Typically, consolidation in the sector comes with the rising cycle. Given that through CY’19e semis seemed to have reached a trough, low channel inventory levels and promising volume recovery in CY’21e give management teams the confidence to act decisively amid appreciating acquisition currency of stock prices.

This year large semis deals announced speak to that trend:

- Analog Devices Inc. (NASDAQ: ADI) and Maxim Integrated Products Inc. (NASDAQ: MXIM) (9.1x EV/Sales LTM) announced July 13, 2020

- Nvidia Corporation (NASDAQ: NVDA) and ARM Holdings (ARM) (~18x EV/Sales LTM) announced September 13, 2020

- Advanced Micro Devices Inc. (NASDAQ: AMD) and Xilinx Inc. (NASDAQ: XLNX) (11x EV/Sales LTM) announced October 27, 2020

- Marvell Technology Group Ltd. (NASDAQ: MRVL) and Inphi Corporation (NASDAQ: INPHI) (14x EV/Sales LTM) announced October 29, 2020

The natural question is: where will future bids strike next?

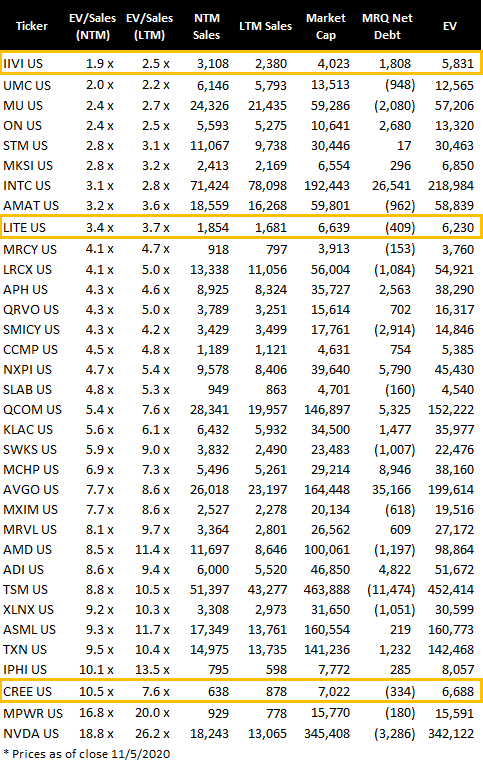

Narrowing the scope to the next substantial acquisition in the space, we screened for companies, who with a customary ~35% premium would cross a $5 billion enterprise value. The companies in the mid-cap space would bring in the right mix of scale and lower integration complexity, alongside the strategic impact that may fill the gaps in the product offerings at a potential acquirer.

Based on the screen, two companies stood out. Both II-VI Inc. (NASDAQ: IIVI) and Lumentum Holdings Inc. (NASDAQ: LITE) are trading in line with historical averages (and are therefore at a significant discount to other Semi names). On the other end of the spectrum, Cree Inc.’s (NASDAQ: CREE) recently announced divestiture could make it an attractive acquisition candidate as a pure play in an enticing market.

IIVI: Trading at 2.2x EV/Sales NTM, IIVI appears to be one of the cheapest names in the Semi space. IIVI is a Silicon Carbide (SiC) fabricator and a wafer supplier critical to the industry. SiC-based devices operate at higher voltage levels and offer better power efficiency than that of Silicon-based (Si) chips. Thus, for applications such Electric and Hybrid Vehicles (xEV), 5G Infrastructure, renewable energy, and Datacenter power supplies, only SiC-based chips can deliver the right trade-off of performance and economics. As a result of these advantages, SiC is set to displace Si across the power semis spectrum.

IIVI market capitalization, versus its SiC peers, makes it a more manageable entry into that business as its Enterprise Value, including a theoretical 35% acquisition premium, is still digestible at ~$7.4B. With $0.8B of net debt on the books, a takeout multiple approaching 2.6x EV/Sales LTM would be vastly lower than the notable semis acquisitions announced this year.

The key reason for this discount could be that IIVI makes the strategic fit more challenging. Although the SiC wafer business at IIVI is an appetizing asset, very cyclical optical components business may not be as desirable to potential acquirers. The optical components business derives its revenues from telco operators with volatile and lumpy capex. It ships optical components (transceiver modules and ROADMs) where pricing power is not often firm. Thus, when IIVI is compared to other pure play SiC wafer fabricators, their overall business is less attractive, which may make it more difficult to like in an already cyclical environment.

As a result, the mix of potential buyers is nuanced. In 2019, IIVI acquired Finisar, which brought in the InP (Indium Phosphide) technology. Similar to SiC, InP is another compound that can address Si’s shortcomings. InP allows chip fabrication of optical components using a cheap CMOS process, and advanced packaging of electro-optics. The process is called Silicon Photonics (Sipho). It looks to rapidly reduce the cost/bit in wired communications (compared to Si-built devices), allowing adoption in the Cloud and 5G networks. This is one of the key reasons MRVL bid for IPHI.

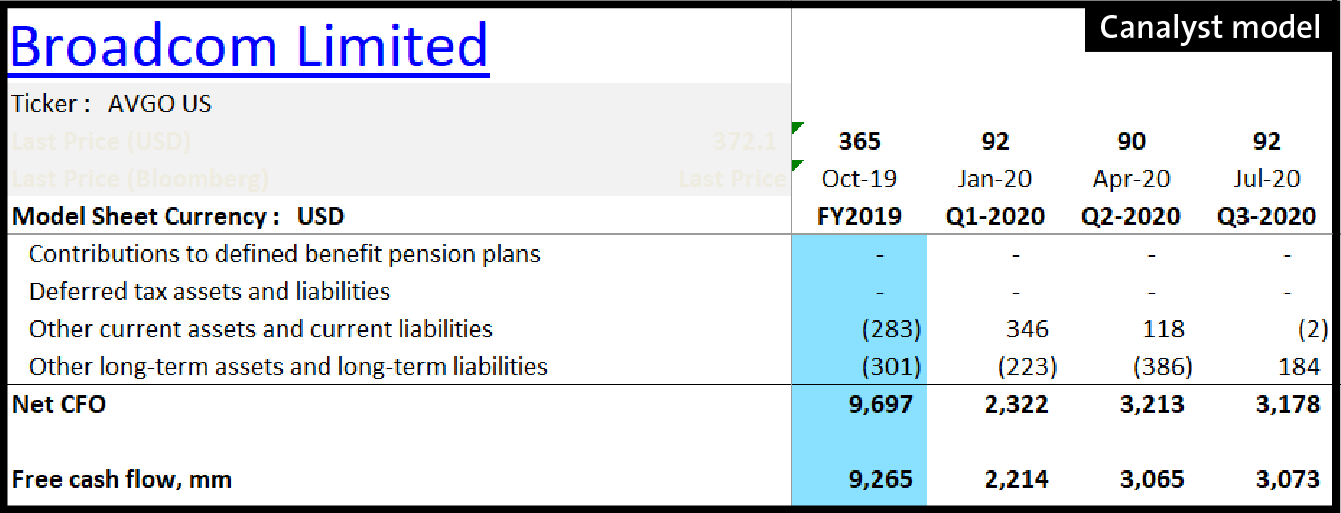

Broadcom Inc. (NASDAQ: AVGO) and Qorvo Inc. (NASDAQ: QRVO) appear to be the most likely acquirers. On the electro-optics side, AVGO can use SiPho to strengthen its Data Plane (switch) offerings (AVGO competes with MRVL). On the SiC Power semis side, AVGO has FBAR analog fabs that can benefit from larger scale. As a serial acquirer, AVGO has an elevated leverage of 2.2x. Yet, its $3B FCF quarterly run rate can effectively pay for the total transaction in 2-3 quarters. On the other hand, this is more the reason to use the proverbial acquisition currency. AVGO’s multiple has expanded from 12x at the beginning of this year to 14x PE NTM to date, allowing it to consider greater range of $-considerations.

QRVO may find synergies between its internal analog fabs and IIVI’s wafer business. Also, its 5G Infrastructure wins are based on its GaN-on-SiC technology. It likely sources wafers from IIVI or CREE. Vertical integration would strengthen QRVO’s analog offerings for 5G and Auto markets. QRVO’s sub-1x leverage is benign but would allow only partial balance sheet-based financing. Its 19x PE NTM multiple (vs. its mid-cycle mid-high teens PE) makes it attractive to use stock in the potential offering mix.

LITE: A close peer to IIVI, LITE also appears to be an attractive take-out candidate. It derives revenues from the sale of optical components for the Consumer, Communications and Industrial markets. Unlike IIVI, it does not have a diverse Materials business and, hence, is likely more digestible. Using the same ~35% premium for LITE’s stock price brings us to the transaction Enterprise Value of $8.2B ($400M net cash position) and an acquisition multiple of 4.8x EV/Sales LTM. Like its close peer IIVI, LITE will likely carry a mid-single digit transaction multiple, given the underlying profile of the business fundamentals.

Aside from QRVO and AVGO, we also see likely acquirers in the Networking space. In the last two years, Cisco Systems Inc. (NASDAQ: CSCO) has acquired both SiPho component and electro-optic module vendors. It bought Luxtera in 2019 and has bid for Acacia Communications Inc. (NASDAQ: ACIA). LITE offers both component and DCI (data center interconnect) modules, making it a close comparable of CSCO’s recent targets.

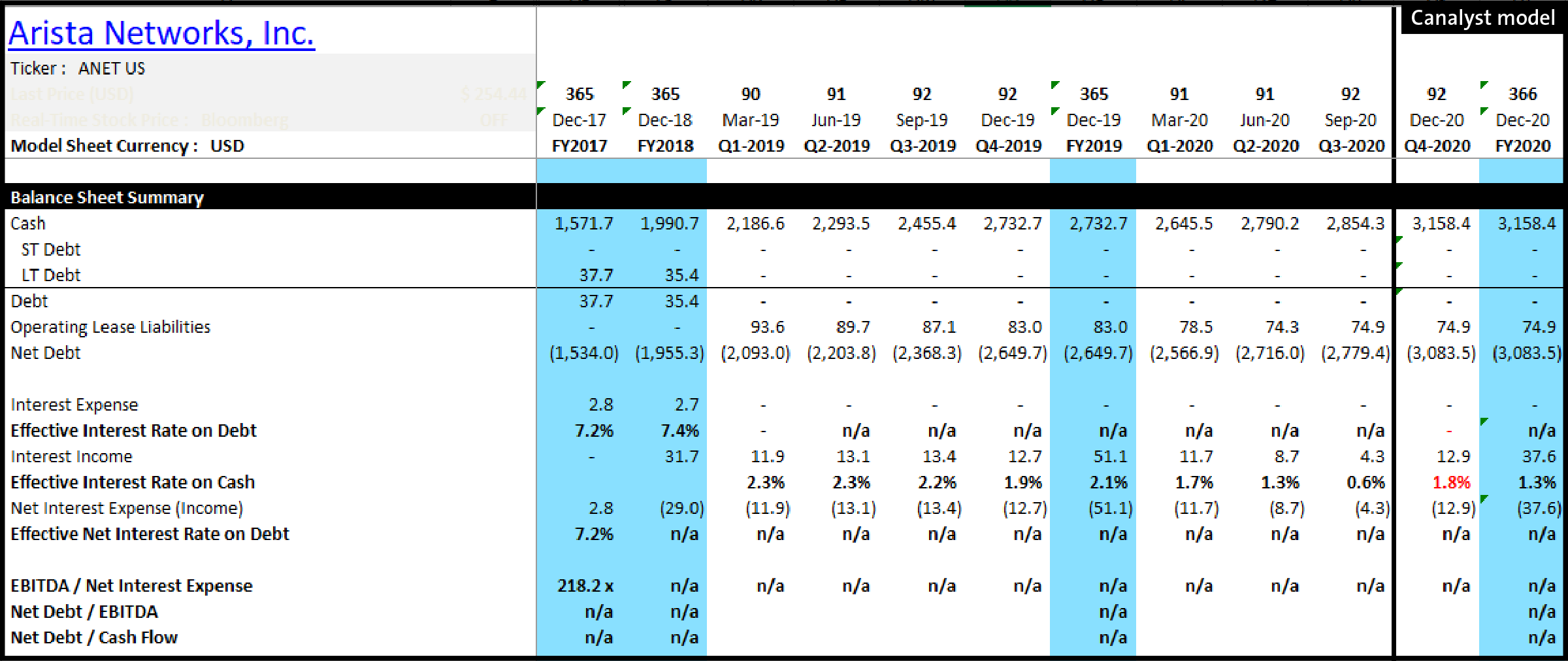

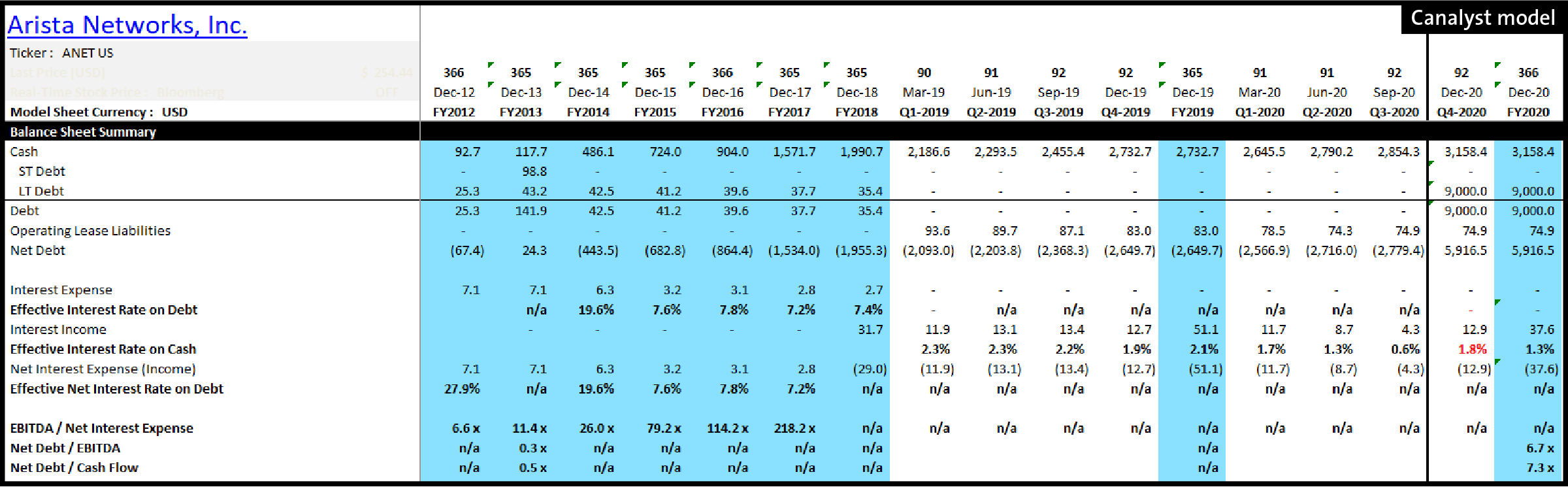

CSCO’s competitor, Arista Networks Inc. (NYSE: ANET) has $2.7B on the balance sheet and no debt. Our modelling shows that a $9B debt financing would raise the leverage to ~7x, which looks prohibitive.

Again, a mix of cash and stock could work. ANET and its networking peers saw their valuation multiples contract over the last 2 years, making it less attractive to issue stock. Yet, DCI optical modules are expected to drive the 400GbE cycle in CY’21e, which underpins growth expectations for ANET. The ANET thesis seems to be turning the corner after a post earnings run in the share price of ~22% week-to-date to a near 52-week high, which could be the catalyst for management to issue stock for a strategic acquisition. Although it is a wild-card for ANET, LITE could fit the bill.

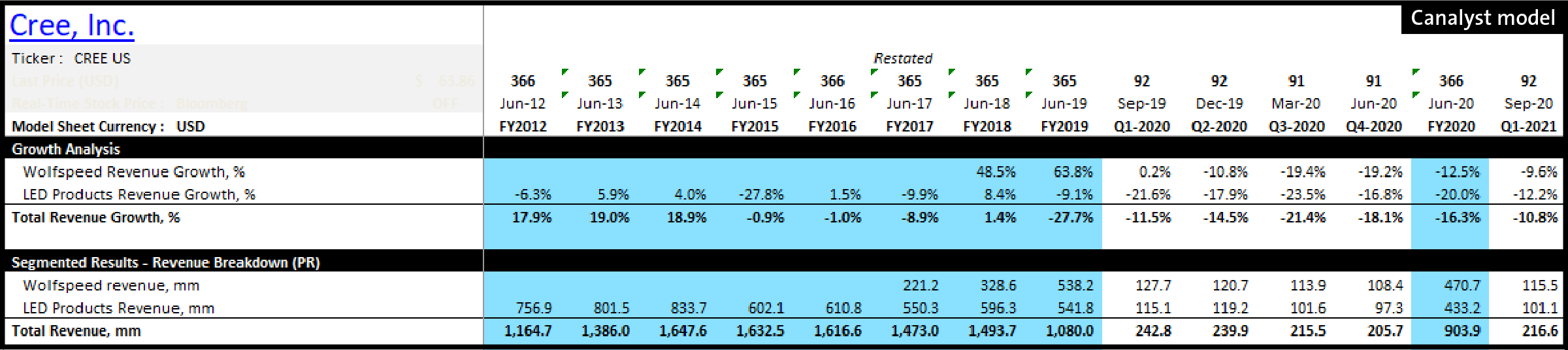

CREE: If we deviate from multiples and focus on digestible EV and recent events, CREE appears to have recently positioned itself as a more attractive acquisition target. Last week, it announced the sale of its struggling LED division for $300M. That, in turn, leaves CREE with its Wolfspeed business, which would be strategic for many potential suitors. Wolfspeed fabricates Silicon Carbide (SiC) and Gallium Nitride (GaN) wafers and devices, offering a pure-play exposure to end markets with above-industry growth through the medium term (CY22-24e).

CREE is one of a handful of key suppliers of SiC wafers (IIVI), making the company a strategic asset.

CREE expects Wolfspeed to grow at least 30% CAGR to FY’24. For its FQ1’21 (September quarter) Cree reported a $10B pipeline and $700M new design-ins Wolfspeed won during the last quarter alone ($1.7B YTD). CREE has a contract to supply wafers into China-based Yutong Group electric bus manufacturer and Euro-based chipmakers (Infineon, STMicroelectronics) that are close to the Automotive Tier-1 OEMs looking to launch multiple lines of EVs. Wolfspeed’s underlying growth potential makes CREE an attractive asset for large companies struggling to grow beyond mid-single digit CAGR.

European Union raised its emission reduction requirement from 40% to 60% by 2030e. Thus, CREE is a natural target for Euro-based acquirers. Yet, CFIUS already blocked Infineon’s $850M bid for Wolfspeed (Power and RF) in 2017. Fast forward to ‘20e, Wolfspeed is worth ~$7B (market capitalization). CREE’s rising valuation and potential acquirers’ own multiples could prompt an acquisition before a market correction cuts the M&A wave short.

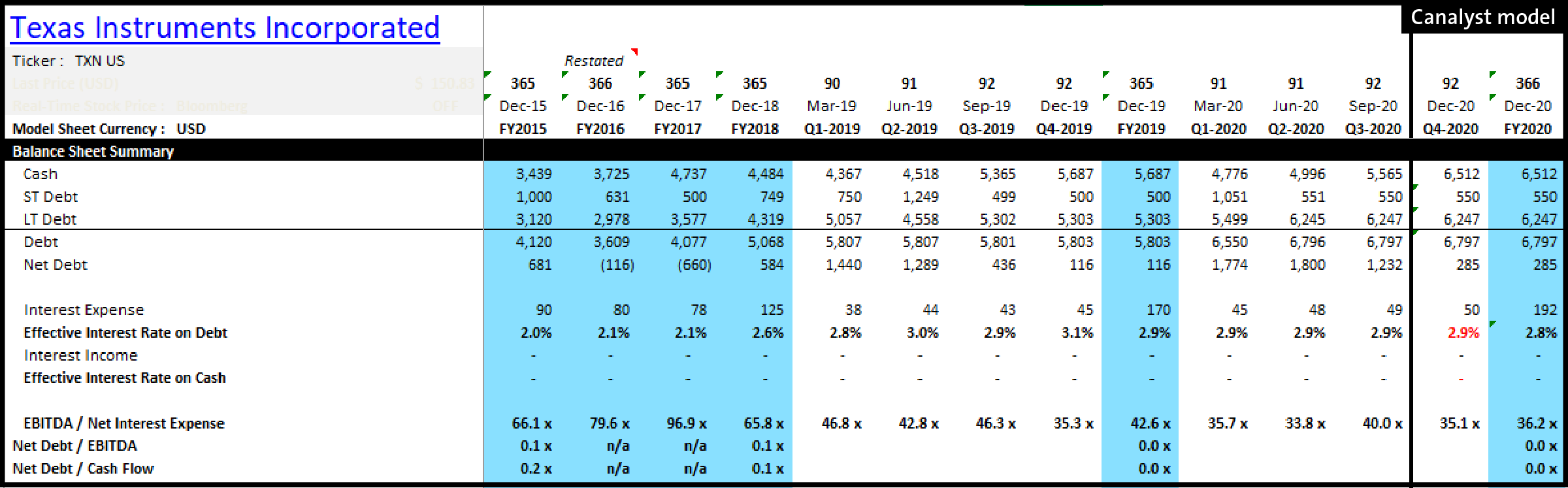

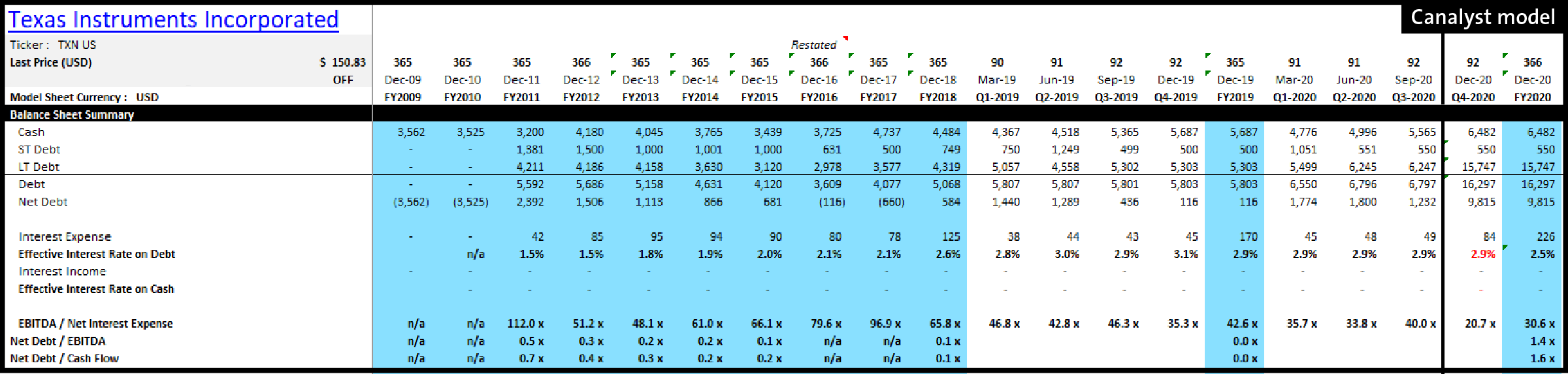

For Euro-based acquirers, it is unlikely that CFIUS will reverse its national security concerns this time. On the US side, however, Texas Instruments Inc. (NASDAQ: TXN) could likely find a strategic fit for CREE. It would strengthen TXN’s Automotive and Communications offerings. Also, TXN could move SiC wafer production to its 300mm line, resulting in economics that would hardly be matched anywhere else. TXN has $5.6B of cash and leverage of 0.2x.

With a typical 30-40% premium on CREE’s $7B market cap, TXN can finance a potential $9.5B equity consideration using its balance sheet. The post- transaction consolidated leverage would be 1.4x (net debt / EBITDA).

The transaction multiple would come to ~10x EV/Sales LTM, based on the ~35% premium. It is fairly close to the simple average taken across the 4 large announced deals this year (13x EV/Sales LTM). CREE has a $335M net cash position, without the LED sale proceeds. More likely, TXN can issue shares and use the acquisition currency priced at 26x forward PE multiple (vs. 23x for mixed-signal analog).

Another US-based natural buyer would be ADI. But, that is unlikely given its ongoing bid for MXIM. Also, CREE could find a strategic fit at ON Semiconductor Corporation (NASDAQ: ON). But, ON’s size (~$10B market capitalization) and current leverage (2.3x) would make an acquisition of CREE’s size difficult to execute.

If you’d like to learn more about Canalyst’s coverage or custom screens, request a demo today.