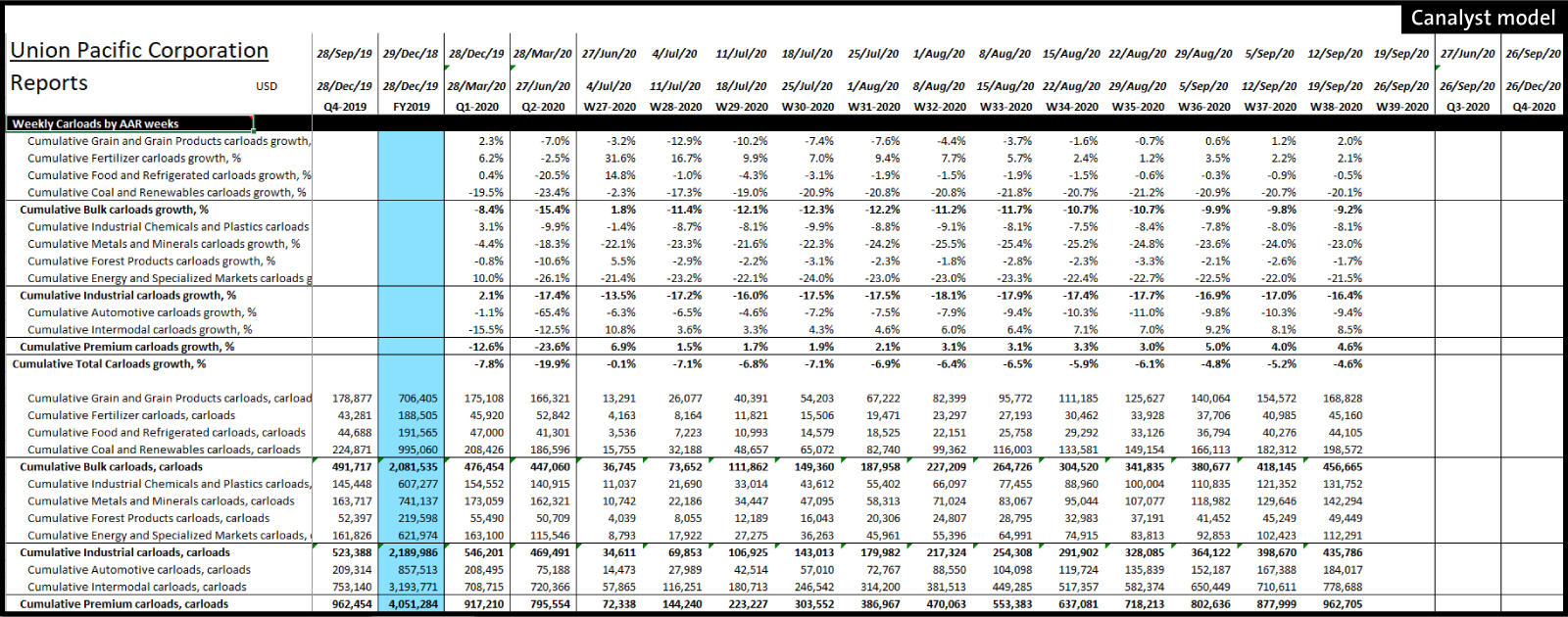

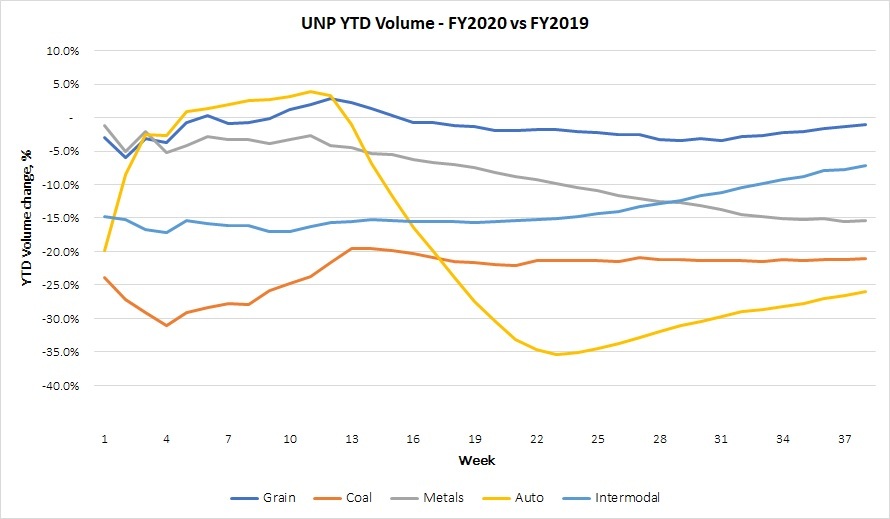

Like most railroads, Union Pacific Corp. (NYSE: UNP) has recorded modest improvement in carloads. As of the penultimate week in Q3/20, QTD total carloads are down 4.6% over Q3/19, a material improvement from the 19.9% retraction in Q2/20 over Q2/19.

The recovery has been led by intermodal carloads (up 8.5% y/y) followed by grain and grain products, and fertilizers (up 2.0% and 2.1% y/y respectively). Food and refrigerated carloads are essentially flat, down 0.5% y/y. UNP also witnessed an increase in forest product volumes at the beginning of the quarter as the price of lumber soared and demand for home improvement products rose during lockdowns. Volumes have since settled and are down 1.7% y/y.

While still down 9.4% y/y, automotive carloads have seen an impressive improvement over Q2/20 which plummeted 65.4% y/y. The company transported more automotive volumes in the first six weeks of Q3/20 than it did in all of Q2/20. Coal and Renewables, Metals and Minerals, and Energy volumes continue to remain below pre-COVID levels (down 20.1%, 23.0% and 21.5% y/y respectively).

All Canalyst railroad models have weekly volume tabs as well as a key weekly operating metrics tab with system train speeds, inventory, and through dwell for all railroads. For a closer look, request a demo of our 4000+ equity model platform today.