A story of a DBaaS product cycle

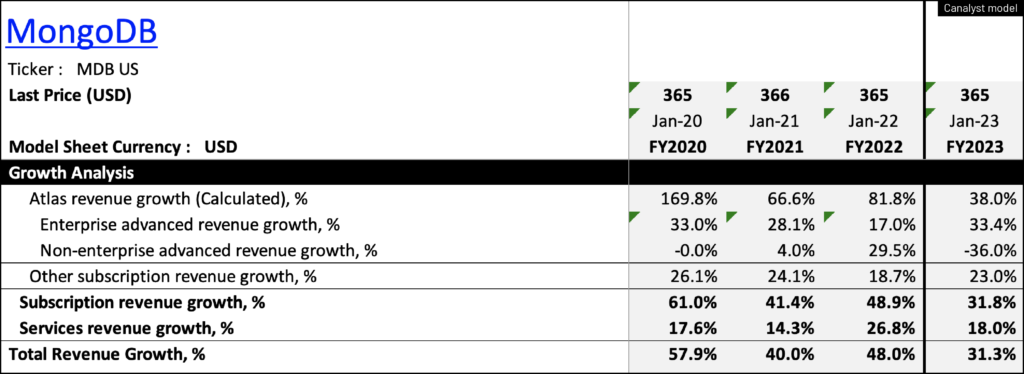

Taking a closer look at MongoDB’s (MDB) recent results, it is unlikely that investors were impressed with the FY/23e guide for revenue growth of ~31% y/y, a meaningful deceleration from FY/22e +48.0% y/y. The following analysis uses MDB’s fundamentals to explore what might have encouraged a +49% jump despite the deceleration and volatile macro conditions.

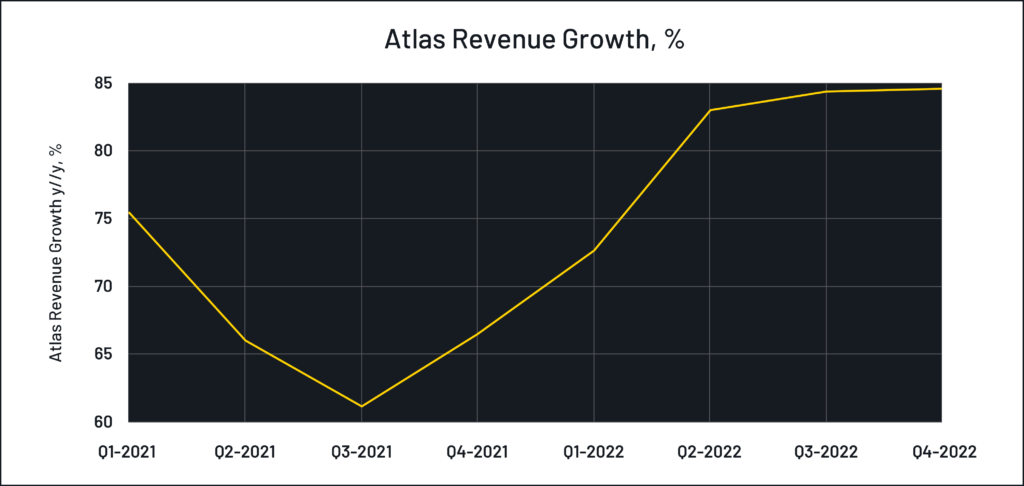

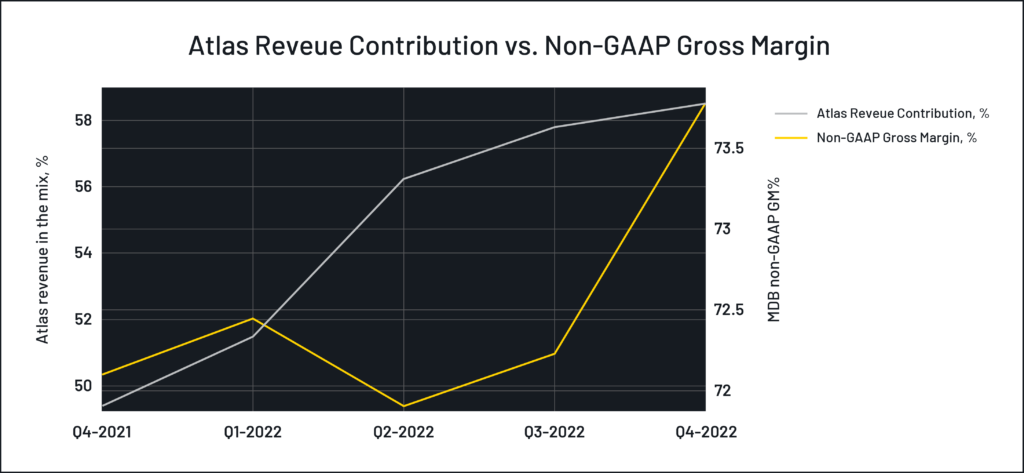

MDB delivered another quarter of acceleration for Atlas, its fully-managed Database-as-a-service (DBaaS) offering, of 84.6% y/y (FQ3: 84.4% y/y). As marginal as this acceleration was, the key takeaway is that fully-managed distributed databases matured as a trusted Enterprise tool. Atlas revenue accounted for 58.5% of total revenue in FQ4/22 (FQ4/21: 49.4%).

The accelerating growth of distributed databases are a direct result of the structural changes underpinned by digital transformation; changes that have clearly been accelerated by the pandemic. Distributed databases like Atlas are at the forefront of the structural trend of ‘lift-and-refactor’ restructuring, whereby enterprise workloads are redesigned and rewritten to run in the cloud-native environments. Taking full advantage of the elasticity of the Public Cloud, and the rapid development and deployment of new feature sets by DevOps teams.

As the TAM for this offering grows, those positioned well are set to address the demand from Enterprise teams of developers, IT infrastructure support, and operations staff. If market maturity becomes evident for Atlas, which is suggested by the fact that the majority of 7-figure deals in Q4 were Atlas-based, then, once combined with multi-cloud deployment, the case for stable revenue acceleration for Atlas becomes stronger.

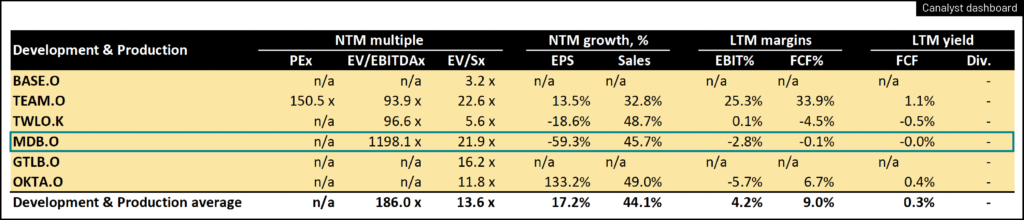

Amid the broad-based (multiple) contraction we have seen, MDB is trading at one of the highest revenue-based valuation multiples in the Enterprise software sector (22-23x EV/Sales NTM). Yet, MDB’s outlook of low-30% y/y growth for the year implies that its impressive Cloud-business will meaningfully decelerate in FY23e from 81.8% y/y we have seen for the entire FY/22.

Should this be the case of prudent conservatism in the face of a worsening macro, one may note that a guide for similar growth deceleration have punished management teams elsewhere in this reporting season (read: Snowflake (SNOW) fell ~27% in the three days following its reporting despite similar guidance to MDB).

Additionally, given the mix-shift to Atlas at MDB, the direction of gross margin expansion is a positive outcome that should not be ignored, especially in the context of comparable peers. The company reported a +200bps adjusted gross margin expansion in FQ4/22. Some of that was helped by the seasonality of the business renewals for Enterprise Advanced (EA), a server-based product. It appears as though the Enterprise investment cycle is alive and well, whether workloads run in a serverless environment on the Public or Private cloud.

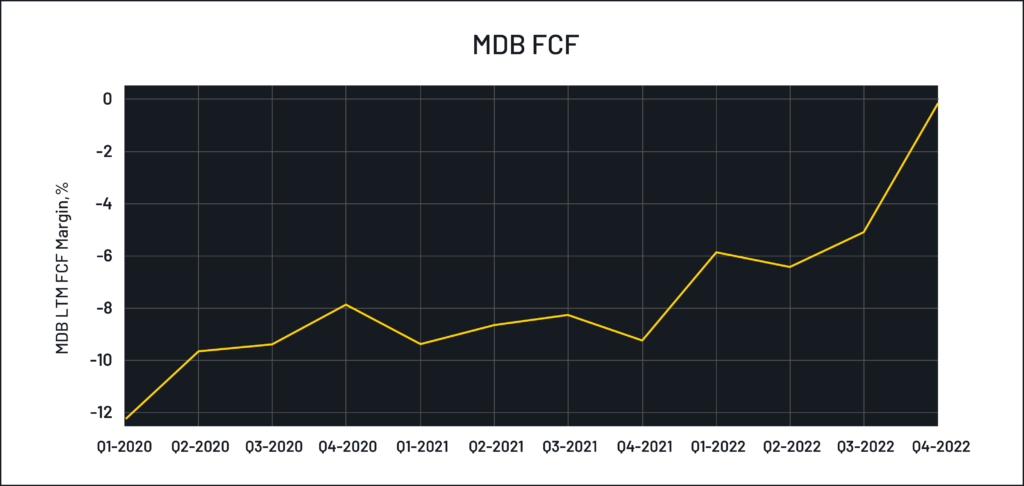

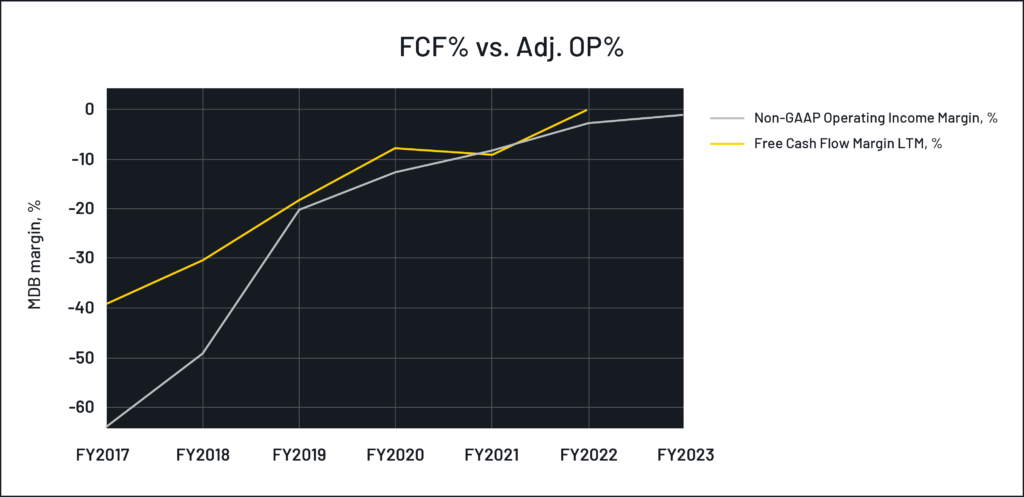

Now that the discount rate is unwinding, investors’ focus is moving to the bottom line across many stocks in this space. At $18.8M FCF calculated for FQ4/22 (vs. -$19.5M in FQ4/21), MDB is sitting in a strong position in the near-term. Looking forward, it appears that MDB is closing in on structurally positive cash inflows, while at the same time growing its Cloud business at ~85% y/y in FQ4/22.

While MDB expects FY/23e non-GAAP operating loss (FY23e adjusted operating profit margin: -1.9% to -0.6%), the company may end up with positive FCF for the year. Historically, MDB’s FCF has trended higher than accounting profits (losses).

As a result of the macroeconomic uncertainty and the subsequent impact on valuations, it is unsurprising to see favorable responses to those names that guided to a positive FCF outlook rather than large revenue outperformance. The trend of cash generation leading operating results is a quality we often look for at SaaS companies. It is the sustainability of positive FCF scaling faster than the top line growth that is particularly attractive, and it is what helped this name stay ahead of the benchmark and the majority of the Enterprise software universe used in this analysis.

The lack of earnings durability and early stages of a (late) product cycle

The most recent reporting season was not confidence-building for MDB’s direct competitor, Couchbase (BASE). This was BASE’s second earnings report since the company went public in July 2021, and looking at the performance since the FQ4/22 (ended Jan 31, 2022) report on March 9, one can clearly see a forming pair trade.

BASE recently launched a distributed database platform that directly competes with Atlas, and yet, the rate of the end market adoption has yet to be reflected in the figures amid accelerating revenue contribution reported by MDB.

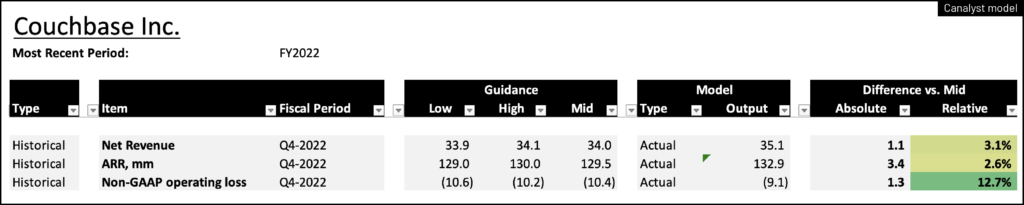

In its FQ4/22 report, BASE delivered a modest beat (+$1M vs. consensus) on the top line of $35.1M that grew at 19.2% y/y. ARR was the bright spot, with acceleration to 23.3% y/y in the quarter (FQ3: 20.6% y/y). Non-GAAP (adjusted for stock-based compensation) operating profit was ~$1.3M better than the midpoint of the guided range of -$14.4M.

Refer to the Guidance tab in Canalyst models for similar analysis on this and other names.

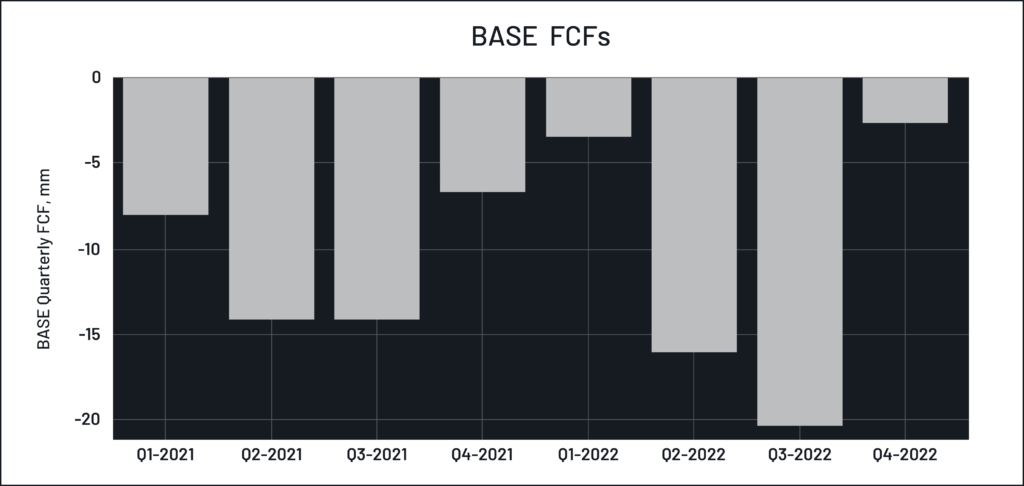

None of the headline number strength we noted for MDB existed for BASE. In fact, BASE subscription revenue slowed to 16.9% y/y (vs. 20.4% y/y in FQ3). Non-GAAP gross margin (adjusted for stock-based compensation) contracted and non-GAAP operating profit margin(adjusted for stock-based compensation) worsened on a y/y basis, with FCF remaining firmly negative.

In October 2021, BASE launched its rival to MDB’s Atlas, a fully-managed DBaaS offering called Capella. But, aside from sporadic data points on its adoption (read: web traffic among developers rising 34% y/y, 2x the free trials in the quarter than total trials during the last 12 months), BASE did not report any meaningful revenue contribution.

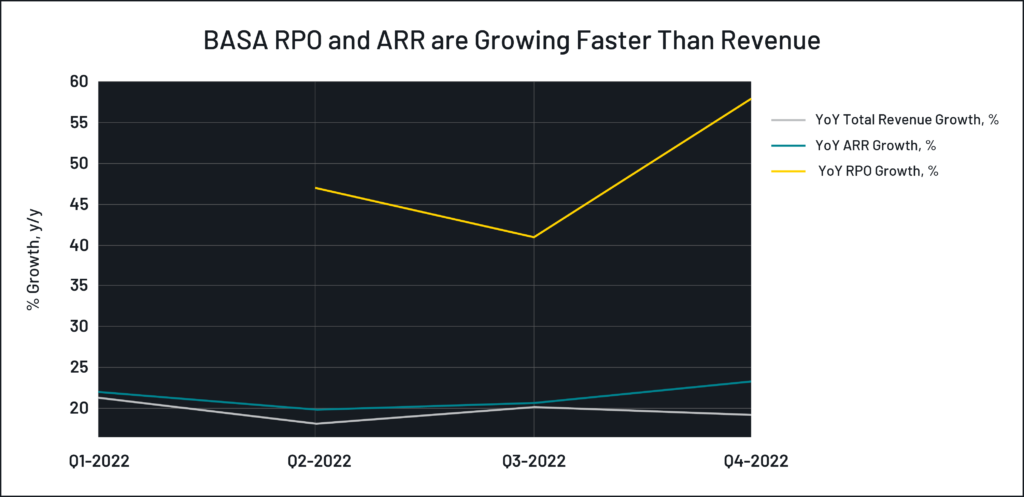

However, the company reported acceleration in some metrics that may be more representative of the underlying demand, mostly for Couchbase Server. In FQ4/22 RPO (remaining performance obligations) of $161.6M grew at 58% y/y and contract bookings inflected by growing by 2x on a q/q basis to $72.4M.

Despite RPO growth being vastly above that of revenue, Capella’s revenue contribution is difficult to forecast due to the timing of credit use and the pace of customers’ ramp. Also, the increase of Capella in the mix and lower contribution from Couchbase Server licenses will result in slower growth given the differences in revenue recognition for each.

Based on BASE’s guide of ~17% y/y revenue growth in FQ1/23e and ~19% y/y for FY/23e, the back half should see moderate acceleration of the top line, though it is unclear whether the implied revenue growth acceleration would be the result of the ramping consumption of Capella.

BASE heavily leverages its partnership with AWS for Capella distribution and new customers. Should BASE add other Public Cloud providers as partners, it would be reasonable to expect a faster DBaaS rollout and, in turn, the convergence of revenue growth to the upside in the direction of RPO and ARR.

Pending other developments, investors are likely waiting for a more instructive set of data points before the structural drivers of the TAM allow replication through BASE what early MDB investors saw since the IPO in 2017 – a 1,286% return.

In the near term, BASE appears to have all the makings of the opposite of what investors currently appreciate in MDB: the durability of earnings/cashflow. Given the near-term macro concerns, investors are placing increasing importance on the sustainability of earnings, or in the case of SaaS names, FCF. At BASE, the cash outflows are still vast.

Arguably, BASE is early in its growth cycle and over the long term the last quarter’s reported results may not be representative of the value potential that may reside in the name. Yet, in the near-term, the lack of a maturing product cycle that can scale FCF into positive territory takes priority for portfolio positioning. The diverging performance of the MDB-BASE pair following the results appears warranted.

As we came out of the last reporting season, MDB’s results speak of the need for testing earnings durability in the face of the risk of duration inherent in the cashflow streams of growth companies. And that durability starts, in our view, with a resilient product cycle whose characteristics are reflected on the top and bottom lines at MDB in FQ4/22.