/20. Align is a medical device company that primarily manufactures and markets a clear aligner alternative to traditional braces under their Invisalign brand. Complementary to this, Align also sells their iTero intraoral scanner, exocad® computer-aided design/manufacturing software, and various non-case products & services. All of these are intended for use in the treatment of varying degrees of misaligned teeth (also known as malocclusions) that have been traditionally dominated by wire and metal brace technologies.

As we wrote about last year, Q3/20 appears to have been an inflection point. The pandemic created a favorable catalyst for a market adoption at the expense of traditional braces, resulting in a material quarterly beat. Align went on to post three more record quarters, while further pulling on all the levers of value it identified throughout COVID. Its Q3/21 results are set to drop after market close on October 27th and will be the first quarter where Align will have to show growth on top of the favorable COVID dynamics. Keep an eye out for their Active Doctors and their Utilization Rate, as Align will largely go as those metrics go.

Growth Opportunity

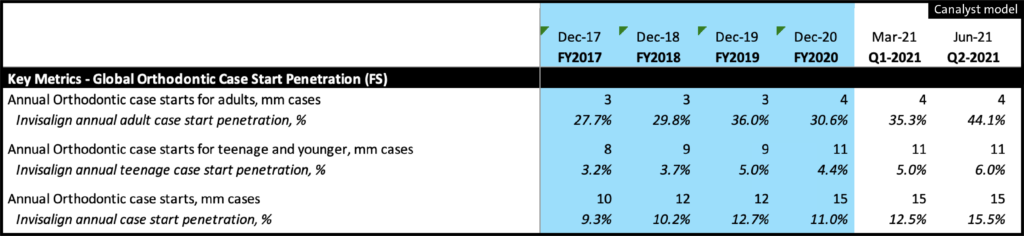

60-75% of the global population is thought to have some form of malocclusion (crowded teeth, overbite, underbite, crossbite, gap teeth, etc.), with ~15 million people globally starting treatment every year. Most of these cases are treated with the use of traditional methods, i.e. braces, and may be combined with elastics, metal expanders, headgear, and other devices. 90%, or 13.5 million of the 15 million annual case starts could be treated using Invisalign clear aligners as of December 2020. That percentage was 75%, 75%, and 60% for the years ended 2019, 2018, and 2017 respectively, which illustrates the significance of product innovations that have allowed Align to increase its usability. This is without even considering the growth added to the market because of Invisalign.

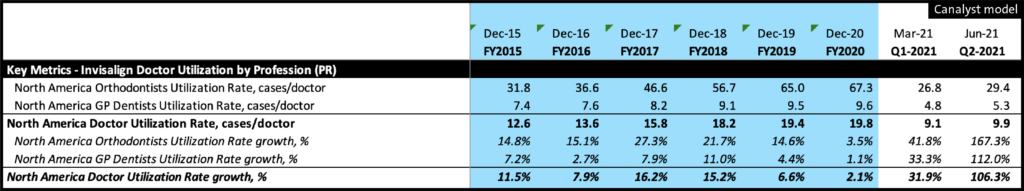

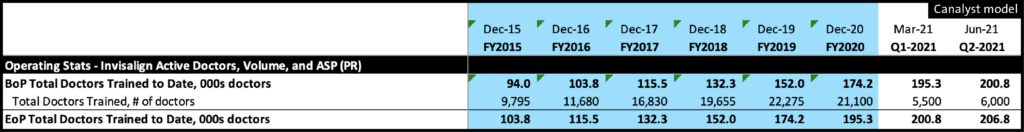

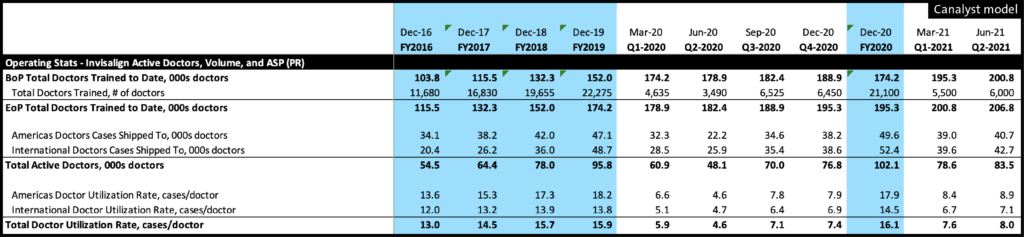

Dental work is done in GP dentist and orthodontist offices, with GP dentists commonly referring patients to orthodontists, acting as a sort of gatekeeper to the high-volume utilizers of Invisalign. While GP dentists can and do prescribe Invisalign, it is at a much lower rate, about 7x less in 2020 as shown in exhibit 1 below. It follows then, that training and raising awareness with the GPs is important not only for the possible case start by the GP, but also so that the conversation of the potential suitability of Invisalign can start at the GP’s office even if the patient is referred to an orthodontist. As such, Align focuses on constantly training doctors (both GP and orthodontists) to use Invisalign, with over 200,000 doctors trained globally as shown in exhibit 2.

These utilization rates will likely continually improve as the clinical confidence in the use of Invisalign increases with advancements in product offerings and complementary technology. This is important because the teenage and younger market represents 75% or 11.25 million annual case starts globally. These case starts are more complex than the average adult case start and practitioners will need time to build confidence, especially since many of the most recent innovations to the product are just now providing clinical proof of concept to dentists. The most significant of these innovations was the rollout in 2018 of Invisalign treatment with Mandibular Advancement, which is the first clear aligner solution for Class II correction in growing tween and teen patients (Class II malocclusion is one where the upper front teeth are protruding over the lower teeth, representing an excessive horizontal discrepancy). This offering combines the benefits of a clear aligner solution with features for moving the lower jaw forward, while simultaneously aligning the teeth without the need for elastics that are typically used for Class II patients. Another innovation unveiled in 2018 was Invisalign First, which is a treatment option designed especially for younger patients with early mixed dentition and a mixture of baby/permanent teeth. These innovations have collectively contributed to the increase in Invisalign applicability from 60% of cases in December 2017, to 90% of cases by December 2020. The penetration of this market is still relatively low for Align, especially within the teenage and younger segment, which has the largest potential for growth as shown in exhibit 3.

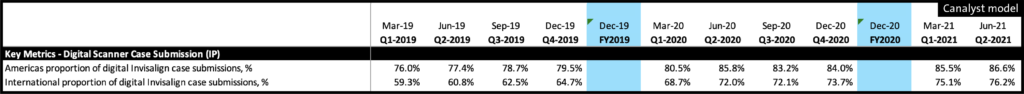

Digitization of the dental practice has been a goal of Align for many years, with COVID accelerating the adoption of digital technologies that reduce face-to-face interactions and speed up in-person meetings. The company’s iTero intraoral scanner allows dentists to visualize and evaluate various treatment options. The scanner itself is handheld and provides a 3D image of a patient’s oral cavity, allowing for aligners to be manufactured faster and more accurately than the traditional method of using PVS impressions. The most recent iteration of their scanner, called the iTero Element 5D scanner, is the first integrated dental imaging system that simultaneously records 3D, intra-oral color and near-infrared imaging and enables comparison over time using time-lapse technology. In keeping with digitizing the dental practice, Align purchased exocad Global Holdings GmbH on April 1, 2020, which is a Computer-Automated-Design/Manufacturing software company for restorative dentistry, implantology, guided surgery, and smile design. While not directly related to the core product, this allows the end-to-end service offering of Align to appeal more to GPs and orthodontists. The continuing importance of the iTero scanner as a seamless part of the Invisalign treatment process is clearly shown by the increased proportion of case submissions that are conducted via scanner as shown in exhibit 4.

Invisalign Go-to-Market

Align has made a conscious effort to stick with dentists and avoid engaging in the direct-to-consumer (DTC) market for clear aligners, the bet here is that in the long-run, dental work stays in the dentist’s chair, especially for teen/younger patients, who have more complex issues on average, this is likely a safe bet. Instead of cutting providers out, they are investing in dentists by taking an active role in training them. This allows Align to leverage dentists networks, helping them get in front of their target demographic organically. Although not explicitly reported, the constant training of new doctors, along with the consistently rising utilization by active doctors (83,500 doctors started at least 1 case in Q2/21), implies favorable cohort dynamics as shown in exhibit 5 below.

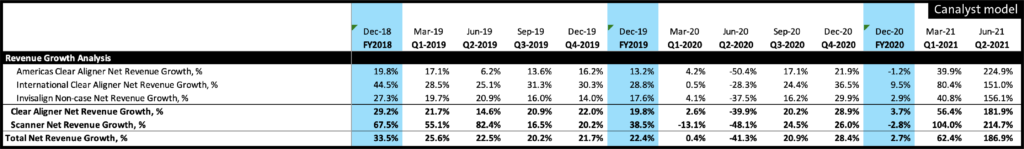

The financial incentive for a GP or orthodontist to prescribe Invisalign is also favorable for Align. It takes substantially less time for a dentist to prescribe Invisalign and the process requires less follow-up visits than traditional braces, which means higher volume possibilities. Also, because Invisalign is reimbursed at the same level as braces in most places, the margin is not affected on the revenue end for the dentist, with their cost being roughly $1,200 per case (representing Align’s ASP). A great example of these efficiencies and the potential continued growth trajectory for Align was the massive surprise they posted in Q3/20. While other companies in the devices space were all suffering due to lockdowns imposed as a result of COVID, Align doubled down on marketing spend, posting a record (at the time) $312.5 million of SG&A in Q3/20. This, after reducing SG&A in Q2 vs Q1 of 2020, which was the first quarter over quarter decline in SG&A since Q4/15. This approach, along with their digital friendly offering, especially when contrasted to braces, saw Align post 21% revenue growth in Q3/20. This was on top of a non-COVID 20.2% growth figure posted in Q3/19, essentially meaning Align was growing as if COVID never happened, while in the middle of COVID lockdown (as shown in exhibit 6). This was reiterated by Align in their Q3 conference call, which mentioned that those results were posted with GPs and orthodontists operating at 70-75% of pre-COVID capacity. This means that Invisalign must have massively displaced braces well above the normal rate of cannibalization that was already occurring prior to COVID, a trend that is unlikely to reverse once we can claim we are officially in a post COVID environment.