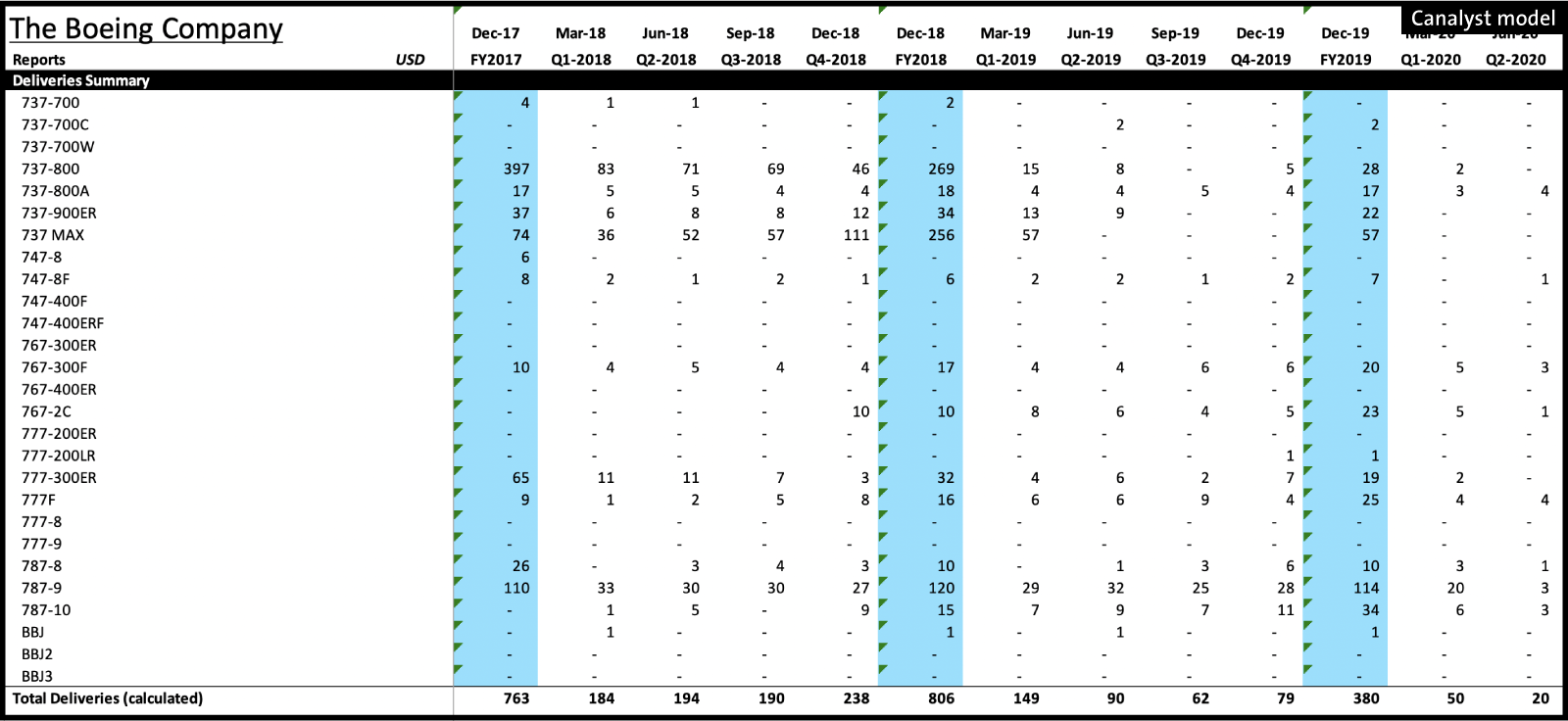

The Max was grounded in March 2019, and deliveries of the plane subsequently halted. Production, however, continued on, albeit at a slower rate, until it was suspended in January 2020 – mere months before the pandemic effect was felt across the globe. With air travel down to unprecedented levels, airlines have grounded fleets, deferred orders, and slowed down or stopped payments on new orders.

Grounding of the once high demand 737Max planes coupled with the adverse effects of the pandemic on the aviation industry, have caused a staggering impact to Boeing’s top and bottom lines. This comes as no surprise, as historically, the Commercial Airplanes segment has contributed to more than half of the company’s revenue.

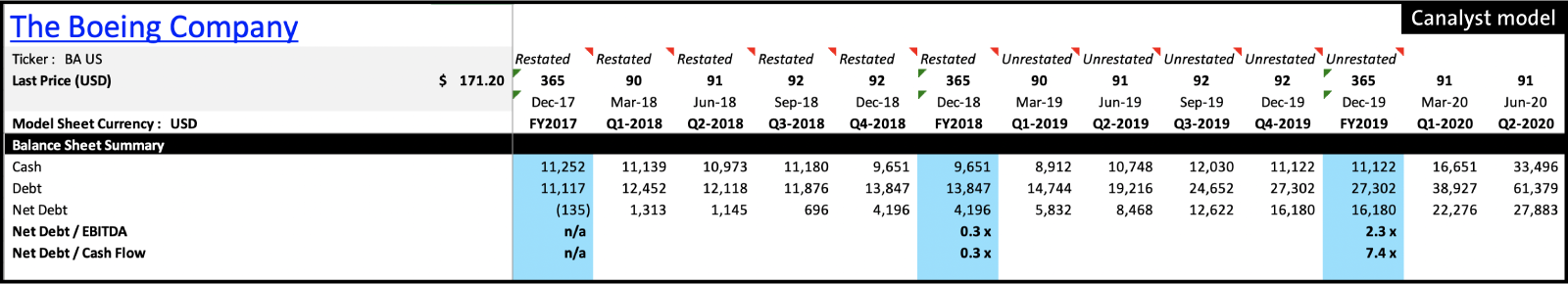

Negative cash flows prompted Boeing to raise new debt during the first half of 2020, with net debt (adjusted for cash and equivalents) rising to an all time high (refer to Canalyst model below).

Boeing expects negative operating cash flows in future quarters until deliveries can resume and ramp up, but if there are any delays to those expectations, it may very well need additional financing to fund operations and obligations.

As of the end of August 2020, Boeing reported a YTD net order of negative 932, and cancellations of over 400 for the 737Max planes. But it still has an impressive 4,387 plane backlog, with the majority coming from the 737 program. It’s possible the 737Max could be ready to return to service by the end of this year – at least in some regions. According to recent news, the executive director or European Union’s Aviation Safety Agency (EASA) has said he’s satisfied with the changes to the 737 MAX and that the agency is reviewing final documentation and US Federal Aviation Administration (FAA) is also believed to be close to re-certifying. Once the 737Max is certified and is ready to return to service, we’ll slowly see a ramp up of deliveries in future quarters. Boeing expects production of the 737 planes to gradually increase to 31/month by 2022. Air travel, however, may take up to three years to return to pre-pandemic levels. According to the IATA, average air travel trip length is expected to decline by about 8.5% globally in 2020. Per a survey conducted by Deloitte in June this year, current consumer behaviour is voicing caution against air travel, especially long-haul international trips. In the medium term this could shift demand towards narrow-body aircrafts.

A redeeming factor amidst all this is the company’s strong backlog, as well as the continuous growth of the defense and space industry. Boeing is faced with a tough uphill battle towards recovery. Overcoming its first hurdle — recertification of its 737Max planes – however, appears to be on the horizon.