The last fiscal year has brought record numbers of new listings, whether it be via SPAC or traditional IPO. According to Axios, there already have been 279 IPOs in 2021 (that doesn’t include the 423 SPACs).

It’s been keeping us busy, and as the number of IPOs seems only to grow the amount of sellside coverage has begun to shrink. With a lack of coverage, having the opportunity to analyze reliable models becomes an ever-increasing advantage.

Some of the most downloaded (popular) IPO names we have built recently include:

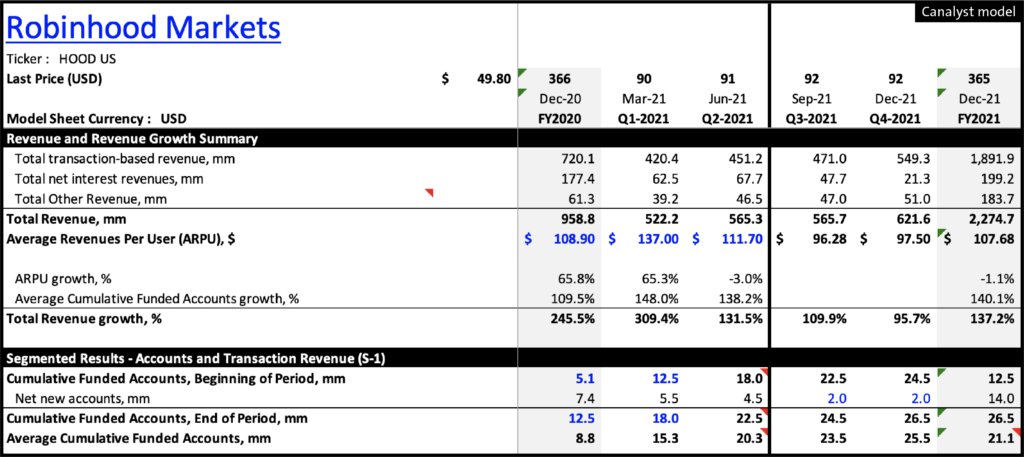

Robinhood (HOOD)

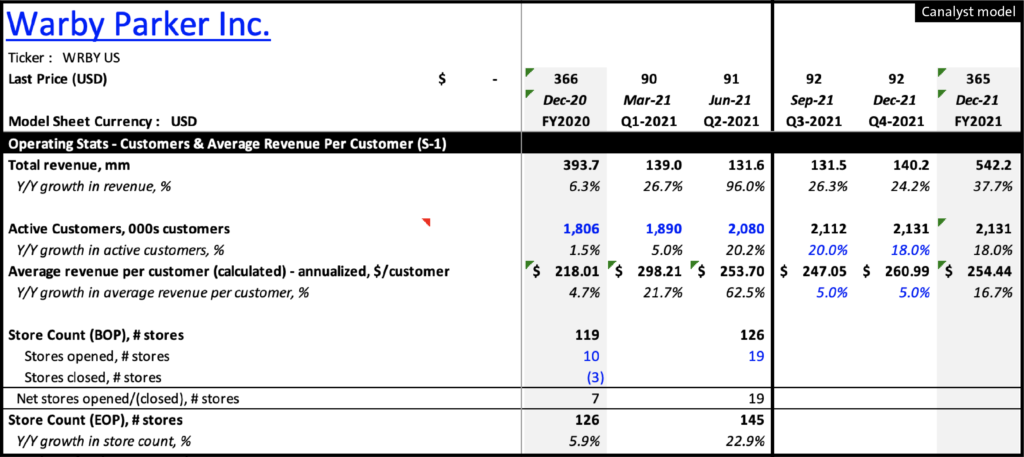

Warby Parker (WRBY)

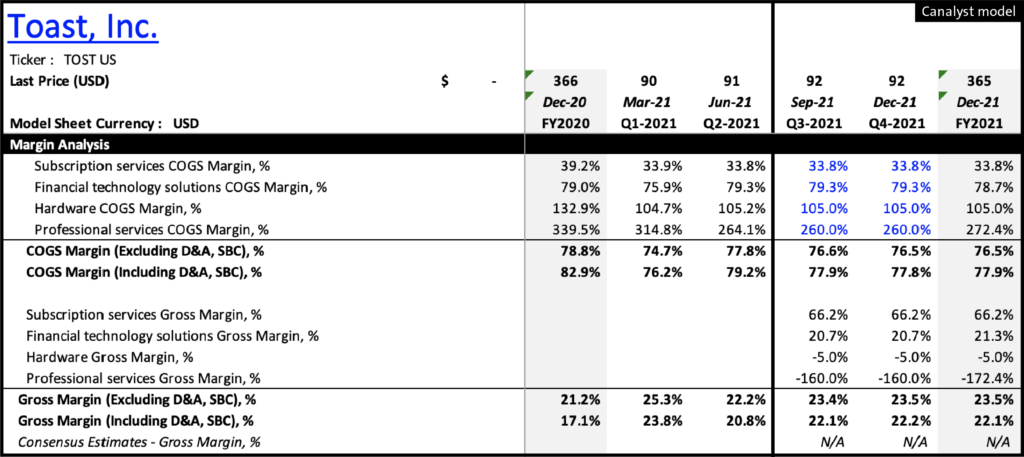

Toast (TOST)

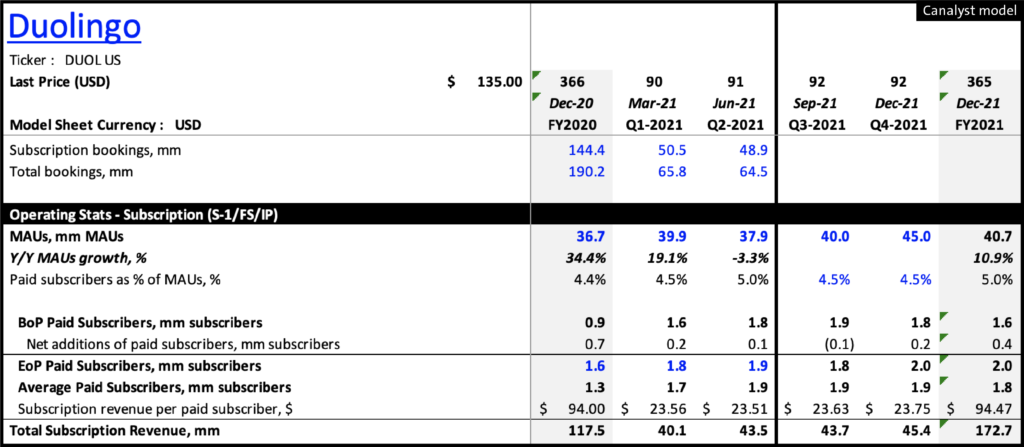

Duolingo (DUOL)

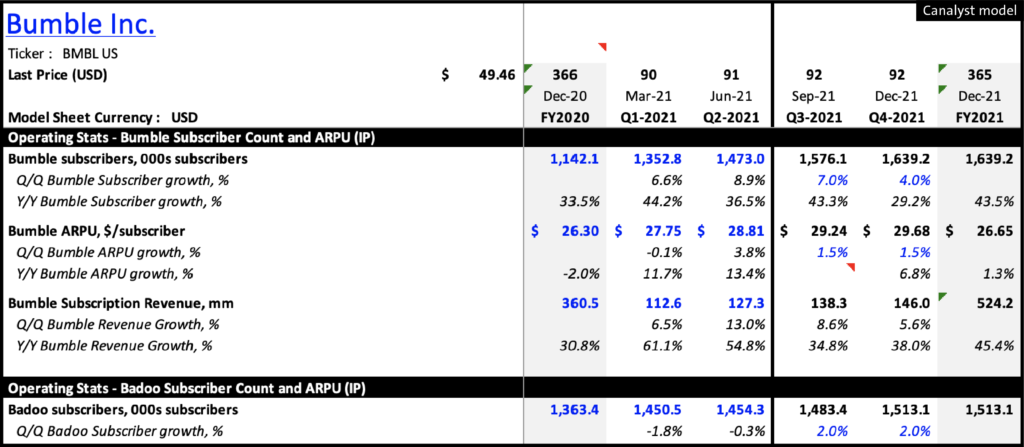

Bumble (BMBL)

At Canalyst, we want to make sure that you have access to the most up-to-date and reliable financial models. So, as firms publish their S-1s and S-4s ahead of IPOs, our dedicated team of analysts immediately starts building the model.

If you and your team want to save a ton of time on new listings, on top of everything else in your coverage universe, request a demo today and talk to our team about getting a trial with Canalyst.