Farfetch Ltd. (NYSE: FTCH) has also benefitted from market optimism and a rotation into luxury combined with a “paradigm shift in how luxury is being consumed”, according to Farfetch management.

Market and Industry

Farfetch, a global online platform for the luxury fashion industry, has been a beneficiary of the COVID-19-induced rotation from brick-and-mortar to online shopping. According to Bain, the global market for personal luxury goods was $307 billion in 2017, growing at a 5% CAGR, and is expected to reach $446 billion by 2025. The online share of this market in 2017 was ~9%, growing at 27% CAGR since 2010, and is expected to reach 25% by 2025.

Bain also states that Millennial and Generation Z online shoppers accounted for 85% of the growth in luxury fashion in 2017, and are expected to account for 45% of the total luxury fashion spend by 2025.

Assuming Millennial and Generation Z online shoppers represent the majority of the addressable market of online luxury shopping, the potential market opportunity is ~$446 * 45% = $200 billion by 2025. A more conservative approach suggests the target market for Farfetch would be $446*25% = $111.5 billion.

Post-COVID

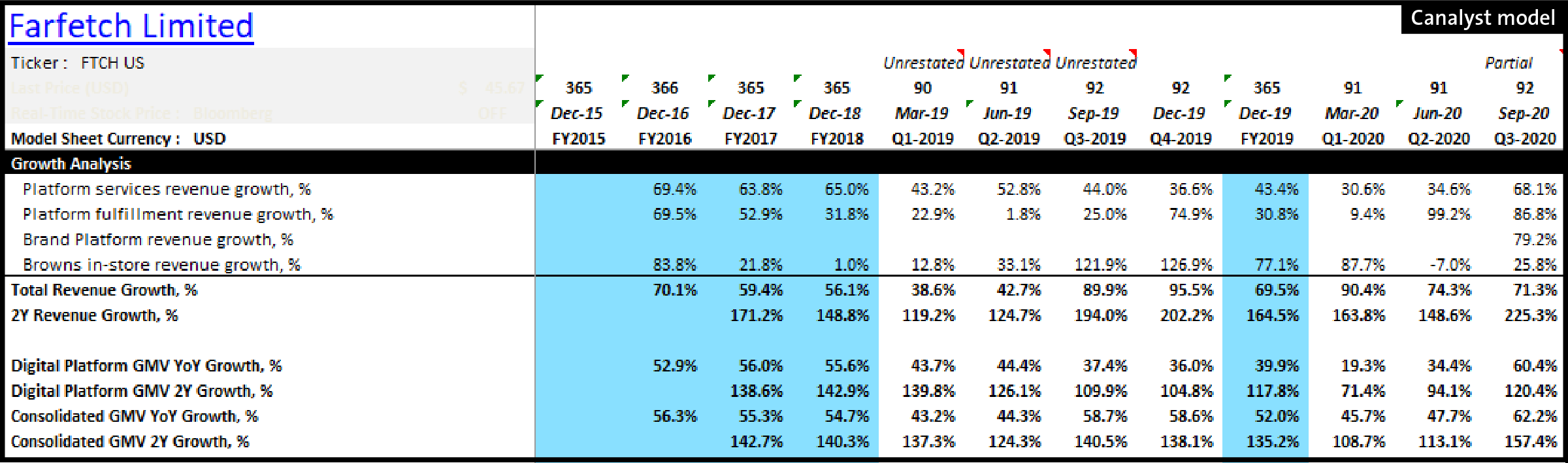

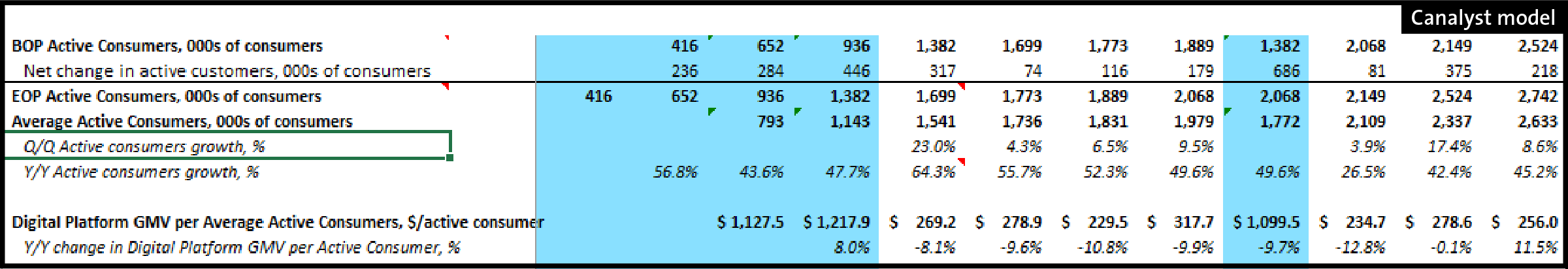

After two quarters of the pandemic, online penetration in the luxury space has been material. Last week the company beat Q3/20 consensus numbers on both the top and bottom line. Its record performance was fueled by a 60.4% y/y growth in its digital platform gross merchandise value (GMW). This was the highest GMV in growth in 10 quarters, driven by active customer growth. Economics on the new cohorts also exceeded historic levels – on a 3-month LTV that was higher than the past 7 quarters of cohorts. The company saw a lower cost of customer acquisition and quoted a “less competitive advertising environment” on the conference call. Management guided to Q4/20 digital GMV of 40-45%, down from the record quarter, but still well ahead of Q1 & Q2 and Q4/19.

On the conference call, Farfetch management highlighted a paradigm shift in how luxury is being consumed. Online penetration for the luxury industry is expected to advance from 12% last year to 30% by 2025.

Granted, Q3-2020 was an impressive quarter for a lot of internet retailers. It’s difficult to extrapolate the current environment into forecast periods, particularly given news surrounding the upbeat COVID-19 vaccination efficacy — i.e. a 70+% in revenue growth and 60+% growth in GMV may not be sustainable. But if management is correct and “…what we are seeing is the acceleration of the secular trend of online adoption in luxury”, there could be a fairly solid runway for continued growth.

This industry also appears fairly under-penetrated. A handful of notable competitors include: Net-a-Porter (owned by Richemont and founded by now Co-Chairman of Farfetch), SSENSE, ASOS (LSE: ASC), etc. SSENSE has a bigger presence in Canada, but doesn’t really compete with Farfetch globally. ASOS has a different target audience considering its average order value is only about £70 while Farfetch has an average order value of $500. Farfetch itself actually doesn’t see any direct competitors, though technology companies that provide white label service by enabling e-commerce, such as Shopify (NASDAQ: SHOP) and Square (NASDAQ: SQ), and traditional luxury sellers are indirect competition.

The strong quarterly results followed closely on the heels of a partnership agreement with Alibaba (NYQ: BABA) and Richemont (SWX: CFR) on November 5, 2020. Fartfetch will partner up with Alibaba and Richemont to form a joint venture in China, extending its 757 million consumers on Alibaba platform, whose average order value is 30% higher than Farfetch global average (according to the Chairman and CEO of Alibaba Group, the Chinese luxury market is expected to account for half of global luxury sales by 2025). The global partnership agreement includes a combined total of $1.15 billion investments in Farfetch from Alibaba, Richemont, and Artemis. We’ll be keeping our eye on the runway.