Many eyes will be watching homebuilder results this earning season given the surge in housing starts and construction activity in Q4. US seasonally adjusted housing starts were up 5.8% in December 2020 over the prior month, well ahead of consensus expectations (1.669 million posted vs consensus of 1.560 million units) and up 5.2% y/y. The increase in single-family starts was even more impressive. December marked the eighth consecutive quarter of m/m increases, up 12.0% over November results and a whopping 27.8% y/y. This marks the end of stellar quarter, particularly for single-family home starts (up 28.4% in Q4 y/y and 19.3% m/m).

The homebuilding data points to a very strong second half for home builders. After a slight drop in Q2/20 quarterly results, building product providers enjoyed a meaningful boost in Q3/20 thanks to cheaper mortgages and an exodus from city centres to the suburbs. Many leading brands posted 13-19% y/y growth in Q3, though commodity inflation was a large contributor (>7% in most cases). Commodity inflation will play a meaningful role in Q4 as well (according to the US Labor Department, softwood lumber prices were up 52.2% in December), however the strength of underlying macro data suggests organic growth should also be strong for many/most of the homebuilders.

The newly bolstered Builders FirstSource, Inc (NASDAQ: BLDR) should be a material beneficiary of the strength in single-family home starts. On January 4, BLDR and BMC Stock Holdings, Inc. (BMCH) officially merged through an all stock deal, bolstering BLDR (surviving entity) as the second largest supplier of building materials and services. BLDR and BMCH historically competed in the professional segment (“Pro Segment”) of the U.S. residential building products supply market, which primarily consists of homebuilders and remodeling contractors (on a pro-forma basis, single-family revenue accounted for 72.6% of BLDR/BMCH revenue in FY2019 and 71.4% in Q3/20). According to ProSales magazine 2020 ProSales 100 list, BLDR and BMCH’s TTM net sales as of June 30, 2020 ranked 2nd and 5th respectively. Their combined revenue of $11.2 bn was slightly behind $11.7 bn of ABC Supply Co., which focuses more on roofing and siding products. Based on historical data provided (from Q1 2018), the correlation between total single-family home starts and BLDR’s organic growth on a pro-forma basis is 0.57, which implies organic growth for the combined unit could be ~7.5%.

Above: Canalyst model

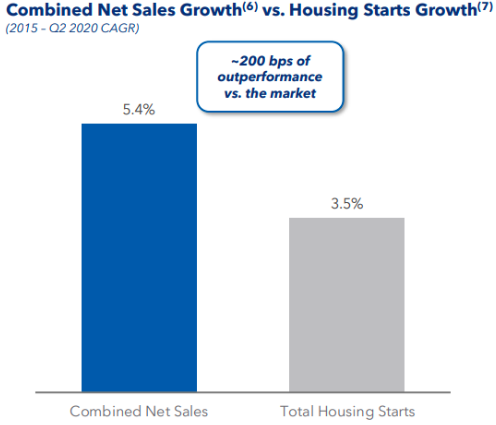

Notably, according to BLDR management, the combined net sales of the merged companies historically outperformed total housing starts by ~200 bps since 2015.

Above: (6) Net sales in 2015 pro forma for ProBuild and SBS. (7) Historical total housing starts data based on U.S. Census Bureau. Sourced from Company Presentation.

There is significant overlap between the product offerings of BLDR and BMCH, as demonstrated in the summary of their segmented revenue breakdown. As such, the combined company should be able to achieve greater economies of scale, while providing investors with a more geographically diverse footprint – their now 550 facilities are located in 42 states, including 44 of the top 50 MSAs (Metropolitan Statistical Area).

Above: Canalyst model

The deal also strengthened BLDR’s exposure in the Southeast (23.2% of total sales in 6/30/2020 vs 33% on a combined basis). While single-family housing starts in the South modestly lagged the other regions in Q4 (up 26.5% y/y vs the total 28.4% y/y increase), on an absolute basis, the South contributed 55.3% to the total increase.

Above: (2) Combined TTM Net Sales as of 6/30/2020. Sourced from Company Presentation.

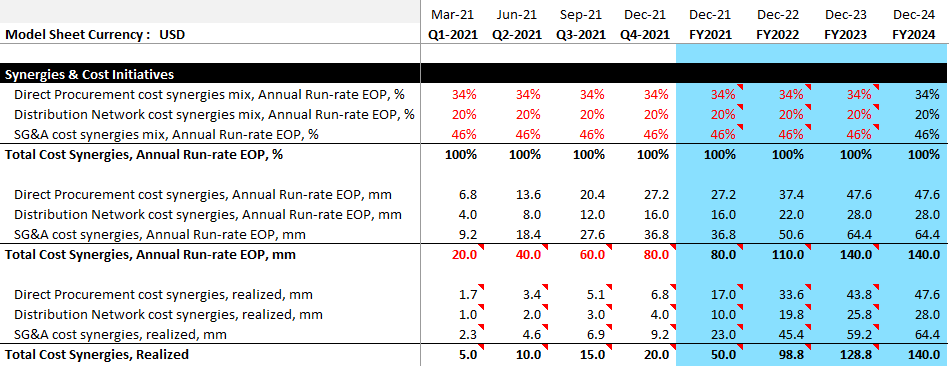

BLDR management expects the merger to yield $130 – $150 mm run-rate cost synergies over the next 3 years. Primary rationalization of suppliers, overhead expenses and facility footprint will all contribute to the cost savings which are broken down to direct procurement (34%), distribution network (20%) and SG&A (46%).

Above: Canalyst model

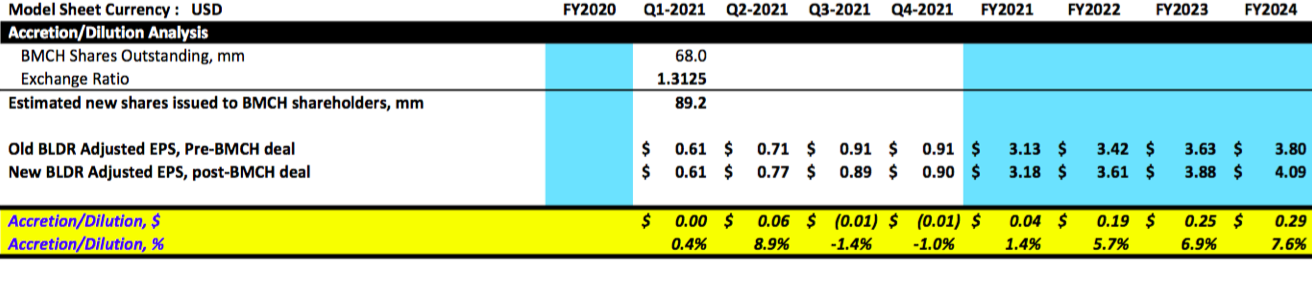

Based on conservative estimates, the new BLDR will slightly pass break-even for the first year (as the company guided), and start to enjoy more accretive returns in the years to come.

There are certainly tailwinds in the current macro environment, that suggest these estimates may be light. December building permits were up 4.5% m/m to 1.709 million units on a seasonally adjusted basis (also beating consensus expectations). Single-family building permits lead the increase, up 7.8% m/m to 1.226 million units in December. Permits typically lead starts by one to two months. Mortgage rates remain accommodative and single-family home inventory continues to be lean. However, inflation and labor supply constraints are a material risk in 2021.