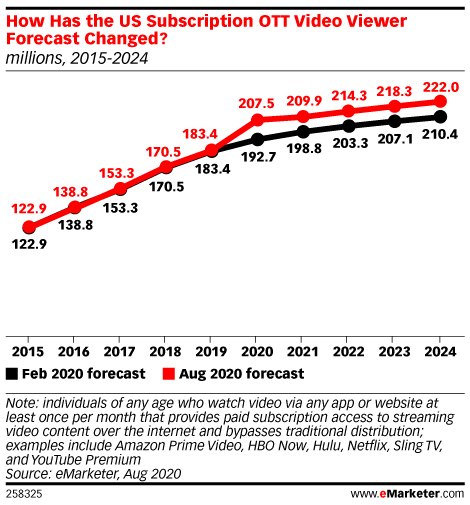

The COVID-19 pandemic has changed our relationship with work and leisure. Increased flexibility in scheduling work and entertainment has led to large viewership growth in on-demand streaming. Lockdowns and COVID-related unemployment are also having a major impact. However, the benefit has not been evenly distributed. Popular streaming platforms are growing their subscriber base and successfully pushing through increases in monthly fees (albeit partially capturing the incremental revenue as margins due to the need to cover high bandwidth expenses associated with growing traffic), while traditional legacy names are playing catch up with self-revolution adaption.

Subscription Video on Demand (SVOD) Operators

1.Market Share

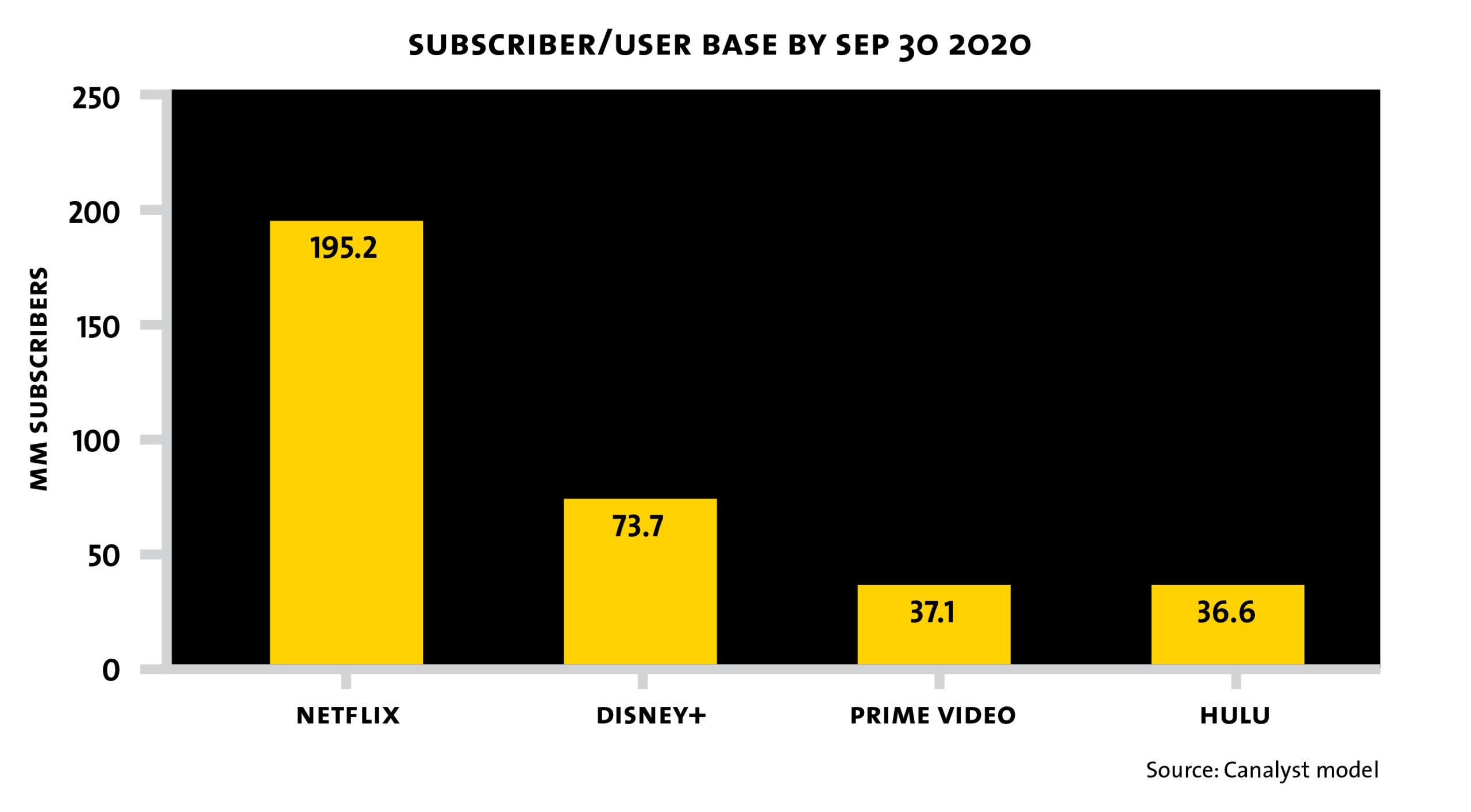

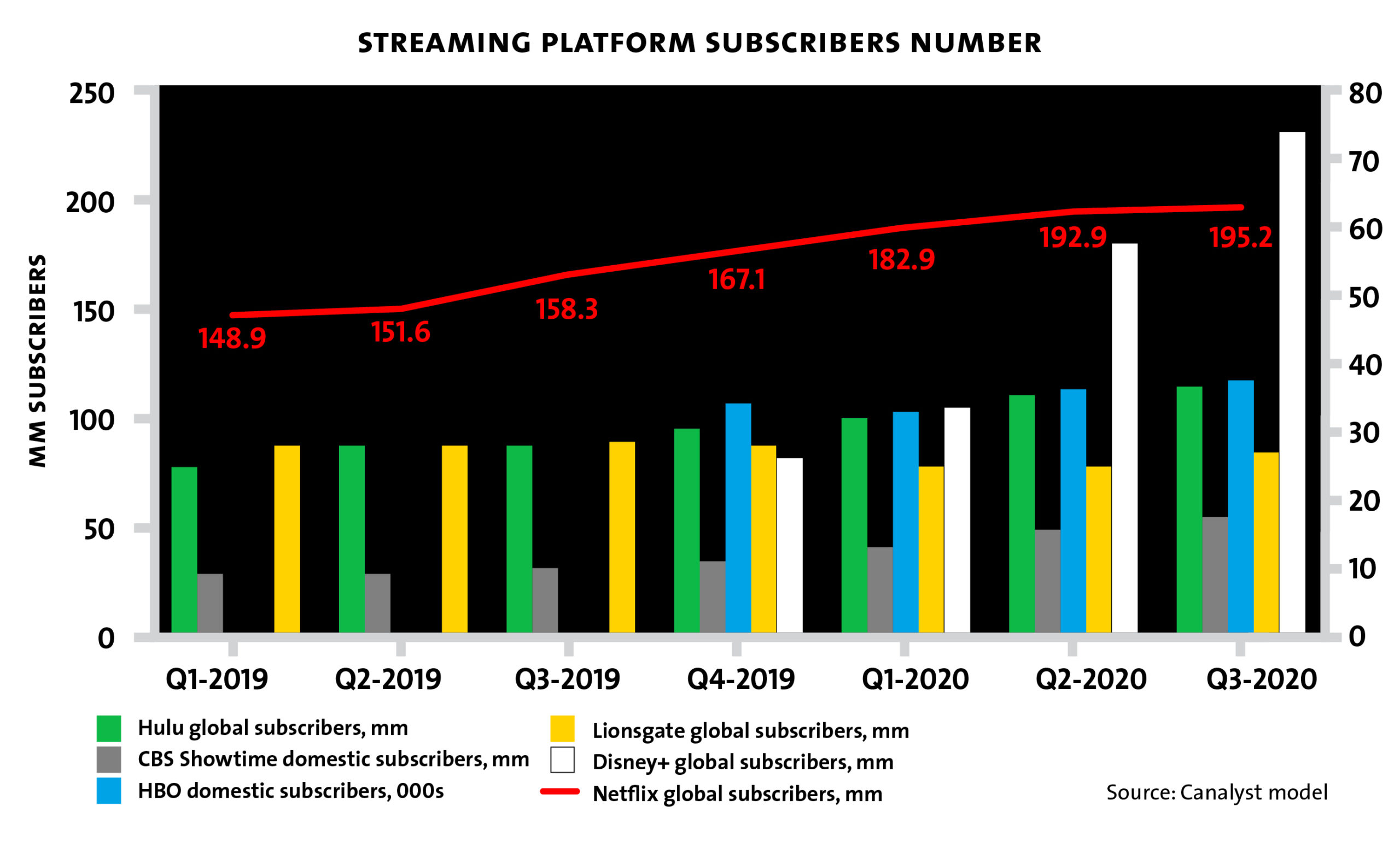

- Netflix subscriber count is found in the Canalyst model.

- Disney+ subscriber count is found in the Canalyst model. According to Moody’s research, Disney+ had 86.8 million subscribers as of Dec 14, 2020.

- According to Kantar research, 23% percent of total Amazon Prime subscribers are Prime video’s active users. A research by CIRP indicates that there are 126m Prime subscribers in the U.S. as of Q3 2020 or close to 15% more than last year. In February 2020, Jeff Bezos announced that the global Prime subscriber count surpassed 150 million. If growing at the aforementioned rate, Amazon Prime global subscriber base should be ~161 million with 37.1m of Prime Video subscribers (23% of 161m) as of Q3/20.

- Hulu subscriber count is based on Canalyst estimates.

- Estimates place Apple TV subscriber count at ~33.6 million as of January 2020 (Variety).

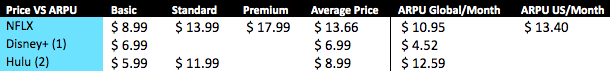

2. Price vs. ARPU (Average Revenue Per User)

- Disney has a bundle plan that includes Disney+, Hulu, and ESPN for $12.99/month.

- Hulu’s $5.99 plan is not ad-free. And its ARPU calculation includes ad revenue.

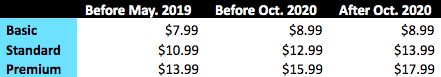

3. Common Strategy: Price Increases

Disney plans to increase the monthly subscription rate for Disney+ globally starting March 26, 2021. In the US, the price will increase from $6.99/month to $7.99/month.

In the past two years, Netflix increased its prices twice. The plan price changes are shown below:

Hulu also increased its Live TV bundle price twice over the last two years.

Linear operators’ self-revolution

1. Pandemic accelerated cord-cutting

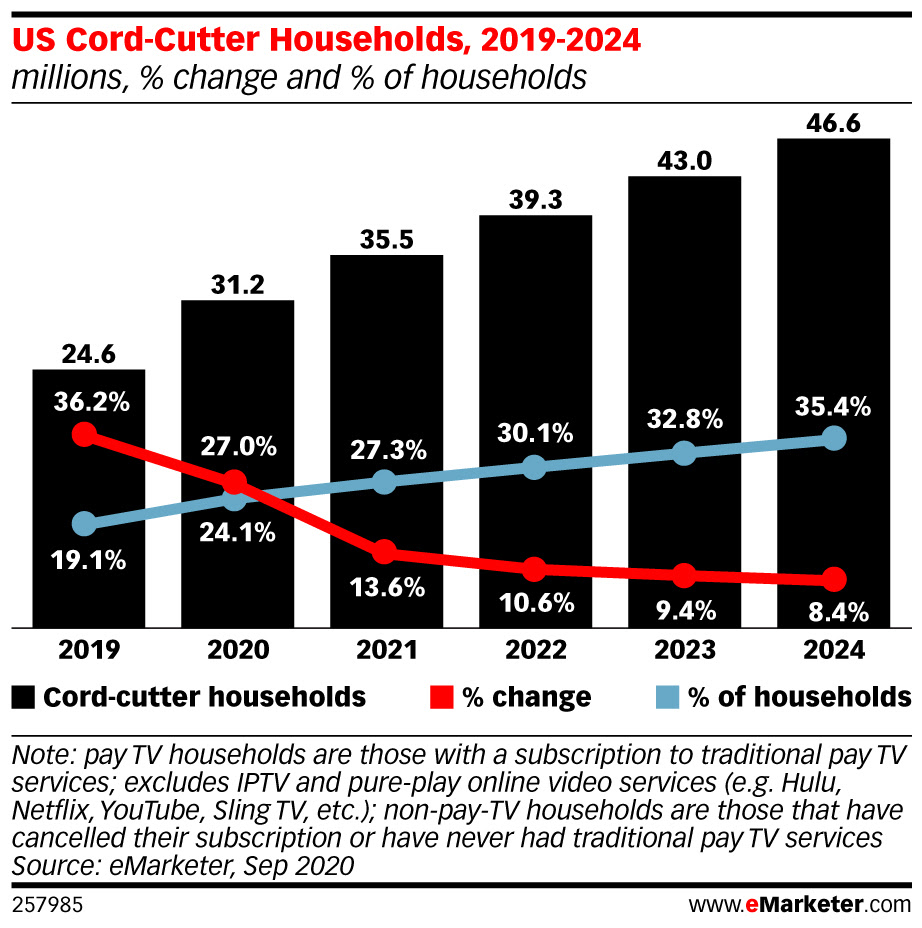

Even before the pandemic, traditional linear streaming operators were faced with intense cord-cutting. Industry forecasts show that over 24% of US households will cancel their Pay-TV (cable subscription) plans in future years. The pandemic has accelerated the trend. See our blog post on the cord-cutting trend here.

The 2020 recession led to more households terminating their expensive Pay-TV subscriptions. The cancellation of live sporting events and the lack of live broadcast of the same resulted in a less attractive Pay-TV offerings.

2. Too Little, Too Late

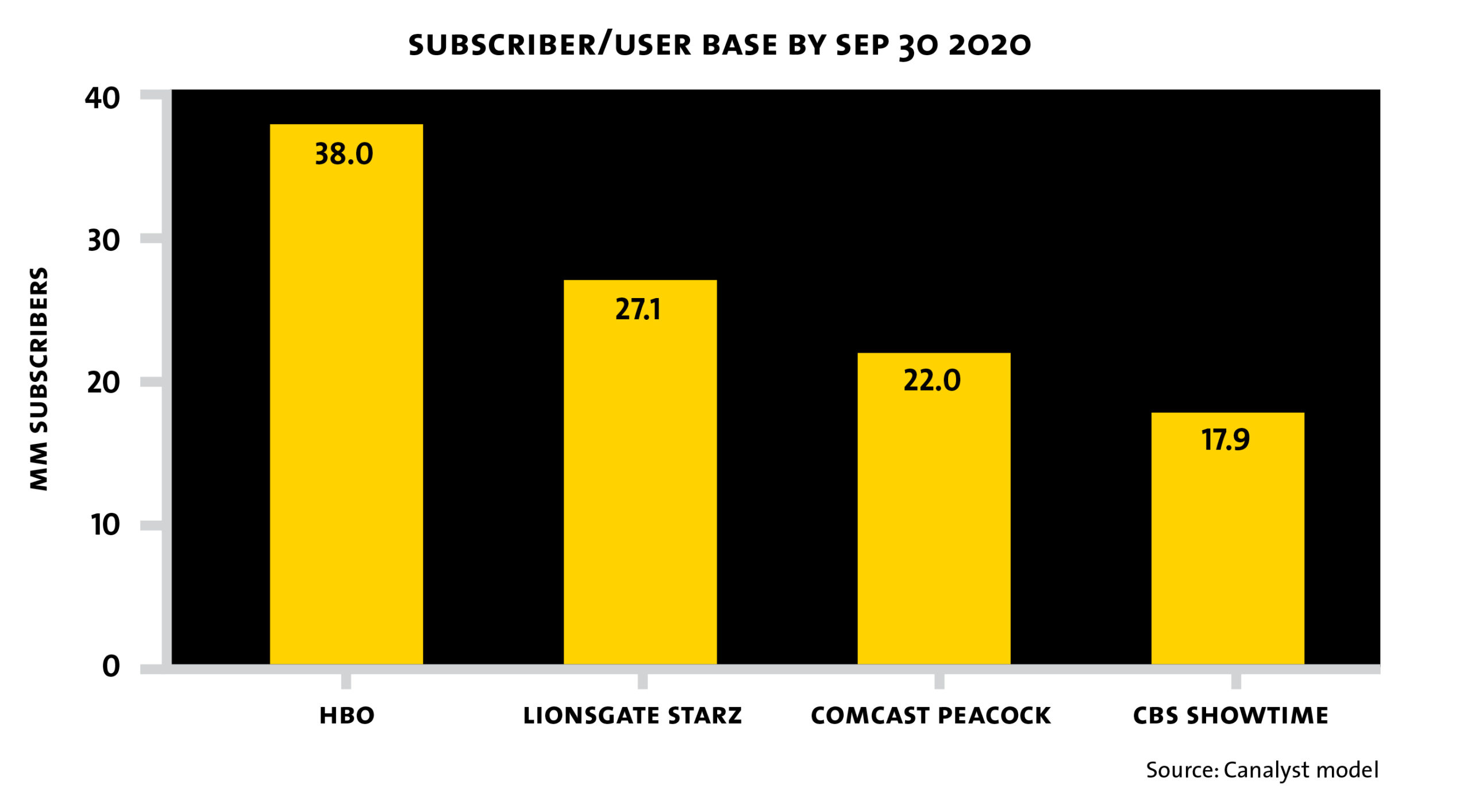

Traditional TV content providers are trying to slow down cord-cutting. Giants such as ViacomCBS, Lionsgate and Comcast have launched their own streaming services to keep consumers engaged. In some cases, they were successful in convincing the cable TV subscribers who planned to cancel the service to retain customers by switching to the captive streaming platforms. But the trend has been so pervasive that we wonder whether any such effort would be too little, too late. On top of that, it will be a challenge for the linear TV operators to keep their legacy programs as assets rather than liabilities.

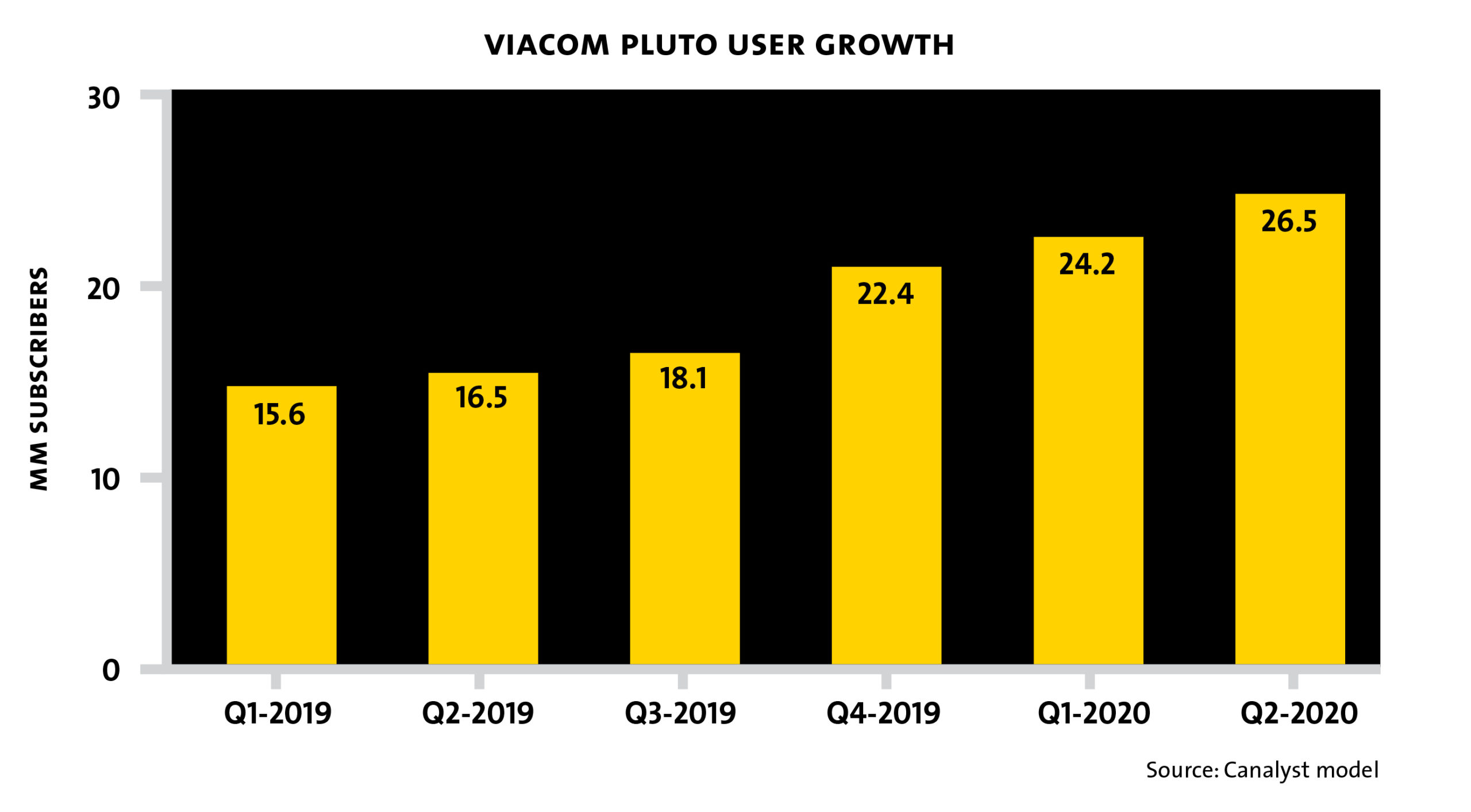

On the other hand, Viacom’s online free live TV platform Pluto may be a good example of leveraging legacy content to attract viewership. This service is an online version of traditional cable TV and not ad-free. However, the advantage of Pluto is the access to ViacomCBS’s on-demand library. Pluto TV saw great user growth in past quarters (see chart below). Its former CEO Tom Tyan has been named the new CEO of ViacomCBS streaming. It is unclear though what role Pluto TV will play after the merger of Viacom and CBS. It also remains to be seen whether it will be an extension of Pay-TV or a gateway to streaming.

3. Reorganization to counter internal resistance

Massive reorganization is taking place. In just the past 12 months, CBS, Comcast Corp.’s NBCUniversal, and AT&T Inc.’s Warner Media have all announced new streaming services, named new CEOs, and reduced headcount.

Consumer Behavior

Has the consumer watched more during the lockdown?

Yes! The traffic has increased tremendously.

Another proof of demand for the streaming content is Netflix downgrading its streaming quality in Europe during the lockdown because of the lack of bandwidth. During the lockdown, the viewing public consumed more streaming content as providers also saw additional subscriber growth. Except Lionsgate, almost all major streaming platforms saw larger growth in subscribers (shown in chart above). The streaming industry became fundamentally stronger thanks to the pandemic.