Healthcare highlights, IPOs, and new NPV and Ratios Tabs

Healthcare Highlights

As the world anticipates a COVID-19 vaccine, and adjusts to new realities in healthcare in the meantime, some investors find themselves reluctant to broaden their exposure to the sector. Yet, healthcare remains central to our economy and healthcare innovation will determine well-being and wealth during — and after — the pandemic. To help cut through the noise, we highlight some key areas in healthcare and ask: what is working, what isn’t, and what should we do next?

BIOPHARMA & THE NPV TAB

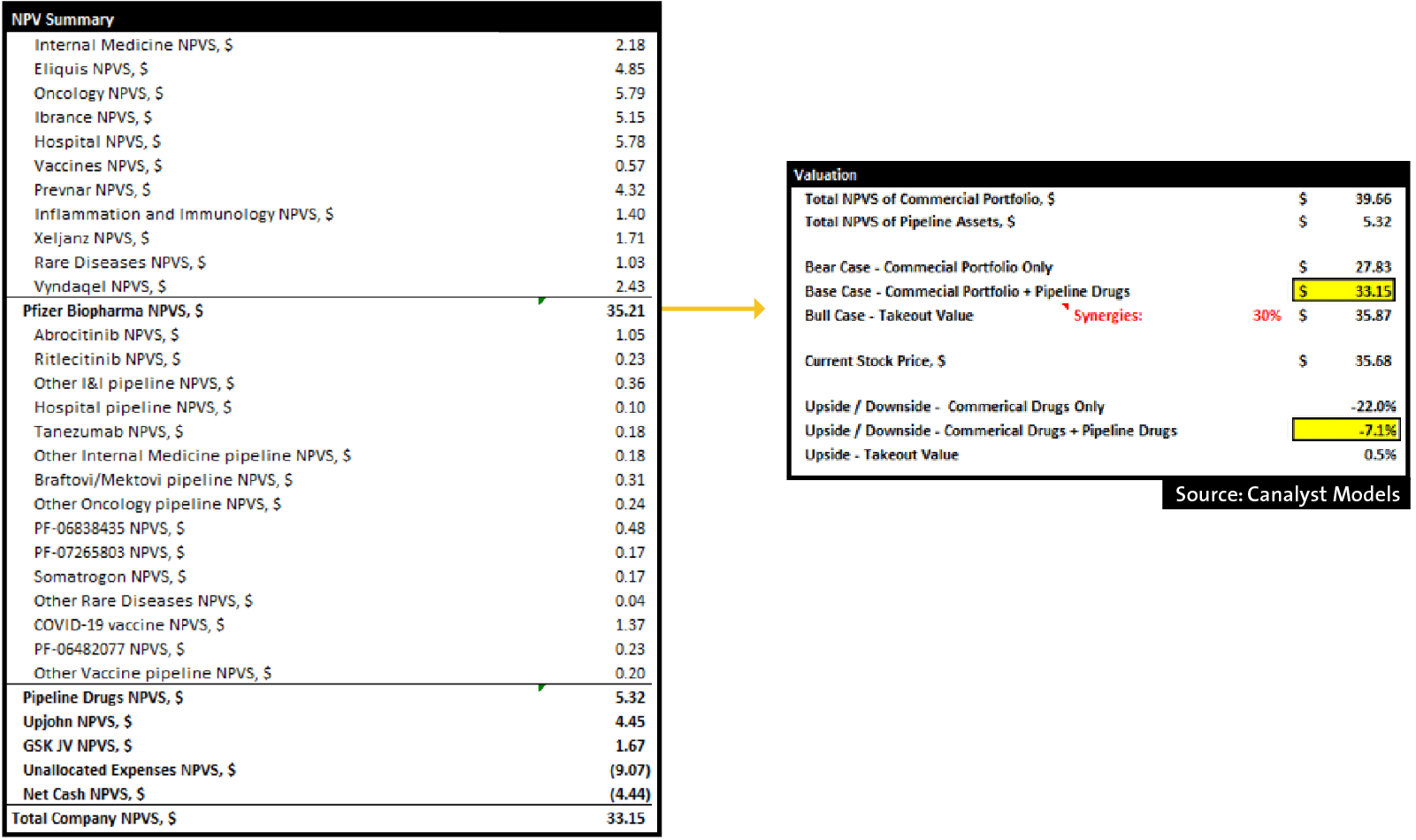

In the biopharma world, the progress of COVID-19 treatment options has been dominating the headlines. However, there are still unknowns around the virus that make it difficult to forecast revenue streams for vaccine producers – will this be a seasonal thing (like the flu)? Or will it mutate? If it stays, how will the pricing evolve? For big pharma, COVID-19 sales are likely to be marginal and the focus will continue to be on companies’ pipeline assets and their ability to substitute expiring drugs with innovative alternatives. This rings true for Pfizer Inc. [NYSE: PFE], which has undergone numerous changes to focus on its biopharma division. As such, good news surrounding its pipeline candidates may eventually rerate this stock’s multiple, which has historically traded at a discount to other biopharma, with current 11x NTM P/E vs. industry median of 14x.

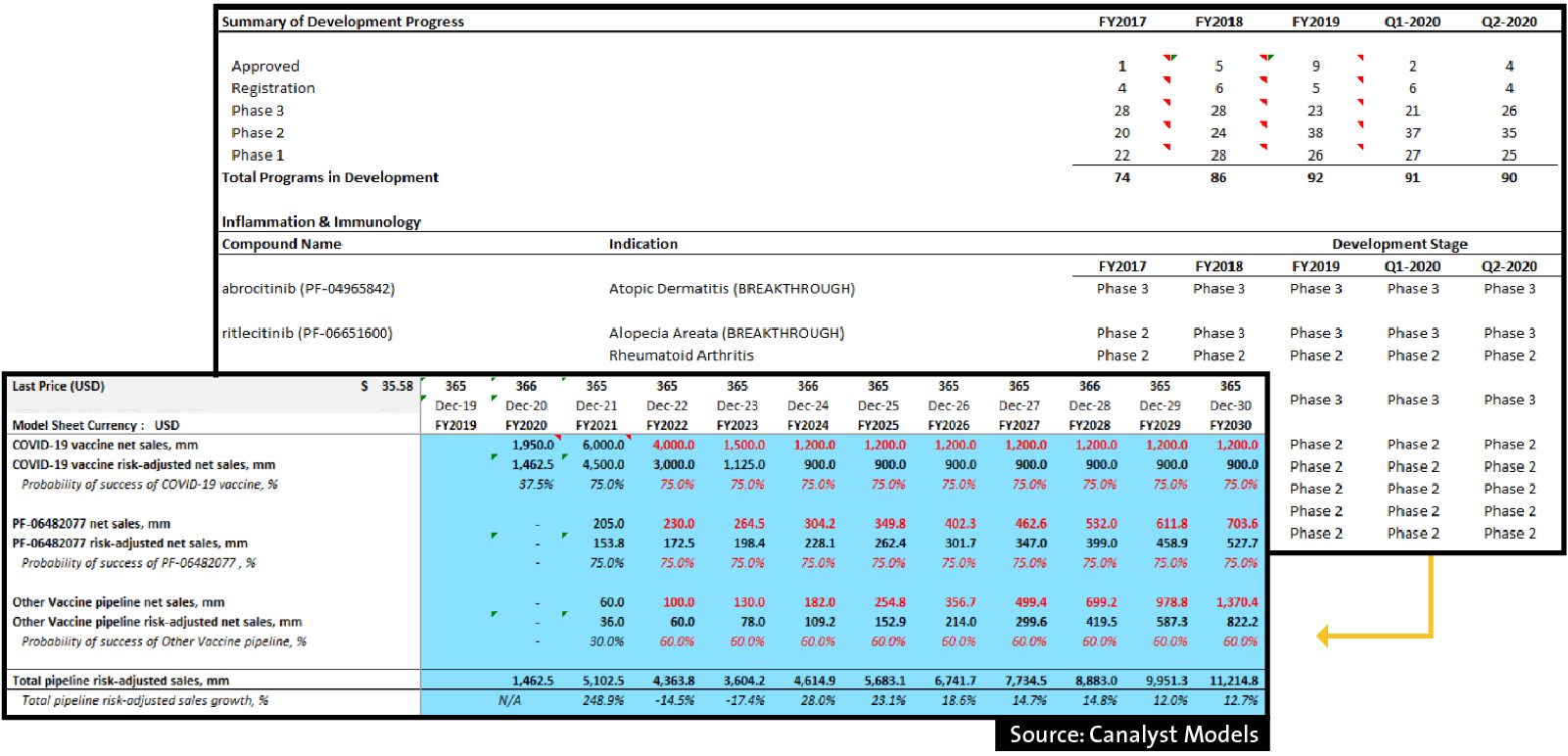

Pfizer separated its consumer business in 2019 and is on track to separate its legacy drug business Upjohn. The company has been in the process of restructuring its R&D group since 2010, reducing research areas from 13 to 5, increasing focus on biologics – away from chemistry. This high-risk-high-reward strategy has been paying off, as the company now has more later-stage pipeline candidates and its success rate of Phase 2 drugs is up from 17% to 53% on a 3-year average basis (2017 vs. 2020). Management believes that the current pipeline can deliver $15B in non-risk adjusted sales in FY2025 and peak sales of $35-40B. (Sept. 16, 2020 JPM Conference).

Despite the announced divestitures and R&D progress, there remains a material disconnect between management’s outlook and that of the Street. While, Albert Bourla, Pfizer’s CEO, thinks that analysts are not modeling all the pipeline assets, the “big” disconnect stems from the Street not assigning value to major vaccines, rare diseases, gene therapy pipeline drugs, many of which are in late stages of development (JPMorgan US All-Stars Conference on September 16, 2020).

Canalyst shares the view that a pharma company should be valued on a granular level and, as such, strong emphasis has been placed on investors’ ability to integrate all those potentially missed possibilities into our models:

1) The comprehensive pipeline tab allows us to zero in on the late stage drugs quickly.

2) Pipeline drugs can be easily integrated into valuation analysis on a risk-adjusted basis.

3) The NPV tab allows for in-depth analysis on a drug-by-drug and segment-by-segment basis (COGS variation, S&M spend can all be drug-specific).

-Yelena Marenych, Equity Research Analyst at Canalyst (Pharmaceuticals & Biotechnology)

TELEHEALTH & TELEMEDECINE

The COVID-19 pandemic has accelerated the adoption of telehealth and telemedicine to cope with rising demand from first-time users and patients with existing conditions. While telehealth is used interchangeably with telemedicine, it is important to differentiate between the two. Telemedicine is often referring to remote clinical services such as diagnostic and monitoring, while telehealth includes preventative and curative care delivery.

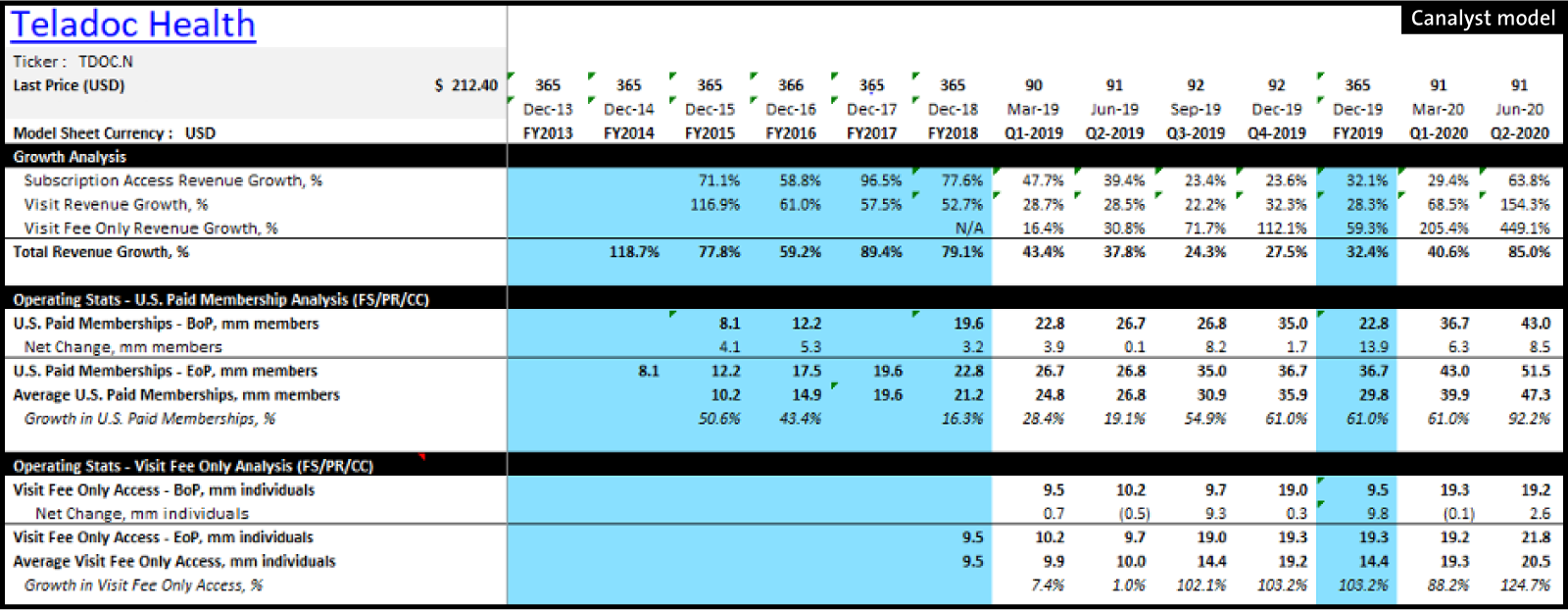

Teladoc Health [NYSE: TDOC] provides virtual healthcare services that address the supply and demand gap that exists between patients and doctors. Its telehealth offering includes emergency health visits, chronic disease management, and psychiatric and behavioural health via several platforms: Teladoc, Advance Medical, Best Doctor, BetterHelp, and HealthiestYou.

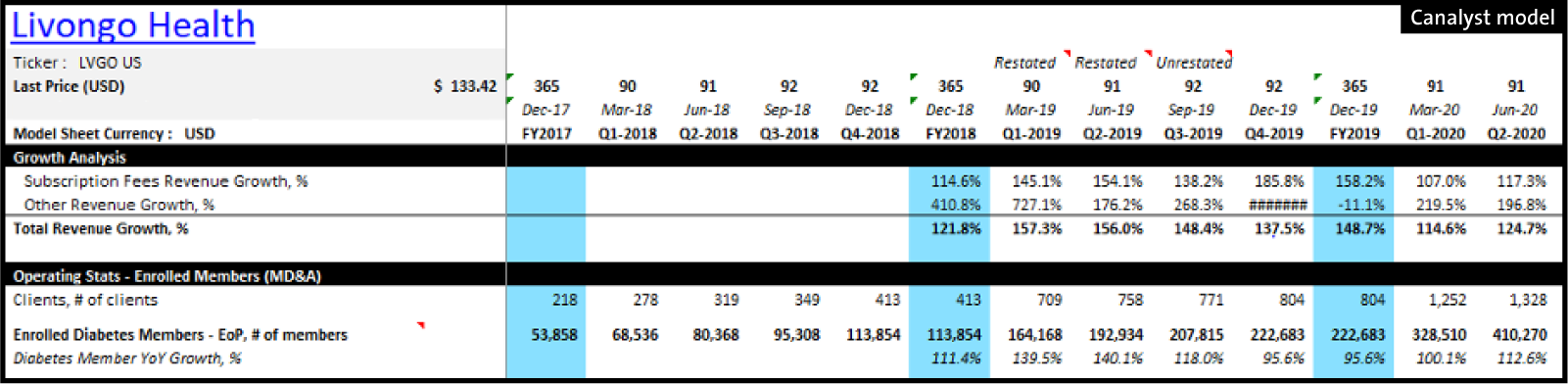

In August 2020, the Company announced its intention to acquire Livongo Health for ~$18.5B with a clear goal in mind – expanding its services and solutions portfolio.

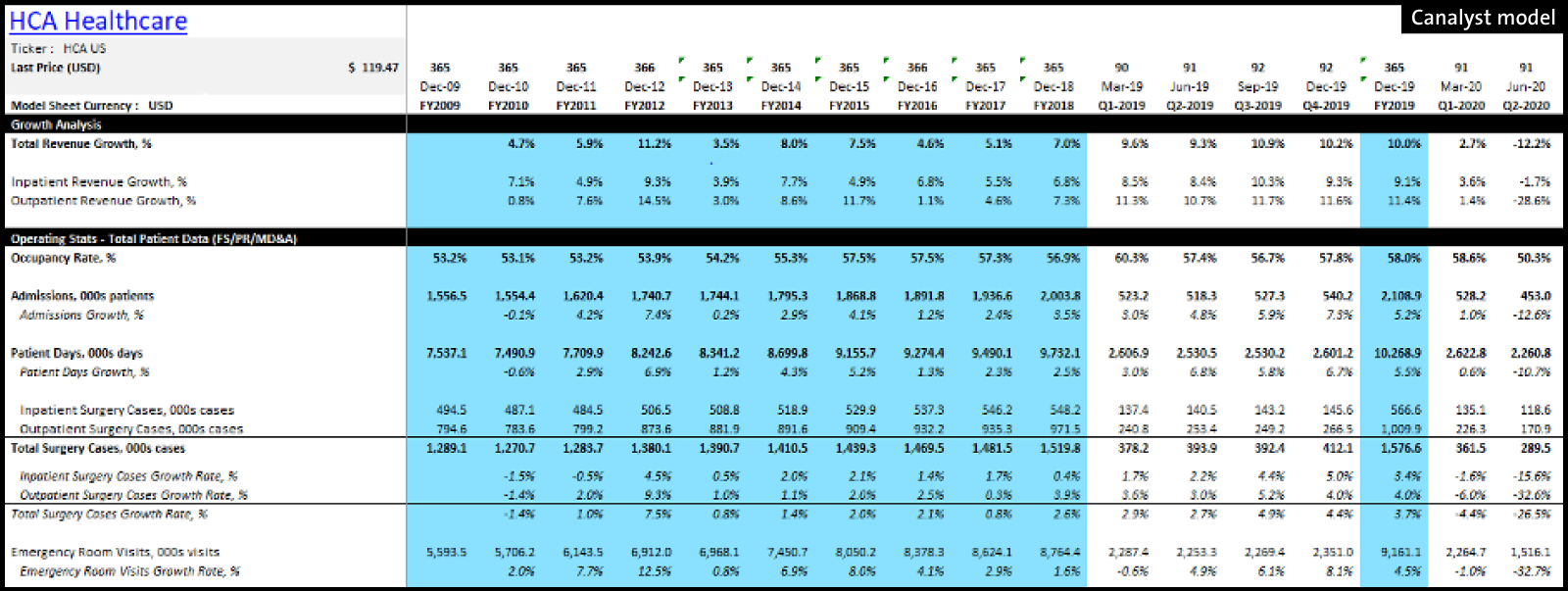

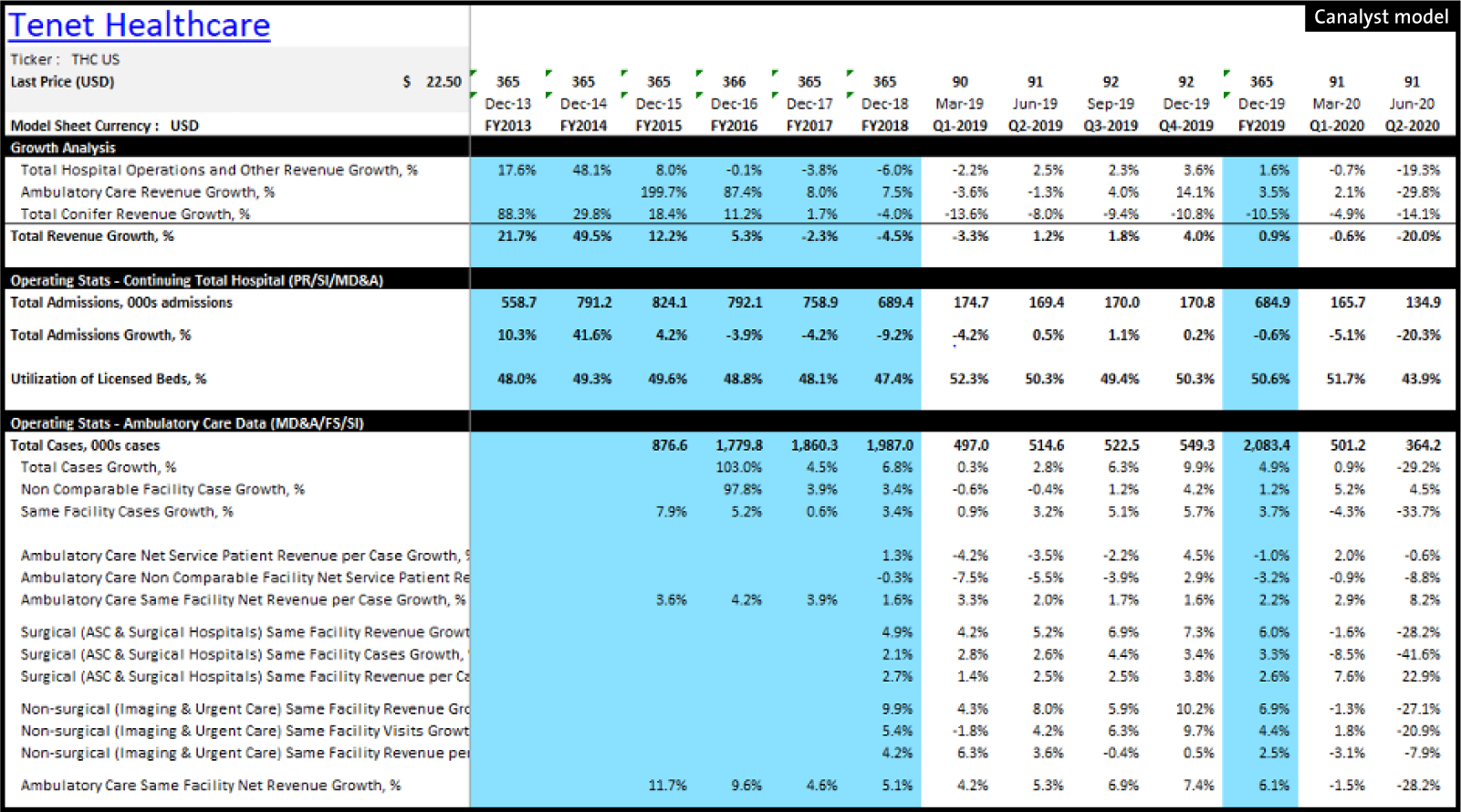

Because of shelter-in-place orders and deferral of non-essential services, hospitals and surgical centers were among the worst performing subgroups of healthcare. A quick look at key metrics – occupation rate, admissions, patient days, surgical cases and emergency visits – of HCA Healthcare [NYSE: HCA] and Tenet Healthcare [NYSE: THC] reveals the damages caused by the pandemic.

MEDICAL DEVICES & EQUIPMENT

Without question, COVID-19 has presented some of the most unique and devastating challenges to businesses across all sectors of the economy. This is especially true for those within the medical devices and equipment space. To understand the impact, we must first examine the effect of COVID-19 on their customers: hospitals and healthcare systems.

To respond to the jump in COVID-19 hospitalizations, The Centers for Medicare & Medicaid Services (CMS) recommended on March 18, 2020 that hospitals across the US postpone elective procedures to maximize available bed space and conserve personal protective equipment (PPE) and ventilators. Although the word ‘elective’ would seem to imply ‘optional’, most elective procedures are vital preventative measures, such as a colonoscopy or essential surgery such as cataract removal (Dai et al.). While this pause was clearly necessary, elective procedures represent a large portion of the profitability of hospitals. US claims data analyzed by Bellemare suggested that during the 6 weeks starting March 15, 2020, 329,000 patients likely deferred procedures in the field of urinary surgery alone. The same study suggested that during the month of May, elective surgeries in general were being performed between 75-82% less on a YoY basis (Morris). This reduction, along with the extra costs of treating COVID-19 patients, such as higher PPE needs and longer hospital stays, put a huge strain on hospital systems. The American Hospital Association (AHA) estimated the pandemic’s cost to US hospitals and health systems at $202.6B between March 1 and June 30 with the reduction in revenue alone representing a decline of $161.4B (Hospitals).

While CMS is now encouraging patients to return to medical facilities to receive care, the fear of a second wave, along with the reluctance of patients to go back to hospitals, make the full return of elective procedures to pre-pandemic levels a while away. GlobalData projects surgery volumes to reach 75% of 2019 levels by the end of Q3 2020 and expects hospitals to reach pre-COVID levels by the end of 2020 with a surge expected in early 2021 to catch up with missed procedures, but they acknowledge, however, that a second wave or various state and federal guidelines may impact those estimates (Timeline).

Since elective surgeries make use of associated medical devices and equipment, the direct link to the significantly negative impact on medical device companies, their suppliers, vendors, manufacturing facilities and distributors is unsurprising.

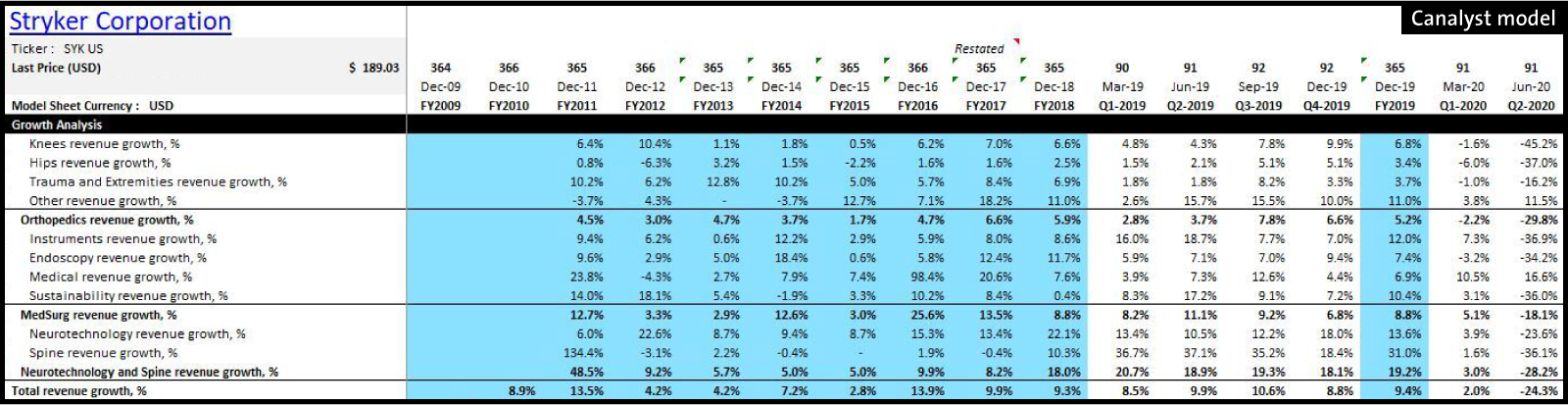

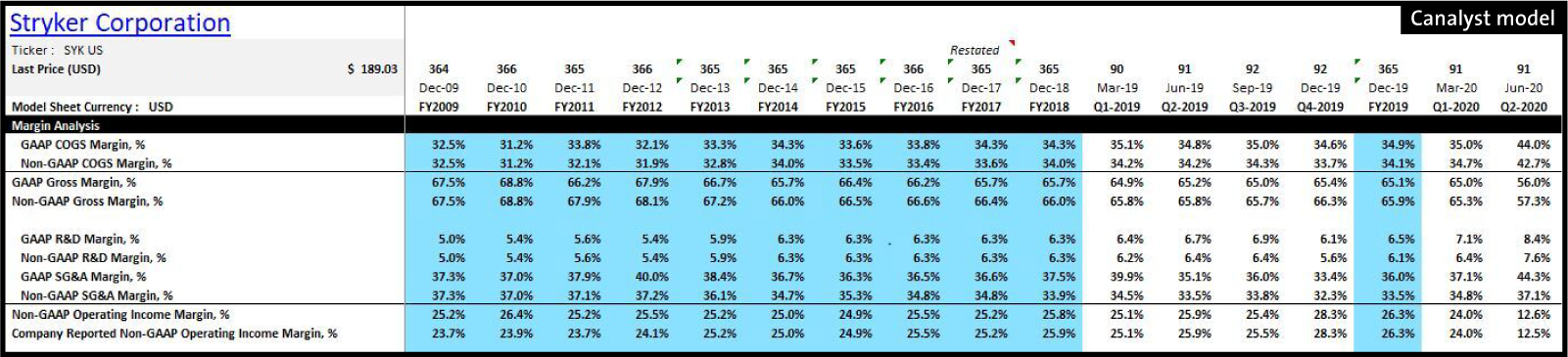

Stryker Corporation [NYSE: SYK] saw a material decline in many products that were sensitive to reductions in deferrable medical procedures, but were able to slightly counteract this impact by selling PPE and hospital beds which were experiencing increased demand (Lobo). Stryker VP Preston Wells admitted in their second quarter conference call that 40-50% of their total revenue involves procedures that can be deferred, with the primary culprits being the knees, extremities, spine, sports medicine, and their ENT business lines (Lobo et al.). As a result, monthly sales growth for Stryker was -36%, -24%, and -10% for April, May, and June respectively, resulting in unsurprising margin contraction. Elective procedures associated with Stryker products recovered to 85-90% of pre-COVID levels in the US, China, and Germany, with the UK, India, and Latin America lagging at around 50% by the end of Q2 (Lobo). Stryker is on track to resume revenue growth during the second half of 2020.

Healthcare IPOs

The healthcare IPO market remained relatively quiet for the most part in 2020, as companies (and investors) tried to gauge the impact from the COVID-19 “black swan” event. For those that decided to make a market debut, everything seemed to go as smoothly as they could have hoped. Here is a summary of a few names that caught our attention.

1Life Healthcare [NASDAQ: ONEM] provides primary care services via a membership-based business model. More than 475,000 members have 24/7 access to the Company’s digital platform, as well as in-office care covered under health insurance programs in 11 states. As of Q2 2020, the Company recorded ~$300M in revenue and ~$100M in negative free cash flow on a last 12-month basis. 1Life Healthcare is headquartered in San Francisco, CA and is valued at ~$3B.

Oak Street Health [NYSE: OSH] and its subsidiaries own and operate 54 care centers that serve ~86,500 Medicare beneficiaries (the U.S. has 33 million Medicare beneficiaries) and help them manage their illnesses. As of Q2 2020, the Company generated ~$730M in revenue and ~$100M in negative free cash flow on a last 12-month basis. Oak Street Health is headquartered in Chicago, IL and is valued at ~$10B.

American Well [NYSE: AMWL] offers a platform that provides a variety of telehealth needs including urgent to acute and post-acute care, chronic care management and healthy living. As of Q2 2020, the Company served 150 health system clients and 55 health plan clients under the subscription model. It generated ~$122M in revenue (>80% recurring basis) and ~$60M in negative free cash flow in H1 2020. American Well is headquartered in Boston, MA and is valued at ~$6B.

GoodRx Holdings [NASDAQ: GDRX] operates a consumer-focused digital healthcare platform that helps consumers compare prices for prescription drugs. It also offers medication savings programs and medical provider consultations to consumers, as well as advertising and consumer solutions to pharmaceutical manufacturers. In Q2 2020, the Company had ~4.4M monthly active consumers and generated ~$123M and ~$76M in revenue and free cash flow respectively. GoodRx Holding is headquartered in Santa Monica, CA and is valued at ~$18B.

Did you know Canalyst builds all pre-IPO models as soon as the S1 hits? Learn more with a demo of our 4000+ equity model platform today.

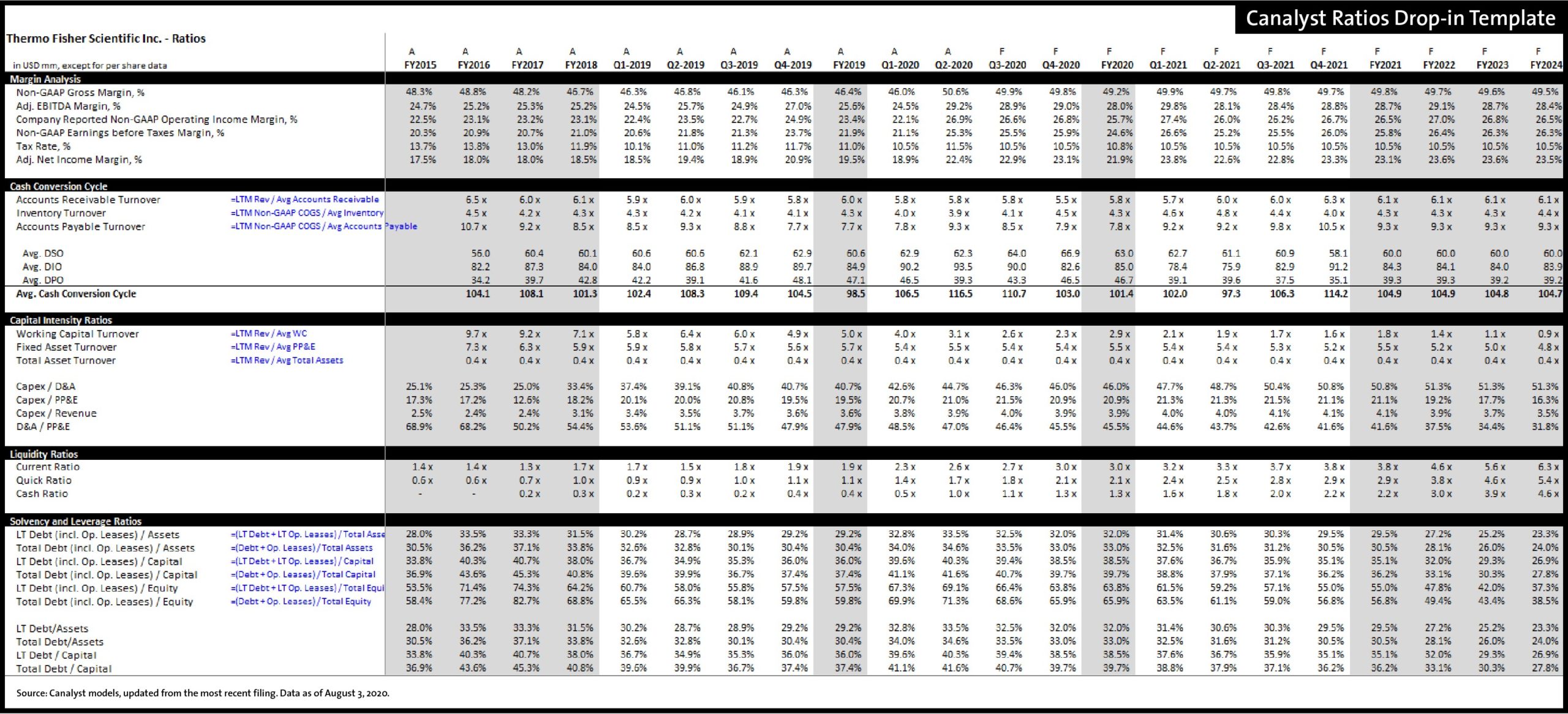

Product News: Ratios Tab

Canalyst’s newest drop-in sheet calculates all of a company’s ratios, making it easier to compare companies across the same sector. The tab includes key activity, liquidity, solvency, profitability, and valuation ratios.

Learn more here or download it right away from your Drop In Sheet Templates folder.

Company News: We’re hiring

Join one of the best run, well financed, and fastest-growing capital market fintechs. We have openings in every department — from equity research and engineering to marketing and account management — in both our midtown Manhattan offices and our downtown Vancouver headquarters (and all the remote locations in between).

Read more about (and please share!) all the open job postings here.

___

James Rife,

Head of Equities at Canalyst

Prior to founding Canalyst, James had 10 years’ experience in equity research and portfolio management. He started his career in equity research with Fidelity Canada’s investment team, covering sectors including Utilities, Forestry, Technology, and Energy from 2006 to 2010. After Fidelity, he took a role as Portfolio Manager at a Boston-based $1B long/short fund, rounding out his experience across most other sectors in the process.

James holds a Bachelor of Commerce from the University of British Columbia, is a recipient of a Leslie Wong Fellowship from UBC’s Portfolio Management Foundation, and is a CFA Charterholder.