Candas Data Science Library, Neuberger Berman x Invest Like the Best, New Dashboards, and Dragoneer leads our Series C

Introducing Candas

If you’re a fan of Patrick O’Shaughnessy’s Invest Like the Best (as are we), you may have heard Canalyst client, Roger Freeman of Neuberger Berman and Canalyst Product Manager, Jed Gore discuss the evolving role of data science in fundamental investing at the end of last Tuesday’s episode with Ricky Sandler of Eminence Capital. Roger and Jed sit down with Patrick to talk about their experiences on the buyside, what the release of Candas means for the future of fundamental investing, and how they both use the library today. Listen to the full interview here.

Candas: A Data Science Library

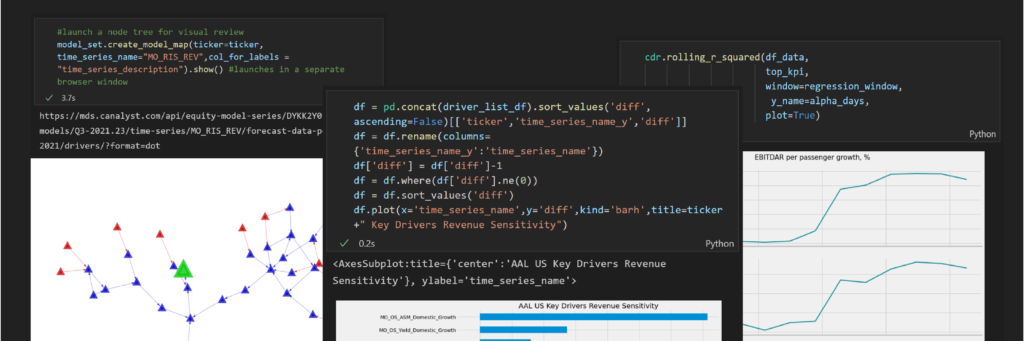

Candas was built by a former PM / analyst to give anyone with entry-level Python knowledge the ability to scale their fundamental investment process. Access, manipulate, and visualize Canalyst models, without ever opening Excel. Whether you’re a data scientist running scenario analysis or an analyst looking to scale your workflow, Candas offers the flexibility of both in an easy-to-use Python library.

Work with full models, create and calculate scenarios, and visualize actionable investment ideas – all in a matter of minutes.

- Workflow: Scenario Analysis

Rather than simply deliver data, Candas serves the actual model in a Python class. Like a calculator, this allows for custom scenario evaluation for one or more companies at a time.

- Discovery: Search KPIs, Key Drivers, and Guidance

Use Candas to search for KPIs by partial or full description, filter by “key driver” – model driver, sector, category, or query against values for a screener-like functionality. Search either our full model dataset or our guidance dataset for companies that provide guidance.

- Meaning: Top KPIs, Top Revenue Drivers

Identify the KPIs with the greatest impact on stock price, and evaluate those KPIs based on changing P&L scenarios.

- Visualizations: P&L Node Tree, Pre-Built Charting

Visualize P&L statements in node trees with common size % and values attached. Use the built-in charting tools to efficiently make comparisons.

Accessing Candas

To see more of Candas in action, check out our recent blog posts:

A New Way to Approach a Traditional JPMorgan Read Through

Goldman Sachs Compensation Ratio Analysis

A New Way to Apply a Macro View to a Sector

Now we can basically throw a list of tickers in and get back earnings sensitivity to a 1% change in a couple of minutes.

– Roger Freeman, Co-Head Data Science and Quantamental Research, Neuberger Berman

Want to learn more, or partner with us as we unlock the full potential of Candas? Request a demo of Candas today.

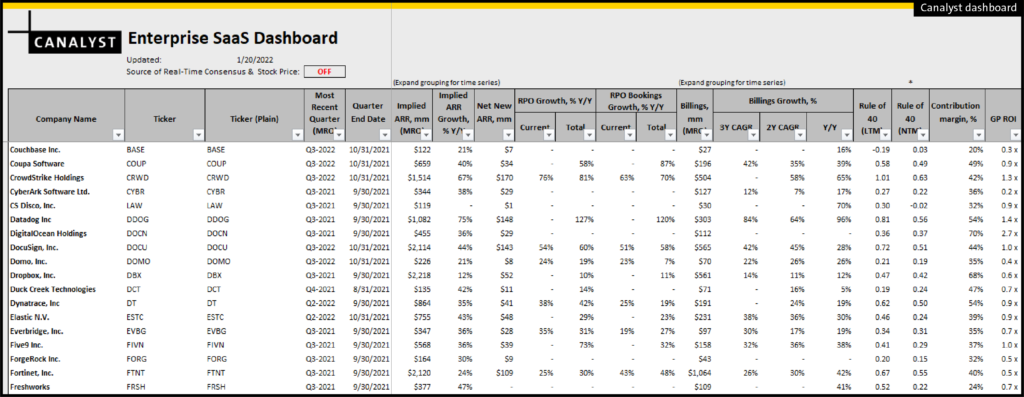

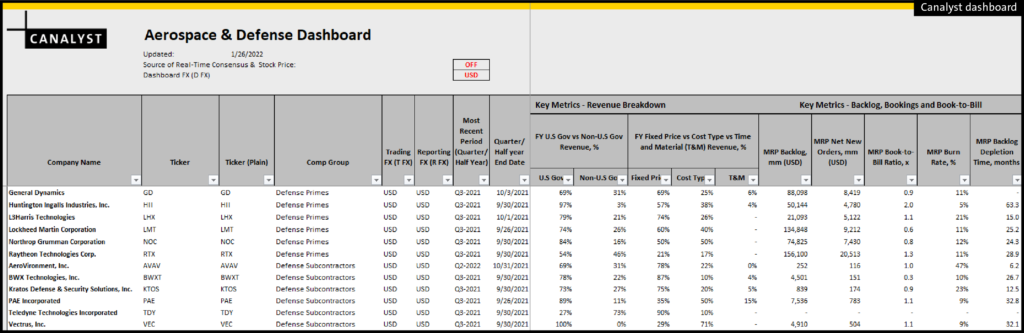

Dashboards, Dashboards, Dashboards

Nothing beats having access to clean fundamental data, and with the launch of Canalyst Dashboards late last year, clients can leverage our clean fundamental data sets to make informed decisions faster than ever.

Two of the most recent additions include:

- Semiconductors – Analyze Revenue breakdown by end market, valuations, margins, growth projections, and more across key players in the semiconductor industry including TSM, NVDA, and INTC.

- Aerospace & Defense – Compare Revenue breakdowns such as Commercial vs. Defense, US Gov vs. Non-US Gov and other key metrics like Backlog, New Orders, Book-to-Bill, and Burn Rate across 30 tickers including BA, LMT, and RTX.

Our growing list of dashboards now includes:

- Aerospace & Defense

- Airlines

- Cannabis

- Enterprise SaaS (our latest version now has DOUBLE the number of names)

- Internet Retail

- Payments

- Rails

- Recent IPOs

- Semiconductors

- Traditional Retail

- Video Games

We identify the constituent companies and key metrics for a given industry. Our team of analysts then dive deep into the company reports to collect the key company reported data.

Canalyst Dashboards package all of the key metrics, together with clean fundamental valuation, growth, margin, and liquidity metrics into one place so that you can focus on your analysis. Switch to the Charts Tab at the bottom of a dashboard to get a visual presentation of key data across tickers:

Access all of our Dashboards directly from the portal here.

Not yet a Canalyst client? To increase your edge by identifying trends ahead of the rest, request a demo of Canalyst Dashboards today.

Series C Funding

Last week marked a major milestone for Canalyst. We announced a $70M Series C growth round, led by Dragoneer, which included CPP Investments, Alta Fox Capital, and Highsage Ventures.

We are very excited about what this means for both supporting our clients’ business goals and enabling us to be a trusted partner for more investment professionals across the world. In the coming quarters, our plans for growth include:

- Expanded global coverage: growing to 6,000 global names

- Global IPO, new issue, and SPAC models

- New, flexible ways to access data in Excel & Python, enabling custom analysis and seamless integration with your existing workflow

- More Canalyst content, including best-in-class valuation content

- More licensed content, including market data and consensus estimates

- Market-leading Python and data science support with our new Candas data science library

For more on how we got here and why this brings us one step closer to becoming the next major financial data platform, check out our Twitter thread here.

Hiring: We’re doubling our team!

Send us your rock stars

With plans to double our team in the next year between our Vancouver and New York City offices, we’re looking for the best and brightest talent. We invest in each employee by providing the support, resources, and opportunities to succeed and learn. Join a championship team, each of us with an integral role in building and running a successful capital markets fintech company that hundreds of firms globally rely on to drive efficiency and ground their financial analysis on sound fundamental data.

There are a number of open roles at Canalyst, so if you know someone who would be a strong fit, please send them our way! Current open positions include:

- Head of Equities

- Equity Research Analyst

- Talent Acquisition Partner

- Software Engineer – C#/.Net

- Software Engineer – Web Technologies

- Engineering – Technical Lead

- Director, Demand Generation

- Director, Information Security

- VP, Human Resources

- Account Executive

- Client Success Manager

- Client Support Associate

- Senior Accountant Financial Ops