The outbreak of COVID-19 in early 2020 and subsequent emergency shutdowns caused the housing market in many countries to suddenly pause. While the economy gradually recovered at a moderate pace, home-buying activities quickly caught up, driving average housing prices to be even higher than pre-pandemic levels. Monetary and fiscal policies all contributed, as well as a lifestyle shift prompted by working from home and remote learning.

With people now spending more time at home working and learning, the demand for larger homes increased meaningfully. According to a Survey published in September by RE/MAX, 32% of Canadians no longer want to live in large urban centres and 44% of Canadians would like a home with more space for personal amenities, such as a pool, balcony or a large yard. An increasing number of homebuyers sought single-family homes such as singles, semi-detached and townhomes rather than condos.

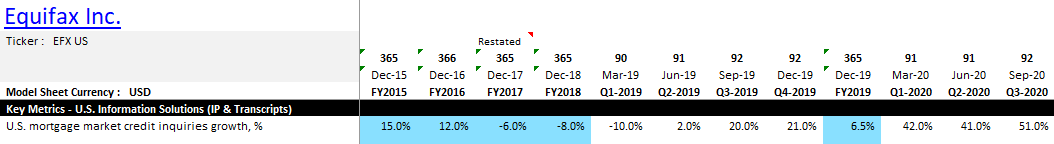

These new trends were concurrently propelled by aggressive monetary and fiscal measures that many governments adopted, which were mainly designed to help ease the financial stress. Low interest rates and subsidies both added additional buying power to the housing market. Equifax Inc. (NYSE: EFX) clearly benefited from the accelerated activities as its mortgage market credit inquiries in the U.S. surged at an unprecedented rate. Data from the U.S. Census Bureau shows that New Privately-Owned Housing Units started and under construction have quickly picked up and even surpassed pre-pandemic volume since June/July.

Above: Canalyst Model

Unlike financial transactions which can be operated mostly online, home building and renovation business are difficult to speed up. Safety protocols, reduced workforce and limited supply drove building supplies and construction costs higher. Homebuilders have reported that record high lumber prices this year will likely add an extra $5,000 to $10,000 to the cost of a single-family house (Global News).

Demand in this sector contributed significantly to the y/y revenue growth of many building products companies in Q3, such as AAON Inc. (NASDAQ: AAON) (+18.7%); Builders FirstSource, Inc. (NASDAQ: BLDR) (+15.9%); Masco Corp (NYSE: MAS) (+15.6%); and Fortune Brands Home & Security Inc. (NYSE: FBHS )(+13.2%). According to BLDR, commodity inflation contributed 7.2% which was almost half of its total quarterly top-line growth. Attractive price/volume combined with effective cost control also yielded a significant profit margin boost, e.g. AAON’s EBITDA Margin improved to 26.4% in Q3 from 20.2% one year ago, and MAS achieved 24.4% compared to 18.6% in 2019.

A vaccine may be on the horizon, but accommodative fiscal and monetary policies will likely remain in place for some time, as well as an adapted sense of an office-centric workplace.