We recently released new templates on our platform to help you get our data the way you need it. Move any of these templates into our models to employ our data into your custom analysis.

Templates available include:

- Comp sheet sample

- Annual summary page

- Incremental M&A analysis

- Updated DCF and DCF (half-years)

- LBO model

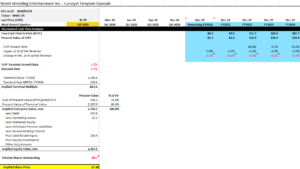

Try our DCF sample to test assumptions on terminal growth, discount rates, etc.:

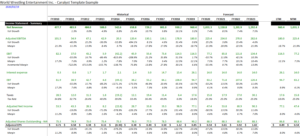

Check out our Annual Summary page to get a quick snapshot of each fiscal year:

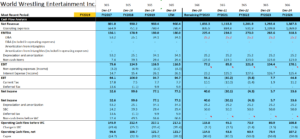

Use our LBO model example to help determine a fair valuation of the company you’re interested in:

If you find these helpful, that’s just the beginning. We can transform our data into nearly any type of template for you. To discuss building your own custom templates to enhance your workflow, contact us at support@canalyst.com if you have an existing subscription. To get started with Canalyst, request a demo.