The dashboard has some interesting time series, such as Purchased Transportation Margin and Asset Light Logistics Services Revenues Mix.

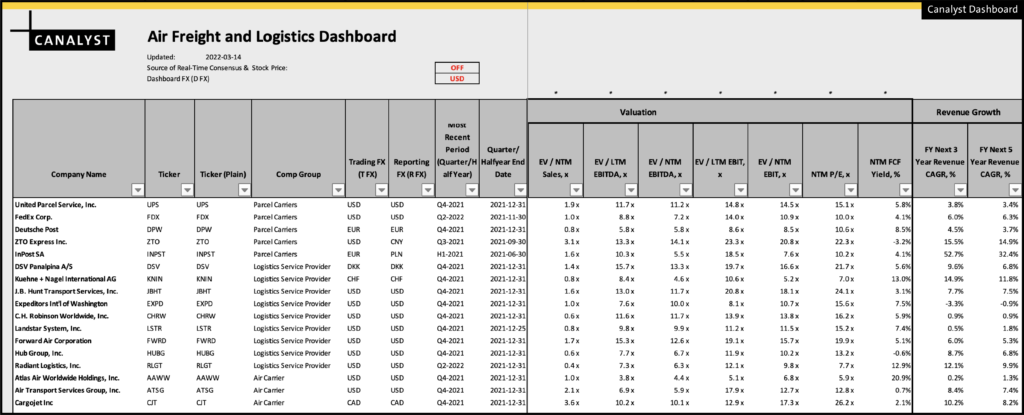

In this example we will seek to answer two questions for the Freight Carriers in the Air Freight and Logistics Dashboard:

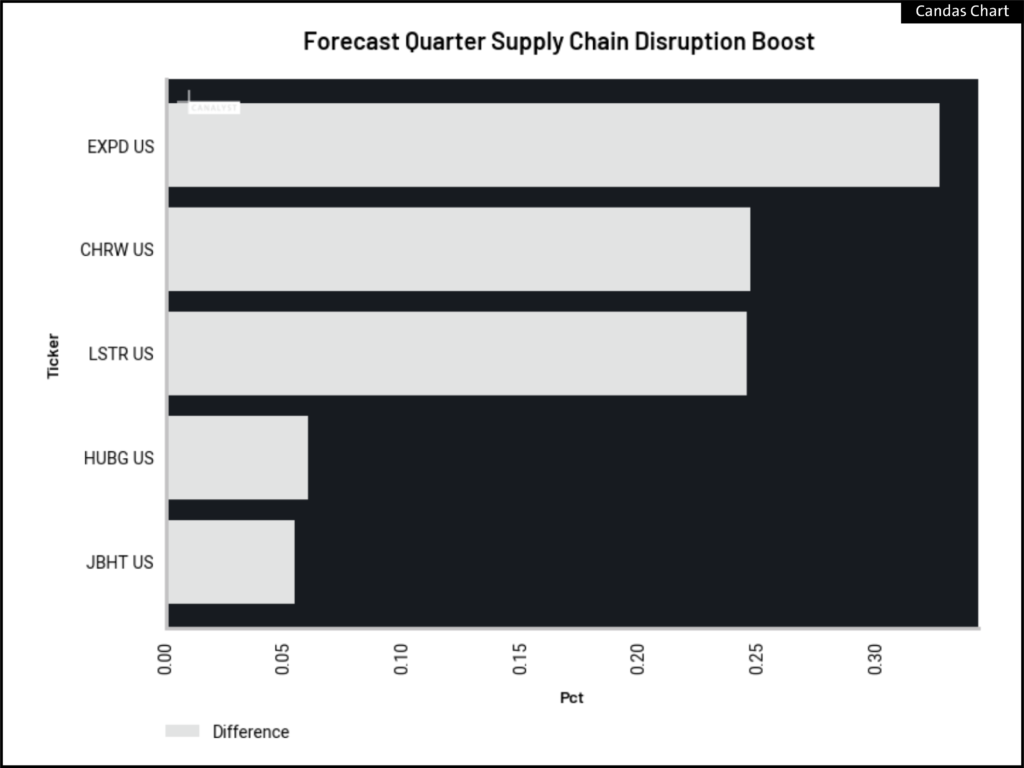

- For whom was the Supply Chain Disruption the biggest boost?

- And, using Landstar as an example, what does current company guidance suggest vis a vis Supply Chain Disruption continuing?

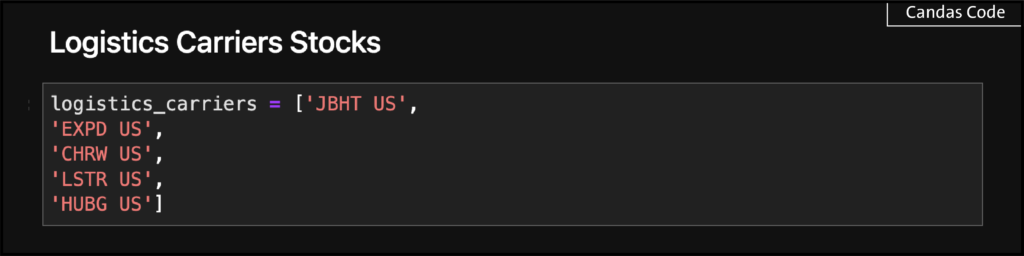

Beginning with our list of stocks

We can look at the Revenue over time for all stocks in our ModelSet and clearly there’s a boost for most of these companies from the start of COVID-related Supply Chain Disruption.

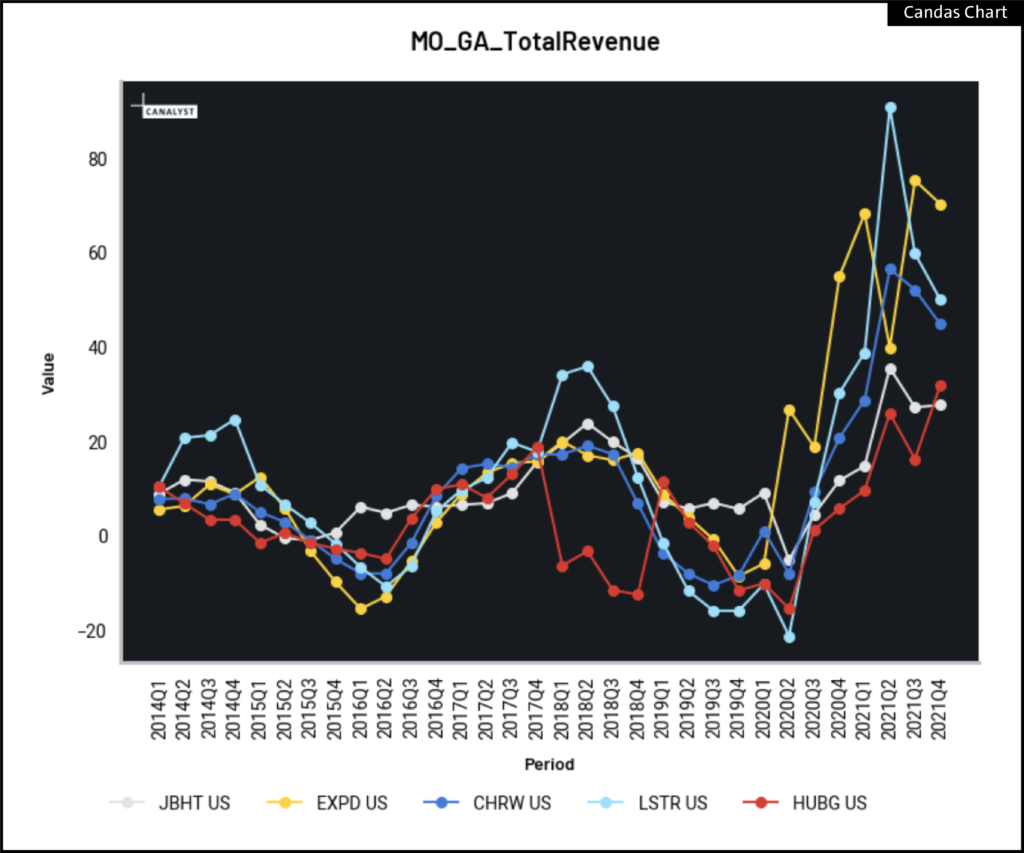

To answer our first question, we performed a simple multivariate regression with a dummy variable of Supply Chain Disruption = 1 after March 2020 and 0 before March 2020.

To illustrate the output, the chart below shows HUBG brokerage revenue in blue (actual), the fitted model in salmon, the predicted +1 with supply chain disruption quarter in purple, and the predicted +1 quarter no supply chain disruption in red.

Of the companies in our list, EXPD has the biggest boost from Supply Chain Disruption, JBHT the least – and almost none.

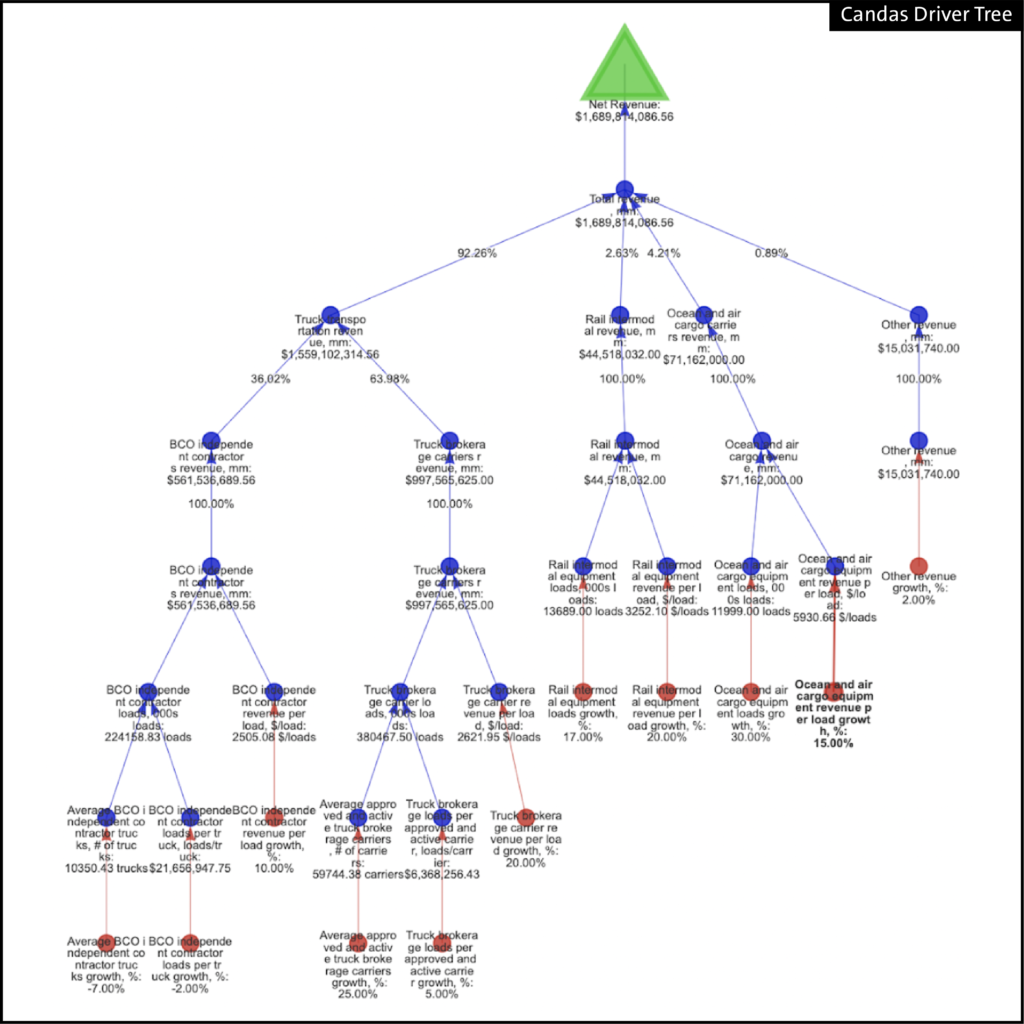

Taking one stock as an example, LSTR, we can dig a little deeper into the changes from the post-COVID era

First, we use our ModelMap to get a build of Revenue:

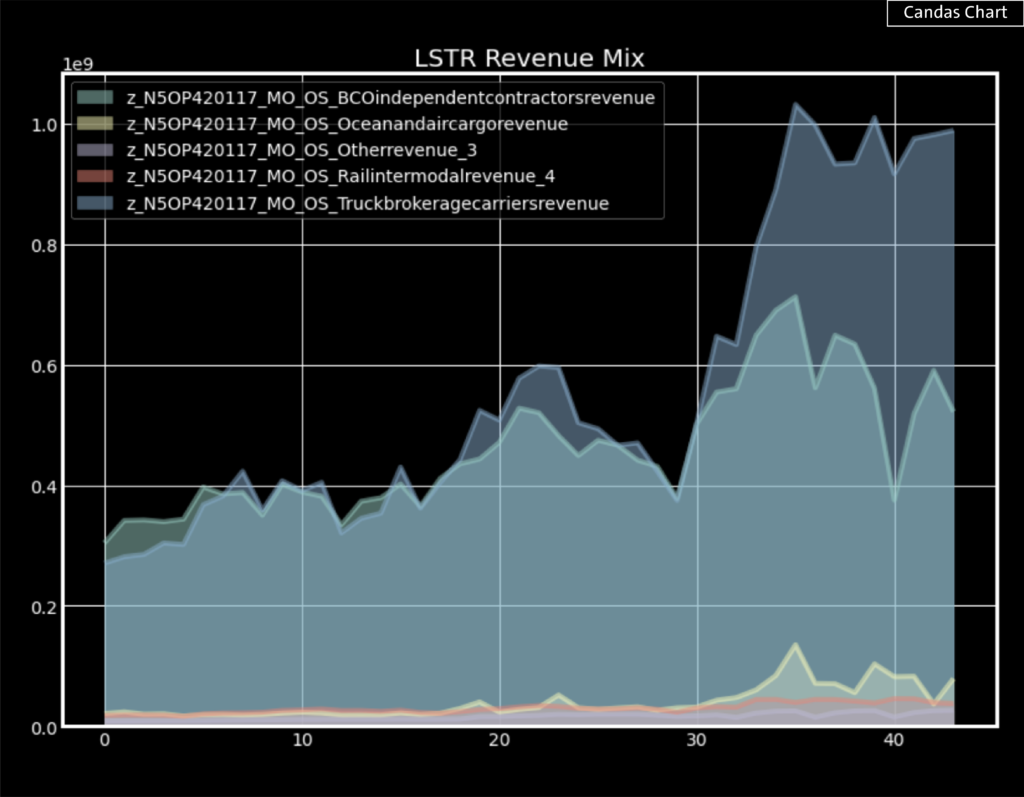

We can easily slice one level of the revenue build ModelMap and get an area chart which shows the bump in LSTR revenues post-COVID has been largely driven by Truck Brokerage Carriers Revenue:

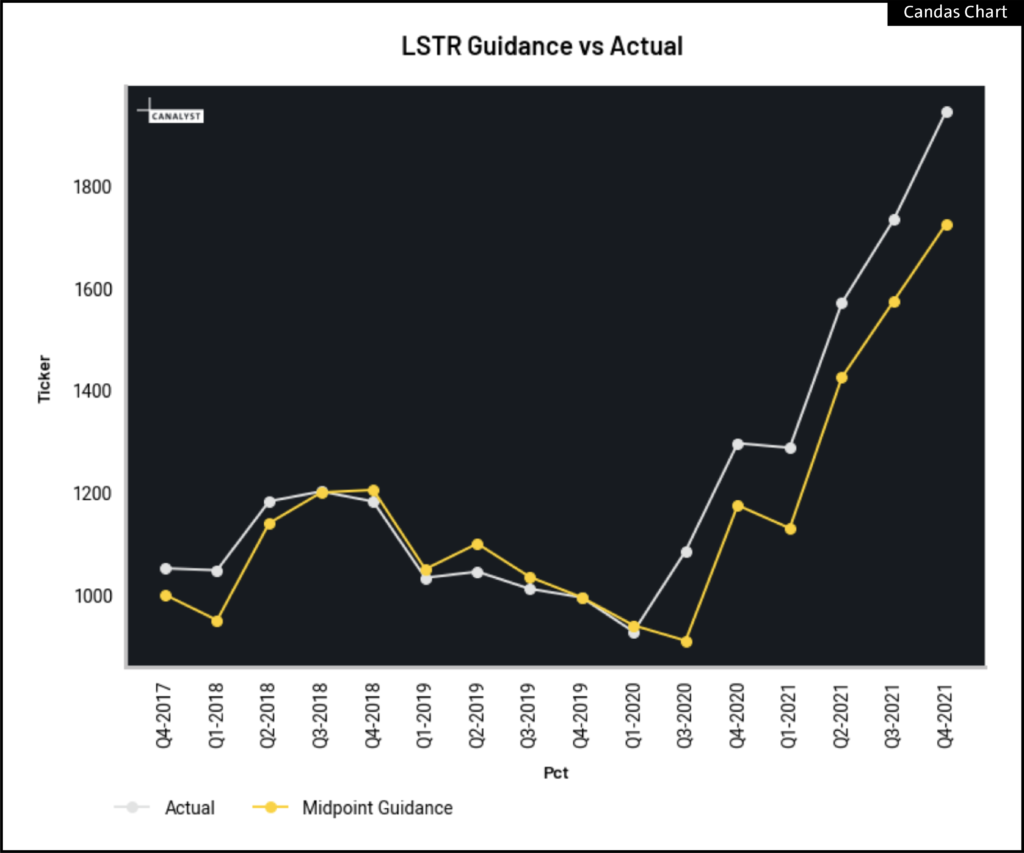

Turning to LSTR guidance, the company began beating the mid-point of their quarterly guidance range as the Supply Chain Disruption era began.

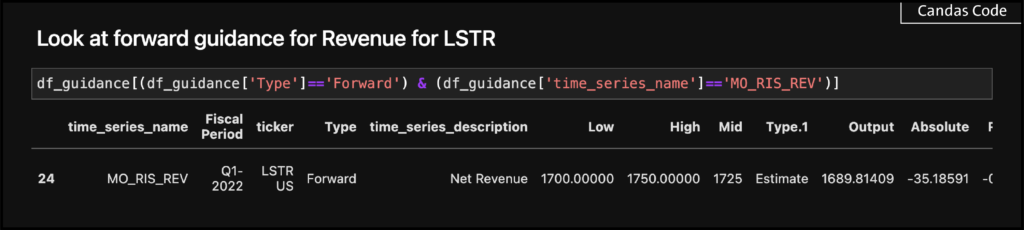

Looking at the upcoming quarter LSTR has a range of 1,700 to 1,750 with a midpoint of 1,725.

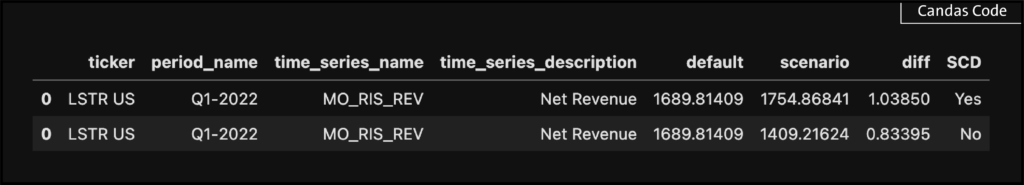

And in our “SCD Yes” scenario (Supply Chain Disruption continues) we predict a revenue number of 1,754. “SCD No” (Supply Chain Disruption ends) would suggest a much lower 1,409mm of revenues.

Bottom line: LSTR guidance implies continued supply chain disruption.

For a video demo of this analysis and Candas, check out Jed Gore’s demonstration at BattleFin’s Datapalooza here.

Check out Github for more examples and analysis from Candas Senior Product Manager, Jed Gore.