With most of the Q1/21 earnings season behind us, broad-based multiple contraction has occurred in several high-growth technology names, offering attractive entry points/risk-reward for investors. The indexes seem to have bottomed out for the time being with the NASDAQ at -8% and the BVP Nasdaq Emerging Cloud Index at -27%.

One of the biggest movers was Fastly, Inc. (NYSE: FSLY), down -32% post-earnings (2021-05-05 through 2021-05-13). Fastly is a Content Delivery Network (CDN) business and a leading player in the emerging Edge Computing market. FSLY’s Compute@Edge product competes primarily against Cloudflare Inc.’s (NYSE: NET) Workers offering. Earlier in 2020, FSLY lost Bytedance’s Tiktok as a customer, amid the intensifying US-China tensions. The stock rebounded on rumors of a buyout by Cisco (NASDAQ: CSCO).

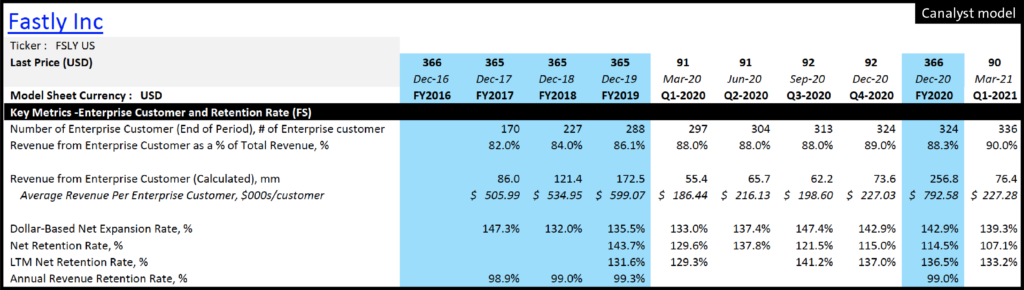

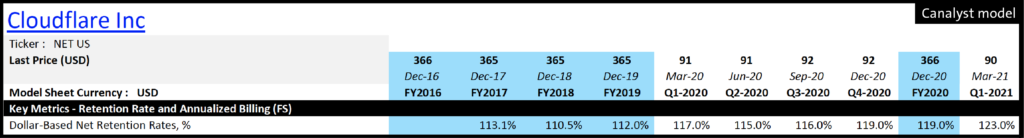

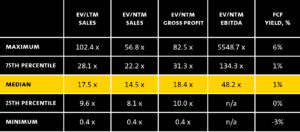

On the back of a CFO departure and deceleration in Net Retention Rate (NRR) from 115% in Q4/20 to 107% in Q1/21, FSLY retreated with a peak-to-trough drawdown of -69% (2020-10-13 to 2021-05-13). Management indicated that NRR reflects some seasonality in the business and has pointed towards LTM NRR as a more appropriate metric. In stark contrast, NET bottomed out at -34% from the peak on 2021-02-10 and has recovered to -20% at the time of writing. Execution and the frantic pace of product development (Workers KV, Durable Objects, Workers Unbound, Pages, Cloudflare One, etc.) at NET have accordingly earned it a premium multiple.

While CDN is a legacy business that has mostly been commoditized (dominated by Akamai Technologies (NASDAQ: AKAM)), the Edge is becoming the next frontier of cloud computing. It is a paradigm shift in software design that will move certain workloads from the centralized cloud infrastructure (think AWS, Azure, GCP) to the ‘edge’ of the network for the purposes of speed, low-latency and security required for next-generation applications such as 5G, IoT and Autonomous Driving.

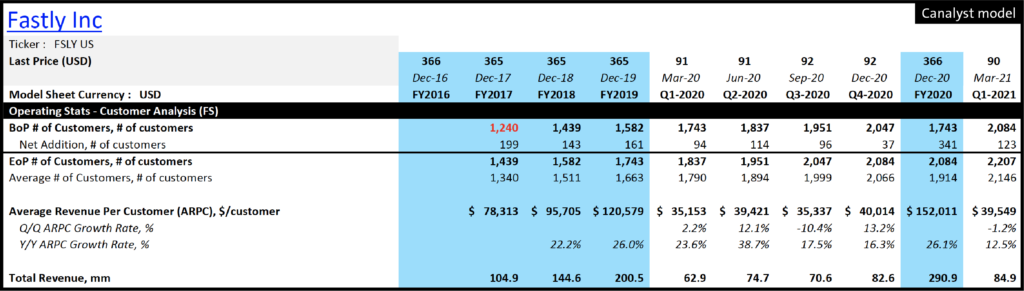

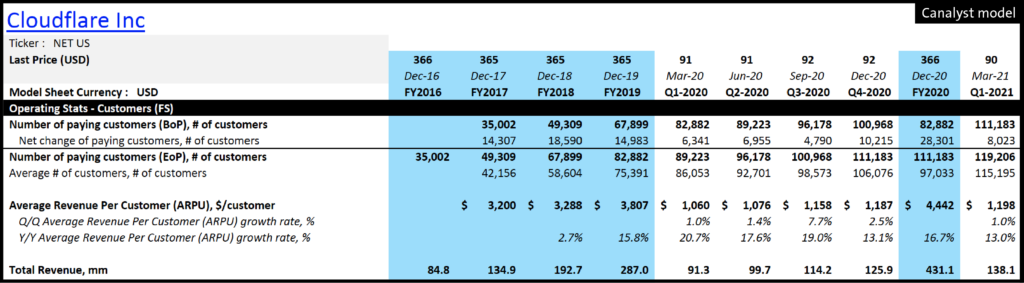

FSLY’s primarily usage-based pricing (The Signal Sciences business is subscription based) vs. NET’s SaaS-like subscription billing dilutes the accuracy of a direct revenue growth comparison. In turn, we use the Canalyst models to supplement our analysis and highlight the differences between the two sets of business fundamentals.

At first glance, NET has a higher customer count with lower ARPU, indicating a contrast in end market and product positioning.

FSLY prides itself on working with engineering-focused, internet-native companies and offers them white-glove support while NET has historically been more bottom-up in its approach to sales. Both provide self-serve purchasing with high-quality documentation. However, NET is rapidly moving up-market and views itself as an encompassing platform that offers a broad set of point-solutions (in-addition to edge compute) to large enterprises.

While not directly comparable to that of FSLY, NET’s key performance metric DBNRR (Dollar-based Net Retention Rates, includes churn) is a solid 123% as of Q1/21. Similarly, FSLY’s DBNER (Dollar-based Net Expansion Rates, excludes churn) of 139% reflects Fastly’s focus on optimizing existing customer spend (The “expand” in a “land-and-expand” strategy).

While FSLY’s recent price movements reflect turmoil at the company, we saw many positive indicators in the Q1/21 report. The company reported record Net Customer Adds of 123 and higher Average Enterprise Customer Spend of $800,000, compared to $782,000 in Q4/20. This may have resulted from the recent changes in management team (new CRO hire in Q1/21) as well as revised go-to-market strategy after the acquisition of Signal Sciences, leading to larger deal size bookings, simplification of order processing, and sales cycle contraction.

Moving forward, we are looking for indications of improving momentum at FSLY. That includes acceleration of Net Customer Adds, improving NRR and DBNER, a new CFO hire, integration of Signal Sciences, and strength of Compute@Edge’s revenues. Edge Computing is a nascent space for which both FSLY and NET provide meaningful exposure with their best-in class performance, security, and strong developer focus.

At Canalyst, we track all the relevant historical SaaS metrics in our models. We encourage prospective and current clients to visit our web portal and take a deeper look at our models alongside our Enterprise SaaS Dashboard.