American Tower (NYSE: AMT), the world’s largest REIT at a market cap of $127 billion, deals primarily in the leasing of wireless and broadcast communication towers. As of Q3/21, its total tower portfolio consisted of nearly 217 thousand towers and 1,800 distributed antenna system (DAS) sites across the globe. To further monetize their existing properties, management began a pilot program in 2020 creating data centers on nine existing tower sites; six “Edge” locations, and three “Metro” locations. After a couple small scale transactions in the data center space over the past two years ($75 million in 2019, and $210 million in 2021), AMT’s new CEO has accelerated their positioning with a $10 billion bid for CoreSite and their data center portfolio. This latest acquisition suggests that management sees edge computing as a major source of their growth strategy moving forward.

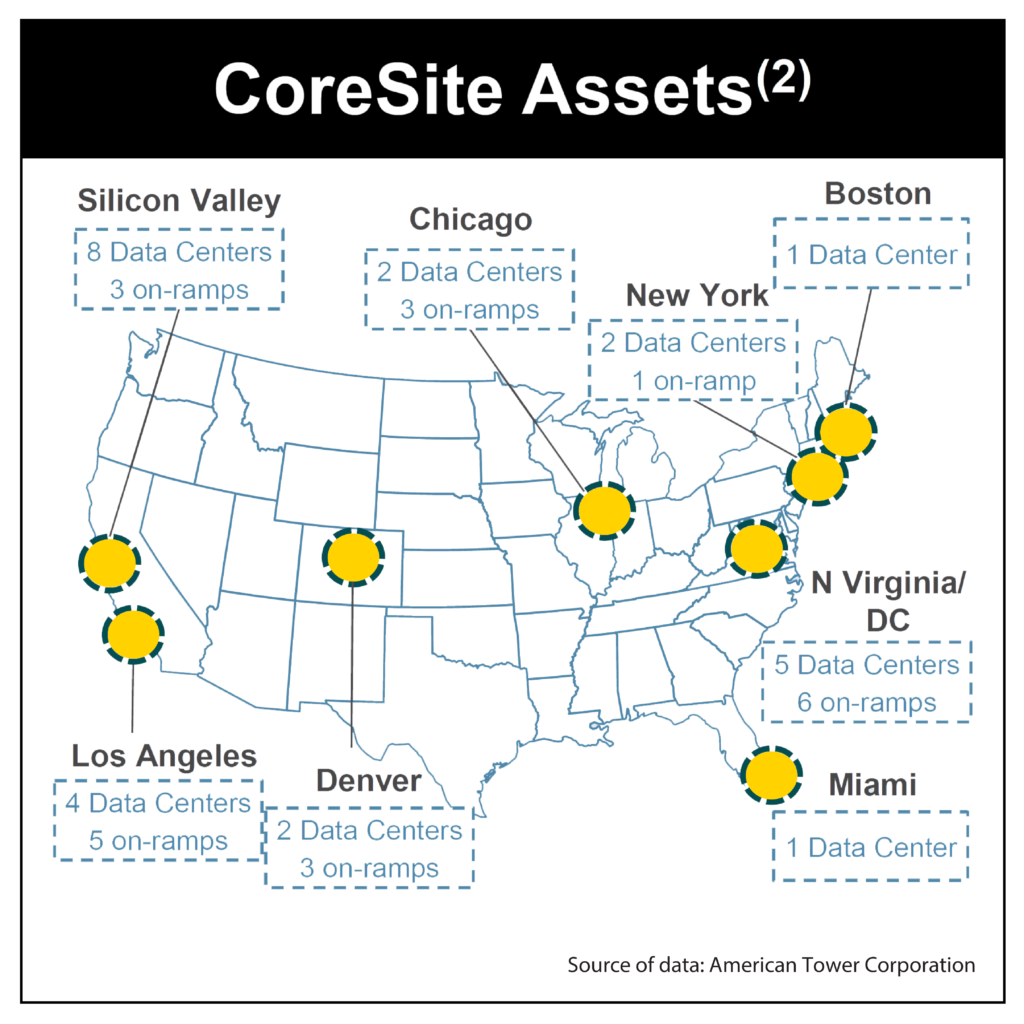

CoreSite’s assets totalling 2.75 million square feet across 25 properties span crucial American metropolitan areas (see below), and generate ~$700 million and $380 million in revenue and operating profit respectively. It is CoreSite’s experience deploying and managing data centers that could help unlock future growth at AMT.

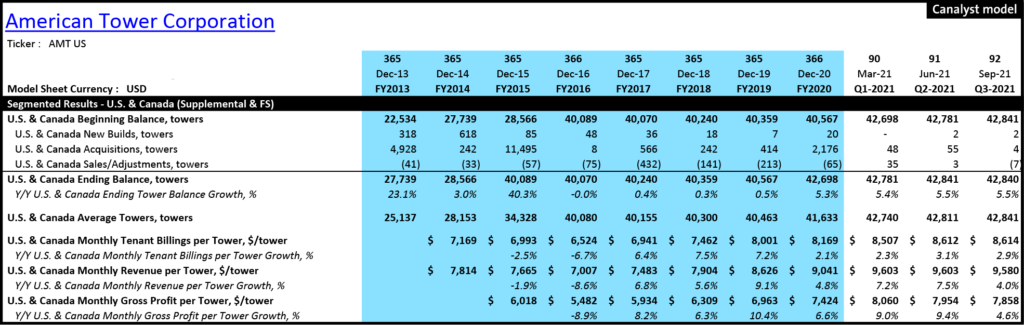

Management’s strategy of adding incremental revenue to existing tower locations has bolstered gross margin per tower at virtually a 1:1 ratio with revenue. Gross profit per tower has moved in lockstep with revenue in the 6 years since their last major acquisition in their U.S. & Canada segment.

Should the AMT management team find a way to successfully incorporate data centers en masse, investors may get a second chance at AMT circa 2015. Either way, the new exposure to edge computing and further exposure to IoT, coupled with an acquisitive team at the helm, AMT continues to be an interesting name to monitor.