With the prevalence of the inexpensive streaming options, such as Netflix Inc. (NASDAQ: NFLX), Hulu and Disney + (both NYSE: DIS), HBO Max (NYSE: T), available via the internet, more and more people are cord-cutting. This is a material headwind for Qurate Retail Inc. (NASDAQ: QRTEA), which is traditionally known for selling to consumers directly through cable TV. The target audience for the company are predominantly 35-64 year old, above average net worth, female cable subscribers. As QRTEA’s main customer base is paid TV households, the company’s financial performance is meaningfully dependent on keeping the cord intact, however that dependence appears to be lessening.

Overview

Based on a study by PWC in 2019, PWC concluded that:

- Cord-cutting has slowed – consumers who still have pay-TV recognize that it fulfills a need in their video service portfolio.

- Once a revolutionary shift, streaming has become commonplace – 90% of consumers are watching video content over the internet.

- Consumers have seemingly settled into their video service portfolios, having curated a selection of services that meets their content needs.

Cord-cutting has been ongoing for some time now. As PWC points out, consumers have had sufficient time to figure out the right “video service portfolio” for them. Different consumers have different content needs. A household may have cable TV with sports for the dad, Disney+ for the children, and Netflix for the whole family. Consumers are testing which bundle of services meet their content needs and by the end of 2019, consumers were much more educated on what services were being offered and have settled into their ideal mix.

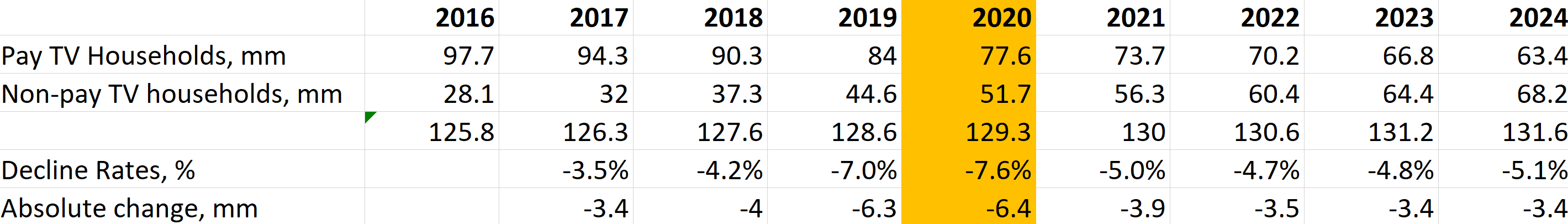

Table: US Pay-TV vs. Non-Pay-TV Households, 2016-2024. Source: eMarketer

According to eMarketer, it is estimated that 2020 will be the worst year for cord-cutting (6.4 million Pay-TV households are expected to cut the cord; represents a -7.6% decline) – yet another ripple effect from COVID-19. According to a study conducted by The Harris Poll in 2019, where cord-cutters were asked what they missed most about Pay-TV, 23% missed live events, 22% missed local and national news, and 19% missed sports. Due to COVID-19, the broadcasting of live events and sports have been affected, thus incentivizing viewers to remove Pay-TV from their video service portfolio. From 2021 to 2024, eMarketer expects Pay-TV Households to decline within a range of -4.7 to -5.1%.

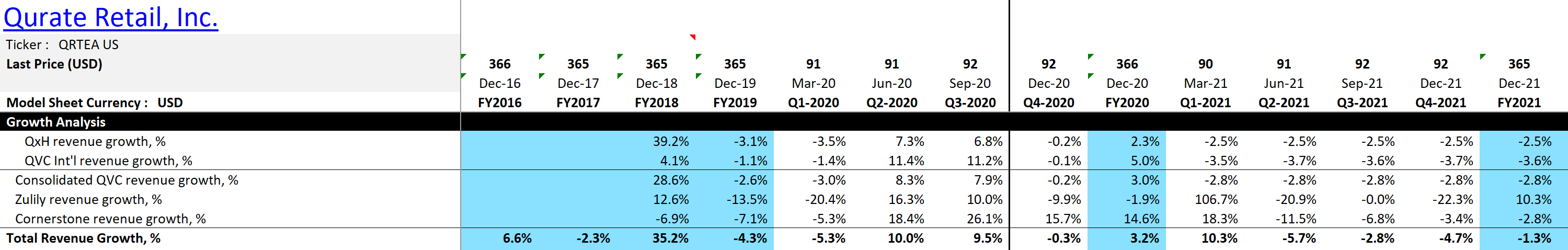

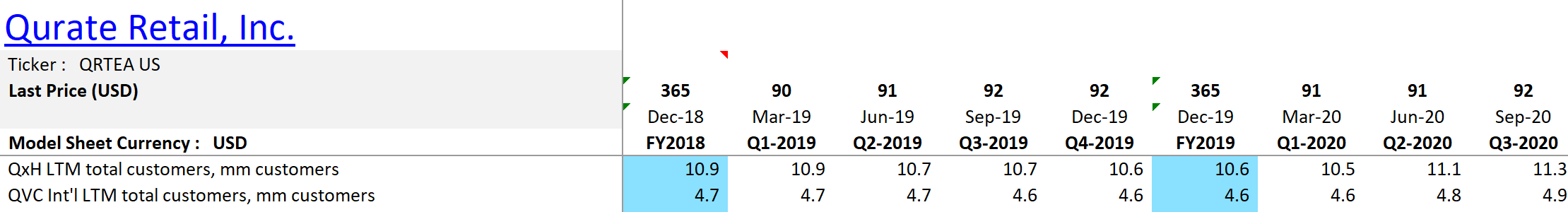

Despite this accelerating headwind, QRTEA revenues improved. In Q2 and Q3 of 2020, the company had significant growth in its LTM customer base and revenue.

Above: Canalyst model

A Multi-platform Company

QRTEA has made significant efforts to expand to major platforms and diversify away from its TV dependency. Customers are no longer tied to a cord. QRTEA offers free live-broadcasting of their show on their mobile app, e-commerce websites, various social media pages and on various connected-TV platforms. QVC could be streamed for free to TV using an Amazon Fire Stick or Roku TV, as an example, providing the same experience as traditional cable, mitigating the outflow of repeat customers.

The migration of customers from one platform to another, simply means QVC must adapt and migrate to those platforms as well. Live-streaming QVC is not exclusive to Pay-TV. While it seems counterintuitive, the virus induced acceleration of e-commerce purchasing behaviour may be a tailwind for direct to consumer retailers that traditionally relied on cable networks to reach their target audience.

As evidenced by QRTEA’s most recent financial performance, the reduction in Pay TV households through 2020 has been mitigated as management has adapted to the new TV landscape by converting streaming service users into paying customers.

Mobile platforms:

Android — over 1mm + installs, 4.2 stars, 24k reviews

iOS QVC app — 4.9 stars, 342.2k reviews, #87 in shopping category, works with apple watch, installs unknown

iOS HSN app — 4.8 stars, 145.4k reviews, #188 in shopping category, installs unknown

Connected-TV platforms:

Amazon Fire Stick — #1 in shopping category, installs unknown (there are roughly 71.2 mm Amazon Fire TV users according to eMarketer)

Roku TV — 3.5 stars, installs unknown (Roku is the biggest Connected-TV platform at 84.7 mm users according to eMarketer)

According to Statista, it is projected that there will be more than 200 million Connected-TVs in the US by 2021. Households are cord-cutting, but not TV-cutting.

Social media platforms:

Facebook — 3mm+ followers (company streams on Facebook Live)

Instagram — 639k followers (Furthermore, each QVC host have their own Instagram page)

Twitter US — 144k followers, Twitter UK: 66k followers

QVC Host as Influencers — Each QVC host has their own independent company run social media page. Most TV hosts are on Instagram and Facebook, and some are on more. David Venable, a host known for showcasing kitchen products, has over 490k followers on Facebook.

Tik-Tok — no presence yet, but I found a job posting from the company offering a marketing position for YouTube and Tik-Tok social media strategy.

Video-streaming platforms:

QVC YouTube channel — 371k subscribers

HSN TV YouTube channel — 151k subscribers

All the above platforms offer live-streaming except for Instagram and Twitter.