Another week of historic volatility, and instead of enjoying the conference season buzz, we’re adapting to our makeshift home offices and penciling in a snack break every 45 minutes.

Active managers are currently in the process of trying to identify dislocations between stock price and business risk/impairment (i.e. which stocks are down 50% but are still worth 85c on the dollar). Now is the time to stress test how much business has been impaired by the pandemic.

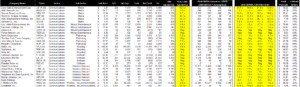

To help our clients identify investment opportunities, Canalyst has built a flexible screen across 2,500 models to triangulate leverage, business impact, and valuation changes from the extraordinary events of the last month.

Using this screen, you can test assumptions across a wide range of companies, as valuations morph in this volatile environment. There’s still a universe out there, and because of these changing market caps, new companies are appearing on the radar.

We are the only company offering adjusted EBITDA across thousands of names and our clients — more than 500 asset managers — are using this screen to identify new opportunities.