The following is an excerpt from CB Insights Research Brief, Canadian Fintech Market Map, from November 21, 2019.

While deals and dollars slowed to Canadian startups in the first half of 2019, early-stage startup activity suggests that there’s more to the story.

On an annual basis, deals and dollars were down from previous highs. The first half of 2019 saw 240 venture rounds to Canadian startups, compared with 281 in H1’18. Total funding was also down year-over-year, hitting $1.7B in H1’19 versus $1.9B in H1’18.

At the same time, early-stage and late-stage trends paint a different picture. Seed deals accounted for a larger share of overall deals in H1’19, indicating growth among startups at earlier stages. And, at later stages, Lightspeed POS went public on the Toronto Stock Exchange in March, raising $240M and seeing its shares jump 26% on the company’s first day of trading.

Finally, looking at Canadian “fintech” (financial technology) specifically, funding was up substantially in the first half of the year. Canadian fintech companies raised $251M through the end of H1’19, nearly double the $133M raised in H1’18.

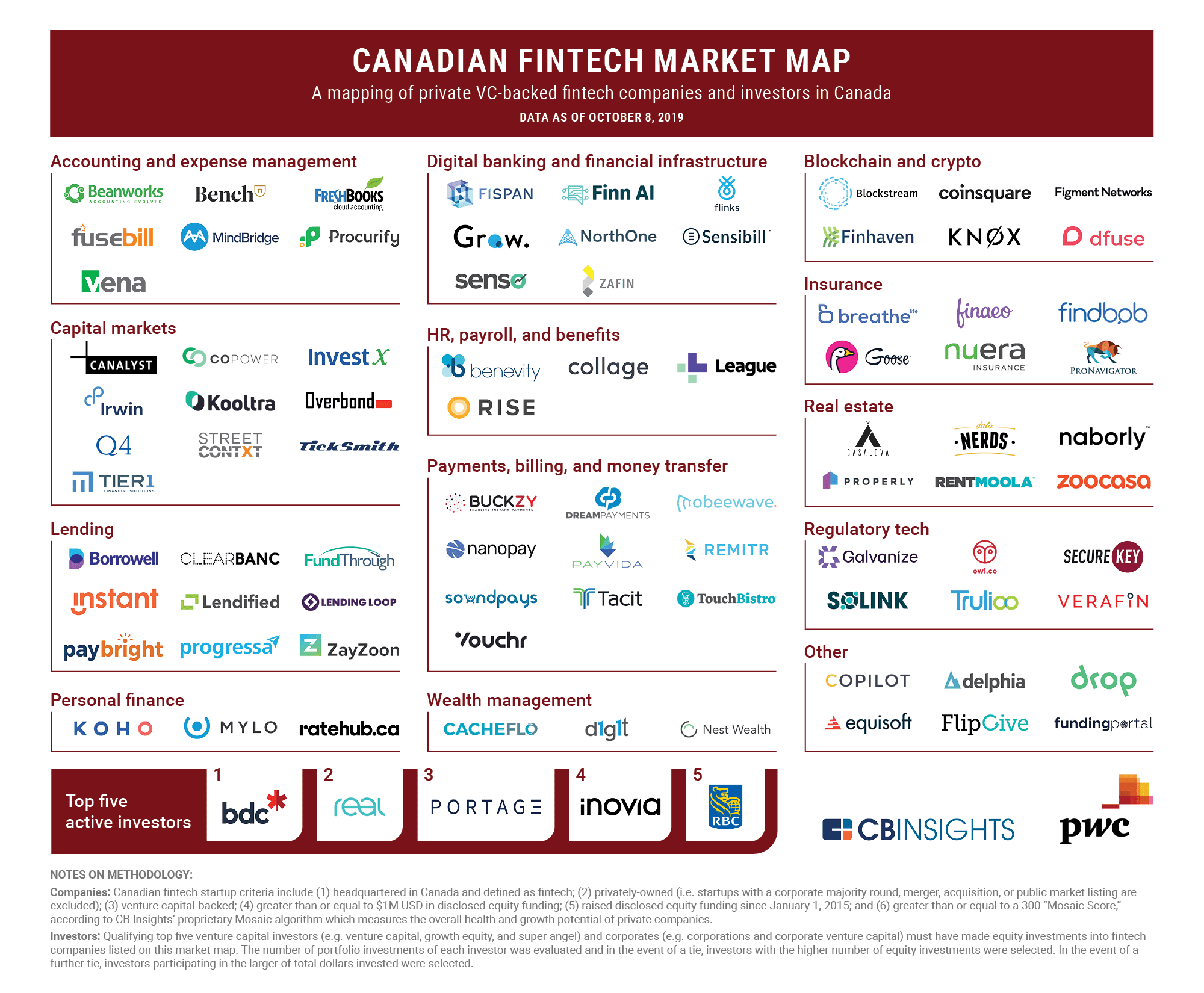

The 2019 Canadian fintech market map

The startups selected for inclusion in the market map below are all Canada-headquartered, VC-backed fintech companies that have at least US $1M in equity funding, and have obtained equity funding since the start of 2015. Included startups also have a CB Insights Mosaic score of at least 300. Mosaic is a quantitative framework that measures the overall health and growth potential of private companies.

Startups headquartered in Ontario dominate the table, with over 40 fintech companies from this market map headquartered in the Greater Toronto Area. Vancouver and Montreal come in second and third, respectively, with 25 fintech startups headquartered between the two.

We expect this cohort to evolve as new players emerge and others falter or exit.

Read the full research brief from PWC here.