Trends improved across the portfolio and all regions each month of the quarter and into July; total ecommerce was up ~30% over last year. In Wholesale, both stores and the ecommerce business are outperforming (vs management expectations), albeit shipments declined dramatically coming into the quarter (Wholesale sales were down 85% in Q1/21 and Retail down 66%). Gross margin increased 500 bps (480 bps on an adjusted basis) on better average unit retail and favorable channel mix (Asia generates higher gross margin). The Canalyst CPRI model shows that inventory is also in great shape at down 7% — the company expects inventories to sequentially decline throughout FY21 and end the year approximately in line with the full year sales decline.

On the conference call, management made an interesting callout about Michael Kors watch sales inflection over the past several months–that’s a major change in trend (watches have been a consistent big drag for the past few years).

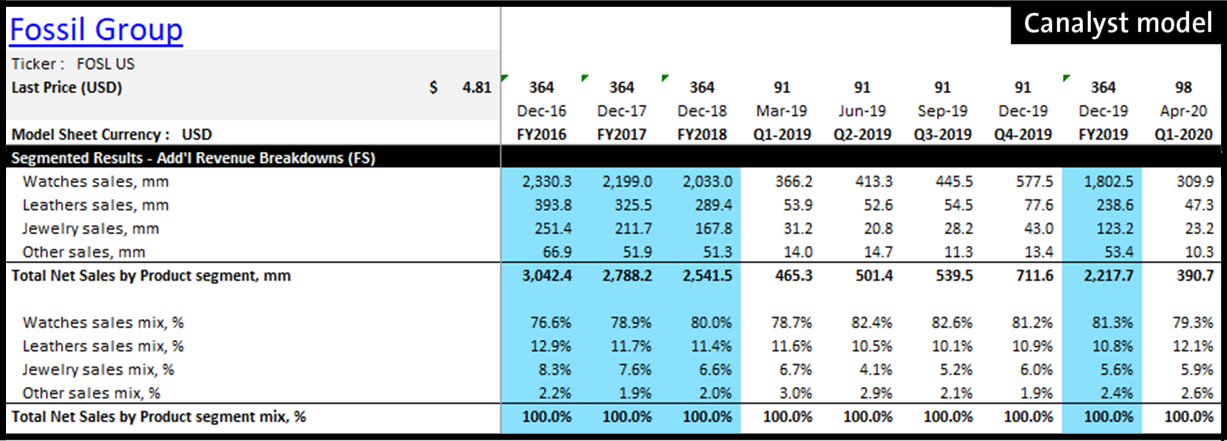

Fossil Group (NASDAQ: FOSL) reports Wednesday August 12. According to the Canalyst FOSL model, watch sales represent ~80% of total revenue (79% in Q1/20 and 81% in FY19). We’ll be watching.