IPOs Galore, UBER MATE, Drivers Worksheets, and Squat O’Clock

IPOs Galore: Timing Is Everything

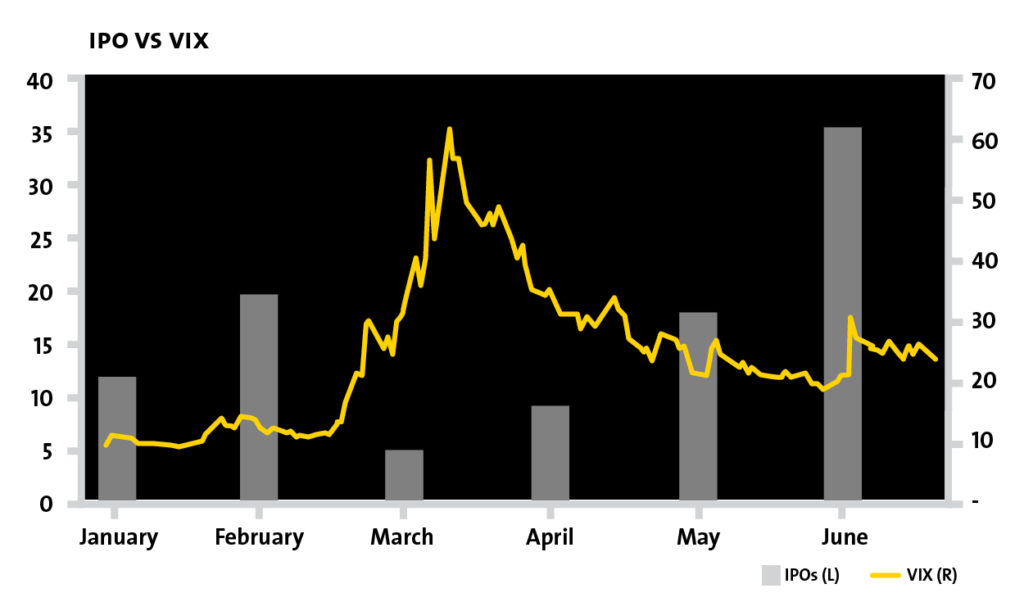

While the VIX was dropping towards 30 in May and June after significant volatility in March and April, companies rushed to take advantage of the opening window for IPOs. There were over 3 times more companies that priced IPOs listed in the US in May and June than in March and April.

Canalyst prepared models for 19 companies that filed for IPO since May 26th. Healthcare and Info Tech/Comm Services stand out as sectors where the most IPOs were filed, with Canalyst delivering 7 pre-IPO models each since late May (and counting).

Above: Number of IPOs (L) and VIX (R) in the first half of 2020

Strong Starts

Some of the businesses that were able to complete an IPO almost immediately following the VIX retreat were those that might thrive in a post-COVID economic environment. Vroom Inc. [NASDAQ: VRM], ZoomInfo Technologies Inc. [NASDAQ: ZI], and Agora Inc. [NASDAQ: API] are three such companies. All three originally filed prospectuses prior to the market volatility in late February and March, and weren’t able to finalize their IPOs until June.

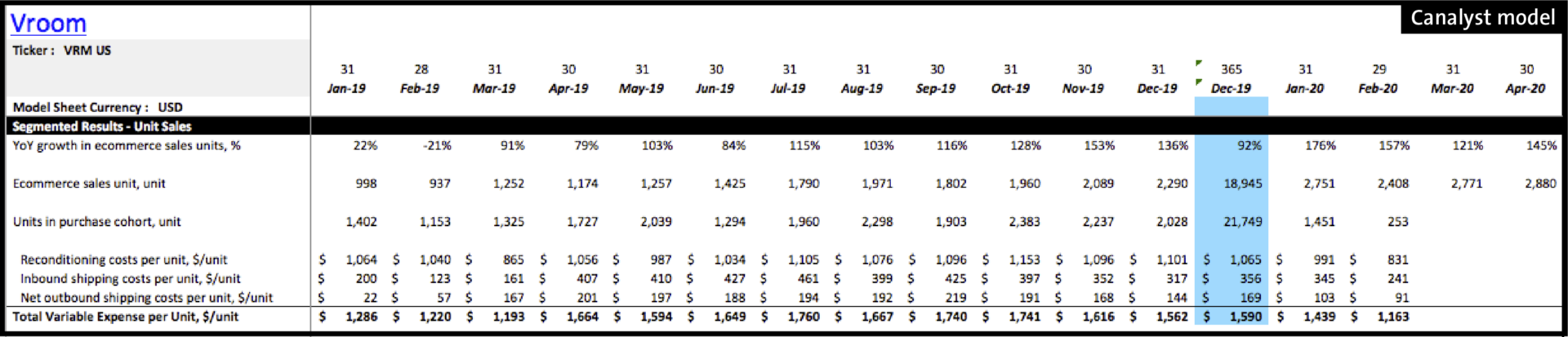

VRM

Vroom Inc. [NASDAQ: VRM], an online based used-auto retailer, has a recent history of quick growth in ecommerce unit sales. Vroom filed its draft prospectus in December but it wasn’t until June that it was able to price and sell its IPO. Supplemental monthly data provided in the prospectus shows a softening year over year growth rate in March before a pickup in April, demonstrating resistance to the slowdown.

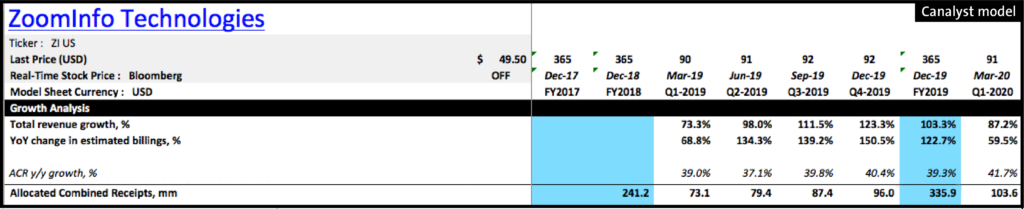

ZI

ZoomInfo Technologies Inc. [NASDAQ: ZI], a leading go-to-market intelligence platform for sales and marketing teams, originally filed back in November and also completed its IPO in June. The company showed year over year growth in Allocated Combined Receipts, a measure of organic revenue, of around 40% for each of the past 5 quarters.

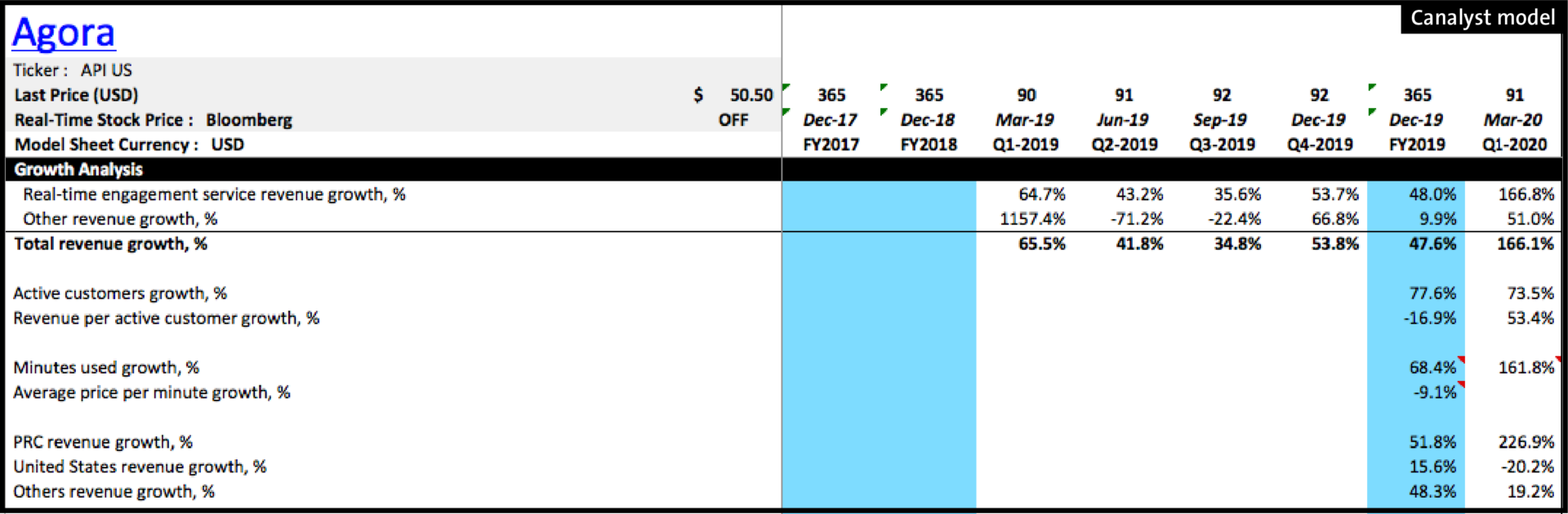

API

Agora Inc. [NASDAQ: API], a platform that enables developers to easily incorporate real time video and audio in their existing applications, filed its draft prospectus in early March and then priced in late June. It operates using a freemium model whereby developer clients are initially given free minutes to use their platform and are then billed once usage passes a certain threshold. The company showed strong growth in active clients as well as growth in minutes used of over 160% in the quarter ended March 2020. Their largest revenue source by geography, China, showed revenue growth of 227% year over year, demonstrating a large uptick in usage during that country’s COVID-19 lockdown.

With low rates and an uncertain growth environment, investors are willing to pay a premium for companies with high potential for growth. Each of these IPOs rose over 100% in their first day of trading.

Using Canalyst IPO models you can generate forecasts, check forward valuation, and formulate a good understanding of the business model. Bringing this understanding of the business to company meetings during a roadshow can help differentiate you as an analyst or PM looking to build a long-term relationship with management.

Canalyst builds our pre-IPO models off the S-1 immediately, while the sellside is still on restriction. We cover every North American name that has a projected market cap of $100M or higher, all data is sourced from prospectus and presentation slides, and our models include all segments, KPIs, and non-GAAP figures. Email notifications are sent as soon as models are available for download so our clients can get a head start on their analysis.

Learn more by requesting a demo today.

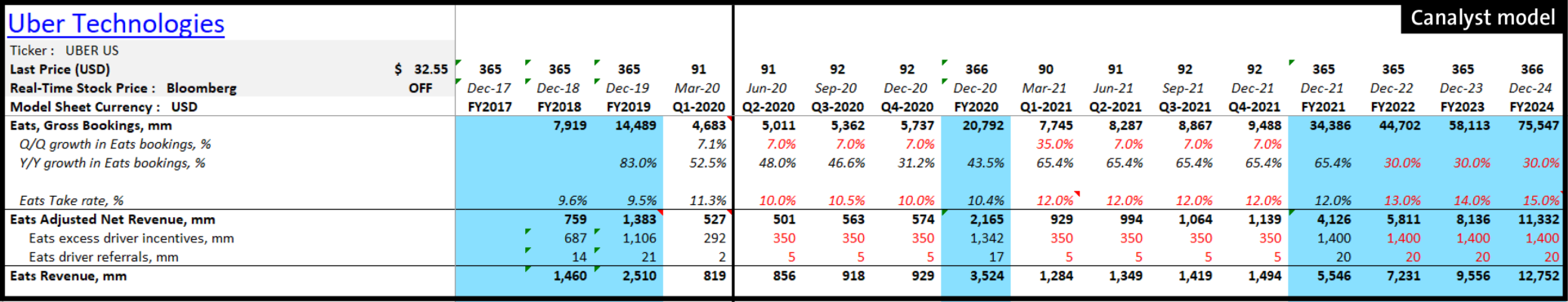

It’s UBER MATE: The IPO That Got Away

With its ride hailing businesses hit hard with the COVID-19 epidemic and down 80% on the year with no respite in sight, Uber Technologies Inc. (NYSE: UBER) needed to make a splash to placate its increasingly concerned investor base. It had a bright spot with Uber Eats picking up significant business, but with regulatory pressure and significant competition from DoorDash and Grubhub the business continued to lose oodles of cash with a staggering $313M loss on $527M in revenues during the first quarter of 2020. Smarting from an earlier failed attempt to buy Grubhub, which ended up going to Just Eat Takeaway for $7.3B on likely antitrust issues, Uber Eats was desperate to close its 16% market share gap with DoorDash at 45%.

Enter Postmates, a business that didn’t even start out as a food delivery business but as a general courier service — yet one of the first apps where you could order a burrito from Mission Taqueria or a donut from Bob’s Donuts in San Francisco in 2012. While the company reportedly pulled its IPO in late 2019 due to market conditions, COVID-19 became a boon for food delivery apps, and so 2020 seemed like a good opportunity to try again (with an apt ticker of MATE). In the end, it just made more sense to combine the two businesses in an already cut throat market rather than to continue to compete and suck up more funding in a winner-take-all food delivery industry that has had over $3B pumped into by VCs over the last 5 years.

So where does that leave Uber? With scant details known other than the $2.65B price tag in an all stock transaction, the deal does seem like a winner for Uber Eats, which saw a 100% Q2 2020 increase in bookings as the company was able to enjoy the economies of scale of the combined businesses, cross sell into Postmates’ commerce market, and lower overall customer and restaurant acquisition expenses. As Postmates is considered a more premium player, the combined companies’ Takeaway Rate should continue to climb well into the double digits from its 2019 9.5%. While Uber saved some of its precious cash in an all stock deal, don’t forget to adjust the share count by another 80M+ shares. It’s climbed more than 4x fold from 423M to over 1.7B over the last few years as the IPO, stock options, and acquisitions have continued to increase exponentially. While the deal economics remain a mystery, there are plenty of adjustments to be made in forecasting Uber’s future.

Want to get up to speed on the fundamentals of any name extremely fast? Read more about the Canalyst platform here.

Product News: Drivers Worksheets

In June we launched Drivers Worksheets for all 4000+ of our models to streamline analysis for investors who prefer to see all of the drivers in a model in one centralized place. Learn how our clients are using them for driver identification, testing assumptions, and analyzing the effects here.

Canalyst Fitness Challenge: Squat O’Clock

The Canalyst Fitness Challenge taps into our team’s love of competition, staying connected, and keeping those COVID-19 pounds away. Organized by Team FiTSE, Canalysts track their work-outs and participate in various virtual challenges, including one of our favorite thigh burning pastimes, Squat O’Clock.

—

James Rife

Canalyst, Head of Equities

Prior to founding Canalyst, James had 10 years’ experience in equity research and portfolio management. He started his career in equity research with Fidelity Canada’s investment team, covering sectors including Utilities, Forestry, Technology, and Energy from 2006 to 2010. After Fidelity, he took a role as Portfolio Manager at a Boston-based $1B long/short fund, rounding out his experience across most other sectors in the process.

James holds a Bachelor of Commerce from the University of British Columbia, is a recipient of a Leslie Wong Fellowship from UBC’s Portfolio Management Foundation, and is a CFA Charterholder.