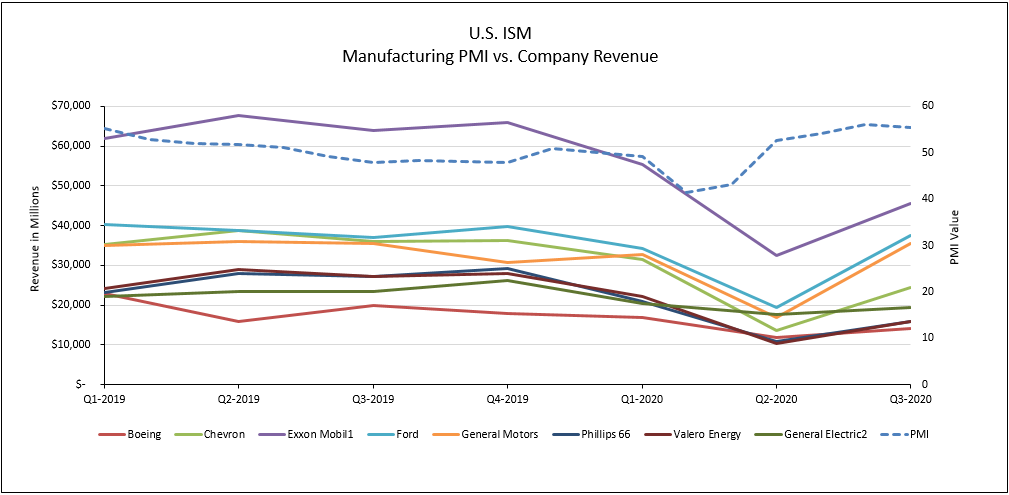

Given the importance of the manufacturing industry in the U.S. (11.4% of total U.S. GDP 2018 according to the National Association of Manufacturers), the PMI tends to be a strong barometer of market conditions. Economic contractions, trade wars, and tariffs weighed on major economies through the latter half of 2019. Optimism returned in early 2020, as the PMI trended up for the first time in several months, albeit modestly. However, sentiment dampened as the COVID-19 pandemic hit, pushing the index back below 50.

Source: Canalyst models

As we can see from the graph, companies generally move in-line with the index. This trend has been especially prevalent in 2020 as the world was hit by the pandemic.

Manufacturers have been challenged by demand and business disruptions as shutdowns began in January in China. Faced with supply chain disruptions and decreased demand for their products and services, manufacturers began lowering production and cutting costs. According to the National Association of Manufacturers, production in U.S. manufacturing decreased 18.5% between February and April, while employment declined by at least 1.3 million. U.S. manufacturing output declined a whopping 46.7% in the second quarter compared to the first, but has since seen an increase in the third quarter as demand and production picked up following the re-opening of businesses. However, the sustainability of the surge in demand and production is somewhat questionable. The latest (November) report by the ISM indicated that the industry is expanding at a slower rate. According to the Supplier Deliveries Index, with a reading of above 50 indicating slower deliveries, supplies are still being delivered at a slower pace compared to pre-pandemic levels.

Source: Institute for Supply Management

Prevailing labour shortages, and the various levels of restrictions implemented are to blame. With the resurgence of U.S. daily cases and the fear of heavier restrictions, we are likely to see the industry continue to expand at slower rates. But with the approval of vaccines and their subsequent deployment, global economic activity should rise, which is a positive for manufacturers. According to a survey by the National Association of Manufacturers, 17.6% of respondents say their firm’s revenue has already returned to normal levels and another 54.3% expect it to return to pre-pandemic levels sometime by the end of 2021. Respondents also expect sales and production to rise 1.9% and 2.2% over the next 12 months respectively. Trading Economics is forecasting U.S. GDP from manufacturing to be around $2.3 trillion dollars for 2021, which is in line with pre-pandemic levels. Given the strong sentiment amongst the manufacturers, U.S. manufacturers revenue/profit appear well positioned to meaningfully rebound from 2020 lows.