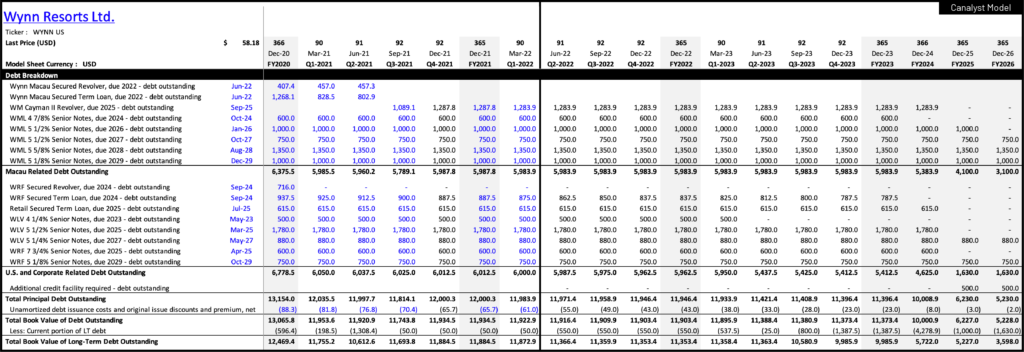

To provide better visibility on the “right side” of the balance sheet, we started adding robust debt forecasting by issuance to our models.

The Debt Breakdown section captures individual credit facilities, including principal debt repayment schedules, interest payments, and cash interest paid. It anchors variable forecasts to applicable indexed rates, assumes principal is repaid at maturity – but is designed to allow users to make early repayment assumptions. We’ve also added Lease Forecasting, which includes lease assumptions and associated rent expenses. All of which is linked to the income & cash flow statements and balance sheet forecasts.

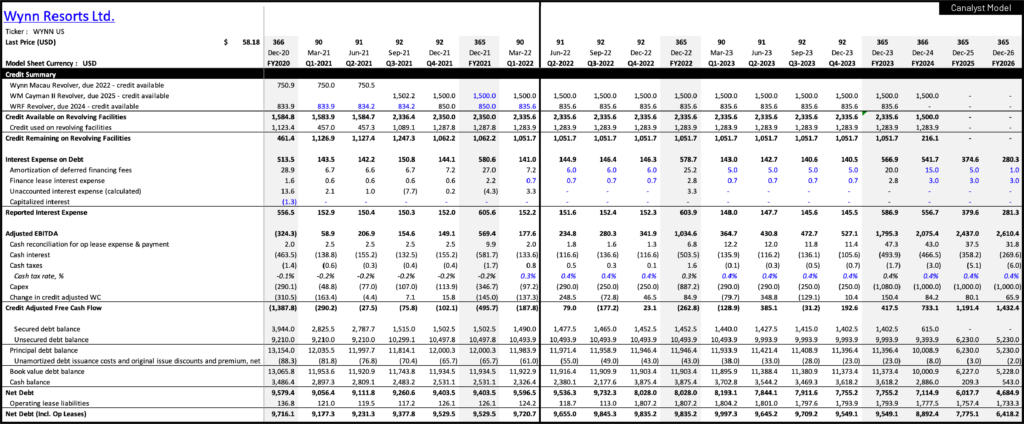

The new Credit Summary reconciles as-reported interest expense with calculated interest expense on the individual debt issues outstanding. It features a breakdown of credit facility availability and the components of net debt – including secured and unsecured principal values. We’ve also added an adjusted free cash flow walk (adjusted EBITDA to FCF) to better align with the lens many credit investors assess the safety/value of their investments.

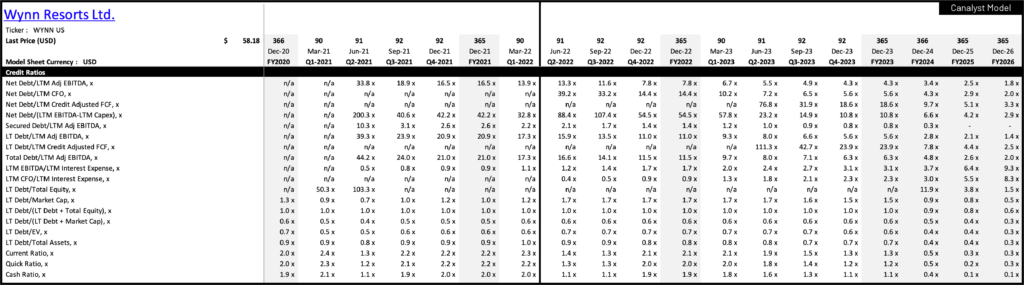

We’ve also added a comprehensive Credit Ratios section to the models.

As the market shifts focus, Canalyst invests in providing the fundamental data necessary to illuminate what matters most, now. We are continually adding Debt Breakdowns to more of our models. Dive into Company Debt and Check out $LVS, $WYNN, and $MGM Canalyst models with our new Credit Section.

Download the Las Vegas Sands $LVS model here

For clients: Download Wynn Resorts $WYNN

For clients: Download MGM Resorts $MGM