Its software platform significantly reduces the cost of running a brokerage firm, enabling Fathom to offer a more attractive fee structure to its agents relative to traditional real estate brokerage firms. In March 2020, Fathom was ranked the #11th largest independent real estate brokerage firm and the #20th overall largest brokerage firm in the United States. As of Q3/20, it operated in 26 cities and 112 local markets (source: SEC filings & Q3 earnings transcript).

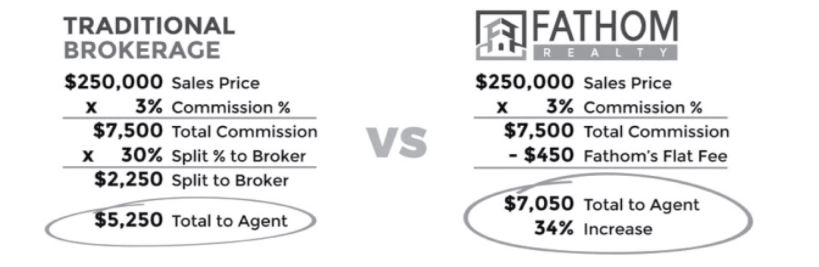

Fathom prides itself on running a collaborative culture with its agents and upon joining Fathom, agents receive marketing, training, and other support services including their own website. In addition, agents can utilize Fathom’s platform’s analytics to increase profitability and reduce relevant risks. Their IntelliAgent platform allows agents to manage their transactions, commission structure, payments and compliance. Agents are also able to utilize business intelligence to analyze the current market environment. The primary factor enticing agents to sign up with Fathom, however, is their fee structure. Fathom keeps $450 from the commission proceeds and the rest is paid to the agent. The $450 fee is charged “for the agent’s first 12 sales per agent’s anniversary year and then $99 per sale for the rest of their anniversary year.” (source: SEC filings) They also charge $85 per transaction on leases. Additionally, agents pay a flat fee of $500 to Fathom in order to cover their operating expenses. The graphic below illustrates why Fathom’s business model makes them more attractive than traditional brokerages to agents.

Above source: SEC filings

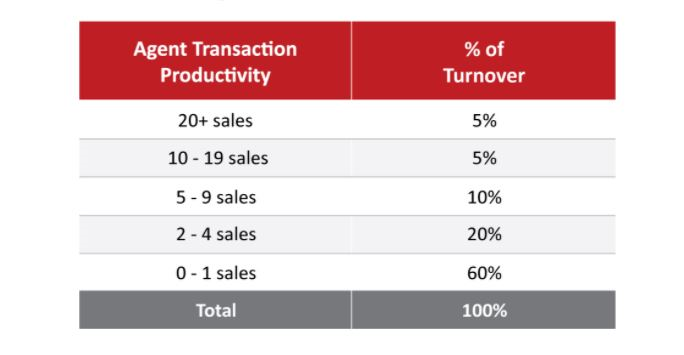

Fathom is able to attract and retain highly productive agents thanks to their fee structure. In fact, as per the company’s 424B4 filing, the number of agents that made more than 20 sales accounted for only 5% of total turnover (agent attrition was ~1.5% per month last quarter according to the Q3 transcript and 17% in Q2/20).

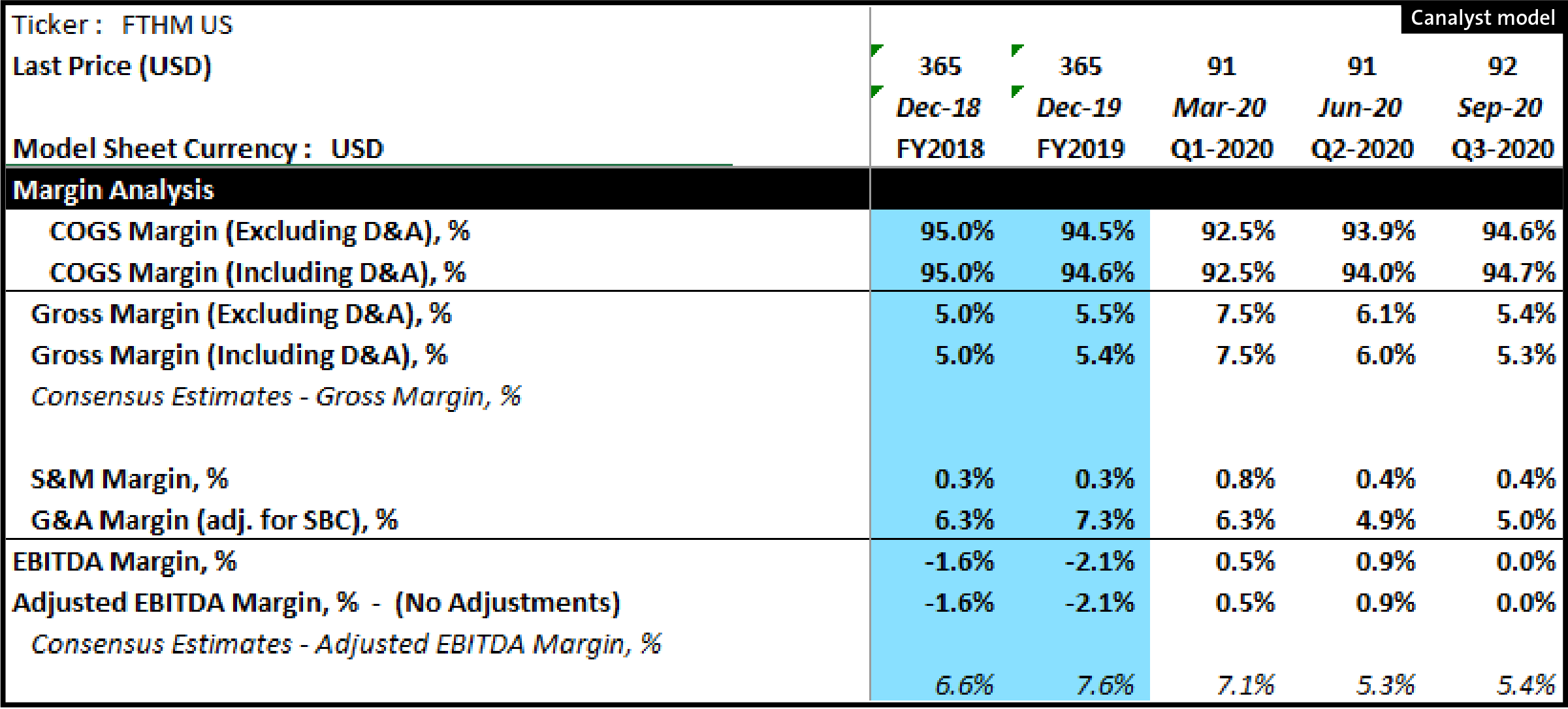

Fathom’s flat fee structure is possible due to the company’s virtual operations and a low overhead. Its operating expenses primarily consist of personnel costs (22 employees as of March 31, 2020), share-based compensation, marketing and fees for promotional services. As of Q3/20, S&M and G&A (adjusted for SBC) accounted for 0.4% and 5% of revenue, respectively. Nonetheless, Fathom operates on an extremely thin gross margin. The company defines cost of revenue as agent commissions less fees paid to Fathom by their agents.

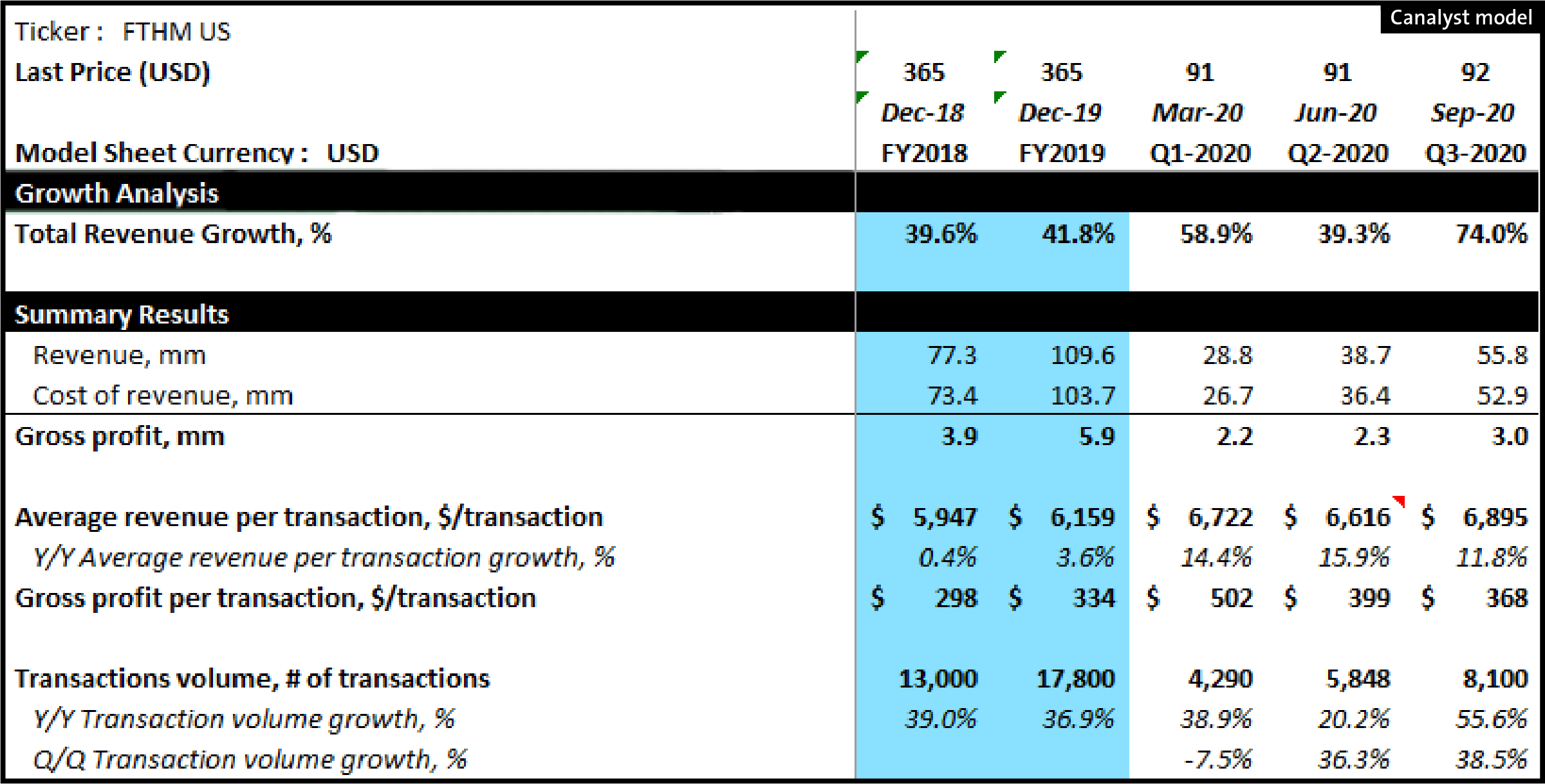

Looking at their numbers, Fathom’s revenue grew 74% y/y in Q3/20 to ~$55 million due to the number of transactions and average revenue per transaction growing 56% and 12%, respectively.

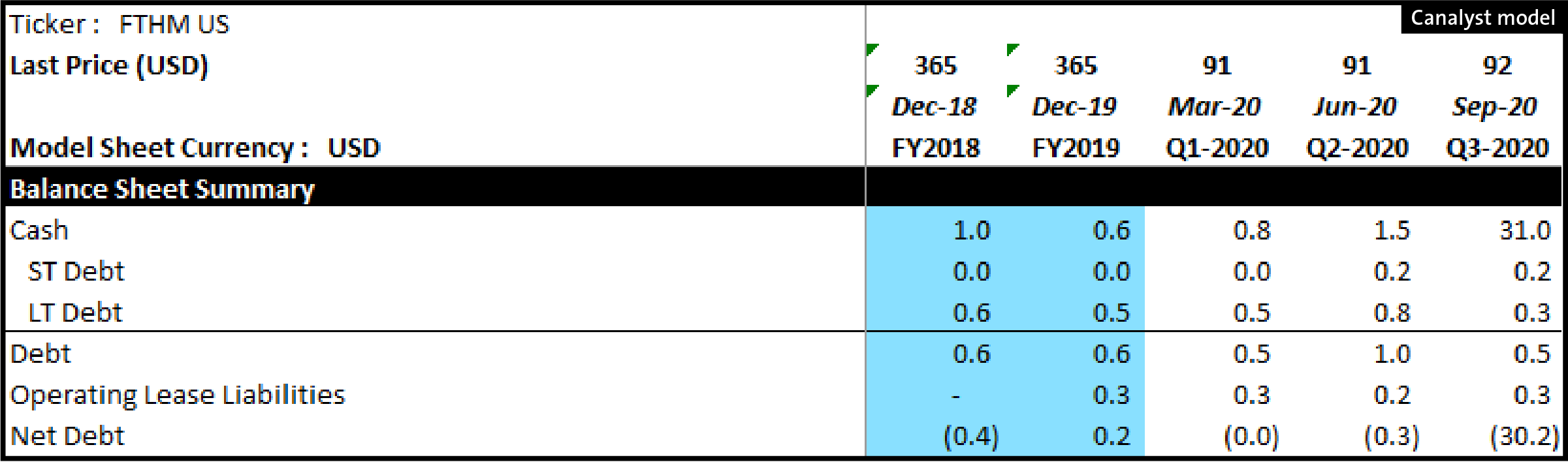

Fathom also benefits from a clean balance sheet with a negligible amount of debt.

Fathom’s business model is heavily reliant on attracting and retaining productive agents. It is all about the number of transactions in a period given that the fee that they receive is capped. Productive agents close more deals which in turn helps Fathom’s bottom line. During Q3/20, the cost to acquire an agent was $920, the lifetime value of an agent was $18,000, resulting in an impressive LTV to CAC ratio of around 20x.

Fathom went public in July 2020, selling approximately 3.5 mm shares at an IPO price of $10 per share. The company currently sits on ~$30mm of cash and is planning to deploy some of that capital to attract more agents at a faster pace.

It’s pretty easy to see how this business could scale, the spread between potential income per transaction for the agent (at Fathom vs a traditional brokerage) is significant. Probably even more so in a contracting market, as discounting fees can become a material competitive lever.

The IPO has been well received, shares are currently trading at almost 4x the IPO price. We will be watching how the company manages to attract and retain more agents, mitigate churn, add incremental revenue streams and increase their share of dollars per transaction.