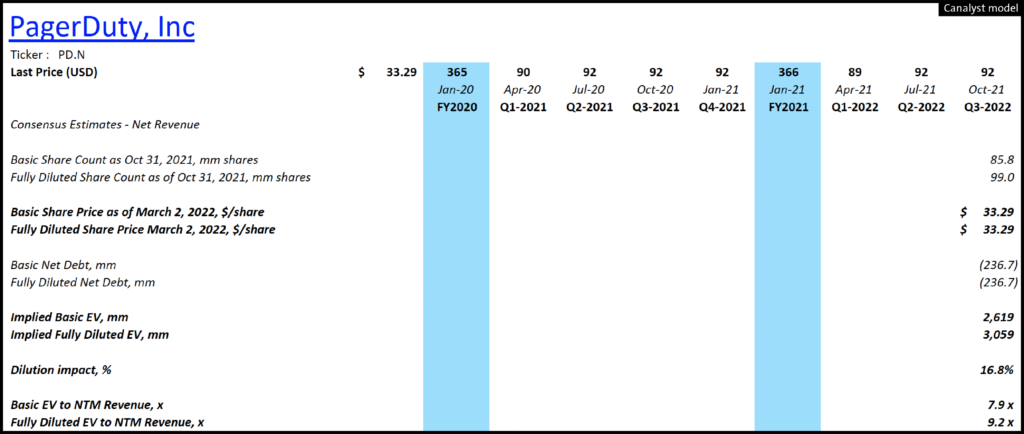

There is an ongoing, often heated debate between tech investors (specifically high growth software) around what share count should be used for the purposes of valuation. The differences in share counts can be minor in mature companies, but for certain high growth names, the differences can be material. A great example is PagerDuty (NYSE: PD), which based upon Q3 share counts and debt, has a 17% delta between the EV derived from basic share count and fully diluted (EV based on the March 1, 2022 closing price of $33.01). On an EV/NTM sales basis that translates into 7.9x and 9.2x multiple, for basic and fully diluted, respectively and could certainly alter investment decisions.

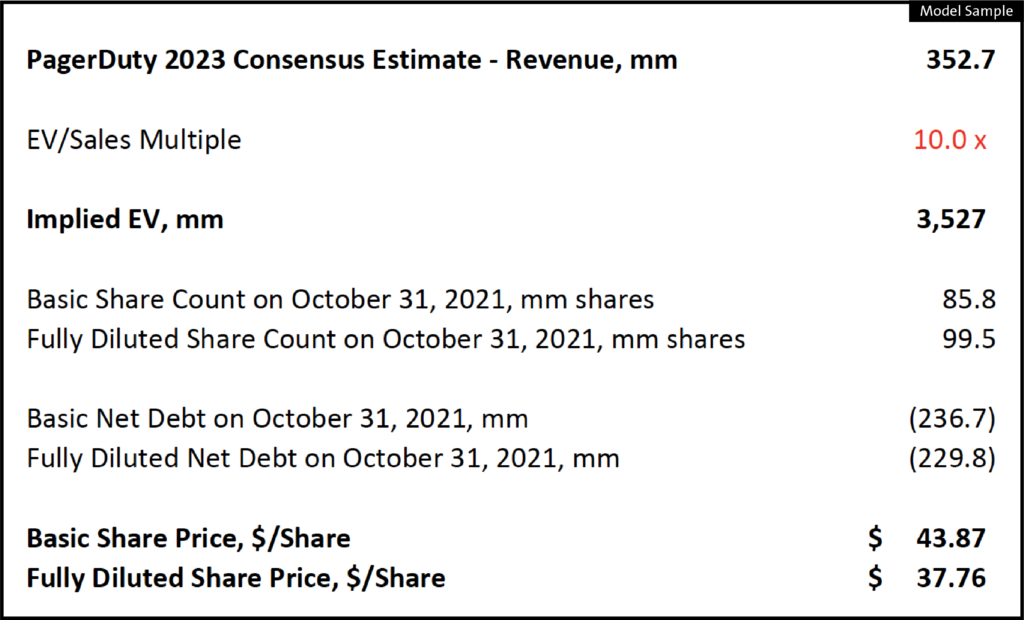

It also means two analysts could agree on projected revenue, valuation multiple and still have significant deviations in price targets. The example below illustrates how significant those deviations can be – the consensus estimates for FY/23 revenue are approximately 350mm, by applying a 10x multiple on an EV/Sales basis, we compute an EV in the $3.5bn range for PD. Using basic share counts this yields a price target of ~$44, however the diluted share count suggests a price closer to $38.

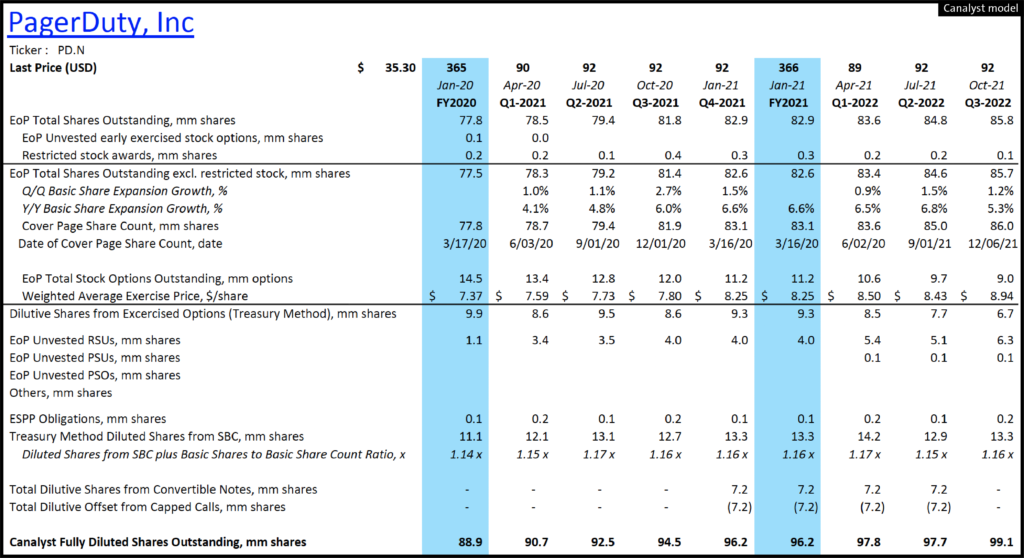

Although PD has a convertible note, the share price is currently within the range of its capped call – meaning the delta between basic and fully diluted share counts is almost entirely attributable to SBC. The bulk of the 13.7mm shares of SBC dilution is due to options, with RSUs increasing materially in the mix over the past year.

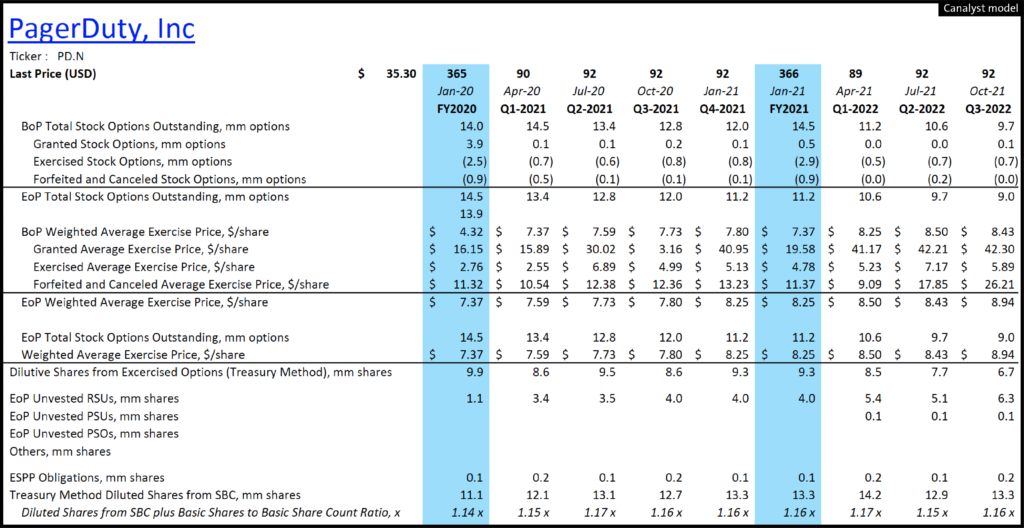

Leveraging the weighted average exercise price for Treasury Method conversion is not a perfect science as the blended price gives an incomplete picture of the different tranches – the PD model includes quarterly grant, exercise and cancelation counts and exercise prices dating back to their first quarter as a public company to help facilitate that analysis.

We’ve added full sharecount build-ups accounting for options and RSUs in dozens of largecap US TMT models. Check it out yourself with a demo of Canalyst today and join the debate!