The bitcoin network introduced a new dynamic into the commodity markets: the concept of an expected negative supply shock caused by the bitcoin reward halving, occurring roughly every four years. Since bitcoin’s inception in 2009, the reward for successfully mining a block has been cut in half three times, with the latest halving occurring in May 2020. Interestingly, the bitcoin price increased exponentially after each one, as is expected from a negative supply shock.

Since each bitcoin halving has proven to be a catalyst for rapid price appreciation, it is no surprise that hopeful bitcoin investors eagerly await each halving. However, it is an event that is dreaded by the miners who work to keep the network secure and verify transactions on the blockchain, as it causes their bitcoin production volumes to be cut in half. Barring a sudden increase in price, this puts immediate and significant downward pressure on industry revenue and profitability.

Consistent with traditional mining companies, direct expenses (such as data center overhead, electricity costs) have minimal variability, meaning miners are very sensitive to changes in the bitcoin price.

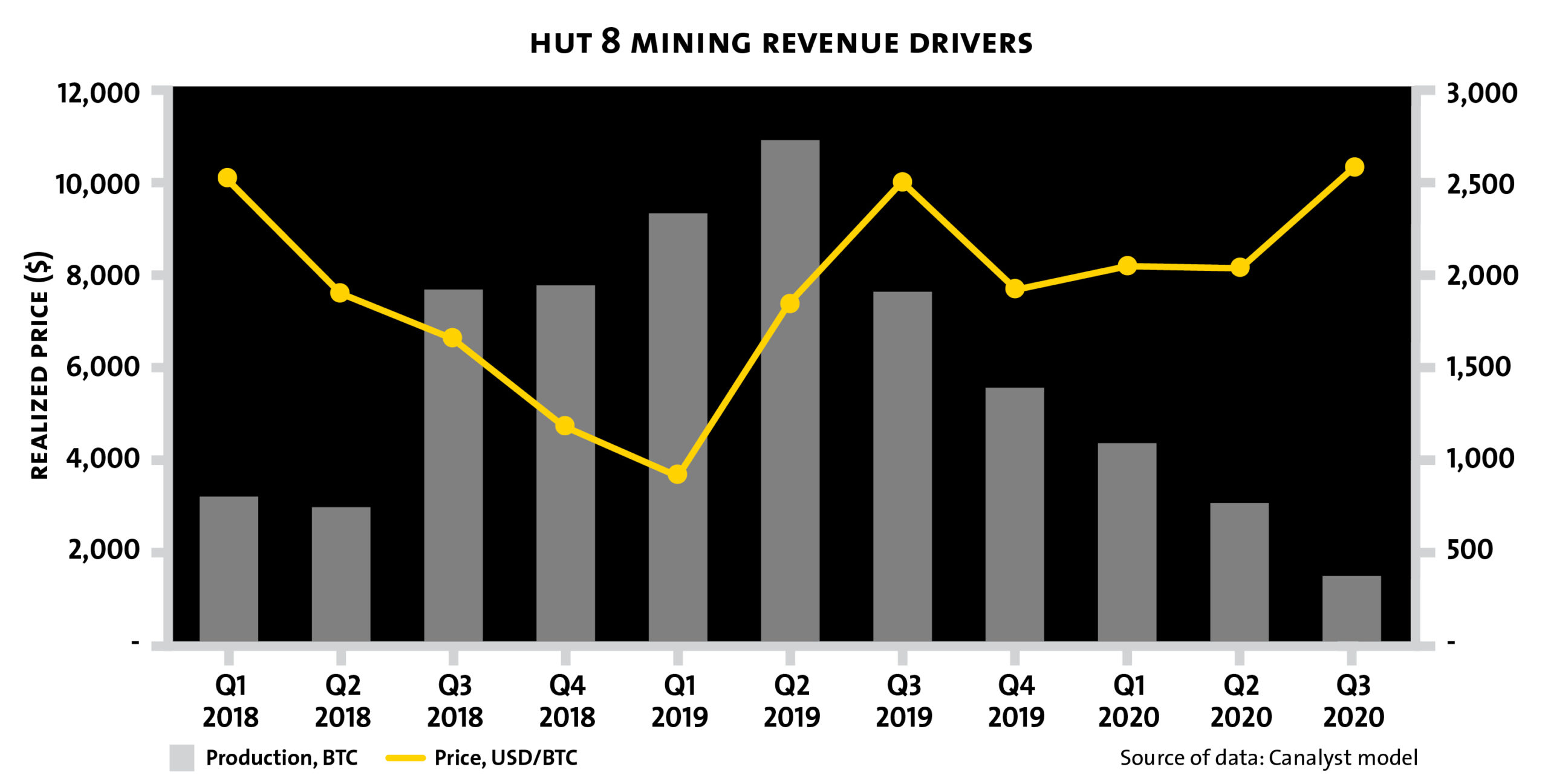

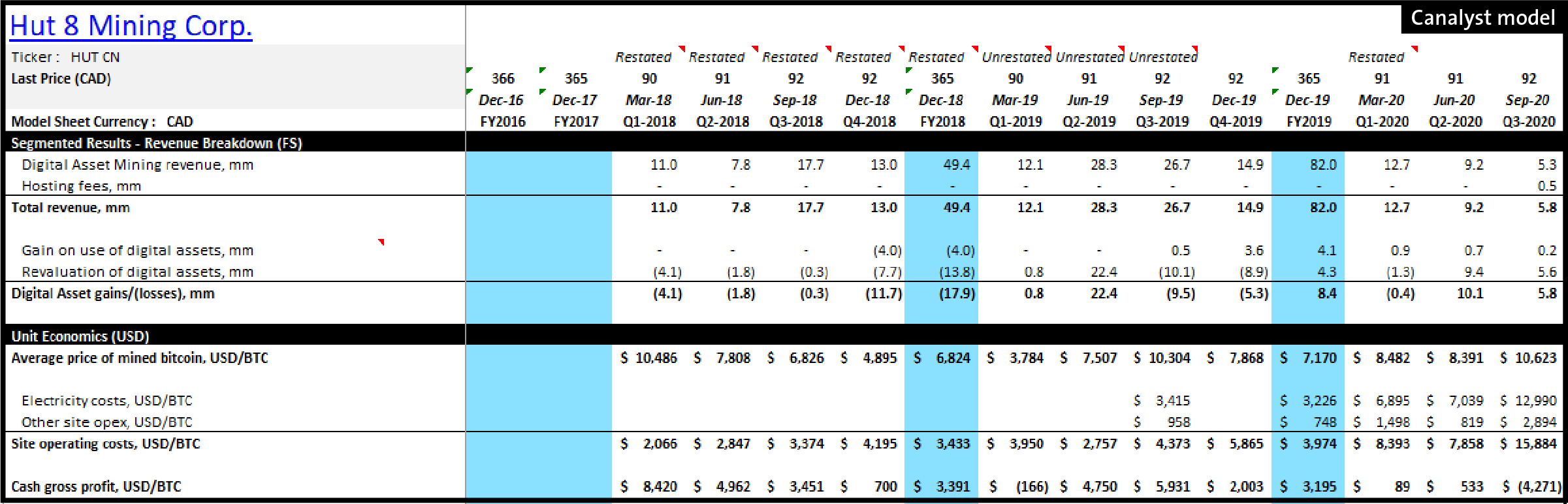

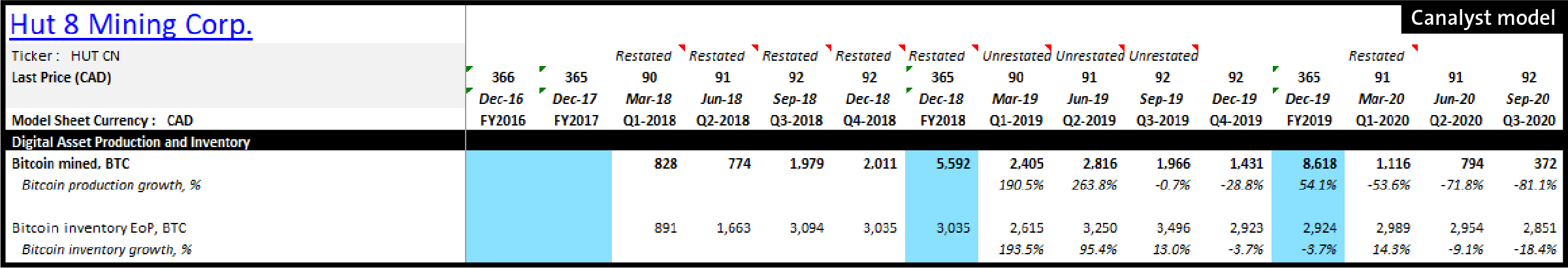

Hut 8 Mining (TSX: HUT) is a large-scale commercial bitcoin miner with two facilities in Alberta, Canada, where it has access to reliable, low-cost electricity. The company began mining in early 2018 and quickly ramped up its operations, reaching peak production in Q2/19, just as the market price for bitcoin was also reaching the 2019 peak.

Since then, HUT’s bitcoin production has been declining, having reached its lowest production in the first full quarter after the May 11th 2020 halving. As expected, this secular decline in production has negatively affected HUT’s revenue and unit economics, despite a relatively stable bitcoin price between Q2/19 and Q3/20. In that period, revenue declined 81.3%, from $28.3mm to $5.3m.

High fixed costs combined with declining production also resulted in rapidly deteriorating unit economics. The rapid rise in production costs paired with a stagnant market price resulted in a gross margin (ex. depreciation) of -36.8% in Q3’20. The impact of the halving is further exacerbated by the hash rate (the rate at which one earns a bitcoin mining) increasing. Quantifying the total effects of these headwinds the company CEO highlighted it is now “140% more difficult to mine for a bitcoin”.

As a result of declining unit profitability, HUT began selling off some of its bitcoin inventory to bolster cash flow, going against its stated strategy of mining and holding bitcoin on its balance sheet.

Selling bitcoin inventory is a short-term fix, as it does nothing to change the underlying dynamics of running at a negative gross margin. In order for HUT to return to gross margin profitability either the market price of bitcoin must appreciate, or less efficient miners must cease operations, removing competition from the network and increasing HUT’s share of total computational power. As a bitcoin mining company’s production efficiency scales proportionally with their share of network computing, the latter scenarios would enable HUT to ramp up production and recapture its operating leverage.

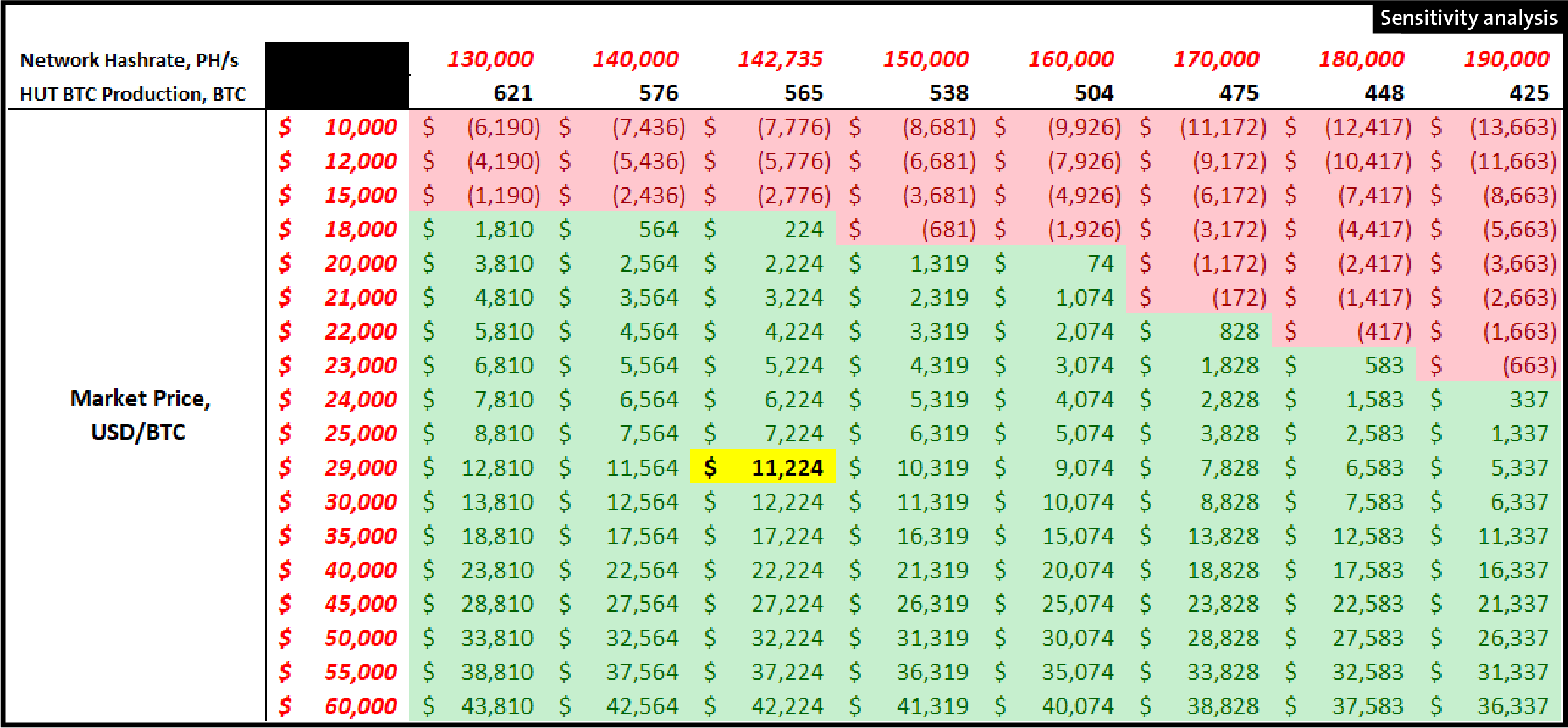

Illustrated below, the sensitivity analysis demonstrates HUT’s gross margin given different assumptions for BTC price as well as network computing power (and therefore BTC production). The underlying assumptions for HUT’s hashpower, power draw and electricity cost (996 PH/s, 97 MW and $0.048 CAD/kWh respectively) reflect reported metrics for January 1, 2021 and assumes the mine has a 100% uptime.

On December 31st 2020 the bitcoin market price closed at $29,001 USD/BTC, and the 7-day moving average of computational power on the bitcoin network was 142,735 PH/s, giving an expected gross mining margin of $11,224 USD/BTC. As shown, current market and network conditions are proving very favorable for HUT, as the company’s gross mining margin projects a significant improvement from a previous low of $(4,271) USD/BTC in Q3-2020.

As Mark Twain wrote, history doesn’t repeat itself, but it often rhymes. Once again, the tough bitcoin mining unit economics observed immediately after the halving have been relieved, mostly caused by a rapid increase in bitcoin’s price since October 1st.