With a recent improvement in sentiment for natural gas production stocks, we wanted to see which companies' cash flow would be most sensitive to an increase in natural gas prices in 2020 and 2021.

Canalyst’s database of models with common sector specific row names enables us to quickly pull data across any number of names. Here we pulled the liquids production proportion across our exploration and production universe and sorted from gassiest to most liquid to narrow down the names we were going to look at. Starting with 98 stocks with liquids weightings, we removed names <$250mm market cap, narrowing it down to 58, and then took the top 15 names on gas weighting.

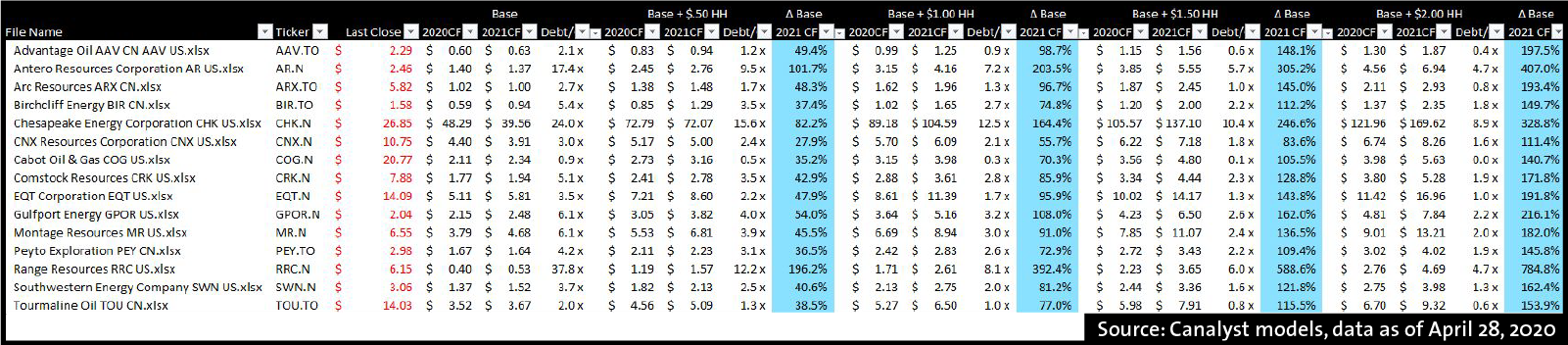

Then, it’s quick enough to link the sheets into a master compsheet in order to run different pricing scenarios across the narrowed universe. We tested these stocks cash flow per share sensitivity at 50c increments in benchmark natural gas prices and got the following output: