MongoDB (MDB) reported its last set of results on March 8, extending a string of earnings outperformance. Its FQ4/22 results (three months ended January 31, 2022) beat expectations across the board and set the stage for further optimism around the structural drivers in the DevOps (Development Operations) space. On the same day (March 8), the Nasdaq composite closed down -20.3% from its peak on November 19, 2021 making it officially a Bear Market.

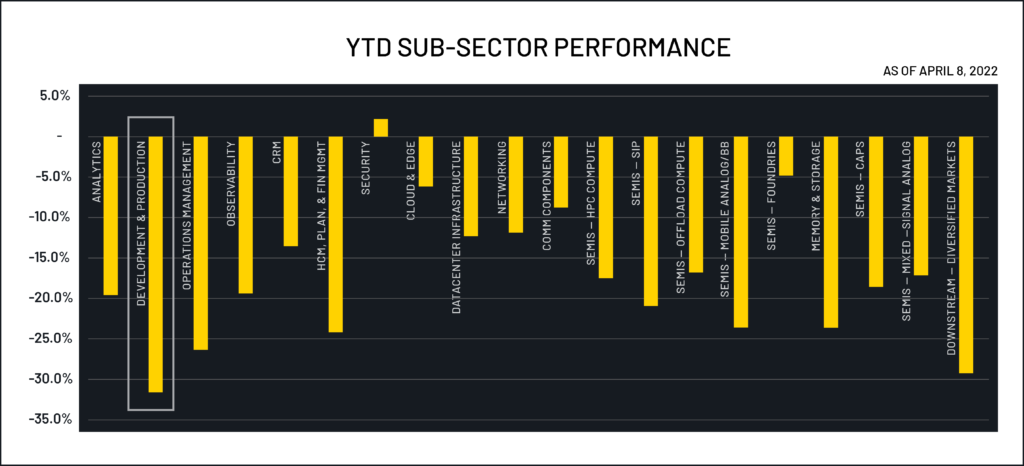

Despite some modest market recovery since then, mid and large capitalization software names remain battered. Excluding only a handful of names, nearly every one of the peer groups containing stocks used in our analysis are in a contraction (on a YTD basis).

The sector that MDB belongs to, after declining -8.2% in Q4/21, is down -31% YTD (as of April 8) based on the average share price performance for all names belonging to the group.

Despite recent volatility, MDB fundamentals continue to strengthen. Management offered another quarter of solid execution, with the numbers well-above consensus estimates. For FQ4/22 (Jan ’22 end), the company reported a large +$23M beat on the top line at $266.5M, growing 55.8% y/y. Equally, non-GAAP EPS (adjusted for stock compensation, amortization of intangibles, and non-cash interest) of -$0.09 was +$0.12 better than expected.

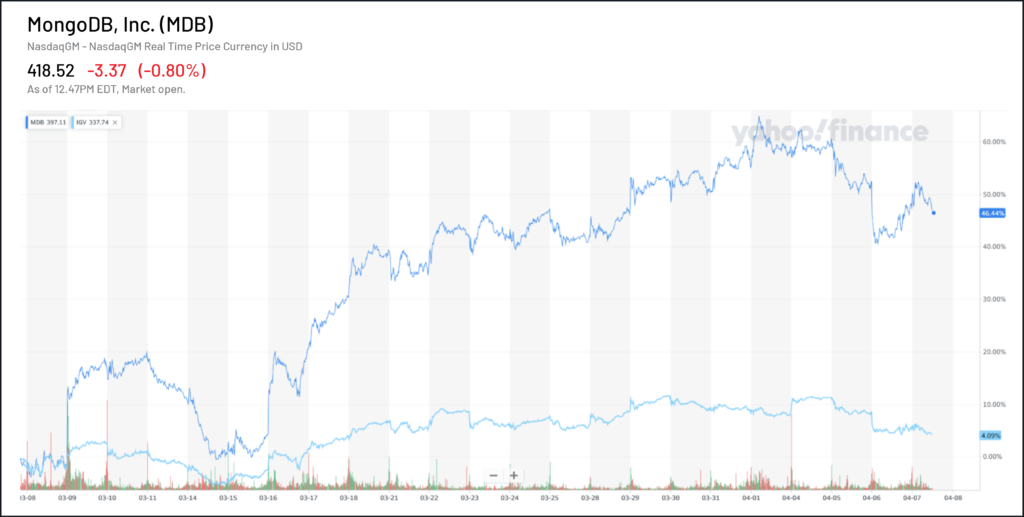

MDB also introduced FY/23e guidance with revenue of $1.15-1.18B or ~34% y/y growth at the mid-point. The stock price was up +18.6% at the close of the following day (Wednesday, March 9). Since reporting, MDB stock price has risen 46% as of April 7. Compared to the IGV index performance of 4% in the same period, MDB’s results clearly delivered and brought on sufficient confidence to hold the name in the face of growing macro uncertainty.

Incidentally, Couchbase (BASE), a close competitor to MDB, reported the very same week. Yet, those results fell short of providing the same kind of confidence; due mainly to the product launch timing, which seems to lag demand. Demand that appears to be energized only by the effects of the pandemic.

MDB reported growth acceleration, which was reflected by strength on the bottom line, and in turn, helped the name stay ahead of most relevant benchmarks. A more detailed analysis shows that MDB’s resilient product cycle helped to mitigate the risks to its cashflow streams.

BASE showed less resilient headline figures. The lack of visibility for its new offerings that are set to rival MDB’s has curtailed confidence. Aside from a few metrics that indicate acceleration in the latter half of the year, the lack of firmer contribution is reflected in continued cash outflows, which elevate risks in a volatile environment.

Continue to part 2 below.