Despite a year-end bounce on the back of vaccine approvals, real estate equities had a tough 2020. Among the worst performing names, the office REITs were hit particularly hard; the segment fell by -21% (compared to a -7% return by the broader REIT Index). Looking forward, office stocks should recover once there is visibility towards meaningful occupancy and rent growth, which will only occur once companies develop and begin to implement their internal plans for a return to the workplace. With the vaccination program commencing, it’s likely that companies will spend much of 2021 developing frameworks for returning to the workplace. Despite a difficult 2020, the long-term future is bright for the office REITs with several tailwinds poised to propel companies’ earnings. However, the reality is that these tailwinds are unlikely to materialize in 2021.

The return to the workplace in the US can be broken into three distinct phases:

- Phase 1 is a period of preparation for reopening US workplaces;

- Phase 2 will see that plan put into effect with some portion of the workforce returning, and;

- Phase 3 is the way forward, with a complete return of the workforce once the public has been vaccinated and the pandemic is fully behind us.

For each workplace, a set of criteria is currently being worked on, comprising every department from HR to IT, that must be approved by senior management before the clock starts on reopening. Protocols will be put into place, office spaces will be prepared, and management and employees will work together to determine who will return to the workplace during Phase 2. There appears to be a high probability that the Phase 1 preparation will take all of the next six months and perhaps a majority of the second half of the year.

Phase 2 is very much a transitory phase, which will see the reduction of public seating by a minimum of 50% and occupancy could still be well below this threshold. Phase 3 is the “new normal,” with most employees required to be in the office but still some portion who will never return to “work” as it was before March 2020. Taking all this into account, actual office fundamentals and transaction activity will likely see muted growth in 2021, at least until there is visibility on a timeline for Phase 3. While stocks should reverse course once a clear path towards office REIT earnings materializes, it’s difficult to see that happening before Q4/21 at the earliest.

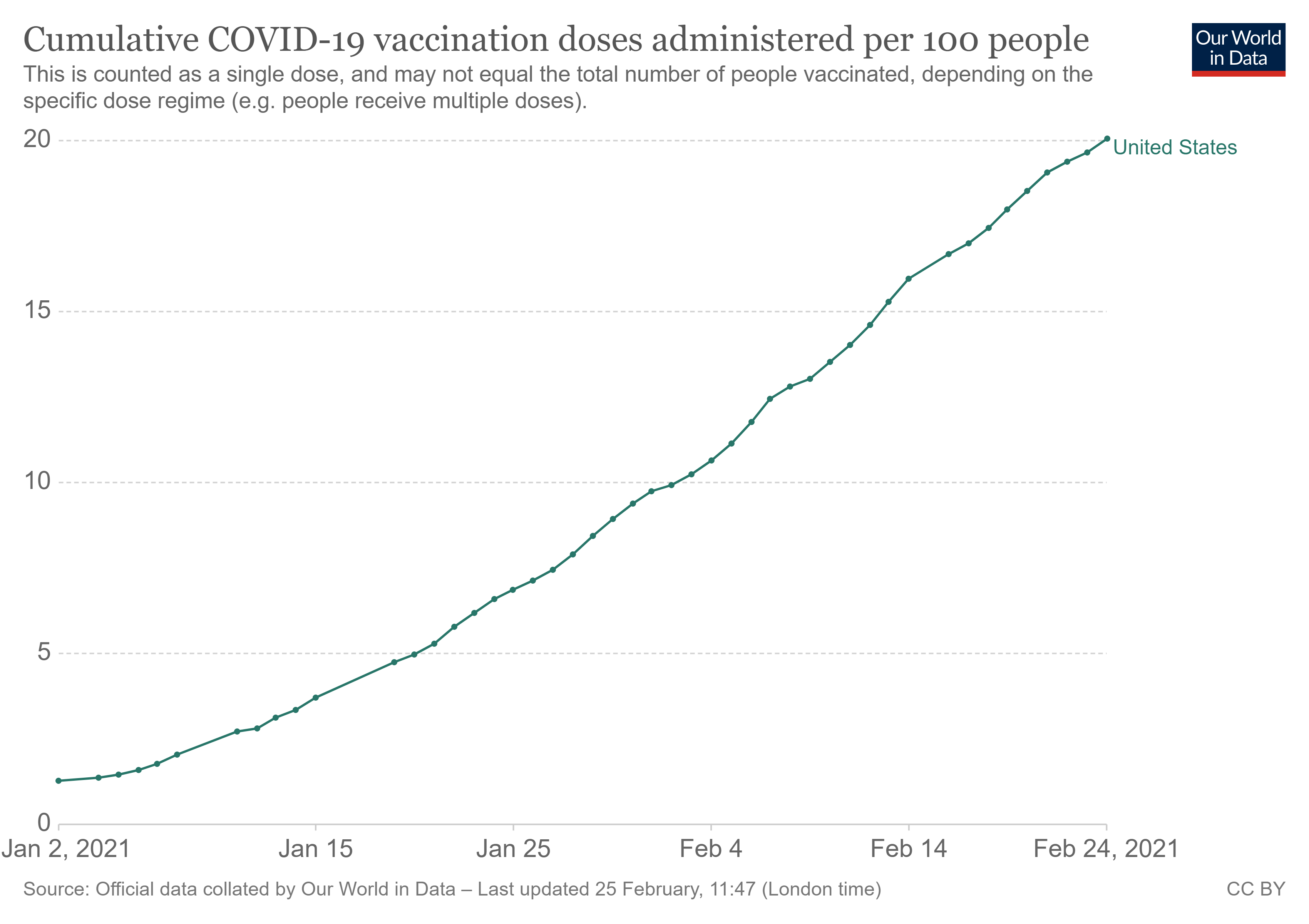

COVID-19 vaccines are a significant boon for all commercial real estate, including office REITs. The initial vaccine administration program got off to a slow start, with 2 million people vaccinated in December, the cadence has picked up materially (~65 million does have been given as of February 23, 2020, according to Our World in Data pictured below) and the hope is that the majority of the US population will be vaccinated over the next year.

While the pandemic has forever changed the percentage of the workforce that will work from home, a vaccinated population does allow for a return to the office and there’s evidence that many will be eager to work in a different environment than their home office for a change. Even with a sizable segment not likely to return to a centralized office environment, the segment that does is likely to be larger than what was being forecast by doomsayers over the summer. In fact, a recent survey shows 24% of employees want to return to an office full time and 50% prefer a hybrid approach — which means that nearly three-quarters want the ability to come into an office. All this points to a day, in the future, where leasing velocity should speed up at an incremental pace, generating positive occupancy and rent growth, propelling the stocks higher. The added foot traffic will also propel parking and amenity revenue growth. With low debt costs, a Democrat-controlled Congress/Presidency, and population and employment shifts, there are reasons beyond the vaccine that point towards a rebound in office real estate.

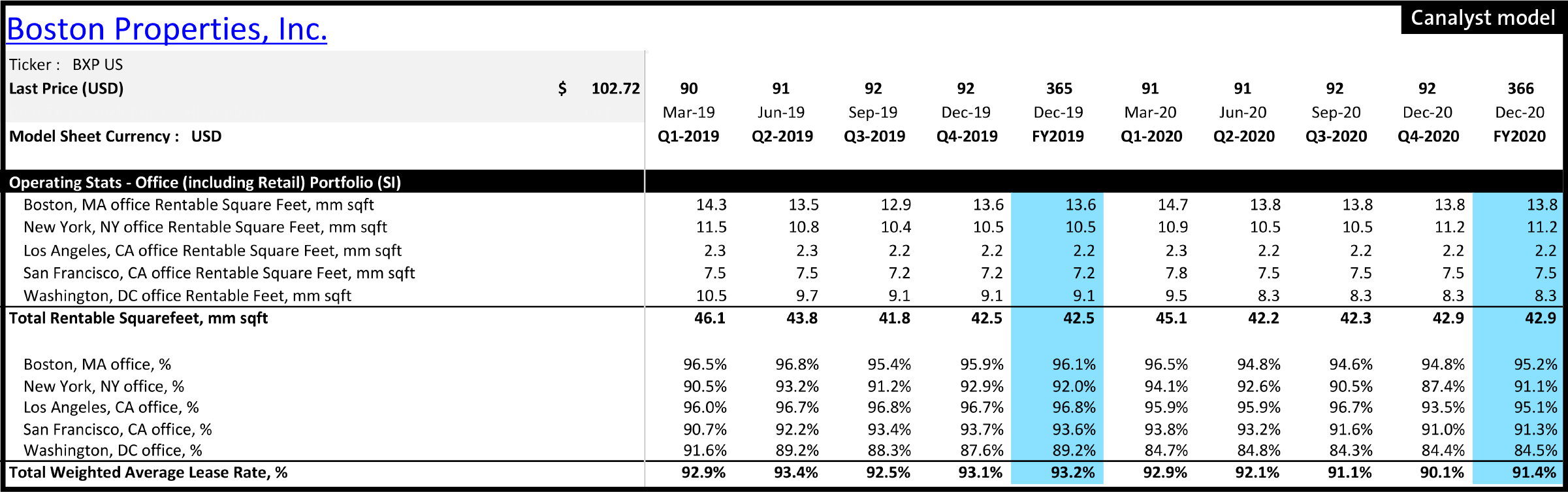

The rotation into REITs with higher pandemic exposure has already begun. Boston Properties Inc. (NYSE: BXP) is up 11% YTD (as of February 24, 2020), despite posting a 12.6% decline in office SP NOI and 26.8% drop in FFO per share in Q4’20 (10.3% FFO per share drop for the full year). The REIT has heavy exposure to New York City (26.0% of its rentable office square footage), which has been hit particularly hard. Occupancy in its New York office space as of Q4’20 was 87.4%, down 550 bps y/y. Total leased office square footage ended the year at 90.1%, down a less dramatic, but still significant 292 bps. The snapshot is somewhat misleading as the company managed to sign 3.7 million square feet of leases in 2020 despite COVID-19 pandemic shutdowns, though it was certainly a tough year. Year-to-date shares are still trading ~30% lower than the highs touched pre-pandemic ($147.83 in February 2020).

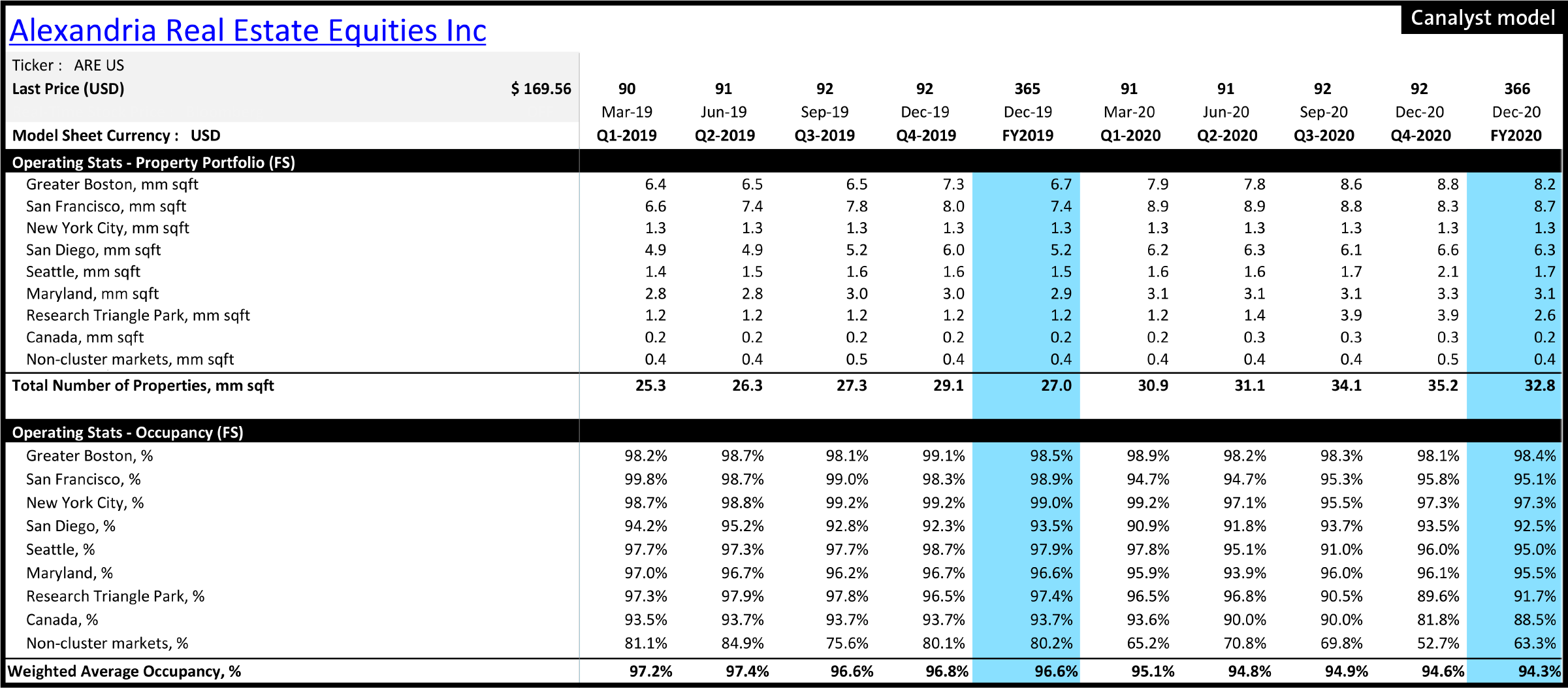

Conversely, Alexandria Real Estate Equities Inc. (NYSE: ARE) is down 8% YTD, after ending the year up 7% over its pre-pandemic high ($178.22 vs $175.74 in February 2020). The company was well positioned as the largest public life sciences REIT (focused on owning, operating, and developing clustered lab space in major life science markets). Its tenant base has been stable through the pandemic, with occupancy at Q4’20 at 94.6% (still down 220 bps), while adding 6.1 mm square feet of rentable properties. Additionally, ARE recently posted an annual 2.6% SPNOI growth and a 4.9% increase in FFO per share y/y.

We’d imagine that there will be many investors looking at quality office REIT names in the not-so-distant future.