Disruption in Mortgage Finance, M&A Made Easier, and Invest Like the Best

Will Pandemic-Driven Growth Last for Mortgage Finance?

As COVID-19 related lockdowns began, companies transitioned to work from home (WFH), schools transitioned their classes online and many families fled cities. Historically, demand has been high for condos located in major urban centers due to their proximity to offices, transportation, and shopping. But in 2020, this long-term trend reversed, as people both feared the risks associated with high density buildings and were no longer constrained by proximity to work.

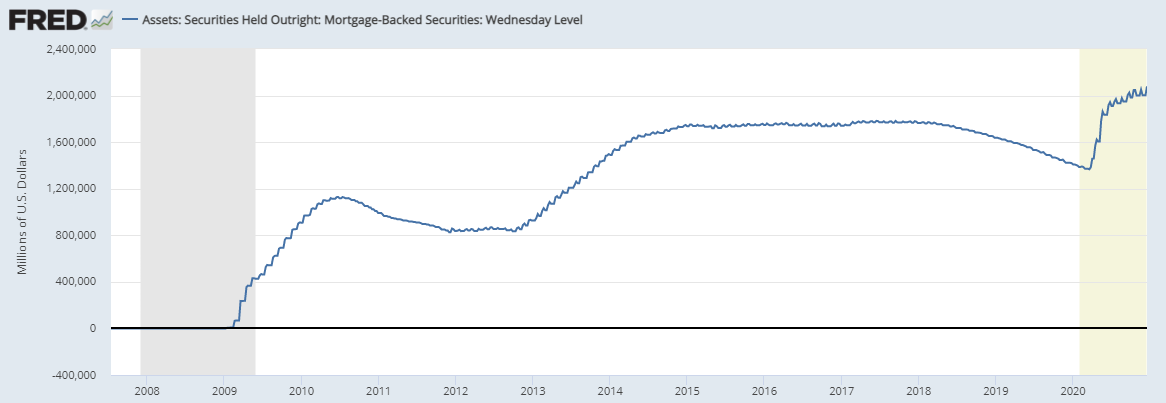

Despite the massive jump in unemployment due to pandemic restrictions, demand stayed robust in the housing market. Demand was fueled by the Fed’s emergency rate-cut and unprecedented support which resulted in mortgage rates touching an all time low. This move created a huge opportunity for both first-time home buyers as well as owners who want to refinance thanks to a massive drop in the cost of borrowing.

Above: The Fed has bought around $1 Trillion of mortgage bonds since March

Source: Board of Governors of the Federal Reserve System (US)

While there was plenty of talk about how this WFH/low-interest environment was beneficial for growth stocks — and particularly for the tech sector — at least one cyclical sub-sector was also poised to benefit. Suddenly, mortgage lenders had a unique opportunity.

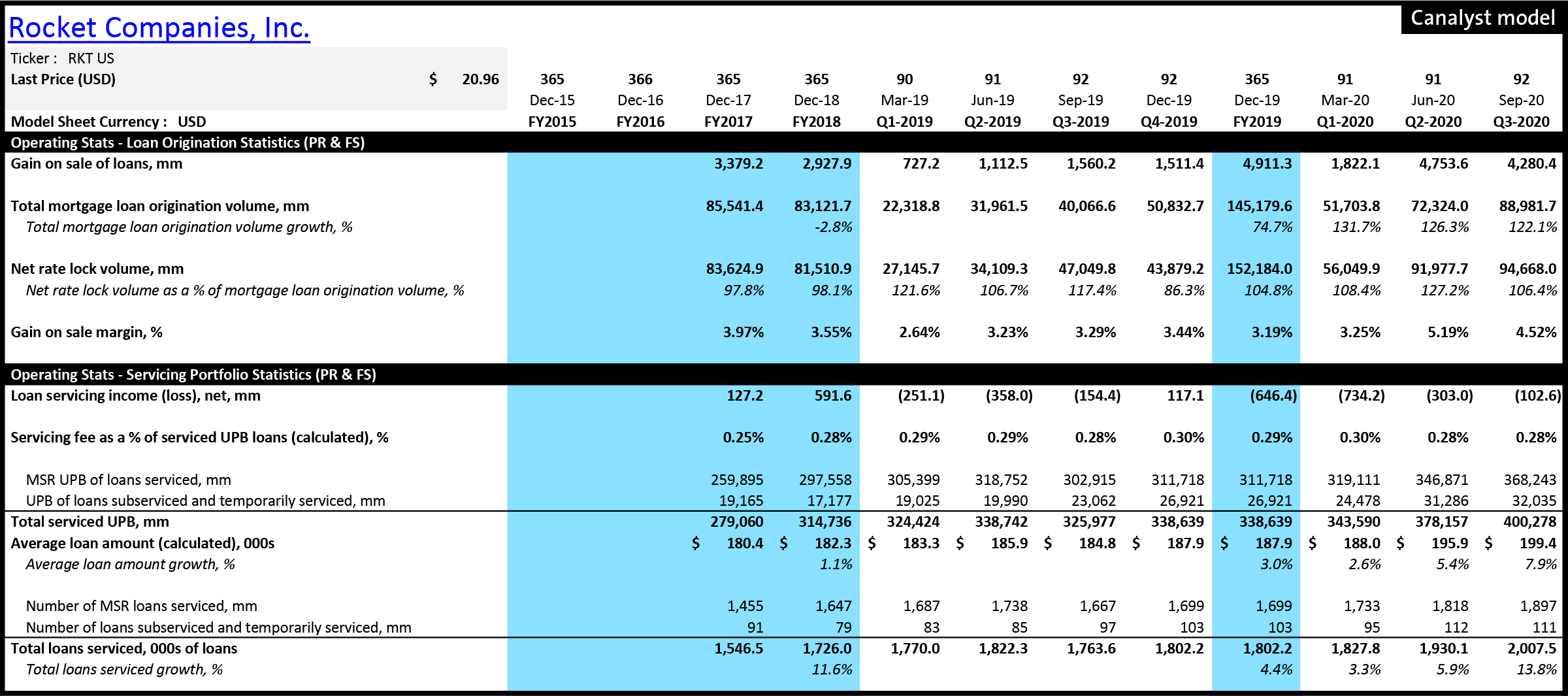

Mortgage lender’s revenue comes from several sources. First, the gain on sale of loans is usually a principal source of revenue which represents the premium a firm receives in excess of the loan principal and certain other fees. Second, upon the sale of mortgages, a mortgage originator might retain servicing rights and as a result, earn revenue which is typically called loan servicing income. Third, while mortgages are still on the books of a mortgage originator, it earns corresponding interest income and interest expense associated with funding cost.

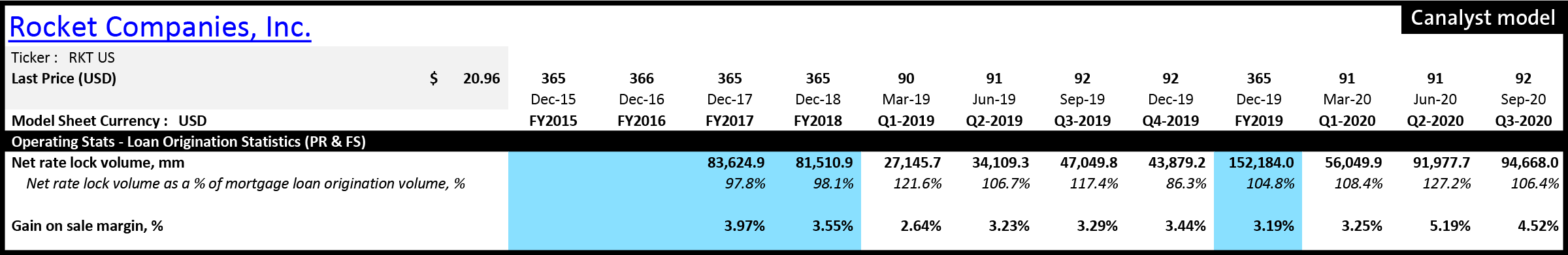

The low-interest-rate environment in 2020 led to a refinancing wave which had a significant impact on all streams of revenue. According to recent MBA research, even though purchase application volume continues to be higher than average over the past decade; the refinancing share of mortgage activity still represents ~70% of total applications. This impacts the gain on sale of loans revenue line in several ways. The most obvious impact is that the increase in origination volume leads to a higher volume of loans being sold in the secondary markets. However, there is downward pressure coming from price competition. Mortgage lenders are trying to capture/retain as much of the market share as possible by offering lower rates than their competitors. Even though revenue may have increased in absolute terms and the margin has increased meaningfully y/y, we can see quite a bit of contraction in the gain on sale of loans margin in Q3 due to fierce competition in the sector. An example is Rocket Companies Inc., which has experienced a decline in its gain on sale margin in Q3 2020 compared to Q2 2020 (4.52% vs 5.19%).

The low-interest-rate environment also impacts other parts of a business. If a company retains mortgage servicing rights they are recognized as a derivative asset on a balance sheet which represents net future cash flows related to service. Change in the fair value of those derivatives due to market interest rate impacts the revenue line along with realized cash flows from servicing. The resulting consolidated number is likely to be negatively impacted by current events since in a low-interest-rate environment fair value of mortgage servicing rights (MSRs) is going down due to prepayments and a decrease in the estimated life of existing cash flows. Lastly, net interest income can go either way depending on terms with the warehouse lender and a mortgage rate charged to the consumer.

Still, understanding market conditions does not give us a complete framework to value a mortgage lending business. The mortgage industry is highly regulated (particularly since the 2008 financial crisis), which poses some challenges with valuation. State regulators require mortgage lenders to maintain minimum net worth and capital requirements. Specifically, tangible equity to total assets should be greater than 6% and a company is to maintain certain net worth and liquidity as a function of its UPB. Failure to comply may lead to suspension or termination of a firm’s origination and servicing activities.

In January of 2020, the FHFA proposed more stringent minimum net worth requirements of 35 bps of UPB for Ginnie Mae Servicing (compared to 25 bps previously). Minimum liquidity requirements were also proposed; the base liquidity requirement of enterprise servicing UPB could go from 3.5 bps to 4 bps. However, by June of 2020, FHFA re-proposed the minimum financial eligibility requirements for single-family sellers/servicers due to recent market events, much to companies’ relief. Effectively, required equity ratios temper growth, impact reinvestment decisions, and set a ceiling on the mortgage lenders potential risk profile. All this regulatory uncertainty affects a firm’s ability to return capital to shareholders such as dividends and share buybacks, ultimately influencing valuation models.

ONE OF THE BIGGEST IPOS OF THE YEAR: ROCKET COMPANIES

Rocket Companies, Inc. (NYSE: RKT) debuted with an IPO price of $18 per share on August 6, 2020. The company operates through two segments: direct to consumer and their partner network. Clients are served by the Rocket Mortgage app and/or mortgage bankers in the direct to consumer segment that generated 71% of revenue in Q3 2020. The partner network segment is powered by the Rocket Pro platform for both marketing and influencer partnerships.

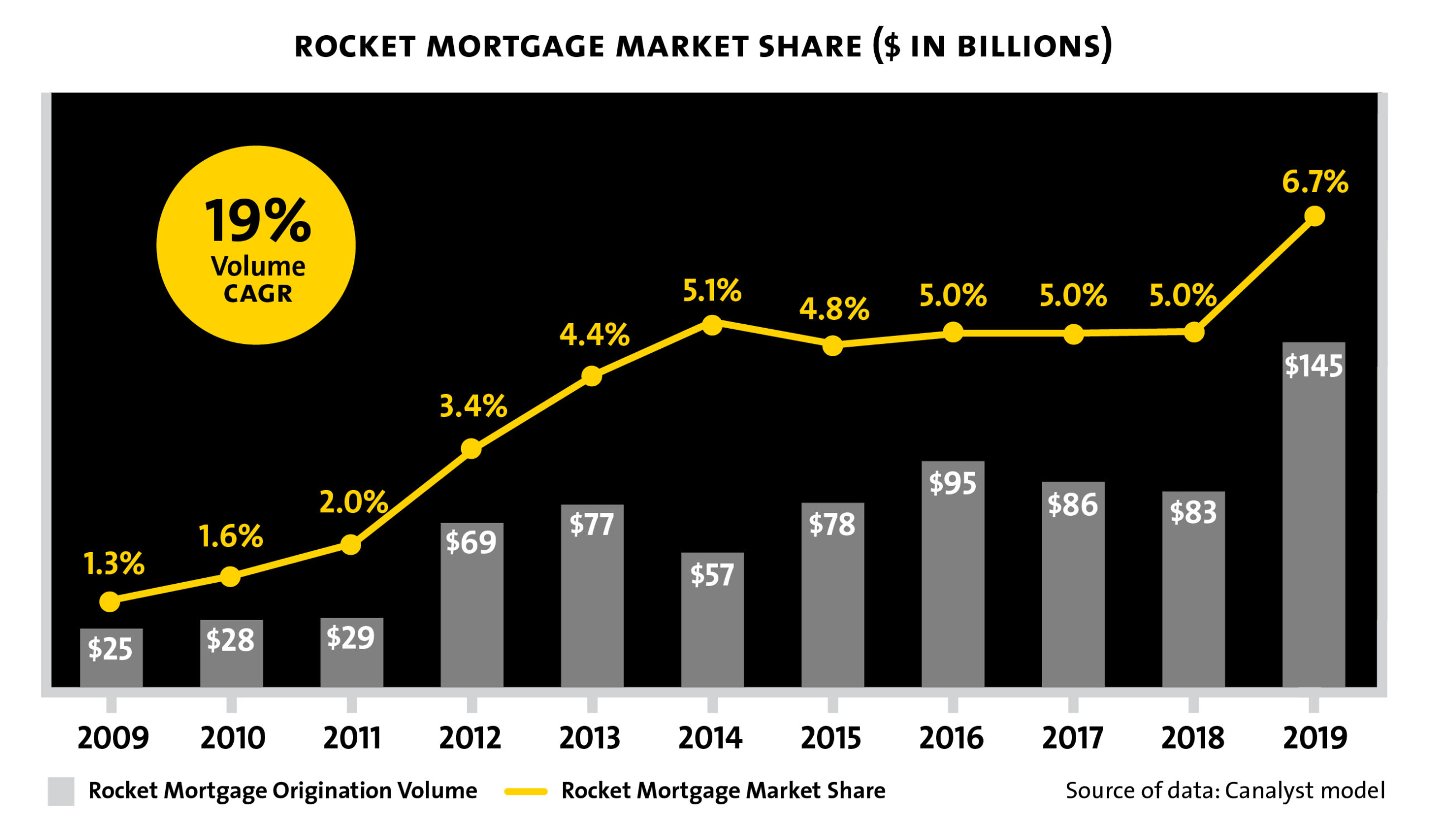

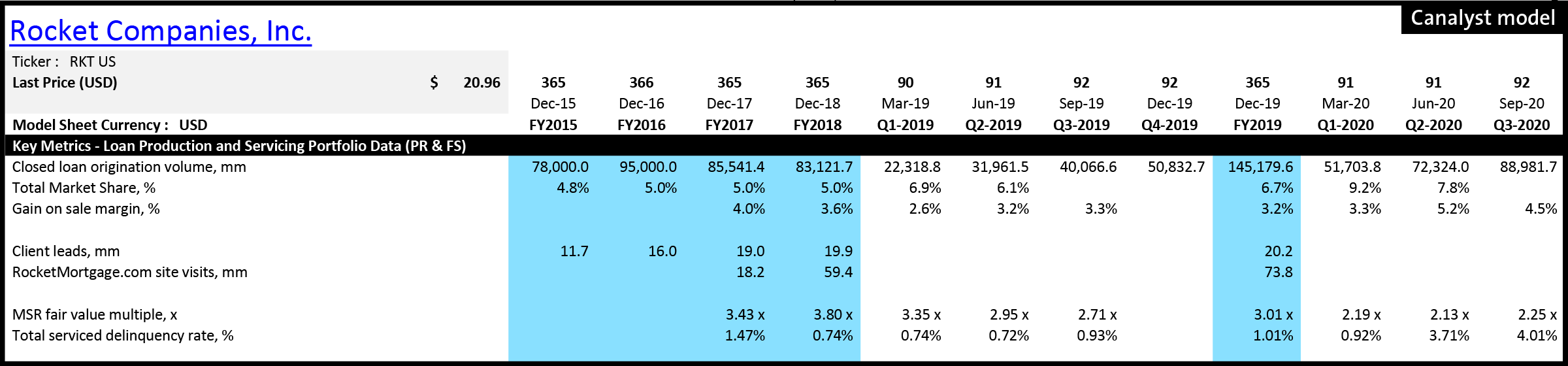

The company decided to go public amid its record breaking quarters in 2020, fueled by low interest rates, generating y/y revenue growth of 116%, 437%, and 186% in the first three quarters of the year, respectively. Being the largest retail mortgage originator in the fragmented mortgage industry is a competitive advantage for the company. RKT acquired market share over the years from 4.8% in FY2015 to 7.8% in Q2 2020. The tech-driven nature of the business with its industry-leading platform and over $500 million technology investment for the twelve months ended September 30, 2020 is another meaningful competitive advantage. The company’s loan application process is more efficient than the rest of the industry and the loans closed per production team member at RKT is 2.9x the industry average in 2019.

KPIs such as closed loan origination volume and gain on sale margin can be used to estimate the gain on sale of loans, which is the major source of revenue (92% of total revenue in Q3 2020). Rockethomes.com’s average unique monthly visits demonstrate clients’ increasing interest in RKT’s services and the advantages of the Rocket Mortgage online platform, which leverages data and technology to improve efficiency and scalability. Client leads have grown 80% from $11.2 million in FY2014 to 20.2 million in FY2019. MSR fair market value multiple is the fair market value of the MSR asset divided by the annualized retained servicing fee and it decreases from 3.43x in FY2017 and stabilizes around 2.2x in FY2020. Total serviced MSR delinquency rate is lower than the average delinquency rate of its peers, which indicates higher loan quality.

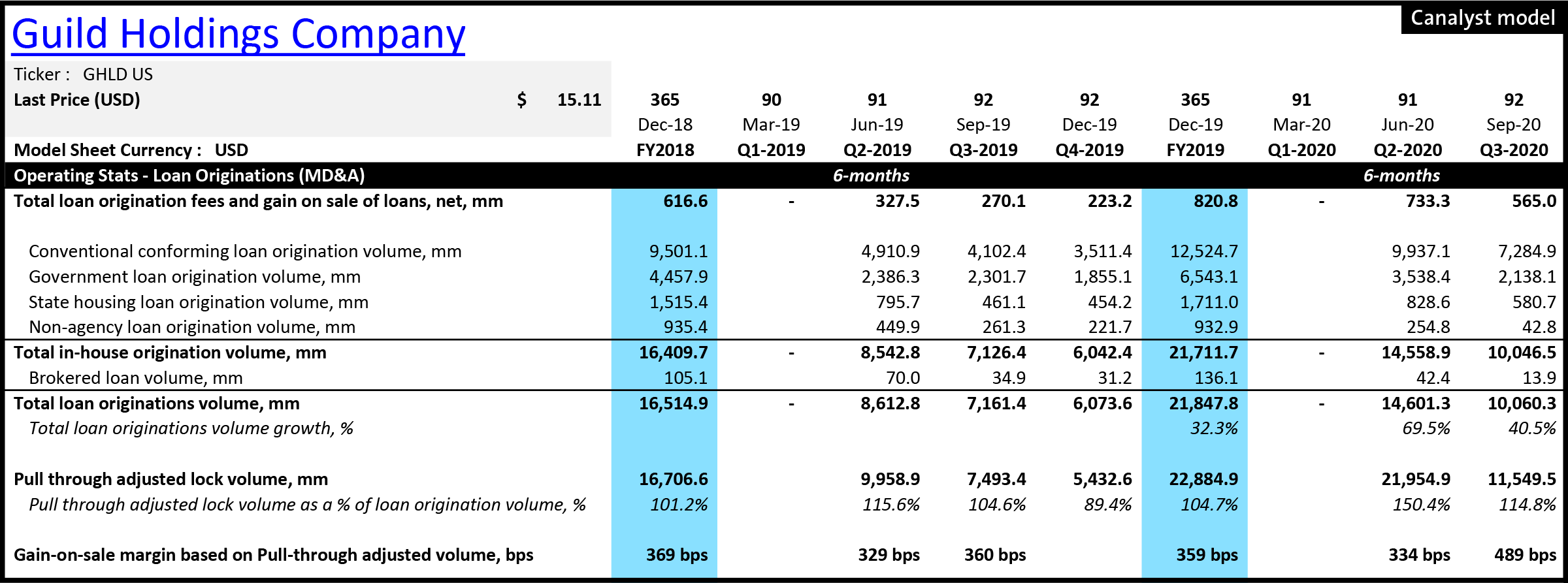

A smaller player in the industry, Guild Holdings Company (NYSE: GHLD) — with a 0.94% market share — went public on October 22, 2020. The company’s comparable KPIs also show that the top-line growth is driven by the overall trend of surging loan origination volume and widening gain on sale margin with some fluctuation in certain quarters.

Despite the pandemic housing and refinancing boom, the market’s interest in these companies appears to be below expectation. RKT initially sought to raise $3.3 billion, but then it was cut almost by half to $1.8 billion. GHLD decreased its IPO size from $8.5 million shares at $17-$19 per share to $6.5 million shares at $15 per share due to lack of demand. Investors are less excited and/or optimistic about the residential mortgage industry despite the current favorable environment due to concerns over interest rate risk, credit risk, and whether the recent growth in the mortgage business is sustainable. Mortgage originator Caliber Home Loans, Inc. and AmeriHome, Inc. both postponed their IPOs in October because of rising market volatility (VIX at 40.28 on October 28, 2020) and surging COVID-19 cases.

A potential headwind to consider is the introduction of adverse market fees on refinanced mortgages by Fannie Mae and Freddie Mac. Effective December 1, 2020, this fee will add 0.5% of the total loan amount. For an average refinanced mortgage, we estimate a reduction in savings of about $15 per month, meaning refinancing homeowners who were previously saving $133 on their monthly payments will now save $118 per month on average. Since there’s still a net benefit from financing, we believe this will only act as a blip and won’t have a significant impact on the demand for refinancing. According to Black Knight, there are around 20 million homeowners who could save around $300 per month on their monthly mortgage payment based on today’s rates.

Mortgage lenders appear well positioned to benefit from strong macro tailwinds in 2021. However, the market’s tempered response to strong fundamentals in this sector suggest that expectations are relatively high, and that the extremely accommodative macro conditions (i.e. historically low interest rates) may not persist beyond late 2021/early 2022. Furthermore, the home purchase sentiment may be plateauing; the indicator posted its first decline after three consecutive months of increases. A resurgence of COVID-19 cases and the uncertainty of the economic recovery path might potentially hinder the ability to repeat the results of 2020 for mortgage lenders.

Drop-in Templates: M&A

Canalyst clients know we are always happy to create custom templates to integrate our models into their process. At the same time, we’re continually adding new drop-in templates to the portal. One of the most downloaded is our M&A template.

The M&A template has been designed to very quickly model in the impact of an acquisition on a Canalyst model, based on the information released in the initial transaction announcement.

Key things modeled in our M&A template:

- Transaction terms, including purchase price, split between debt/equity financing, purchase stock price, closing date, and others

- Target financials and estimates, including NTM revenue, revenue growth rates, synergy targets, one-time costs to implement synergies, and a few other of the target’s financial assumptions

- Pre and post deal metrics to see the EPS and CFPS accretion/dilution as well as the upside vs. the current stock price

- Using the information above and the acquirer’s forecast, an automatically generated pro-forma income statement, balance sheet, and cash flow

See the M&A template in action, in this video tutorial, or dive deeper into all the features and models of the Canalyst platform by requesting a demo today.

2020 Year In Review

2020 brought a lot of new things to our lives, including the advent of the Canalyst blog. While we typically write about new products, names in the news, and market moves, our latest blog post is a look back at 2020. From increasing coverage and (104!) new IPOs, to the most downloaded names and sectors of the year, read more Canalyst stats and what kept us busy in 2020 here.

A Colossus Partnership

We’re big fans of the hit podcast Invest Like the Best, and couldn’t be happier to be partnering with them again in 2021. Recently launching Colossus, their goal is to become the destination to learn about business building and investing. Well on their way, Patrick’s latest conversation with Ram Parameswaran is excellent. Listen to the end for an interview with Canalyst client Drew Wilson of Fenimore Asset Management.

___

James Rife,

Head of Equities at Canalyst

Prior to founding Canalyst, James had 10 years’ experience in equity research and portfolio management. He started his career in equity research with Fidelity Canada’s investment team, covering sectors including Utilities, Forestry, Technology, and Energy from 2006 to 2010. After Fidelity, he took a role as Portfolio Manager at a Boston-based $1B long/short fund, rounding out his experience across most other sectors in the process.

James holds a Bachelor of Commerce from the University of British Columbia, is a recipient of a Leslie Wong Fellowship from UBC’s Portfolio Management Foundation, and is a CFA Charterholder.