Align Technology Inc. (NASDAQ: ALGN) is a clear aligner alternative to dental braces, their product offering is marketed under the well-known brand name Invisalign. Braces and aligners make up the market for treating misaligned teeth (also known as malocclusion), a market that is estimated to affect a surprisingly large majority of the global population (60-75%). Not all affected by malocclusion seek treatment of course, with the global number of annual treatment starts sitting at roughly 12 million people. Align estimates that about 8.4 million of the current 12 million (70%) annual treatments could use Invisalign, with 1.5 million people starting cases with them in 2019.

The company has experienced strong growth on their basic value proposition of providing a clear aligner solution to braces. To continue this cadence, Align has leveraged its sizable database of completed and active cases to drive innovation – both to expand scope into more complex cases and increase efficiency. This scope expansion is particularly important, as 9 of the 12 million annual treatment starts (or 75%) are in the teenage and younger group, which is a more complex group to deal with than adults.

Examples of Align’s recent product advancements include SmartForce attachments, and their mandibular advancement solution. SmartForce attachments are tooth colored buttons that exert extra directional pressure on specific teeth when the aligner is put on to help deal with crossbite, as shown in figure 1 below. Their mandibular advancement solution makes use of “precision wings” that are molded onto the aligner and exerts directional pressure on the jawline to deal with over/under bite, as shown in figure 2.

As a result of these and other advancements, Invisalign continues to expand usage, especially within the teenage and younger group, with that group representing roughly 32.8% of case shipments in Q3-2020 compared to 25.5% for the year ended 2017.

Figure 1: SmartForce attachments Figure 2: Precision Wings

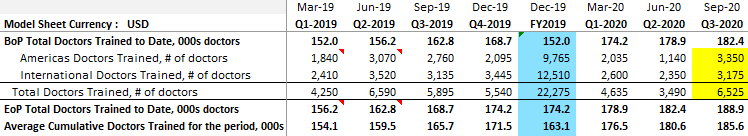

Invisalign is a treatment option that requires a GP dentist or Orthodontist to prescribe, and monitor progress. As such, an important part of the business model is to educate and support practitioners. To date, Align has trained roughly 189,000 doctors (mostly via in person sessions), however, they now offer virtual training that appears to have had a significant adoption rate as last quarter saw a near record in doctor adds (more below). To encourage doctor utilization, Align also sells their iTero scanner, which can be used as a complementary product to Invisalign. The iTero scanner helps practitioners achieve efficiency during the impressions, the initial setup of invisalign. By reducing the time it takes to complete impressions, and increasing the quality of the impressions, Align has increased the profitability for the dentist/orthodontist for the procedure. Utilization is also supported through discounts based upon the number of cases. The byproduct is twofold, the more cases a doctor initiates, the more comfortable they become with the product, thus the more likely they are to initiate again and acquire complementary pieces of equipment, like the iTero scanner.

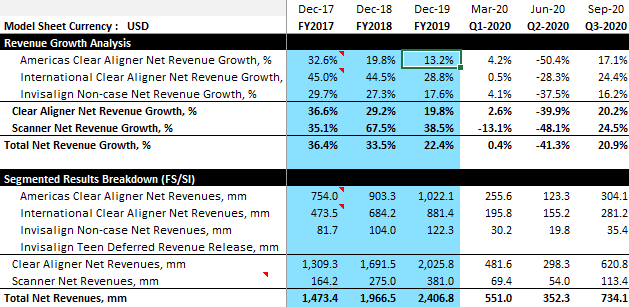

Q3 2020 was a phenomenal quarter for Align. Revenue of $734 million was 43% ahead of the consensus estimates of $514 million. Adjusted EPS was also a huge beat at $2.25 vs consensus of $0.54. The quarter, in many ways, was in-line with the growth exhibited in 2019 which was considered a strong year for Align, with clear aligner revenue growth roughly the same as 2019 (20.2% in Q3-2020 vs 19.8% during 2019 as shown in model below) despite a challenging environment.

Above: Canalyst Model – Third Quarter Revenue Snapshot

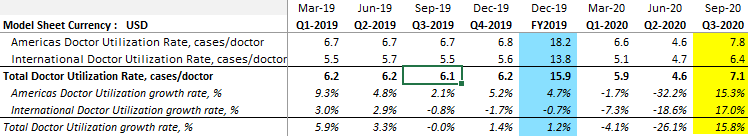

Growth was driven this quarter by a massive uptick in utilization (the number of Invisalign case shipments per active doctor for the quarter). The y/y growth rate of 15.8%, to 7.1 cases per active doctor, is the highest utilization ever for Invisalign.

Above: Canalyst Model – Doctor Utilization

Another encouraging metric was the number of new doctors trained in their Americas region (3,350). As previously mentioned, virtual training was well adopted from doctors resulting in near record new doctors trained on both the international and domestic front (as shown in the model below).

Above: Canalyst Model – Doctors Trained

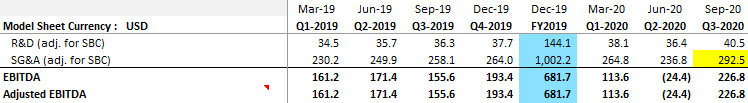

Align’s SG&A helped fuel the growth. While most companies cut or maintained marketing spend during the pandemic – Align doubled down. After holding SG&A relatively steady in Q1 and decreasing it noticeably in Q2, it set a record for SG&A spend in Q3 at $292.5 million.

Above: Canalyst Model – SG&A Spend

Spending was targeted for teen/mom leads and for new brand partnerships including the NFL and various social media influencers. Align also introduced digital offerings: My Invisalign app, virtual training, virtual appointment/care, and cloud integrations.

Given record utilization was at least part of the catalyst leading to these impressive results, the question is begged: was this partially a factor of pent-up demand being pushed from Q2 to Q3? According to the CEO in the Q3 2020 earnings call, GP dentists and Orthodontists were operating at about 70-75% capacity in Q3/2020. This implies potential gains in market share for Invisalign relative to traditional metal braces. Given their digital initiatives, Invisalign is a more virtual friendly offering than the incumbent, with estimates suggesting that patient-doctor interaction time is cut up to 80% with Invisalign. There is no surprise then that Align rallied around 35% on earnings (October) and has held up nearly two months later. We’ll be watching to see if they can leave a lasting impression.