Every analyst will tell you revenue is the most important line item in a model to get right. Most costs are proportional to revenue (cost of goods sold, marketing spend, staffing costs, etc.) and executive teams rationalize cost structures based on their revenue expectations. When companies miss revenue forecasts, costs are cut, re-investment into the business slows, and the future can look grim quickly.

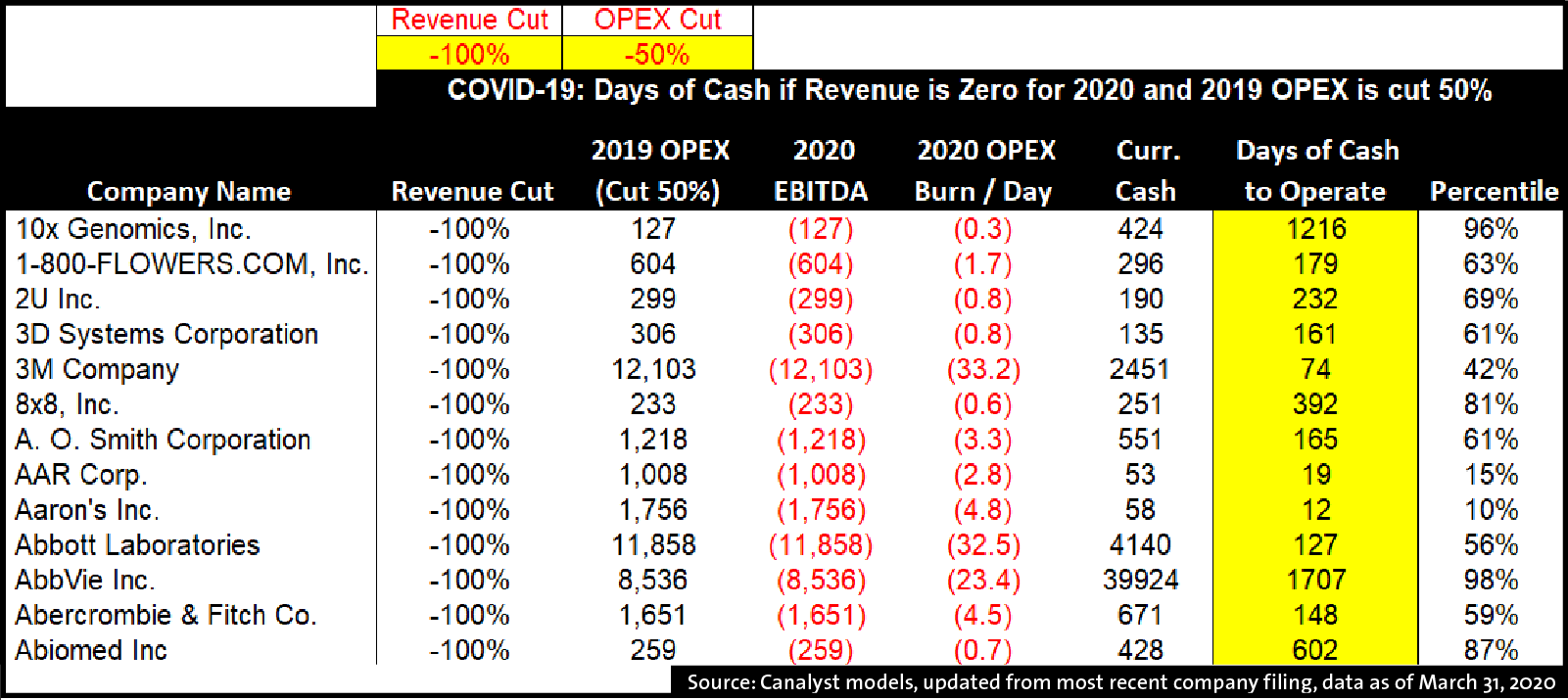

To help our clients navigate this environment and leverage our data, we’ve built a Solvency Screen across ~3,000 names. Relieving analysts from forecasting revenue, this screen assumes that companies have zero revenue for 2020 and operating costs are cut 50% (both are adjustable for your individual outlook), to get to Days of Solvency = (OPEX Spend per day / Cash on hand).

There are many ways to use this screening tool, which is why we are excited to share it with many of our clients who will have differing views about 2020. Two ways the template may be useful are:

1) Defense: To isolate companies that have weak cash positions, sort data by “Days of Cash to Operate”; stay in front of companies that are most at risk to raise additional capital and;

2) Offense: Assess which names will outperform as the economic recovery gets underway. The market recovery is generally led by companies who have inherently weak fundamentals, are overly levered, and were priced for disaster. As uncertainty abates, these are the companies that will benefit the most from a market recovery. Use the FIFO (First in First Out) principle: Generally, the first companies to trade down at the beginning of a market correction are the first ones to lead the recovery.

By enabling our clients to transition from being defensive early in the recession (cash sufficient, quality companies) to offensive upon a recovery (cash poor, levered), the Solvency Screen is another example of how Canalyst’s data can be leveraged to uncover investment opportunities quickly.