When the COVID-19 pandemic struck in early 2020, auto-manufacturers slashed their orders on parts and materials with their respective tier-1 suppliers in anticipation of a massive decline in vehicle demand. As a result, semiconductor manufacturers and foundries pivoted, diverting chips to product markets with more optimistic demand outlooks, such as consumer electronics and data centers, effectively reducing the manufacturing capabilities across the auto industry. This measure backfired as the demand for vehicles industry-wide was severely underestimated.

As a result, there was an estimated supply shortage of ~1 million units in Q1/21. IHS Markit predicts the automobile manufacturing supply chain will be constrained into Q3/21, with order lead times roughly doubling from 12-16 weeks to 23 weeks. Further, Edmunds highlights new vehicle inventory on sale at dealerships nationwide was down 36% y/y for March 2021, with average transaction prices (ATP) up ~5% and 12% for new and used vehicles respectively over the same period.

Impact on Manufacturers

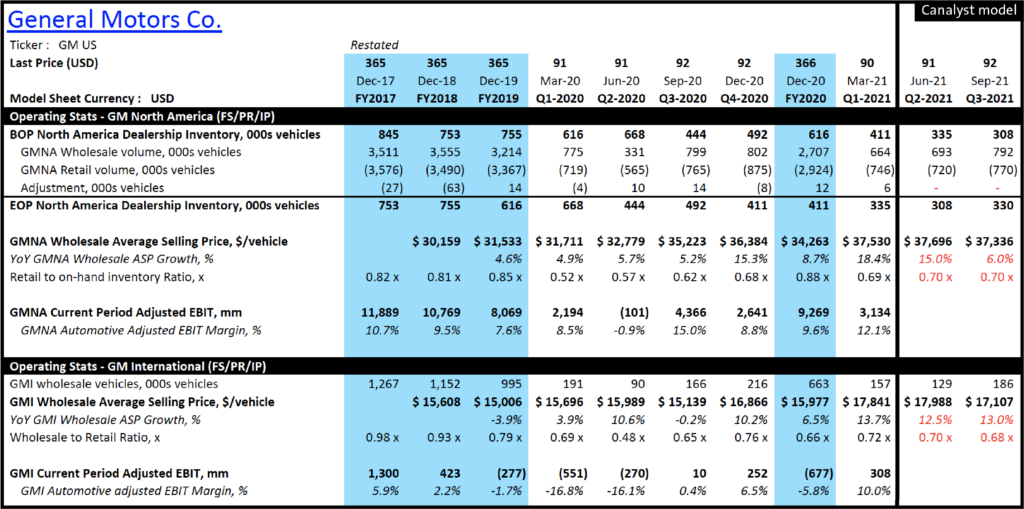

From an initial forecast of $60.6 billion and 2.2 million vehicles lost in production in late January 2021, the estimated loss has increased to $110 billion and 3.9 million vehicles. GM (NYSE: GM) management has quantified the cuts as having an impact as large as $2 billion on 2021 profit. Ford (NYSE: F) has noted their production of the F-150 pickup trucks could be reduced by 10-20% of their Q1 production plan, impacting their bottom line in the range of $1 – $2.5 billion.

However, the latest commentary by management points to a more positive tone. In a press release, GM (NYSE: GM) stated that it expects first-half financial results to be significantly better than the first-half guidance previously provided. This is due to the pull-ahead of some of its projected semiconductor deliveries into Q2-2021. Similar is the case for Ford (NYSE: F), where the company now expects adjusted EBIT for the Q2-2021 to surpass its expectations and be significantly better than a year ago. This coupled with a very favorable price-mix environment for new vehicles may help automotive manufacturers offset the decline in inventory caused by chip delays, thereby beating expectations in 2021.

Impact on Auto-Retailers

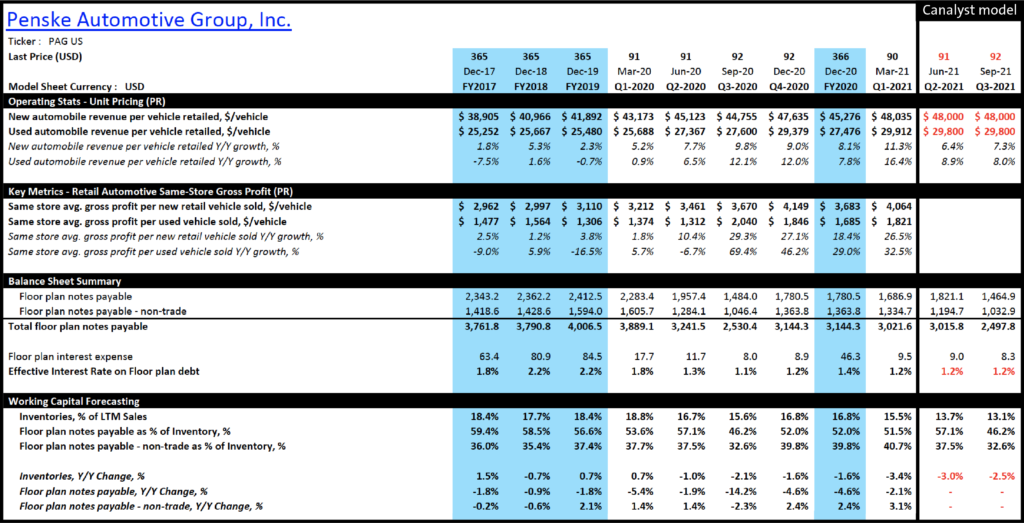

On the auto-retailer side, Penske Automotive (NYSE: PAG) reported lower inventory in Q1/21 due to both production cut by manufacturers (due to chip shortage) and strong demand from end consumers. These two factors have led to a large increase in average selling price (ASP) per new (+11.3%) and used vehicle (+16.4%), thereby increasing their gross profit per unit (GPU) (by 26.5% and 32.5% respectively).

In addition, the depletion of inventory has led to a reduction in the company’s floor plan notes payable which has, in turn, caused a reduction in floor-plan-related interest expense, helping expand bottom-line margins.

The sizeable supply/demand imbalance appears to have created a dynamic that’s far more accommodative for the auto industry than initially anticipated, and one that could persist through the near term.