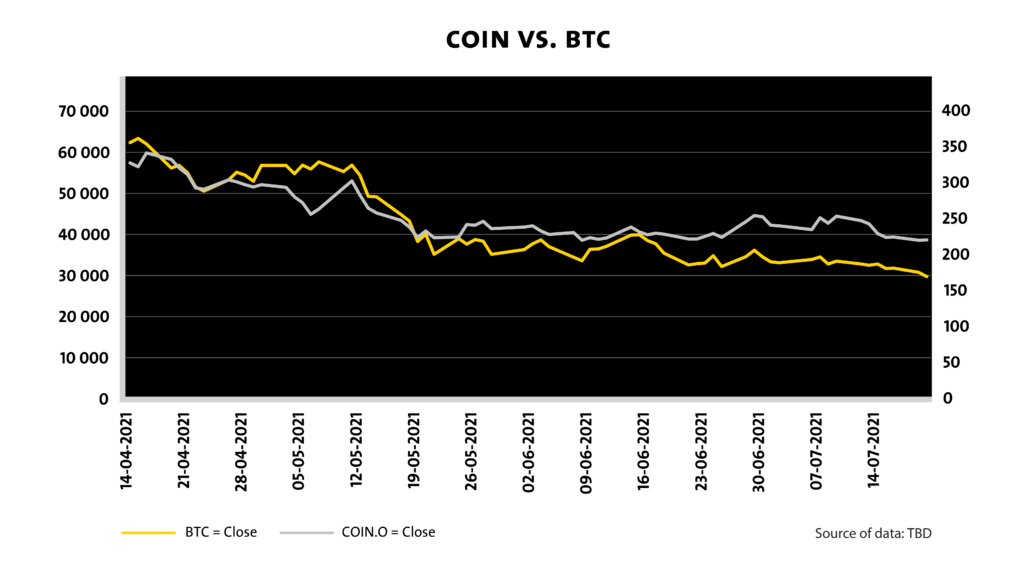

The past three months have been a rollercoaster ride for bitcoin from its high of over $63,000 in April to around $35,000 as of June 24, almost a cut by half from its peak. China’s mining ban and loss of momentum (partially due to Elon Musk’s tweets) led to the recent drop in the bitcoin price. Recently IPO’d Coinbase Global (NASDAQ: COIN) has garnered material interest as an alternative to gain exposure to cryptocurrency; with relatively solid fundamentals and less volatility (though still down 25% from its close on its Nasdaq debut on June 24).

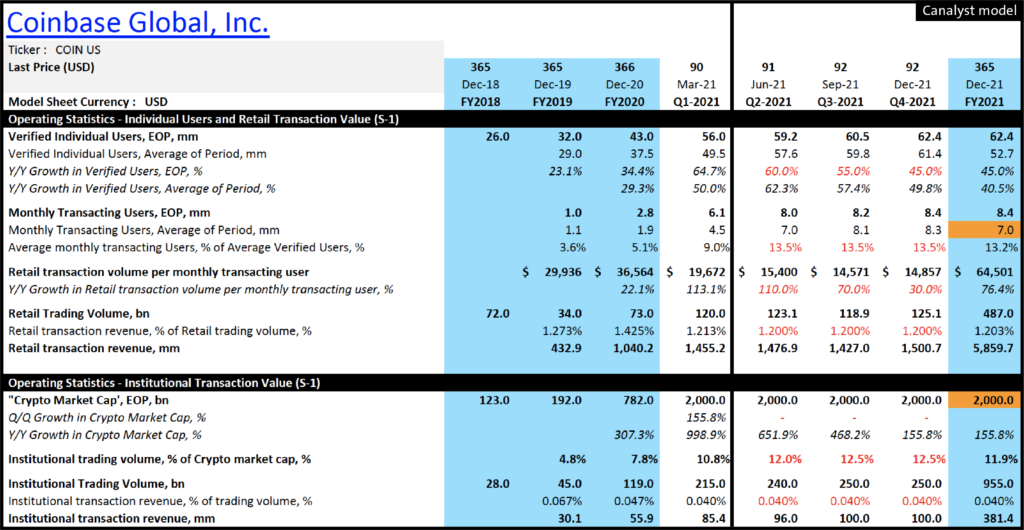

Coinbase is a profitable business with an operating profit margin of 54.8% and a diluted EPS of $3.05 for Q1/21. The majority (85%) of COIN’s ~1.3 billion 2020 revenue came from transaction processing, for which COIN takes 50bps of the total transaction value. Given its exposure to the underlying value of the transactions on its platform, a strong crypto market is favorable for COIN. As per company management, their base case assumptions are a flat crypto market cap and an average monthly transacting users (MTUs) of 7.0 million for FY21. That is expected to lead to a diluted EPS of $11.01 for FY/21 without changes in other underlying assumptions in the model.

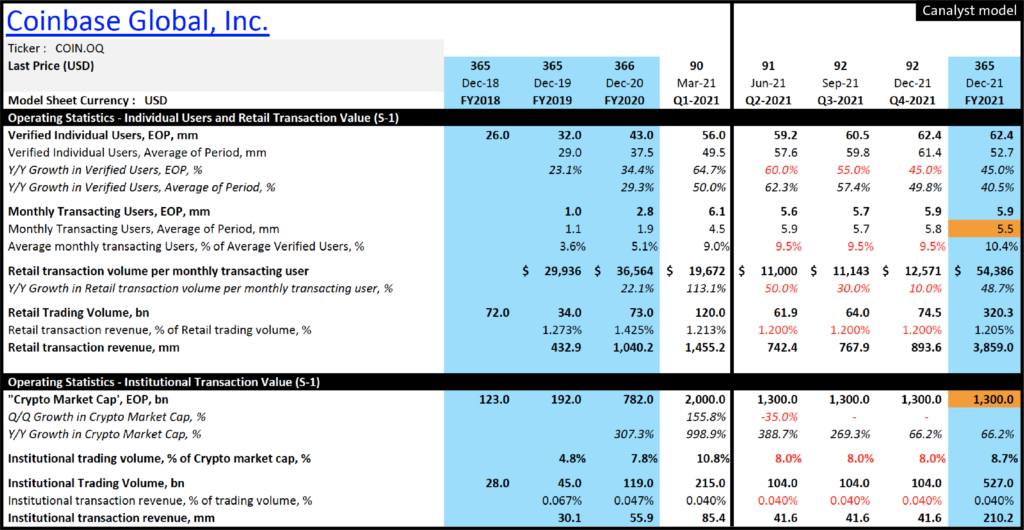

However, the crypto market cap was sitting well above $2 trillion when COIN last updated its FY21 MTU scenarios via its shareholder letter on May 13. A bear case seems more likely as the crypto market cap has dropped to around $1.3 trillion as of July (TradingView). Though we’d be remiss not to caveat that the July 26th price movement on rumours of Amazon’s (NASDAQ: AMZN) potential involvement in the industry, highlights how quickly that can change.

The Company is estimated to earn a diluted EPS of $6.81 for FY21 with the assumption of 5.5 million average 2021 MTUs and a sizable decrease in crypto market cap based on the Company’s outlook. A lower retail transaction volume per MTU and a lower institutional trading volume have also been modeled to reflect a less active crypto market. The stock is trading at a FY21 P/E of 36x under the bear case scenario, rich versus traditional brokerage firms but difficult to compare given its direct competitors such as UPHOLD and Binance are private.

The recent price decline was difficult for many to digest but does not appear to be a repeat of the 2018 cryptocurrency crash as the perception, adoption, and market participants of the crypto market are different from 2018. The crypto market cap as of this writing is about double the peak before the great crypto crash in 2018 and is more than ten times the market cap after the crash. Major cryptocurrency prices may stabilize at current levels (or Amazon may have just been the catalyst for yet another material run up) and the crypto winter may not come. Even if it does, Coinbase is in a relatively good position as long as there are a fair amount of trading activities and low-to-moderate crypto asset price volatility.