Canalyst’s New Credit Section, a New Head of Global Research, Revisiting the Hottest IPOs Since 2021, and a London-based Canalyst Client on Invest Like the Best

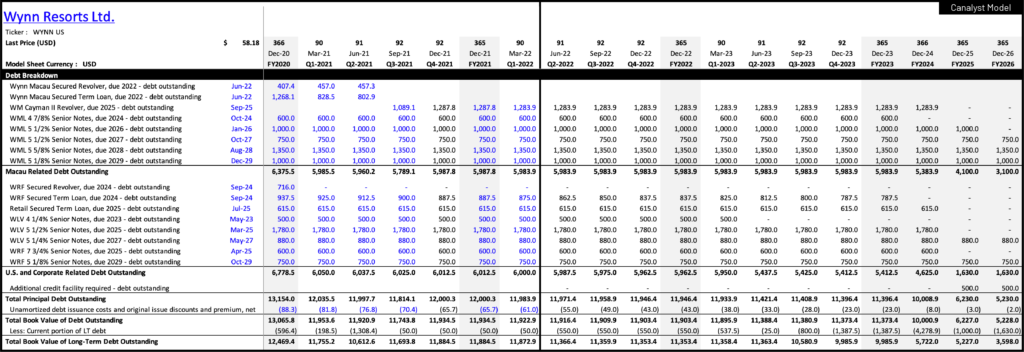

Better Visibility on the “Right Side” of the Balance Sheet

Amid inflation concerns, cash is once again ‘King’. Equity investors are shifting focus from Sales/EBITDA multiples to balance sheet health and leverage ratios. With this shift, we are starting to see increased overlap in the metrics used by both equity and credit investors – specifically in regard to capital structure and cash generative abilities.To provide better visibility on the “right side” of the balance sheet we’ve started adding a Debt Breakdown, which includes fully integrated, by issue, debt waterfalls that tie into our fundamental models. Dive into Company Debt and Check out $LVS, $WYNN, and $MGM Canalyst models with our new Credit Section.

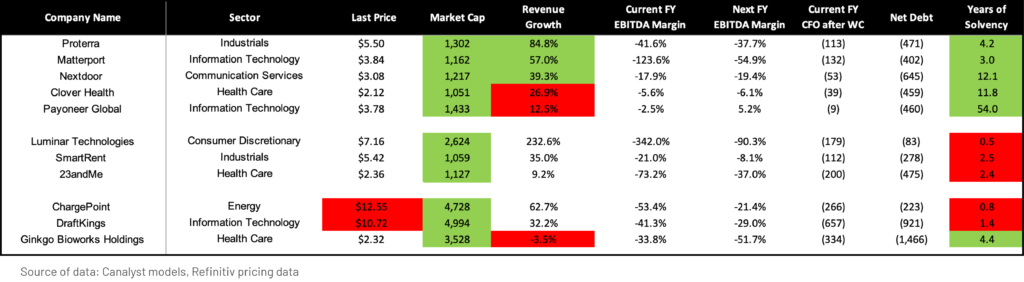

Revisiting the Hottest IPOs Since 2021

In this article, Canalyst co-founder and former PM, James Rife, examines the performance of last year’s IPO wave (spoiler alert: it’s poor), using Canalyst’s industry-leading fundamental data to suggest a methodology for approaching companies in this group. Join the conversation on twitter and let us know what you think.

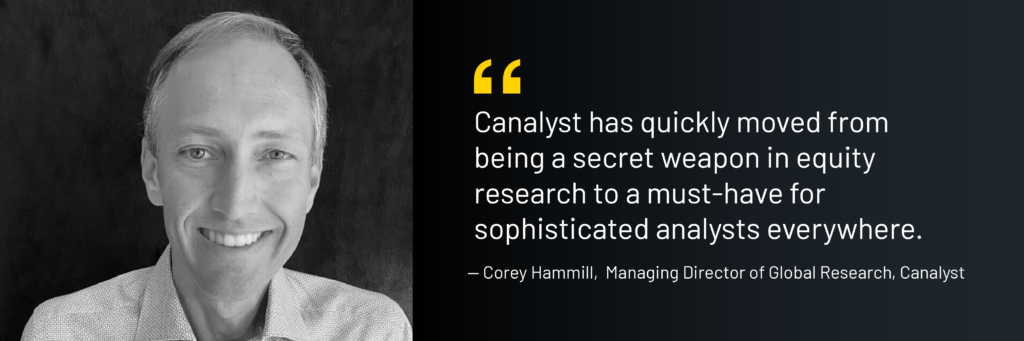

Corey Hammill, Former Co-Founder, Paradigm Capital, Joins Canalyst as Managing Director, Global Research

At Canalyst, we’re big believers in championing and providing high-quality fundamental data to the most sophisticated investors in the world. The addition of Corey Hamill to our executive team as Managing Director, Global Research, reinforces our commitment to our mission. Corey brings over two decades of pertinent capital markets experience, most recently from Paradigm Capital where he was a Co-Founder, Partner, Managing Director, and Head of Research. An early Canalyst client, Corey brings exceptional insight into how professional analysts leverage Canalyst data and models, and how we can evolve to serve our growing global clientele. In his new role, Corey will lead and scale Canalyst’s 100+ person research team as we continue to grow both the depth and breadth of our coverage universe. Read more here.

Global Investor Leverages Canalyst in an Expanding Coverage Universe

We’re big fans of Invest Like the Best, tuning in each week as Patrick O’Shaughnessy interviews the best and brightest of the investing world. Earlier this spring, Patrick sat down for a conversation with our client Giuseppe Coco, Senior Analyst at London-based LK Advisers. The full interview covers his experience manually building complex models, and how Canalyst is now a key component of his investment process – automating his modeling workflow and screening across an expanding coverage universe. For highlights of their conversation, like why Giuseppe says: “…from all the tools I have been using on the buyside, Canalyst reduces friction the most” and why he thinks Canalyst will “…open up very exciting opportunities and use-cases down the line.,” read on here.