For those reasons, broad-based selling typically has an outsized effect on the newest companies. With only quarters and not years to build a public investor base and track record, interest in recent IPOs wanes quickly when the market turns. Still, the same portfolio managers concentrating in existing best ideas would agree there are likely opportunities in this cohort of names, but it’s difficult to know where to start given both the sheer number of 2021 IPOs.

In this note, we examine the performance of the last year’s IPO wave (spoiler alert: it’s poor), and use Canalyst’s industry-leading fundamental data to suggest a methodology for approaching this group.

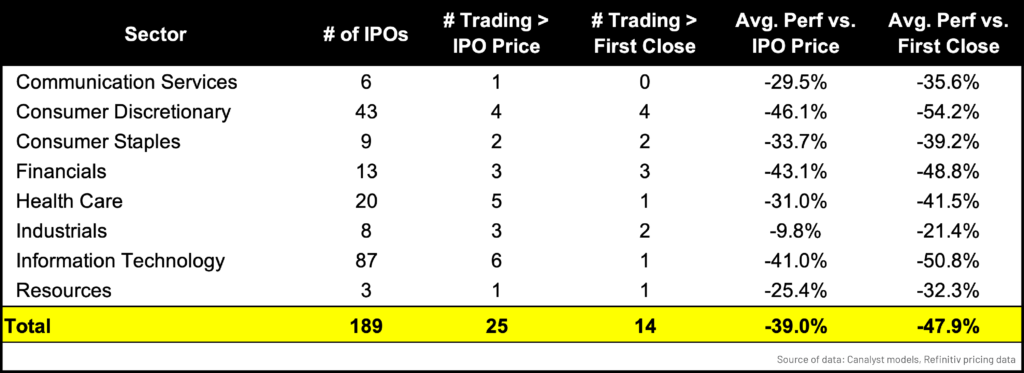

First, some numbers. Since the start of 2021, Canalyst has built IPO models on 240 companies. 51 of those didn’t get off the ground, leaving 189 names in our study. 171 were US traded, with 18 in Canada. By sector: 93 TMT, 52 Consumer, 20 Healthcare, 13 Financials, 8 Industrials, and 3 Energy/Materials.

Of these, only 25 are trading above their IPO prices, and only 14 are trading above their first trading day close. The average performance for the basket vs. IPO price is -39%, and from first trading close is -48%. Intra-sector, the highest growth areas (Tech, Cons) unsurprisingly have the worst performance as we entered the rising rate environment.

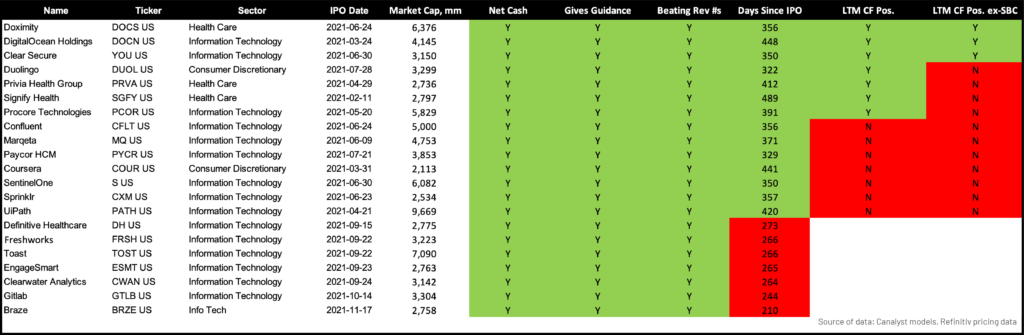

Having established what we likely already knew, how to now approach these 189 names? Our first cut is based on if the company gives guidance. We are looking for names that can potentially build a track record of beating their own set expectations, so we screened these 189 models for the existence of a Guidance Tab. Canalyst collects and tracks all company-given guidance, so in doing this, we dropped the sample set down to 103 companies.

Next, we screened the IPO Tab inside the model for the type of filing (S-1, F-1, or Canadian prospectus), and set aside the 11 names that filed via F-1. Our thought here was that new investors are less likely to go exploring into international filings and their associated risks when a large domestic pool of underperforming new names exists.

Down to 93 names, we then add a simple current market cap screen, which we arbitrarily set a $2 billion cap. This dropped another 53 names, leaving us with 40. While there are undoubtedly some gems in those smaller 53 names, given the current bear market, anyone kicking the tires of a new idea will likely demand sufficient liquidity.

Next, we demand the companies have net cash. With potential recession looming, it seemed prudent to avoid any sort of potential solvency issues. This removed 13 names, leaving 27.

Following that, we looked at each company’s Guidance tab and removed any names where they had missed their own topline revenue guidance since IPO. 6 more gone, 21 remain. We also remove any names that have been public for less than 3 quarters of reporting, and set aside another 7. This also gets us past the typical 180-day lockup periods (the details of which are also captured on Canalyst’s IPO tab in each model).

The last constraints we’ll put on are for the companies to be LTM cash-flow positive. 7 of these make the cut, but then we also examine cash flow ex- stock-based compensation as well, given that this has been a hot topic of late. With this, only 3 names remain.

Doximity Inc. [NYSE: DOCS] — Doximity’s cloud-based platform provides tools for medical professionals, enabling them to collaborate with colleagues, coordinate patient care, conduct virtual patient visits, obtain news/research, & manage their careers. Download the model here.

DigitalOcean Holdings [NYSE: DOCN] – DigitalOcean is a cloud computing platform offering infrastructure and tools for developers, start-ups & SMBs. The platform is used for web/mobile apps, hosting, e-commerce, media/gaming, projects & managed services. Download the model here.

Clear Secure Inc. [NYSE: YOU] – Clear Secure Inc. is a technology company that owns CLEAR, a secure identity platform. CLEAR stores individual’s personal information and associated biometrics data allowing identity verification at security checkpoints. Download the model here.

Please note that as always, Canalyst does not have a view on individual names and these are not recommendations!

Instead, Canalyst increasingly aims to be a platform where you can explore and uncover new research ideas. In the coming months we’ll be releasing new functionality on both our web portal and inside Excel, so sign up to get our product announcements for more info.