The following is an example of the use of Canalyst Fundamental Data using Candas, not intended to be a recommendation of action.

The Python Jupyter Notebooks supporting this analysis can be found at our Candas Github Repository.

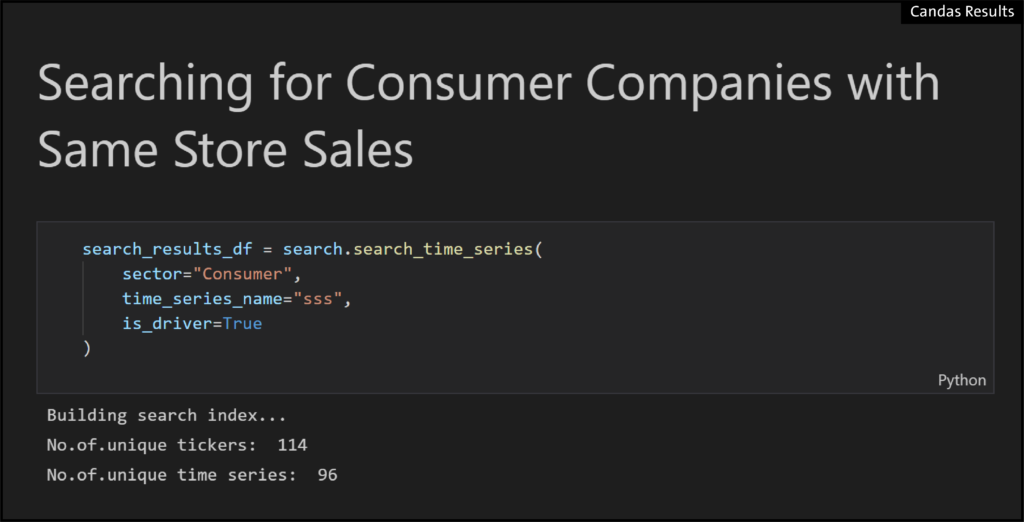

Re-drive a Sector in just a few lines of code:

- Find models which are driven by Same Store Sales.

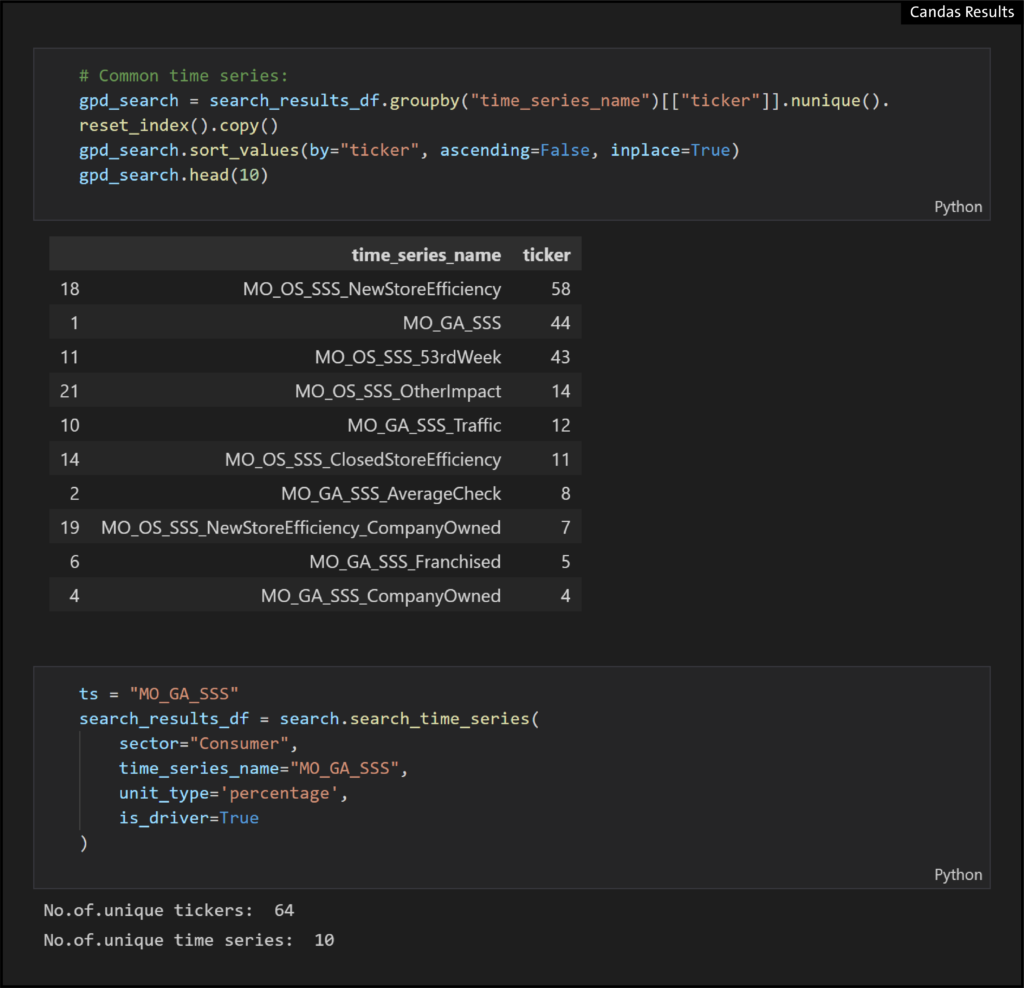

- Same Store Sales search returns a few different series.

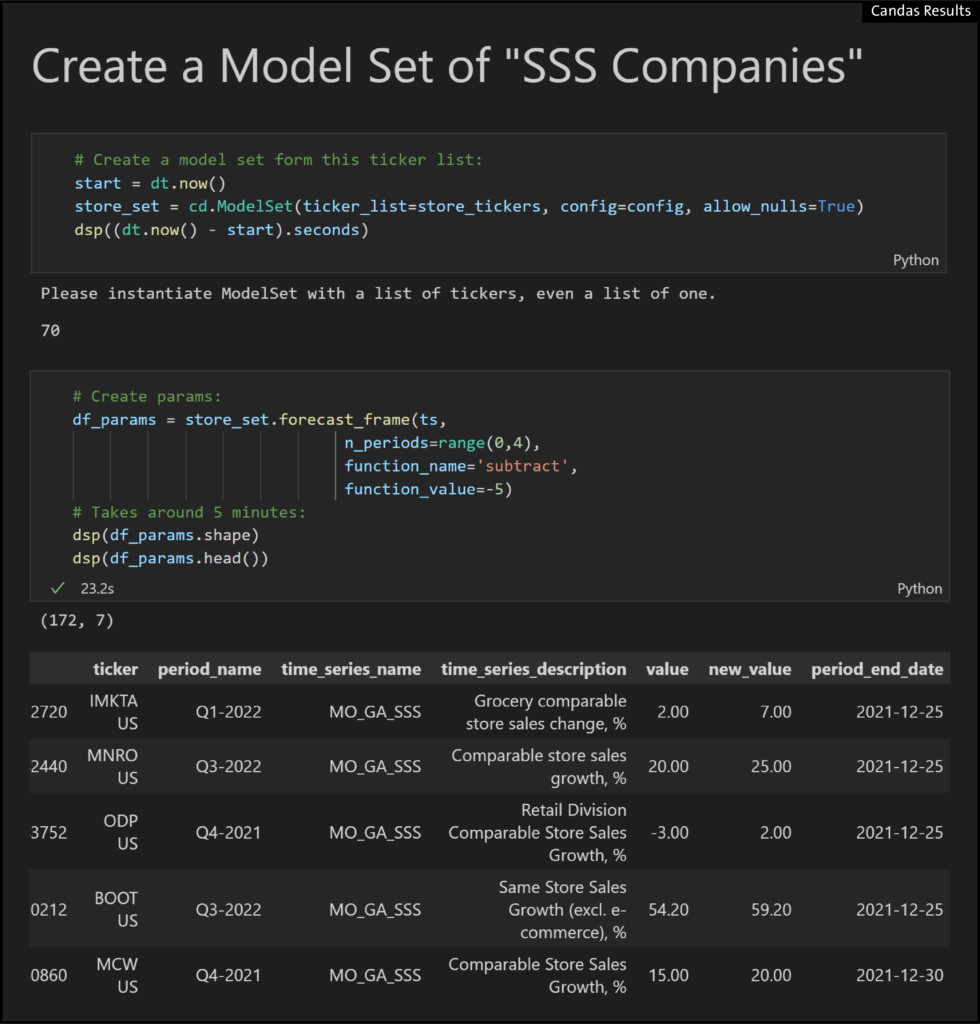

- Leaving us 43 names to build our ModelSet and reset the whole group’s SSS time series to -5 points as an example scenario.

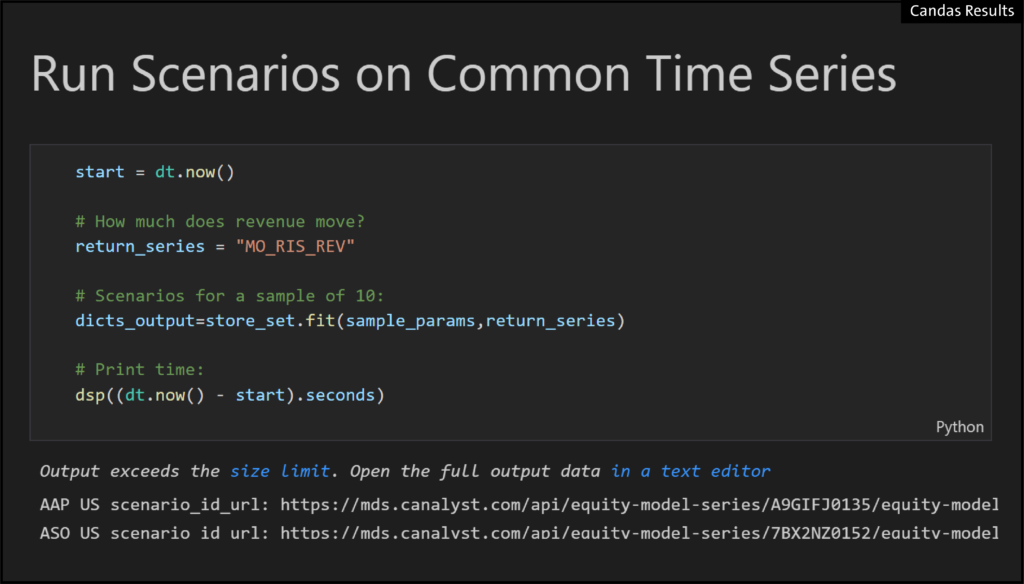

- Now we run the fit() function.

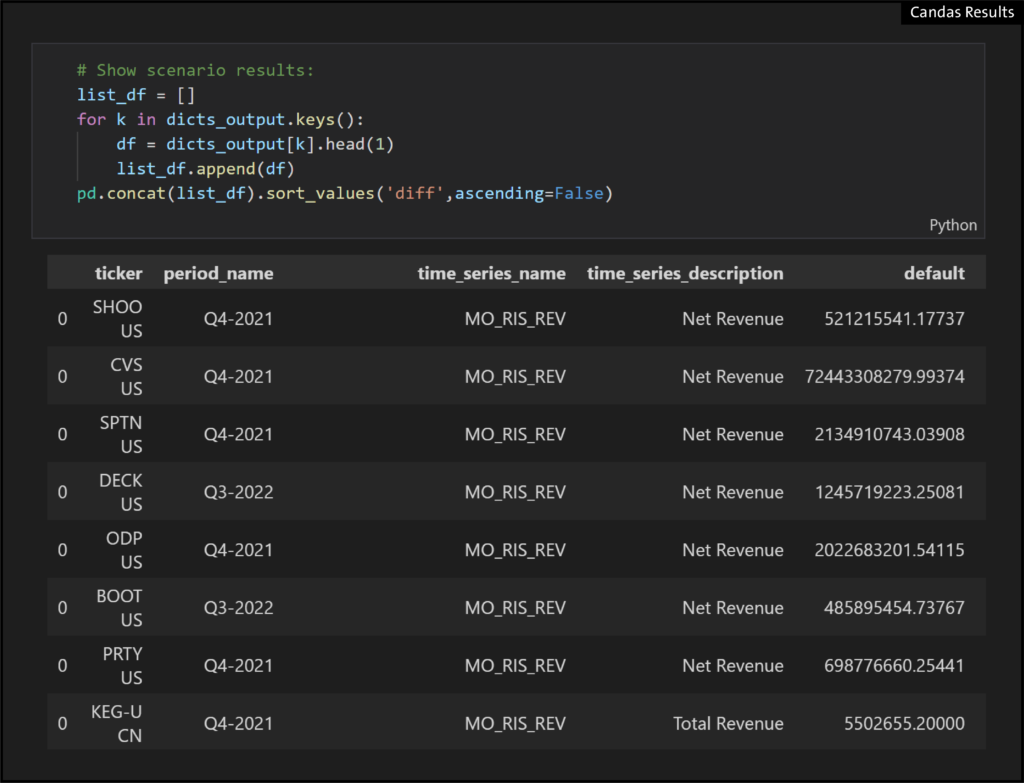

- We can rank order the output across the group.

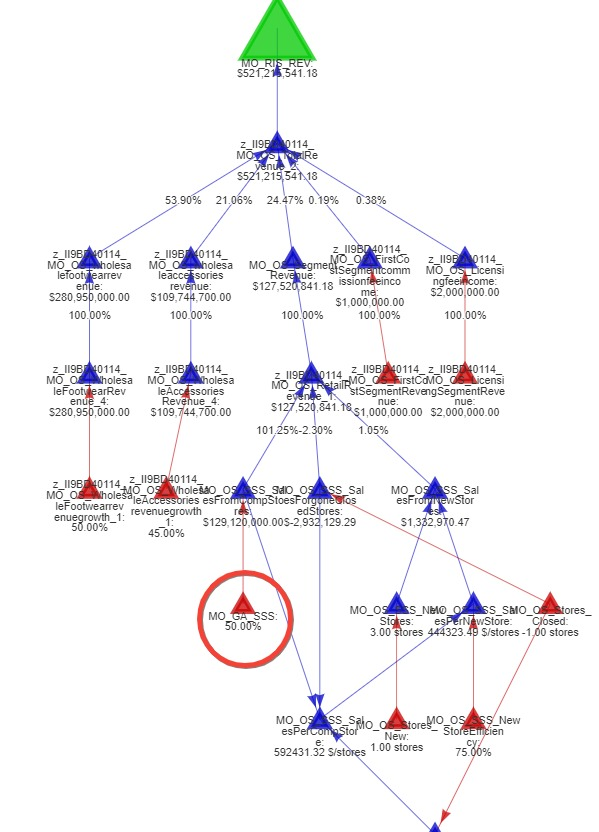

- And we can see the reason why with the ModelMap() function: SSS was already 50%!

Quickly run scenarios like this with Candas. Whether you’re investigating specific comps or trying to evaluate an entire sector, the Candas Scenario Engine lets you quickly assess, adjust, and get results.

Candas helps scale fundamental analysis with its custom functions and resources. Interested to see what Candas could do for you and your workflow? Find out more here, or request a demo today!