Fundamental

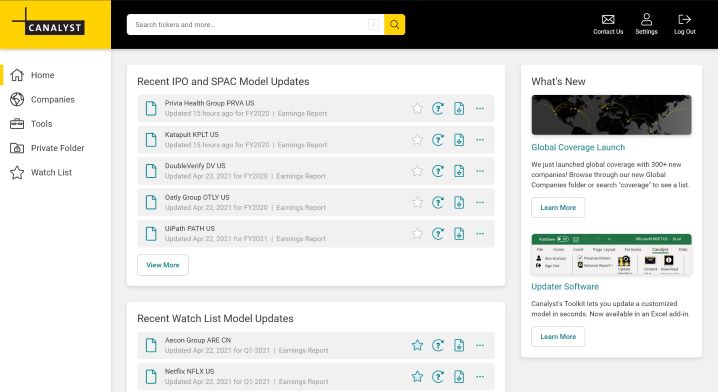

Immediate Access to Robust,

Up-to-date Financial Models

4,000+ models across all sectors and caps.

Download models instantly as an unlocked Excel workbook.

Every KPI That Matters

Every model is updated for earnings announcements, restatements, and significant M&A in near real-time to include:

- Consensus data & real-time stock pricing linked to your data terminal

- Drivers cells for forecasting your assumptions

- Income statement + adjusted numbers, as reported

- Cumulative/quarterly cash flow statements and balance sheet

Consistency, No Bias

Models across all sectors are organized in a consistently structured layout to give you a familiar starting point:

- Historical = 10 years

- Forecast = 5 years of fully linked-up working forecasts

- Forecast drivers tuned to management guidance, consensus, and recent performance

Adaptable to Your Workflow

We provide standard and custom Excel worksheet drop-in templates (DCF, LBO, incremental M&A) that are directly linked to data in the company’s model so you can:

- Perform and repeat relevant analysis across multiple models in seconds

- Customize metrics

- Re-drive values

- Leverage our data while maintaining your proprietary way of valuing companies

Model and Data Quality Is Our Top Priority

Our 100+ person equity research team builds and updates models directly from company filings, using a stringent review process to ensure accuracy.

Manual Review

North America-based analysts build and update all models

Directly Sourced Data

From primary sources such as earnings reports and press releases

No Communication Gaps

Tightly-connected teams, across all functions

Tech-Enabled

Multiple layers of systematic quality checks in the modeling process

How We Build and Update Our Models

-

Two analysts independently enter the data from the public filings

-

Models are compared against each other by a proprietary software check

-

Once validated, a sector specialist signs off

-

A series of quantitative software checks is performed

-

Email notification sent to download available model from the portal