In the mid-morning, semis were relatively quiet after Marvell Technology Group Ltd.’s (NASDAQ: MRVL) report yesterday. Software looked firm with Workday (NASDAQ: WDAY) leading the way. Infrastructure names were all up after both VMware Inc. (NYSE: VMW) and Nutanix Inc. (NASDAQ: NTNX) reported yesterday.

WDAY leads the software names up 13% today. It beat expectations and raised FY guidance. Our emerging thoughts on the results: (i) management set an extremely low bar for themselves going in, and (ii) HCM was not the source of the outperformance.

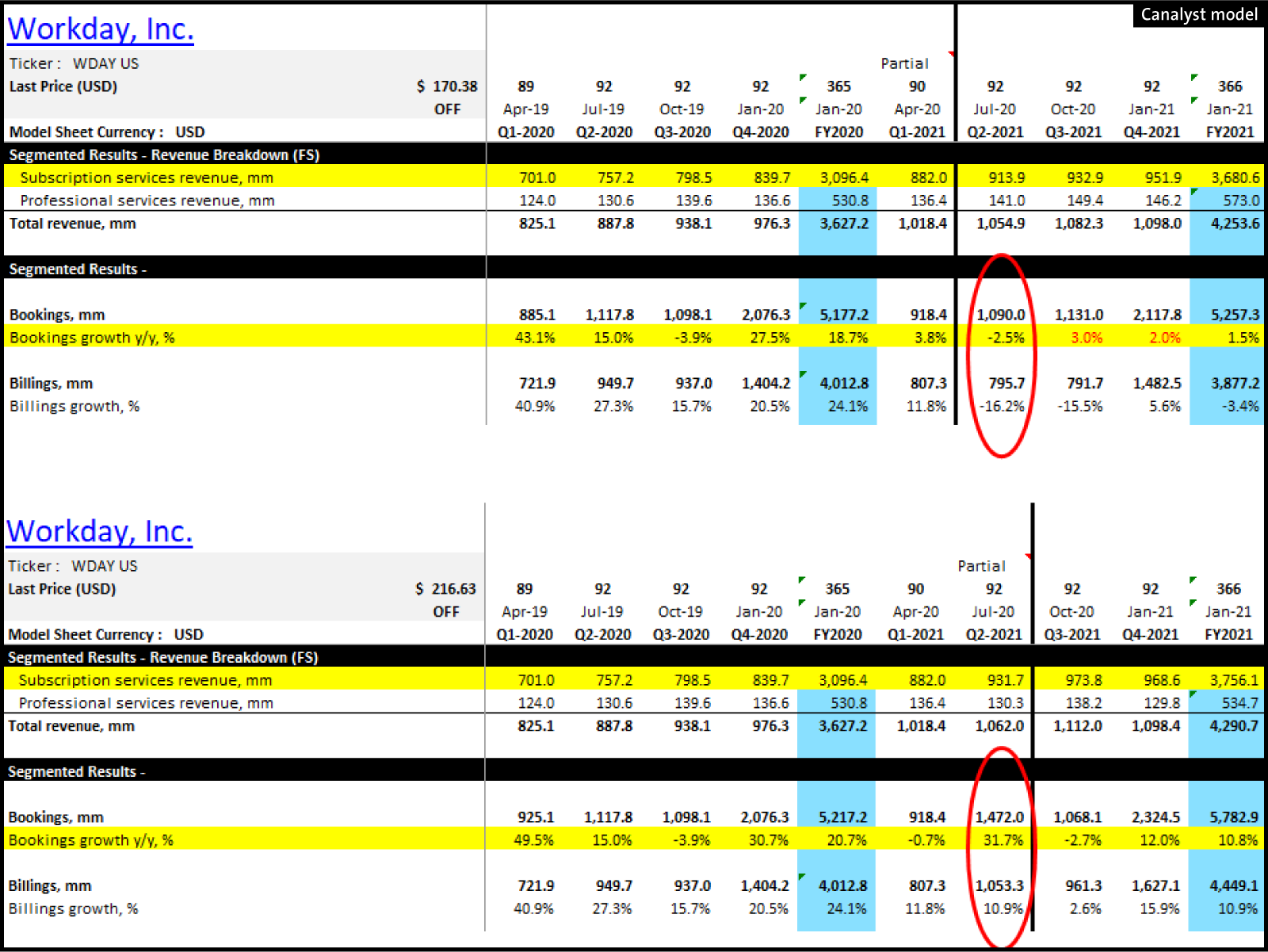

In FQ2’21, revenue grew 19.6% y/y to $1.06B (+$20M vs. consensus) with subscription services of $931.7M topping their guidance of $913-915M. Of that, $6M came from an accelerated conversion of revenue due to an acquisition of a customer. WDAY raised its FY21e subscription revenue guidance by +$50-60M to $3.73-3.74B (20-21% y/y), well-above the FQ2 beat. Adjusted EPS of $0.84 beat consensus by $0.18.

Going into FQ2’20, WDAY had guided for 16-17% y/y growth of revenue performance obligations (RPO) to ~$8.2B. Instead, RPO turned out to have grown +22.3% y/y to $8.6B. The +$400M differential caused the guidance-implied -3% y/y in FQ2’21 bookings to end at +32% y/y based on the reported numbers. The outlook was offered mid-way through the last quarter. With no meaningful distortion in linearity, management’s outlook was overly conservative.

Given all of that, our modeling based on management guidance changes for the latter half of the year. For FQ3’21e WDAY expects high-teen RPO growth again, which makes the bookings seasonality similar to last year and the FQ4’21e, based on the FY subscription services outlook, vastly more subdued. Conservatism or lack of visibility?

In either case, HCM is not the driver, at least not to the degree as the market expects. Instead, WDAY saw a strong demand in FQ2’21 for its Financial Management products, most notably Workday Accounting. Also, Workday Adoptive Planning wins were strong, as companies ran scenarios around the impact from the disruptions to their supply chains. We saw this at Anaplan Inc. (NYSE: PLAN) this reporting season. PLAN reported better than expected Net Retention of 116% (vs. guided downside of ~110%) and robust expansion from its installed base for Connected Planning in Financials, even calling out Retail as a source of strength amid a pandemic. PLAN’s post July Q report chart says more. It has no HCM exposure.

This bodes well for Coupa Software Inc. (NASDAQ: COUP) that is set to report on September 8. COUP competes directly with WDAY’s Scout RFP in the BSM (Business Spend Management) and, given the data points we are collecting, it is positioned to do well this quarter. But, at 41x EV/Sales NTM (based on next 12 months estimates from our COUP model) it is one of the most expensive names under our watch (besides SHOP) and a lot of the goodwill may be baked-in already. Stay tuned.