Zillow (NASDAQ: ZG) exited its i-Buying business and in the process laid off a quarter of its workforce; digital mortgage lender Better.com’s CEO took to Skype in a now notorious three minute call where he laid off 9% of their workforce (about 900 employees).

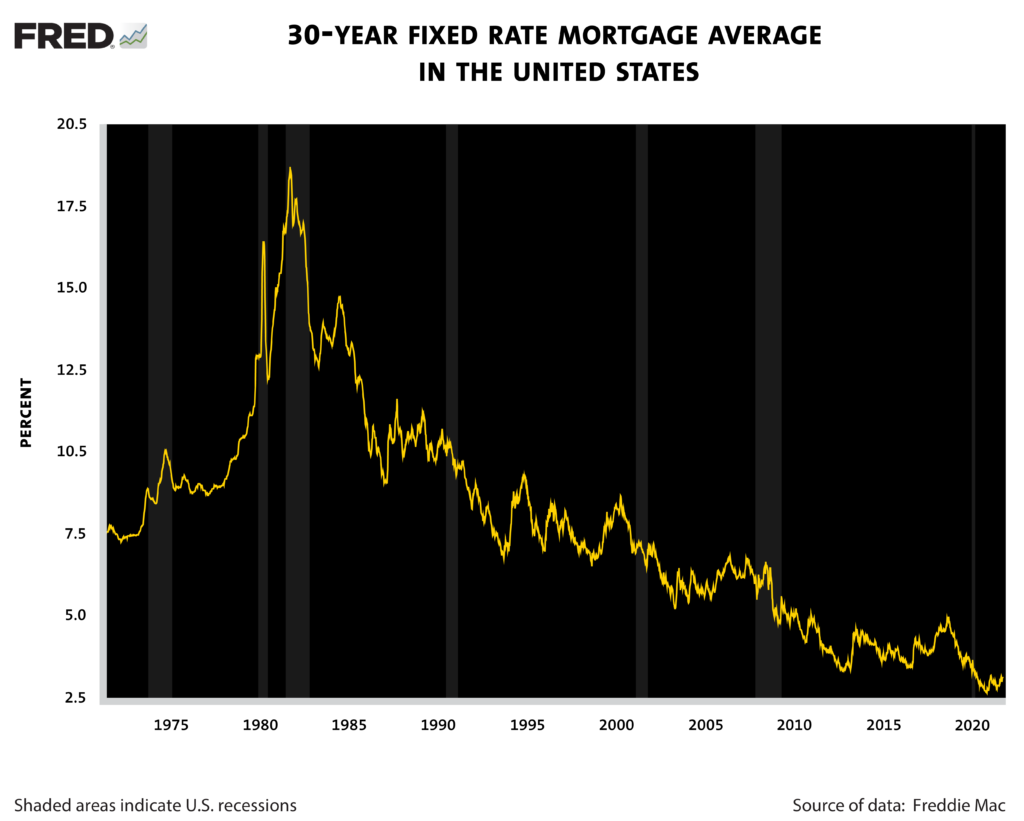

The real estate market seems to be cooling after 18 months of rapid expansion driven by historically low interest rates have been overshadowed by supply chain issues. Both mortgage applications and refinancing applications are down from their peak. During the height of Covid, the supply chain crisis led to a significant increase in lumber prices, though that pressure has since waned, tensions are mounting in other parts of the supply chain such as steel, PVC pipes, drywall, fixtures, and electrical components.

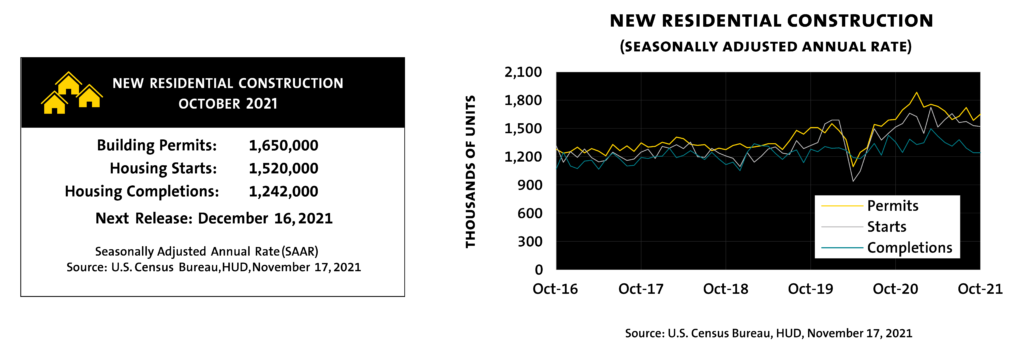

As a result of supply chain constraints, and in anticipation of associated delays, companies such as TRI Point Homes (NYSE: TPH) have started restricting home sales by selling homes later in the construction cycle to align with production levels and deliver homes on time. Delays in procuring engineered wood, windows, and garage doors are a few of the disruptions that caused Lennar (NYSE: LEN), the leading homebuilder in the U.S., to fall ~600 homes behind previously revised (down) Q3/21 projections. Taylor Morrison Home Corporation (NYSE: TMHC) highlighted delayed construction timelines by 2 to 4 weeks in its conference call and lowered its full-year home closing guidance by approximately 5% to around 14,000 units. The delayed construction time is illustrated in the data below which shows the widening gap between housing starts and completions.

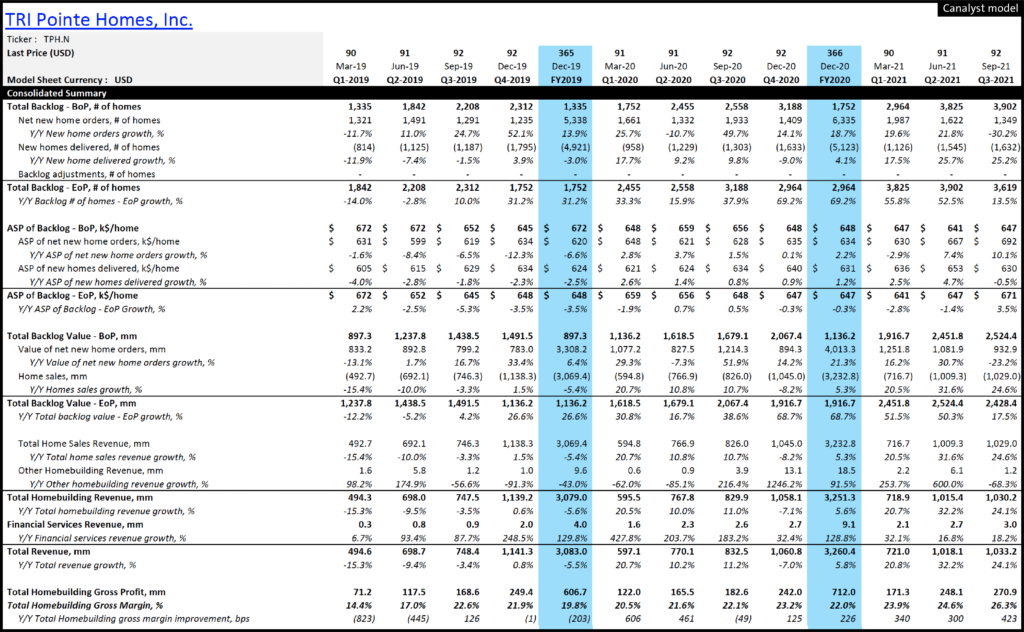

Despite these challenges, housing demand has remained strong, driving U.S. national housing prices to all-time highs. For U.S. homebuilders, the increase in average selling price (ASP) of homes sold more than offset the increase in material and labor costs, resulting in record-high home sale gross margins in recent periods. At Lennar, gross margin on home sales expanded 4.2% to 27.3% in Q3/21, exceeding historical levels of its low-to-mid 20% range. D.R. Horton (NYSE: DHI) and TPH saw similar expansions of 4.3% and 4.2%, increasing their home sales gross margin to 27.4% and 26.3% respectively in the most recent period. Management of both DHI and LEN noted on their most recent conference calls that they believe price increases will offset the cost increases due to supply chain problems and margins will continue to be strong in the short-term while TMHC management expects a 200 bps improvement to a margin in excess of 22% for 2022.

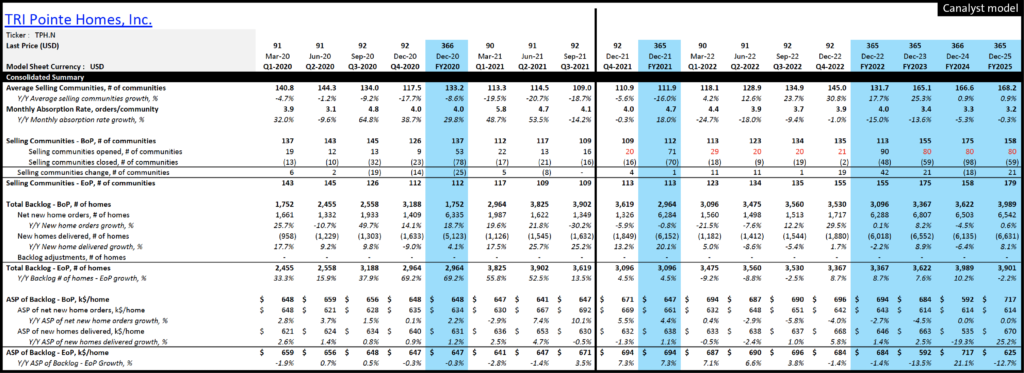

The outlook for elevated margins is supported by the growth in ASP on orders received in recent periods. Due to the lag-time between when the homebuilder receives the order and when the home is delivered, the ASP of homes sold has not yet captured the full effect of the recent increase in home prices. For example, at LEN the ASP of homes ordered increased 13.9% y/y in Q3/21, while the ASP of homes delivered lagged; growing only 8.1% y/y in Q3/21. At TPH, the ASP of homes ordered increased 10% y/y in Q3/21, while the ASP of homes delivered was down 0.5% YoY in Q3/21. As the new homes are delivered to the homebuyers, the increase in the ASP of home orders will be recognized in the revenues of each company, positioning the homebuilding industry to report strong sales and margins for the first half of 2022.

Homebuilders should also benefit from a near term uptick in community count. During the pandemic, the community count was compressed as municipalities were short-staffed and offices were closed. Municipalities were not able to process entitlements, permitting, and land inspections on a timely basis, leading to record low selling communities. As the pandemic subsides, the homebuilding market is expected to grow significantly due to large expansion plans in the number of selling communities. Land pipeline remains robust with plenty of land in the queue to meet growth goals over the next several years. Homebuilders see good buying opportunities in all different markets and are confident this pipeline will produce strong community count growth for the next several years.

Given the number of tailwinds in the homebuilder sector, it does not appear as though recent real estate headlines are indicative of near-term earning potential. While the supply chain crisis is certainly a headwind, homebuilders appear poised to grow in the near term led by ASP increases, historically low-interest rates, and wage increases with further growth in the future led by increased community growth.