TPI Composites Inc. (NASDAQ: TPIC), a global manufacturer of composite wind blades for wind turbines, has had a tumultuous 3 months. The stock was a strong beneficiary of the Democrat win and the subsequent rally in clean energy stocks. Shares closed at $78.74 on February 12, up 218% y/y. Alongside its peers, it came off highs, however the retraction was particularly aggressive as the company’s strong 2020 results (released February 25) were tempered by soft 2021 expectations. TPIC ended 2020 with FY net sales of $1.67 billion, up 16% and EBITDA of $94.5 million (5.7% margin, down 30 bps).

For FY21, the company guided to net sales of between $1.75-1.85 billion and adjusted EBITDA of between $110-135 million. Management continues to believe the outlook is very robust, but did flag a short-term overcapacity issue. The company has taken 5 manufacturing lines out of production in China and is expecting another 10 lines to be operating at lower utilization through the back half of the year. Management also forecasts lower utilization in Q4 for several production lines in other regions. Within the Chinese market, management believes certain customers are shifting production away to mitigate both the geopolitical risk and the increasing costs associated with doing business. Guidance implies 80-85% utilization on 50 dedicated lines for FY21 vs. 81% on 53 dedicated lines in FY20 (Q4’20 utilization was 92% as Covid disruptions were mitigated). According to the Q4’20 earnings call investor deck, lower demand will have a ~$60 million impact on FY21 adjusted EBITDA (based on the guidance midpoint of $122.5 million).

At the Roth Conference, management seemed confident that the anticipated utilization dip in the back half of 2021 will just be a repositioning. They are very optimistic on growth potential and indicated that conversations with customers around 2022 have been strong. Several recent global initiatives to promote wind and renewable energy will likely fuel long-term renewables growth, namely, the announcements of net zero targets for China in 2060, and Japan, South Korea, and Canada in 2050. Given the number of global programs that are set to initiate in the near term, management indicated that muted demand growth in the back half of 2021 could be the calm before the storm (i.e., an escalation of demand) as customers navigate these initiatives and position themselves for a material uptick in demand for green energy.

TPIC could be a material benefactor of both growing demand for clean energy as well as growing demand for ESG investments. The ‘green trade’ has, at least in the short term, been accretive to historic valuation multiples.

TPIC’s performance from February 2020 to February 2021 may be attributable to, at least in some part, the widespread market-move into renewable energy that took place in 2020. Three Global Renewable Energy ETFs with material exposure to TPIC, SPDR S&P Kensho Clean Power ETF (NYSE: CNRG), and Invesco WilderHill Clean Energy ETF (NYSE: PBW), ALPS Clean Energy ETF (BATS: ACES) were up 179.4%, 224.0%, and 145.3%, respectively from February 12, 2020 through February 12, 2021. When compared to the S&P 500 Index (SPX), which returned ~16.4% over the same period, the ‘green trade’ becomes increasingly difficult to ignore. The forces behind this influx of cash into renewable energy funds cannot be pinpointed, but some trends can be highlighted as potential catalysts.

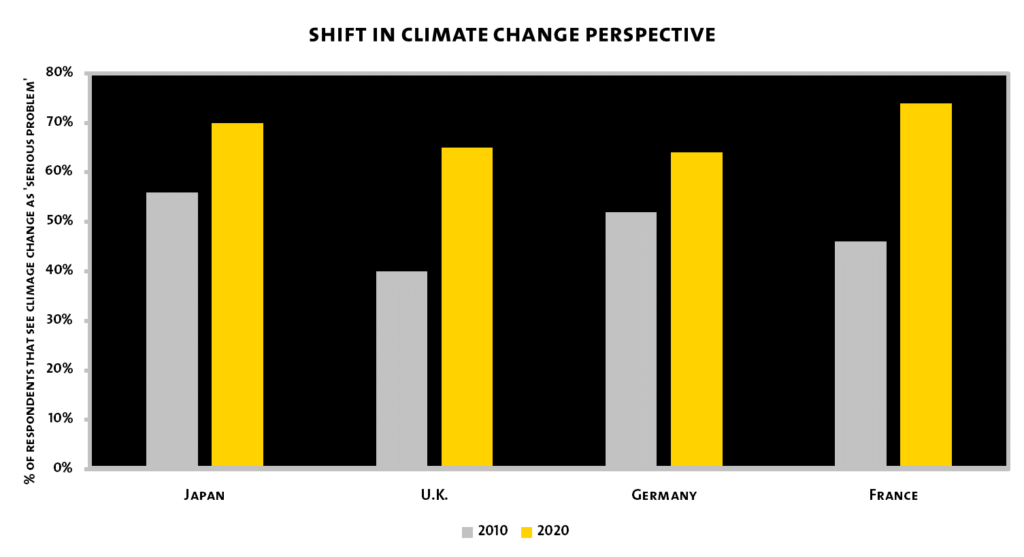

The world is becoming increasingly concerned with the environment. On September 29, 2020, a Pew Research Report, which includes survey results from 2010, 2015 and 2020, probed the level of concern for climate change in various countries around the world. The results suggest that concern for climate change has risen. In 2010, of U.S. respondents, only 37% believed climate change is a very serious problem; in 2020, 53% did. Similarly, in Japan, the U.K., Germany, and France, the proportions of respondents who believed climate change is a very serious problem went up (see graph below).

(Source: Pew Research)

Rising concern for the environment combined with the ease and dominance of passive investing, has caused significant growth in ESG (Energy, Social, and Corporate Governance) investing. In September 2020, Morningstar published a report stating that as of June 30, 2020, there were 534 sustainable index mutual funds and exchange-traded funds globally, with collective assets under management of $250 billion. The report defined the universe of sustainable funds as those index funds and exchange-traded funds globally that use ESG criteria as a key part of their selection or weighting process and/or indicate that they pursue a sustainability-related theme and/or seek a measurable positive impact alongside financial return. As of June 30, 2020, the number of products and money invested in them had more than doubled over the previous three years.

Progressive environmental policies are providing tailwinds to the clean energy industry. And the election of President Biden was no less than a providential event to conclude 2020 for the industry. President Biden’s environmental plan is an example of the many policies around the world that are creating a very strong outlook for clean energy and companies like TPIC. President Biden’s plan aims to ensure the U.S. achieves a 100% clean energy economy and reaches net-zero emissions no later than 2050. Additionally, President Biden’s climate and environmental justice proposal will make a federal investment of $1.7 trillion over the next 10 years, meaning there is a lot of opportunity ahead.

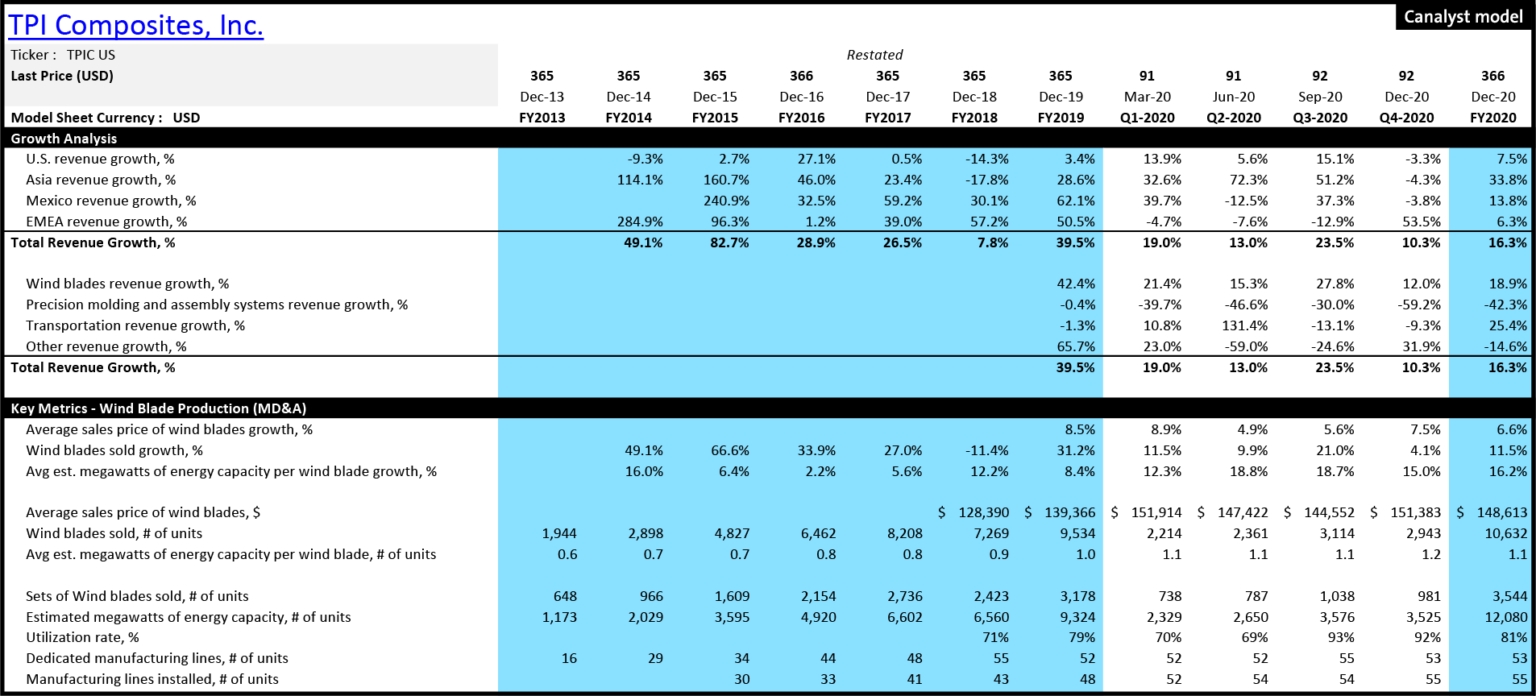

Ultimately, it seems the market is still in price discovery mode as TPIC closed at $53.97 on March 15, 2021, up ~6.16% from its opening price of $50.84 and up ~38.0% from its March 5th low of $39.12. Below is a snapshot taken from the Canalyst TPIC model for reference.