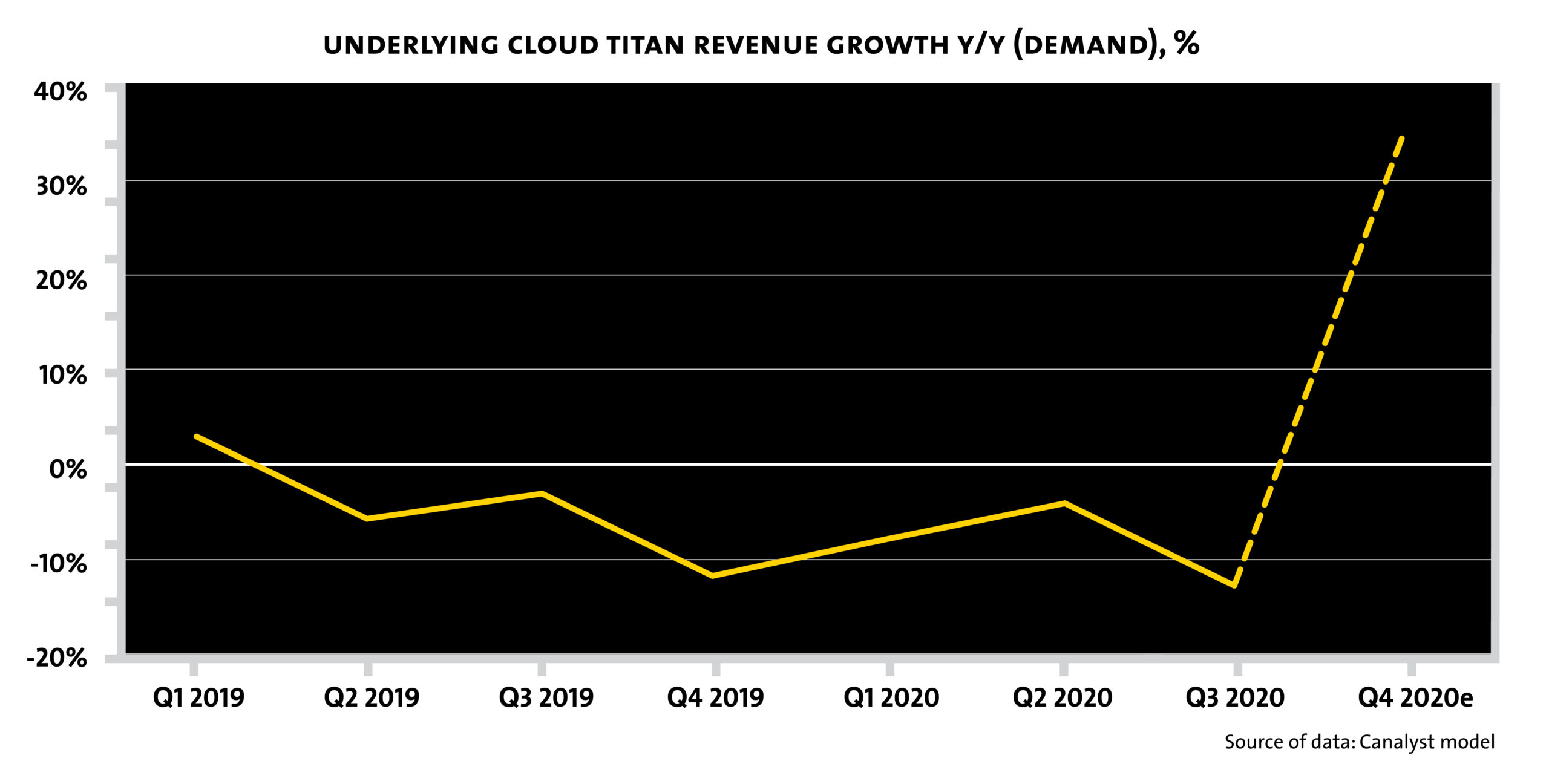

Revenue of $605.4M was well-above the guided range of $570-590M. In Q3/20 revenue was -7.5% y/y, with the Q4e guidance pointing to ~13% y/y rise at the mid-point of guidance. The Networking sector was in a cyclical slump over the last few years. After the quarterly results, investors seemed convinced that we are at the inflection point of another cycle.

Above: Q4e underlying Cloud Titan revenue growth % based on managements guidance for FY Cloud Titan revenue to be up y/y

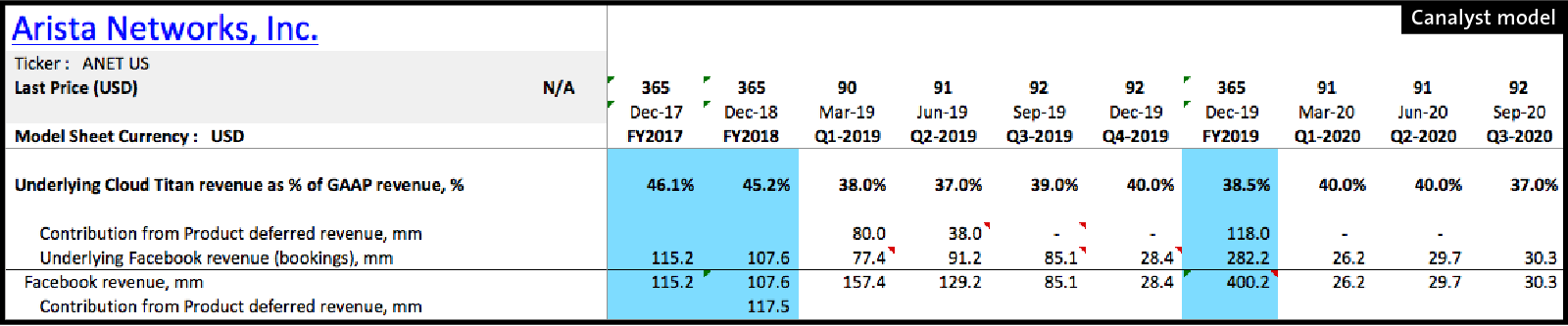

Recent Canalyst model improvements provide visibility into the investment cycle. Report based numbers and changes around product deferred revenue can make it difficult for investor to gauge ANET’s performance on a like-for-like basis (end demand-based). The Canalyst model implicitly derives the organic growth of ANET’s largest business (Tier-1 Cloud), to effectively highlight the inflection points in the investment cycle of ANET’s hyperscale customers (as reflected in the implied guidance for ANET’s Cloud business in Q4e).

We factored in the impact of Facebook’s revenue contribution in ‘21e, as guided by management. And modeled ANET’s penetration of the Campus switching market and related revenue that will be the top grower at the company in ’21e, at the expense of Cisco’s (NASDAQ: CSCO) market share losses.